“It’s not what you look at that matters, it’s what you see.” -Henry David Thoreau (writer)

Here are a few things that caught my attention the past week or so. A few I’m guessing a lot of people don’t even know, but they should.

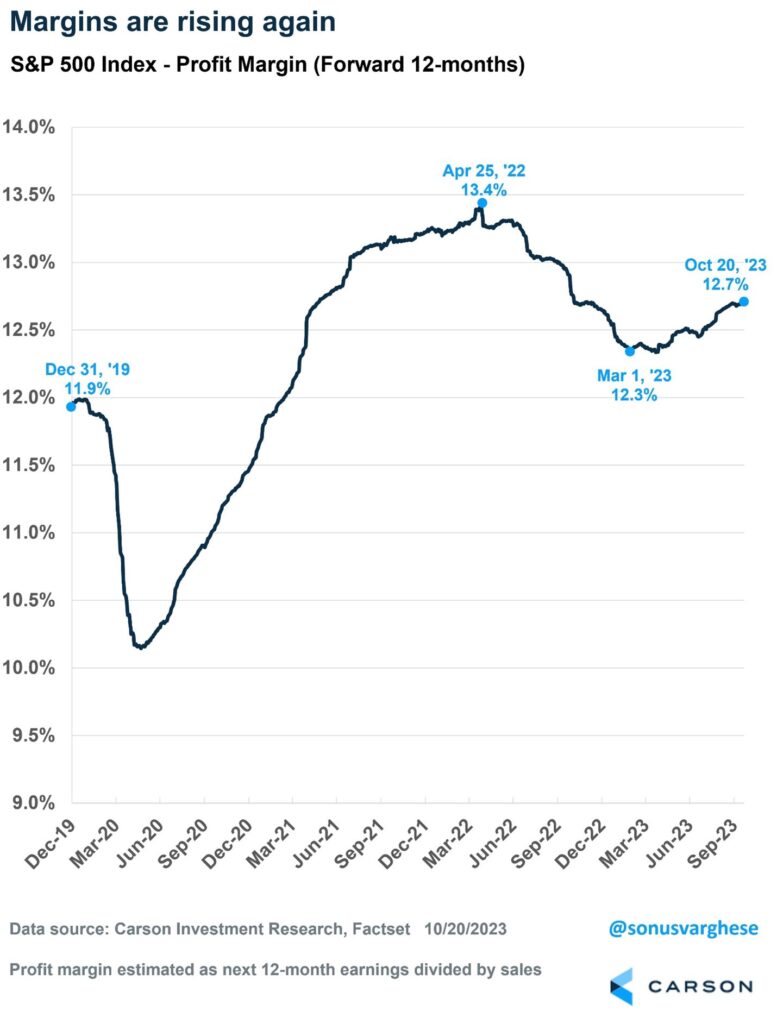

Profit Margins Are Increasing

One of the more obvious things we’ve been told would happen all year was that profit margins would be pressured lower. Well, you might be surprised to know that profits margins have held firm and forward 12-month profit margins on the S&P 500 are trending higher. Just like everyone said. 😉

