“I don’t make jokes. I just watch the government and report the facts.” -Will Rogers

- What happened? Rating agency Fitch downgraded the U.S. government’s longer-term credit rating to AA+ from AAA. This was the second time in history a rating agency did this, as S&P Global Ratings did it in August 2011 after a government standoff over the debt ceiling. Must be something about early August 😉

- Why did they do it? You can read the whole report here, but they cited, “the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers” as reasons for the downgrade.

- What does Washington think? To the surprise of no one, the White House and Washington disagree. U.S. Treasury Secretary Janet Yellen for instance said she strongly disagreed with the decision, calling it ‘arbitrary’ and said it was based on outdated data.

- Why now? Fitch put the U.S. on watch for a potential downgrade three months ago as the debt ceiling drama was in full swing. Why did they do it now? That’s a tough one to answer, as the reasons listed could have meant a downgrade at any point over the past two years. Maybe they did it in August (like S&P) as they hoped the impact would be limited with many on vacation and lower volumes?

The good news is the debt limit has been lifted for two years, Washington has passed multiple bipartisan deals, inflation is slowing dramatically, and economic growth is surprising to the upside. A downgrade now doesn’t make a lot of sense to most of us.

Analysts have generally responded negatively to the downgrade. For example, Mohamed El-Erian, chief economic advisor at Allianz, commented, “I am very puzzled by many aspects of this announcement, as well as the time.”

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

- Is a recession imminent? Credit downgrades are generally not a direct response to the economic cycle nor does the downgrade to AA+ represent any real concern with default risk. The downgrade is not a growth forecast. Still, we want to be emphatic that we believe a recession is not As we’ve been saying all year, the economy is on very firm footing, thanks to a strong consumer, slowing inflation, a healthy jobs market, and improvements in housing and manufacturing. In fact, Sonu wrote about the consumer improving in Three Reasons Why US Consumers Are Feeling Better.

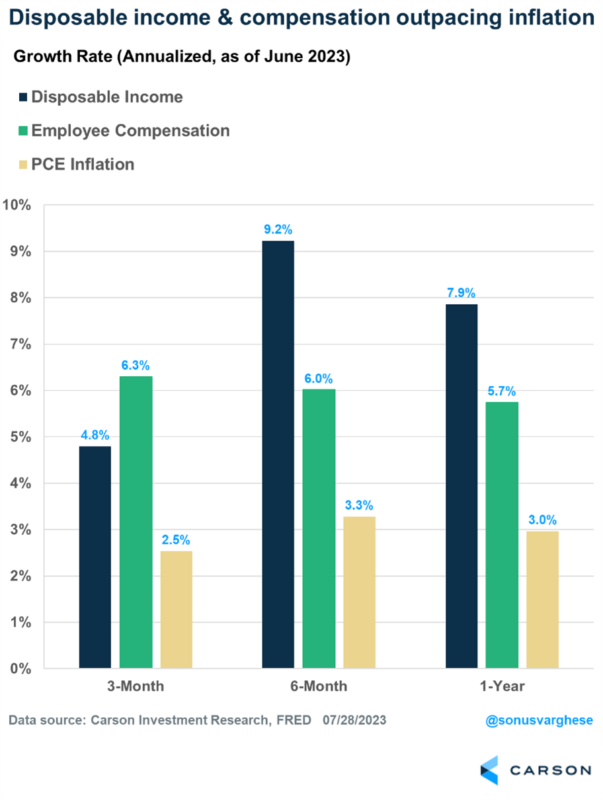

Lastly, here’s a great table that shows disposable incomes and employee compensation are both running consistently above inflation over the past year. We came into this year saying there wouldn’t be a recession (that wasn’t very popular) and we remain in the camp the economy will surprise to the upside if anything the rest of ’23 and the strong consumer is a big reason.

- Does this change our overweight to equities? No, it absolutely does not. We continue to see a better economy coming, stronger-than-expected earnings, continued falling inflation, a broadening out of overall participation (with small, mid-caps, and cyclicals leading), and strong technical trends overall as reasons to expect stocks to outperform bonds and likely do well at least into the remainder of this year.

Speaking of the 2011 downgrade, the S&P 500 is up more than 275% since then. That should help calm some near-term nerves.

Be sure to listen to the latest Facts vs Feelings podcast called Just Like Everyone Expected, where Sonu and I breakdown many of our reasons for still being optimistic.

- What happened in 2011? What I remember most about that downgrade was it came on a Friday after the market closed, almost like S&P was trying to sneak it past everyone or at least give markets the weekend to digest the news. Well, that wasn’t the case, as the S&P 500 saw historic volatility that next week, falling 6.66% on Monday, up 4.7% on Tuesday, and down 4.4% on Wednesday. It was a choppy mess until the ultimate bottom on October 3.

It is worth noting that yields sold off, which means investors were moving to the safety of Treasuries, the exact thing that was downgraded. 😊

One final note is that unlike now, stocks were weak heading into that downgrade.

