Well, election day is now behind us, and while there’s some dust to settle yet, we now know a lot this morning. First, President-elect Donald Trump will be the 47th president of the United States, joining Grover Cleveland as the only president to win non-consecutive terms. Trump also won the popular vote for the first time in his three elections. We deeply respect the office of the presidency and congratulate President-elect Trump on his victory and Vice President Kamala Harris on her hard-fought campaign.

Second, Republicans will control the Senate. Given they will have the tie-breaking vote from Vice President-elect JD Vance, they only needed to flip one seat. Republicans were a heavy favorite to flip a seat before the evening started, and the West Virginia win was called early. Then came a pick-up in Ohio. Republicans were able to defend what was likely their most vulnerable seat in Nebraska and added Montana late in the evening. There are still tight races in Michigan, Pennsylvania, Wisconsin, Arizona, and Nevada that may take days to sort out, but Democrats are defending seats in all of them, so it won’t change the basic outcome.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Third, the House is still close with many tight races and it may take a week or so to know the outcome. But it was a good night for Republicans, which justifies a reasonably strong bias toward Republicans taking the House as well. But it’s legitimately still up in the air.

As always, from the perspective of the guidance we try to provide we are not interested in politics but policy and only policy that we believe will have an impact on market behavior.

In my opinion, there are our 10 quick election takeaways, 6 on the policy side, and 4 related to markets:

Election Takeaways – Policy Impact

- Republicans will go big on deficit-financed spending, but markets like deficits (as we pointed out even in our Midyear Outlook), at least in the near term. If they lose the House this will be tempered, but a Republican sweep will likely lead to a full extension of individual tax cuts from the Tax Cuts and Jobs Act (TCJA), reinstatement of the small set of business tax cuts that were scheduled to sunset, and even add a few new tax cuts. There is little risk at this point that we will go over a fiscal cliff.

- The debt ceiling will be raised, without much noise or market volatility.

- Tariffs will go up, but there’s a difference between making campaign promises and governing and we are unlikely to see some of the more extreme proposals floated during the campaign. Also, once tariffs are announced, and other countries counter with their own tariffs, companies will likely adapt. Keep in mind we had a lot of tariffs even over the last four years under the Biden administration.

- The general regulatory policy will be strongly pro-business with a strong bias toward deregulation. This is likely to have the largest impact on the most highly regulated sectors of the economy, such as energy and finance, though be careful translating this to market outperformance (energy and financials lagged the S&P 500 between 2017 and 2020).

- Defense spending will increase, something we thought likely no matter who was elected.

- Without judging whether it is good policy in general, immigration policy will limit labor supply of both skilled and unskilled workers, acting as indirect ramp-up of the regulatory burden on businesses by limiting who they are able to recruit and hire along with any added regulatory burden in maintaining their employment.

Election Takeaways – Market Impact

- The overnight reaction of markets provides a clear sense of what the market perceives to be “Trump trades.” There is reason for caution about this initial reaction (see below), but it still tells us something about the expected policy influence on the market environment. We have to emphasize that these are not recommendations but simply factual observations:

- US equities are rallying strongly while international equities are seeing modest declines.

- Small caps are up very sharply (!) this morning, climbing significantly more than their large cap peers at last check.

- The financials sector is seeing strong support.

- US Treasury yields are higher, likely reflecting both higher growth and inflation expectations.

- The US Dollar is rising against most major currencies.

- Cryptocurrencies have seen broad support, with Bitcoin hitting an all-time high overnight.

- As we’ve been saying all along, there’s no real historical evidence that which party occupies the White House has a broad impact on stock performance. Nevertheless, decisive resolution of the fiscal cliff and the supply side impact of tax policy are likely to help extend the expansion and support the bull market.

- A Republican president with a Republican House and Senate is one of the worst market combinations historically. But even if Republicans end up sweeping the election, we believe narrow majorities in the House and Senate would give Congress some features of split government, since narrow majorities give centrists more power.