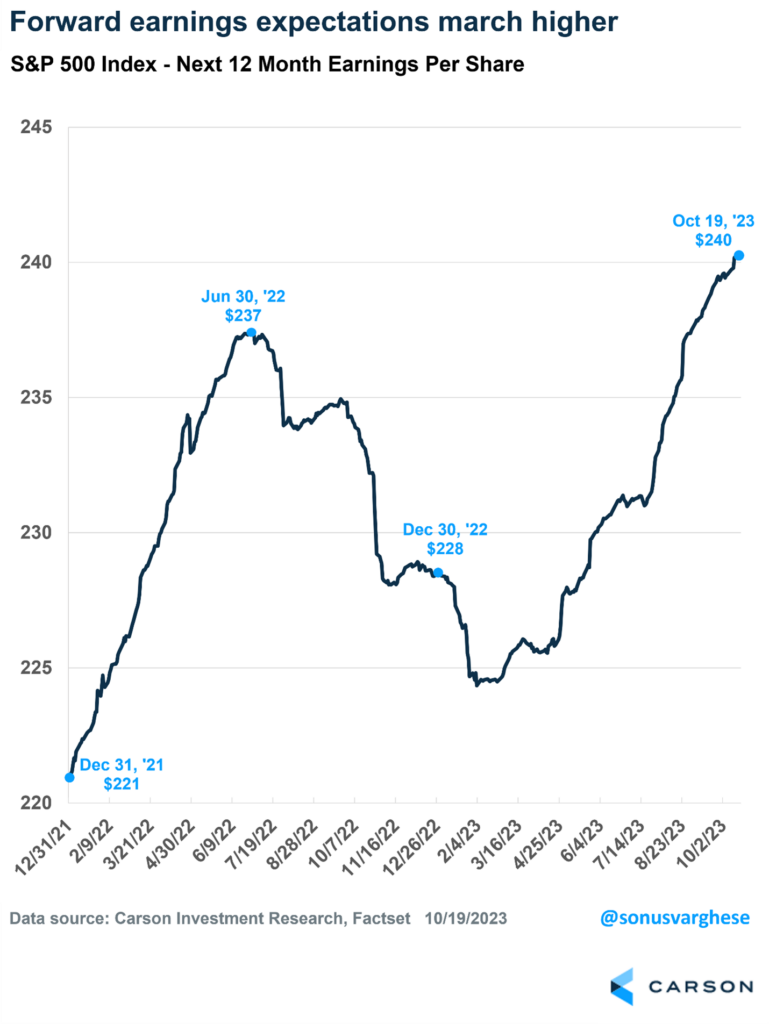

Earnings Should Hit An All-Time High Next Year

Yes, earnings have been lower year-over-year the past three quarters, but there’s a good chance that ends this quarter. What might surprise most investors is forward 12-month S&P 500 earnings are expected to hit a new all-time high next year, as the next few quarters should see solid growth. We’ve long been in the camp there is no recession coming and we still feel the odds of one in 2024 are quite low (more on that below), which should support solid earnings growth.

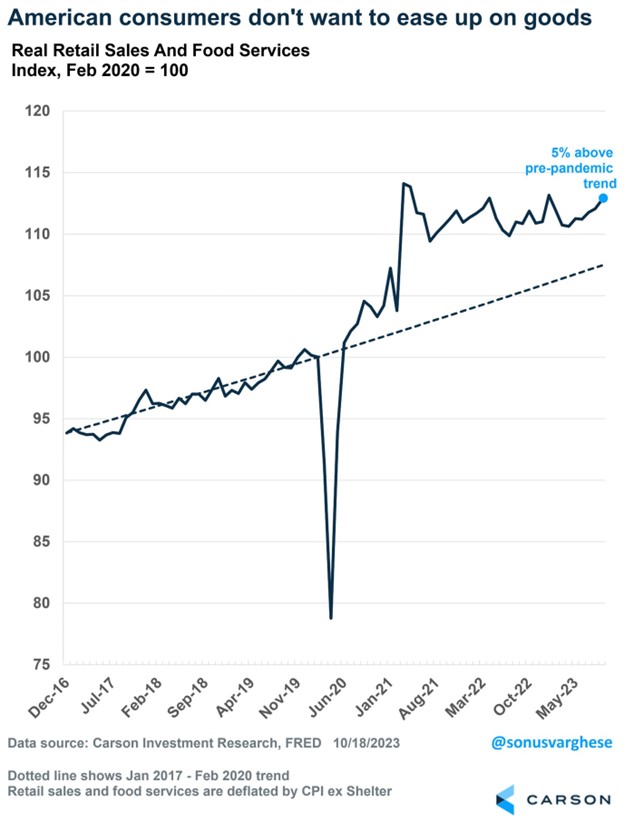

Student Loan Payments Coming Back Could Crush the Consumer

Yes, many suspended student loan payments have resumed, but this doesn’t mean the consumer will stop spending. In fact, if you look at the actual data and not the fear-mongering in the media, we see that some continued to pay their debt this whole time, while if you are struggling to pay now, the government has many ways to help.

