5 Reasons Why We’re Not Worried about Rising Credit Card Debt

Every quarter the New York Federal Reserve releases its household credit and debt report and we get a flurry of headlines about rising credit card debt, and rising delinquencies. As always with these things, it’s important to maintain some perspective. One: Household Leverage is Actually Reducing Credit card debt rose 3.9% last quarter (Q4 2024) …

Animal Spirits Are Flagging, but There’s Plenty of Time to Get Back on Track

Let’s get it on the table. Of all the charts that raise concerns for me about the economy right now, despite a still solid base case, the one below worries me the most. Not for what it represents in itself but for what it says about where we are in the cycle in general. The …

Know Your Worth | Burt White

Carson CEO Burt White joins Carson’s Michael Belluomini, VP, Mergers & Acquisitions, and Jeff Harris, AVP, Mergers & Acquisitions, as they dive into Carson’s recent activity and successes in the M&A world. Topics of Discussion: Carson’s approach to and philosophy toward M&A, both internal and external. How do direct partnership deals help fuel Carson’s rocket …

Business Management

ReFrame | Denise Milano Sprung

Dive into an insightful conversation with Denise Sprung, marketing director at Mitlin Financial. Discover why authenticity is the key to building trust in the financial services industry, innovative marketing strategies that stand out, and how consistency can elevate your social media game. Learn actionable tips to connect meaningfully with clients while staying true to your …

Embracing ‘Unreasonable Hospitality’ for an Amazing Client Experience

“How are you going to top this experience” is a question Denise Sprung, Marketing Director for Mitlin Financial, frequently hears after events she organizes for clients. She once organized a day at an NHL game for an A-plus client and her family, who are all hockey fans. She also organized an event at a local …

Making A Client Relationship Truly Exceptional

In this episode, Ana Trujillo Limón, Director, Editorial, chats with Larry and Denise Sprung from Mitlin Financial about crafting a world-class client experience. The Sprungs share the heartwarming story behind their firm’s name and reveal how their approach goes beyond traditional client interactions by treating each client as a part of the family through personalized …

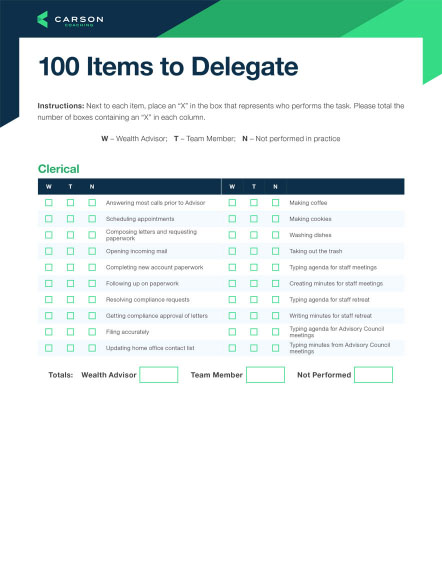

100 Tasks Every Advisor Should Delegate

Find out what tasks you can hand off to free up your time and empower your team.

Marketing

Tamsen Butler: Crafting Compelling Stories

Creating content can seem daunting, even for industry experts like yourself. But whether you’re preparing for a speaking event, writing a blog post, or recording your first podcast episode, what you have to share matters more than how you deliver it. In this episode, Ana Trujillo Limón, Director, Coaching and Advisor Content, speaks with Tamsen …

Minna Shada: Consumer Marketing for Advisors

Are you looking to learn about effective consumer marketing in the financial industry? Today, we look behind the scenes with Ana Trujillo Limón, Director, Coaching and Advisor Content, and Minna Shada, Senior Vice President of Consumer Marketing. Minna talks about her marketing journey since 2013, her pivotal role in partner office marketing, and the innovative …

Kalli Fedusenko: Financial Advisor Marketing

Elevate your financial advisory practice with strategic marketing – it’s not just about attracting new clients, but about showcasing your knowledge, amplifying your visibility, and positioning yourself as a trusted advisor, building credibility. Today on Framework, Ana Trujillo Limón, Director, Coaching and Advisor Content, and Odaro Aisueni, Wealth Planner, ring in the new year with …

The Financial Advisor's Guide to Effective Marketing

Effective advisor marketing in the digital age requires a strategy that fits your firm.

Compliance

Understanding the SEC Marketing Rule for Financial Advisors

In late 2020, the SEC announced that it had finalized changes to its Marketing Rule for financial advisors. The amendments create a single rule that replaces the pre-existing advertising and cash solicitation rules. The rule’s broadly drawn limitations and principles-based provisions are designed to accommodate the continual change in technology and ever-expanding ways in which …

Staying on Top of SEC Marketing Rule Changes

Changes to the Securities and Exchange Commission’s “Marketing Rule” recently went into effect, and they impact everything from testimonials to the definition of an “advertisement.” Staying in compliance with these rule changes can be challenging for advisors, but our on-demand webinar “Staying on Top of SEC Marketing Rule Changes” can help you stay on track. …

How SECURE 2.0 Act Shifts the Retirement Planning Landscape

The SECURE Act brought big changes to retirement planning when it was signed into law in 2019. Now, its sequel – dubbed SECURE 2.0 Act – has just passed as part of the 2023 budget. Though SECURE 2.0 Act’s changes to the retirement landscape aren’t quite as sweeping as the original, there’s still plenty advisors …

Staying on Top of SEC Marketing Rule Changes

Learn how to stay in compliance with SEC rules when using client testimonials and reviews.