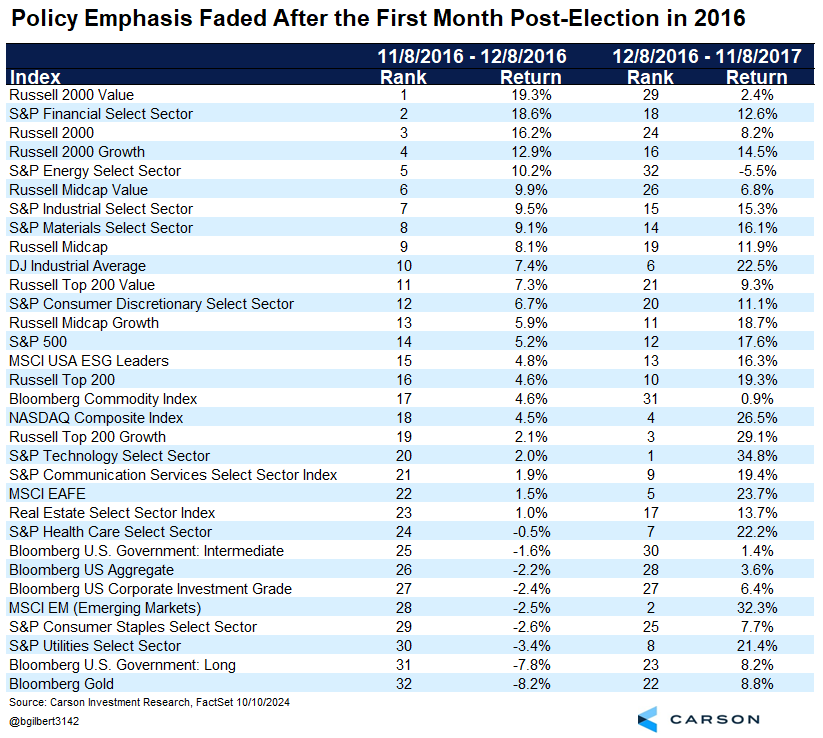

- As we saw in 2016, the policy impact of a new president on markets can give way to broad macroeconomic forces fairly quickly. Yes, energy did well in the first month after Trump was elected in 2016, but it collapsed over the rest of the year and was by far the worst-performing sector over his presidency.

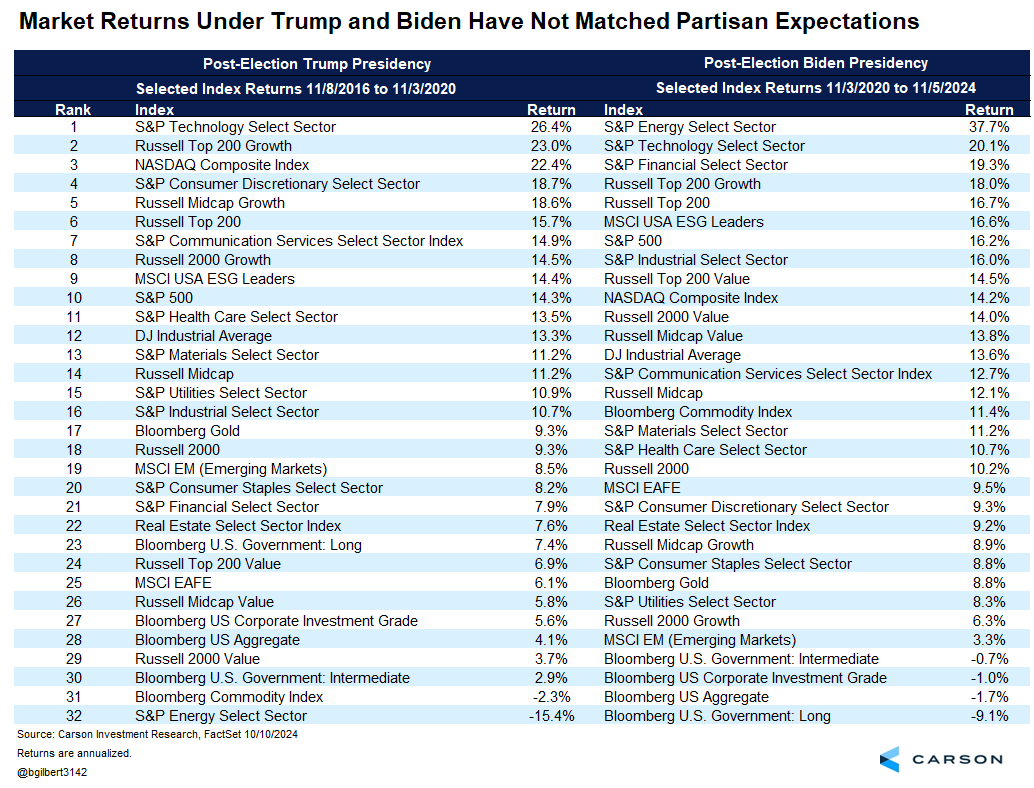

The story of macroeconomic forces is re-enforced if you compare election-to-election returns for President-elect Trump and President Biden. These outcomes aren’t what you would expect from a policy perspective.

We believe Carson Investment Research recommendations were well positioned for either election outcome, but last night’s outcome may be particularly friendly in the near term. We are overweight equities and underweight bonds (limiting the impact of higher rates), overweight US stocks with an emphasis on US small and mid-cap stocks versus benchmarks, and underweight emerging market stocks. We also have dedicated financials sector exposure in more tactical models.

Obviously, the election news is very recent and it will take time to fully assess the outcome. Our goal, as always, is to try to provide thoughtful, actionable advice for any policy environment. We will continue to provide updates on our post-election thoughts as markets, the election outcome, and President-elect Trump provide more clarity.

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here.

02495802-1124-A