The bottom line is that despite student loan payments starting again, we’ve seen virtually no slowdown in spending. In fact, in some cases, we’ve seen more spending. Here’s what Visa’s CFO, Vasant M Prabhu, had to say yesterday at their earnings call: “As we said consistently, we’re not economic forecasters, and so at a macro level, we are assuming no recession in our outlook. We’re also not factoring in any impact from student loan repayments because…we’ve yet to see any meaningful impact.”

Lastly, here’s retail and food sales running 5% above pre-pandemic levels and showing no signs of slowing down.

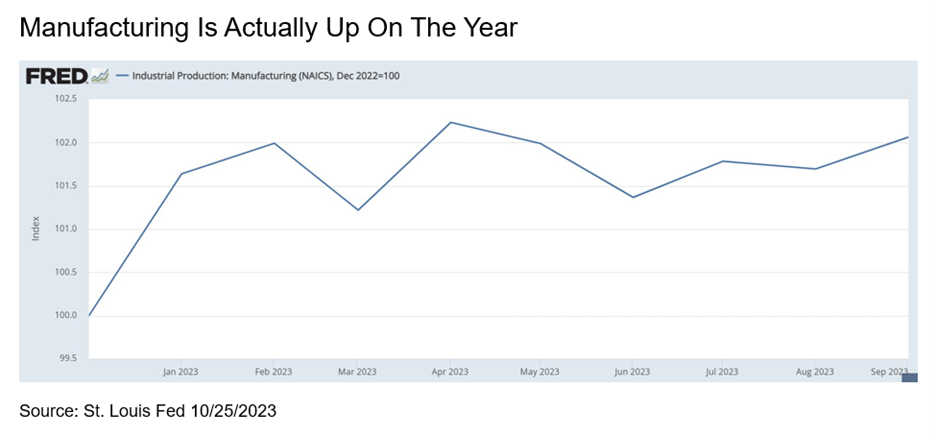

Manufacturing Is Solid

We’ve heard time and time again how poor many of the manufacturing sentiment surveys have been, suggesting a meaningful slowdown. Well, once again, a simple look at the actual hard data (versus survey data which is called soft data) shows a much different story.

Would you believe that manufacturing is up 2.1% this year? If all you followed was the headlines and media, you’d never realize this. Now, to be clear it isn’t like up 2.1% is soaring, but it still paints a better picture than what we’ve been hearing and one that we expect will continue to improve over the coming quarters.