Technology

Peter Lazaroff: Embracing Artificial Intelligence

Artificial intelligence is revolutionizing financial advisory. How will AI impact investors’ portfolios? This week on Framework, Ana Trujillo Limón, Director, Coaching and Advisor Content, and Odaro Aisueni, Wealth Planner, speak with Peter Lazaroff, Chief Investment Officer at Plancorp, LLC, about the impact of AI on financial planning, and the importance of diversification in investment portfolios. …

Power Your Technology and Enhance the Client Experience with Data

Thanks to rapidly advancing technology, financial advisors have access to more data than ever before. But trying to sift through that data and actually use it to enhance your business and client experience can be a challenge. How can you be sure you’re measuring the right metrics, or interpreting the data correctly? How can you …

Our Favorite Financial Advisor Tools to Add to Your Tech Stack

As financial advisors grow their businesses, their operational needs can drastically change, along with the need to provide competitive services. That’s where financial advisor technology comes in. The best financial advisor tools will enhance your processes, save you time and money and foster connections with clients about their specific goals. Today’s technology offerings can …

Building a Top-of-the-Line Tech Stack

An accessible, user-friendly tech stack is crucial to delivering the best client experience.

Investments

5 Reasons Why We’re Not Worried about Rising Credit Card Debt

Every quarter the New York Federal Reserve releases its household credit and debt report and we get a flurry of headlines about rising credit card debt, and rising delinquencies. As always with these things, it’s important to maintain some perspective. One: Household Leverage is Actually Reducing Credit card debt rose 3.9% last quarter (Q4 2024) …

Animal Spirits Are Flagging, but There’s Plenty of Time to Get Back on Track

Let’s get it on the table. Of all the charts that raise concerns for me about the economy right now, despite a still solid base case, the one below worries me the most. Not for what it represents in itself but for what it says about where we are in the cycle in general. The …

Eggscellent Inflation or Not

Ryan Detrick, Chief Market Strategist, and Sonu Varghese, VP, Global Macro Strategist, dive into the rising cost of eggs and other factors contributing to inflation stickiness. They also discuss the stock market flirting with an all-time high, when to expect cuts from the Fed, and much more. Key Takeaways: The S&P 500 is near an …

Outlook 2025: Animal Spirits

The economy had a big year in 2024, avoiding a recession while posting strong job numbers and a soaring stock market. But will it stay that way?

Financial Planning

Navigating Women’s Financial Challenges with Debra Taylor

With studies showing that women often leave advisors if not feeling connected, wealth managers must understand the importance of building relationships with female clients. Tune in to the Framework Podcast episode featuring Debra Taylor, where we explore how intentional connections with women can lead to better client retention and satisfaction. In this episode, Ana Trujillo …

Empowering Women in Wealth Management with Dr. Julie Ragatz

This week on Framework, we address how sponsorship and inclusion can empower women in wealth management. In this episode, Ana Trujillo Limón, Director, Coaching and Advisor Content, and co-host JaQ Campbell, Founder and CEO of Alexander Legacy Private Wealth Management, speak with Julie Ragatz, Ph.D., Vice President, Next Gen and Advisor Development Programs at Carson …

Breaking Barriers in Finance with Sheryl Hickerson

Today on Framework, we explore pathways for women in finance, mentorship, and the strength of having allies. In this episode, Ana Trujillo Limón, Director, Coaching and Advisor Content, and guest co-host, JaQ Campbell, Founder and CEO of Alexander Legacy Private Wealth Management, speak with Sheryl Hickerson, Founder and Chief Engagement Officer at Females and Finance …

How SECURE 2.0 Act Shifts the Retirement Planning Landscape

Stay on top of the shifting retirement planning picture.

M&A

Know Your Worth | Burt White

Carson CEO Burt White joins Carson’s Michael Belluomini, VP, Mergers & Acquisitions, and Jeff Harris, AVP, Mergers & Acquisitions, as they dive into Carson’s recent activity and successes in the M&A world. Topics of Discussion: Carson’s approach to and philosophy toward M&A, both internal and external. How do direct partnership deals help fuel Carson’s rocket …

Know Your Worth | Rafael Mason

Rafael Mason, Partner, Bain joins Carson’s Michael Belluomini, VP, Mergers & Acquisitions, and Jeff Harris, AVP, Mergers & Acquisitions, as they dive into private equity firms and their role in M&A within the RIA space. Topics of Discussion include: What attracted Bain to the RIA industry Why they decided to invest in Carson What …

Know Your Worth | Dani Fava

Carson’s Dani Fava, Chief Strategy Officer, joins Michael Belluomini, VP, Mergers & Acquisitions, and Jeff Harris, AVP, Mergers & Acquisitions, as they dive into the outlook for strategic M&A. Topics of Discussion: How will bigger RIA aggregators like Creative, Mercer, Mariner or even Carson approach strategic M&A? Will we see custodians doing M&A? Where will …

The Essentials of Succession Planning for Financial Advisors

Learn how to choose a successor and find the true value of your firm.

Get Expert Market Insights

The Carson Investment Research weekly newsletter offers up-to-date market news and analysis that could help you serve as a better guide for your clients. Subscribe today!

"*" indicates required fields