ReFrame | Lindsey Lewis

Join us for a live interview with Lindsey Lewis, a trailblazer in wealth management and a passionate advocate for women in financial services. We’ll get some insights on how to foster community for women from Lindsey, who serves as Managing Director and Chair of the American College Center for Women in Financial Services. We’ll explore …

Outlook 2025: Diversifying Diversifiers and Using Capital Efficiency to Do It

One thing we try to do with our 2025 Outlook: Animal Spirits, which we released last week, is translate our views into portfolio actions, since that’s ultimately what matters. You won’t have to dig far to see how our Carson House Views are woven throughout, making it convenient to access advice and insights that align …

Know Your Worth | Rafael Mason

Rafael Mason, Partner, Bain joins Carson’s Michael Belluomini, VP, Mergers & Acquisitions, and Jeff Harris, AVP, Mergers & Acquisitions, as they dive into private equity firms and their role in M&A within the RIA space. Topics of Discussion include: What attracted Bain to the RIA industry Why they decided to invest in Carson What …

Business Management

ReFrame | Lindsey Lewis

Join us for a live interview with Lindsey Lewis, a trailblazer in wealth management and a passionate advocate for women in financial services. We’ll get some insights on how to foster community for women from Lindsey, who serves as Managing Director and Chair of the American College Center for Women in Financial Services. We’ll explore …

6 Steps to Upgrade Your Firm’s Client Experience

Our VP of Coaching & Consulting, Sarah M. Cain, recently had a tooth extraction. She was nervous and had a lot of anxiety going into the procedure. But the oral surgeon she found to do the procedure made it a positive experience—from the pre- to the post-op. “Everyone there made me feel so comfortable,” Cain …

Elevate Your Financial Practice with World-Class Client Experiences

What does it truly mean to provide a world-class client experience? In this episode, Ana Trujillo Limón, Director, Editorial at Carson Group, speaks with Sarah Cain, VP of Carson Coaching. Together, they unravel the art of moving beyond the basics of financial services to create interactions that clients rave about. Listen in as they explore …

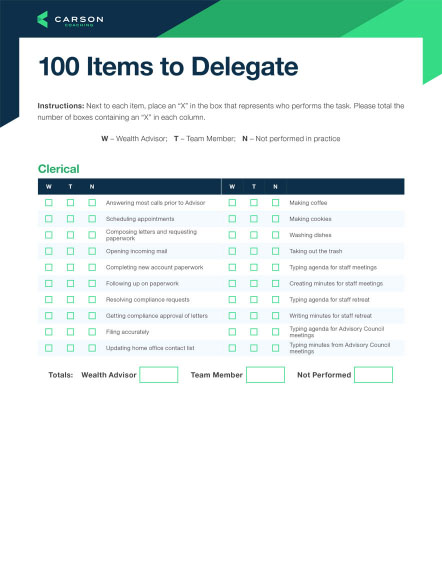

100 Tasks Every Advisor Should Delegate

Find out what tasks you can hand off to free up your time and empower your team.

Marketing

Tamsen Butler: Crafting Compelling Stories

Creating content can seem daunting, even for industry experts like yourself. But whether you’re preparing for a speaking event, writing a blog post, or recording your first podcast episode, what you have to share matters more than how you deliver it. In this episode, Ana Trujillo Limón, Director, Coaching and Advisor Content, speaks with Tamsen …

Minna Shada: Consumer Marketing for Advisors

Are you looking to learn about effective consumer marketing in the financial industry? Today, we look behind the scenes with Ana Trujillo Limón, Director, Coaching and Advisor Content, and Minna Shada, Senior Vice President of Consumer Marketing. Minna talks about her marketing journey since 2013, her pivotal role in partner office marketing, and the innovative …

Kalli Fedusenko: Financial Advisor Marketing

Elevate your financial advisory practice with strategic marketing – it’s not just about attracting new clients, but about showcasing your knowledge, amplifying your visibility, and positioning yourself as a trusted advisor, building credibility. Today on Framework, Ana Trujillo Limón, Director, Coaching and Advisor Content, and Odaro Aisueni, Wealth Planner, ring in the new year with …

The Financial Advisor's Guide to Effective Marketing

Effective advisor marketing in the digital age requires a strategy that fits your firm.

Compliance

Understanding the SEC Marketing Rule for Financial Advisors

In late 2020, the SEC announced that it had finalized changes to its Marketing Rule for financial advisors. The amendments create a single rule that replaces the pre-existing advertising and cash solicitation rules. The rule’s broadly drawn limitations and principles-based provisions are designed to accommodate the continual change in technology and ever-expanding ways in which …

Staying on Top of SEC Marketing Rule Changes

Changes to the Securities and Exchange Commission’s “Marketing Rule” recently went into effect, and they impact everything from testimonials to the definition of an “advertisement.” Staying in compliance with these rule changes can be challenging for advisors, but our on-demand webinar “Staying on Top of SEC Marketing Rule Changes” can help you stay on track. …

How SECURE 2.0 Act Shifts the Retirement Planning Landscape

The SECURE Act brought big changes to retirement planning when it was signed into law in 2019. Now, its sequel – dubbed SECURE 2.0 Act – has just passed as part of the 2023 budget. Though SECURE 2.0 Act’s changes to the retirement landscape aren’t quite as sweeping as the original, there’s still plenty advisors …

Staying on Top of SEC Marketing Rule Changes

Learn how to stay in compliance with SEC rules when using client testimonials and reviews.