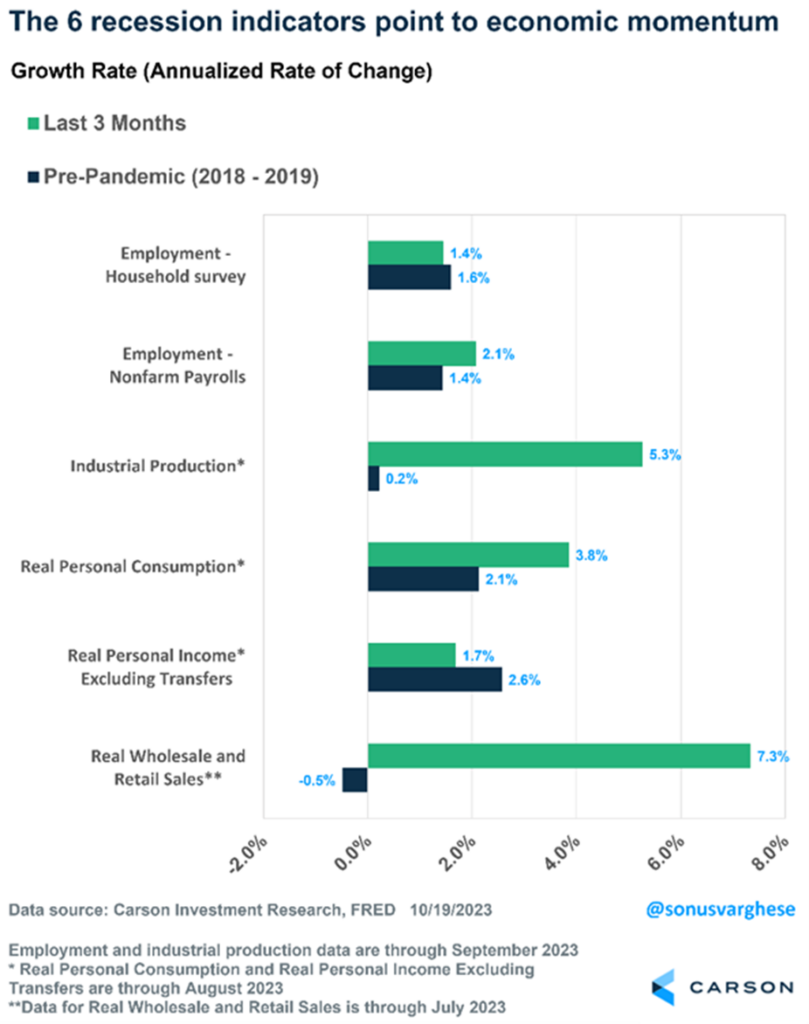

No, A Recession Isn’t Around the Corner

Several big names out there are still calling for a recession, but the data doesn’t confirm that at all. Of course, this might sound like a broken record, as we’ve been hearing this for a year now. The National Bureau of Economic Research (NBER) is the group that oversees calling recessions.

Turns out, they don’t just look at GDP, which explains why we didn’t have a recession at the beginning of last year, even with consecutive negative GDP prints. They instead focus on things like employment, industrial production, consumption, income, and wholesale and retail sales.

Looking at the six indicators they use for a recession shows we are clearly not in a recession, not even close. Employment and incomes are a tad below pre-pandemic levels, but we’ve seen surges in industrial production and retail sales.

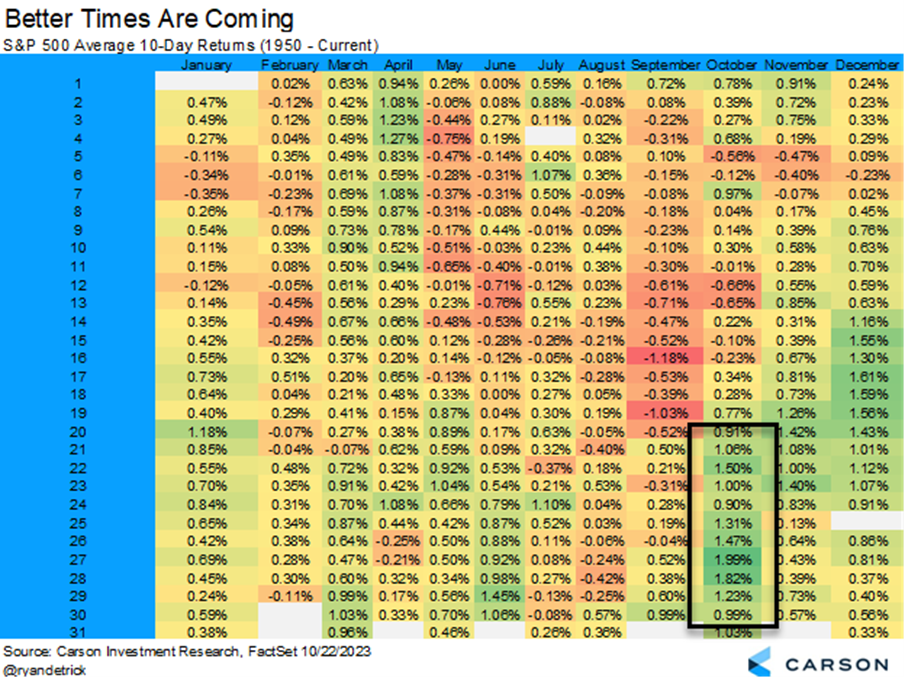

Stocks Can Go Lower, but They Can Also Go Higher

After the best first six months to a year ever for the Nasdaq and the best first seven months for the S&P 500 since 1997, stocks have seen what we consider to be normal seasonal weakness. But for some reason this has confused many investors. It isn’t fun, but to see weakness in August and September isn’t abnormal. But stocks tend to do much better near the end of October.

Here’s a table I’ve shared many times and it has played out quite well this year. It shows the return 10-days after a particular day. All those reds boxes in August and September fit with what we experienced this year, along with the early parts of October. Well, the good news is some of the very best 10-day returns of the year are coming up now and again over the next two months. Don’t give up hope for a fourth-quarter rally just yet.

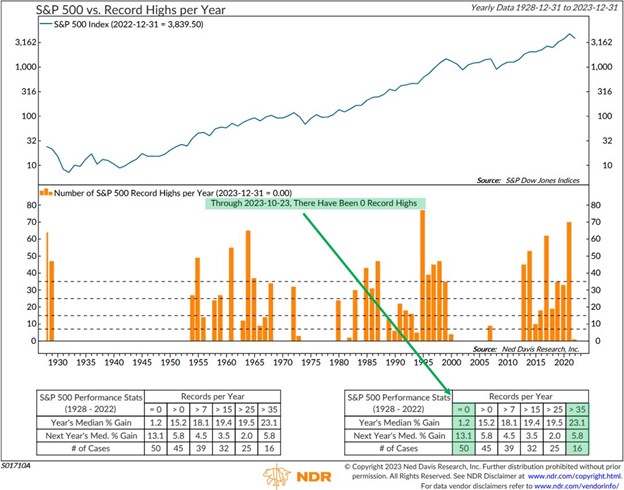

No New Highs Could Be a Good Thing

Our friends at Day Hagan Asset Management tweeted this interesting stat out and I wanted to make sure you saw it. They found that years the S&P 500 didn’t make a new high (like 2023 potentially) saw big jumps the following year, up a median return of 13.1%, while years with more than 35 new highs saw a median return of only 5.8% the following year.

Bears Are Back in Town

Several big names are back in the news calling for a recession. Bill Gross (the founder of bond giant PIMCO) was in the news just this week calling for a recession by the end of the year. We already shared above how that simply isn’t likely, but the point I want to make is to never follow any one person blindly. Mr. Gross also called for the ‘death of the cult of equities’ back in the middle of 2012, right before stocks doubled the following seven years as you can see here.