Technology

Peter Lazaroff: Embracing Artificial Intelligence

Artificial intelligence is revolutionizing financial advisory. How will AI impact investors’ portfolios? This week on Framework, Ana Trujillo Limón, Director, Coaching and Advisor Content, and Odaro Aisueni, Wealth Planner, speak with Peter Lazaroff, Chief Investment Officer at Plancorp, LLC, about the impact of AI on financial planning, and the importance of diversification in investment portfolios. …

Power Your Technology and Enhance the Client Experience with Data

Thanks to rapidly advancing technology, financial advisors have access to more data than ever before. But trying to sift through that data and actually use it to enhance your business and client experience can be a challenge. How can you be sure you’re measuring the right metrics, or interpreting the data correctly? How can you …

Our Favorite Financial Advisor Tools to Add to Your Tech Stack

As financial advisors grow their businesses, their operational needs can drastically change, along with the need to provide competitive services. That’s where financial advisor technology comes in. The best financial advisor tools will enhance your processes, save you time and money and foster connections with clients about their specific goals. Today’s technology offerings can …

Building a Top-of-the-Line Tech Stack

An accessible, user-friendly tech stack is crucial to delivering the best client experience.

Investments

Outlook 2025: Diversifying Diversifiers and Using Capital Efficiency to Do It

One thing we try to do with our 2025 Outlook: Animal Spirits, which we released last week, is translate our views into portfolio actions, since that’s ultimately what matters. You won’t have to dig far to see how our Carson House Views are woven throughout, making it convenient to access advice and insights that align …

Outlook 2025: The Fed May Be Key in 2025, And We Just Got Some Good News

Carson Investment Research released our 2025 Outlook: Animal Spirits on Tuesday. As we highlighted there, we think that economic strengths clearly outweigh areas of weakness in the year ahead, and the opportunities likely have a higher probability of coming to fruition than the threats. We believe that economic momentum, an easing Federal Reserve (Fed), and …

Our 2025 Outlook: Animal Spirits is here!

As we look ahead to 2025, we know the scars of high inflation in 2022 and the higher interest rates that came with it are still with us. We’ve seen it in global elections, where incumbents have been rejected across the political spectrum. We’ve seen it in consumer sentiment surveys, which have improved but remain …

Outlook 2025: Animal Spirits

The economy had a big year in 2024, avoiding a recession while posting strong job numbers and a soaring stock market. But will it stay that way?

Financial Planning

Navigating Women’s Financial Challenges with Debra Taylor

With studies showing that women often leave advisors if not feeling connected, wealth managers must understand the importance of building relationships with female clients. Tune in to the Framework Podcast episode featuring Debra Taylor, where we explore how intentional connections with women can lead to better client retention and satisfaction. In this episode, Ana Trujillo …

Empowering Women in Wealth Management with Dr. Julie Ragatz

This week on Framework, we address how sponsorship and inclusion can empower women in wealth management. In this episode, Ana Trujillo Limón, Director, Coaching and Advisor Content, and co-host JaQ Campbell, Founder and CEO of Alexander Legacy Private Wealth Management, speak with Julie Ragatz, Ph.D., Vice President, Next Gen and Advisor Development Programs at Carson …

Breaking Barriers in Finance with Sheryl Hickerson

Today on Framework, we explore pathways for women in finance, mentorship, and the strength of having allies. In this episode, Ana Trujillo Limón, Director, Coaching and Advisor Content, and guest co-host, JaQ Campbell, Founder and CEO of Alexander Legacy Private Wealth Management, speak with Sheryl Hickerson, Founder and Chief Engagement Officer at Females and Finance …

How SECURE 2.0 Act Shifts the Retirement Planning Landscape

Stay on top of the shifting retirement planning picture.

M&A

Know Your Worth | Rafael Mason

Rafael Mason, Partner, Bain joins Carson’s Michael Belluomini, VP, Mergers & Acquisitions, and Jeff Harris, AVP, Mergers & Acquisitions, as they dive into private equity firms and their role in M&A within the RIA space. Topics of Discussion include: What attracted Bain to the RIA industry Why they decided to invest in Carson What …

Know Your Worth | Dani Fava

Carson’s Dani Fava, Chief Strategy Officer, joins Michael Belluomini, VP, Mergers & Acquisitions, and Jeff Harris, AVP, Mergers & Acquisitions, as they dive into the outlook for strategic M&A. Topics of Discussion: How will bigger RIA aggregators like Creative, Mercer, Mariner or even Carson approach strategic M&A? Will we see custodians doing M&A? Where will …

Know Your Worth | Rob Madore

Rob Madore, Vice President at MarshBerry, joins Carson’s Michael Belluomini, VP, Mergers & Acquisitions, and Jeff Harris, AVP, Mergers & Acquisitions, as they dive into the key value drivers that most buyers look for when making an investment. Topics of Discussion: Consolidation in the wealth management industry How Rob and MarshBerry consult with and prepare …

The Essentials of Succession Planning for Financial Advisors

Learn how to choose a successor and find the true value of your firm.

Get Expert Market Insights

The Carson Investment Research weekly newsletter offers up-to-date market news and analysis that could help you serve as a better guide for your clients. Subscribe today!

"*" indicates required fields