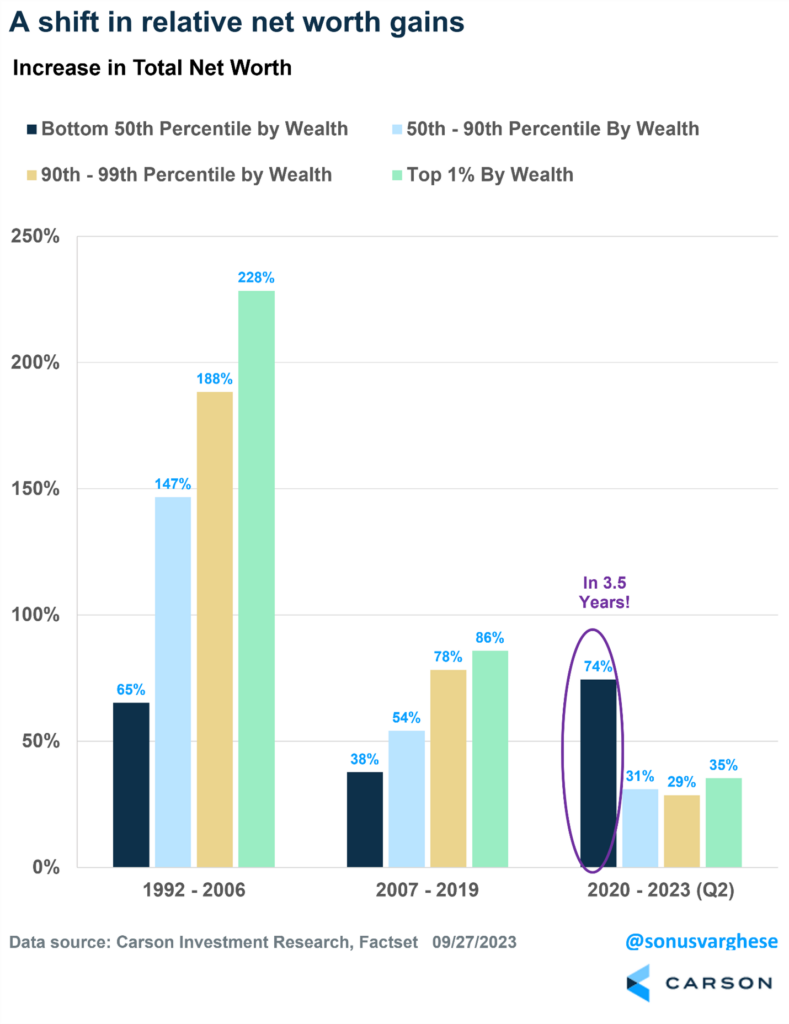

The Consumer Is in Really Good Shape

One of the reasons we haven’t had a recession in the face of higher interest rates and still elevated inflation is people are worth more. If you owned a house or had stocks in the last decade, you’ve seen your net wealth increase, in many cases substantially. Things aren’t perfect, but for some reason, many economists ignored the impact of wealth on the whole equation of how the economy would do. For more on this important concept, be sure to read the blog Sonu Varghese, VP, Global Macro Strategy, wrote yesterday in Here’s Why the Economy Has Defied Recession Forecasts.

Here’s a nice table that shows how net worth has increased widely across the board, but this decade it has actually been the lower earners that saw the largest jumps in wealth. That is something you sure won’t hear in the media. Lastly, the Fed found that household net worth increased by 37% in the past three years, the fastest pace since they started tracking this data.

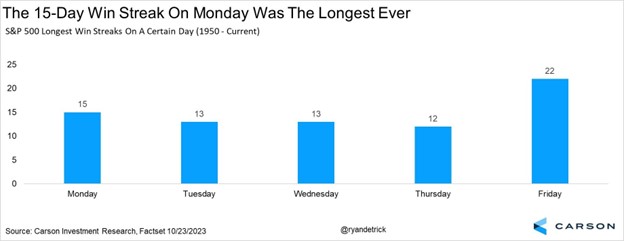

Monday Isn’t That Bad

Last one is… Did you know stocks just had a 15-day win streak on Monday? That’s right, the S&P 500 was higher 15 Mondays in a row! I’m not sure what in the world it means, but only a 22-day Friday win streak in 1955 saw a longer win streak for any specific day of the week.

Conclusion

So, there you go, some things you might not have known, but should. I even made it through this whole blog without pointing out that Michigan is just a bunch of cheaters! But we all knew that already, so nothing new there really 😉

To me, the bottom line remains things aren’t as bad as we keep hearing. Yes, we have many legitimate worries and concerns, but the odds of a recession are quite low, the Fed is likely done hiking, profits should remain strong, and the consumer is healthy. Those aren’t the worst pillars for investors as we move into 2024.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Speaking of Big 10 football, I took Sebastian to see The Ohio State University versus Penn State last weekend and we had a blast celebrating a nice win and his 13th birthday at the Shoe. He is on the right and his brother is on the left. GO BUCKS!

1952037-1023-A