- Was this a surprise? No and yes. After the 2011 downgrade, you could say another downgrade was always a possibility, especially after the latest drama out of Washington regarding the debt ceiling, not to mention Fitch had the U.S. on watch for a move like this. Still, as we will discuss next, the three main reasons they listed as reasons for the downgrade have all been improving, not deteriorating. 🤷♂️

- Debt is improving, not getting worse. They mentioned “general government debt burden” as one of the three main reasons for the downgrade. Well, debt-to-GDP has fallen from 123% in Q1 ’22 to 119% in Q1 ’23 and is well off the previous peak of 135%in Q2 ’20. The Congressional Budget Office is projecting steady growth in debt-to-GDP moving forward, but that’s a forecast. Why pull the trigger when the trend is improving?

- Is the government really worse? They cited a deterioration of governance quality as another reason for the downgrade. We’d say things haven’t changed all that much over the past decade. Now we aren’t saying things are great here, but we believe they’ve been bad pretty much overall the past decade, so we don’t see them getting worse.

Not to mention over the past two years saw Congress pass three big bipartisan deals, including the Bipartisan Infrastructure Bill, the CHIPS Act, and a spending deal to avoid a debt ceiling breach earlier this year. It’s also important to keep in mind that sometimes the government that governs best is the government that governs least. Gridlock can be a fiscal positive.

We get it, many may not like the government, but we don’t think things are that bad. Besides the quote by Will Rogers above about the government, we are often reminded that if the opposite of pro is con, then the opposite of PROgress must be CONgress.

- A worse next three years. Lastly, they cited deterioration over the next three years as the final reason for the downgrade, while also citing they expected a ‘mild recession’ sometime later this year or early next year (that sounds familiar).

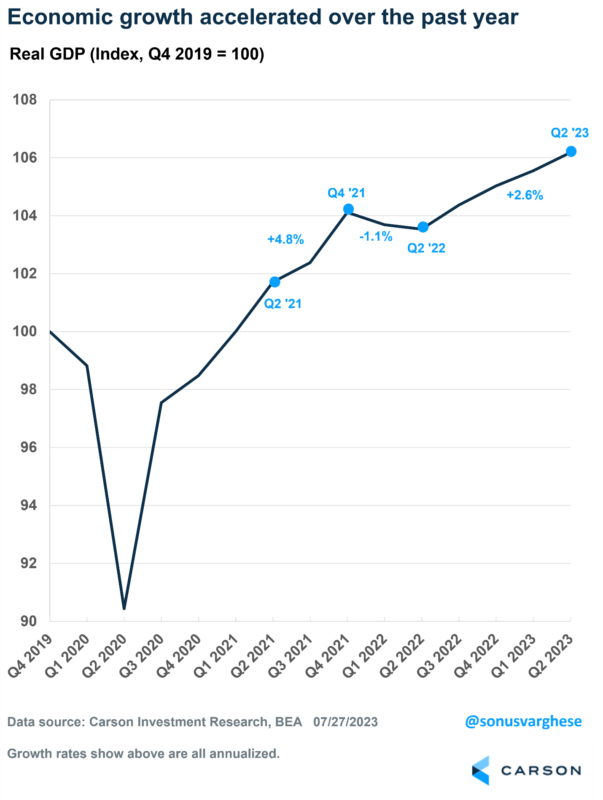

We are taking the other side to the recession talk, as we have all year. Inflation is down from 9% to 3%, earnings are bottoming and trending higher, the consumer is strong, and the labor market shows no signs of slowing. Real GDP is up a very solid 2.6% year over year, and the unemployment rate is holding near 50-year lows.

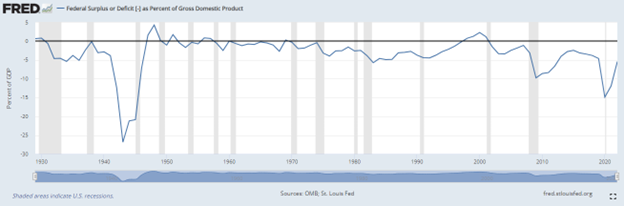

They cited worries over fiscal deficits and “unsustainability,” but they then projected federal deficits of 6% of GDP over the next few years. This isn’t anything new, as it is what the CBO has been projecting. Lastly, the deficit has quietly been improving from 15% of GDP in 2020 to 5.4% as of 2022. Granted, this is off pandemic historical extremes outside WWII and is not a desirable level, but there’s nothing new here other than positive trends.

The bottom line is U.S. Treasuries are still considered to be the ‘safest’ asset in the world and we don’t expect that to change due to this credit rating downgrade. The irony is that the world wants safe assets, and the one country that is willing (and perhaps, able) to issue even more of them is the US, though that also means that the US is issuing more debt! Europe, Japan, and China are the only other potential candidates, but for various reasons they’re not in a position to supply investors with safe assets to the degree the US can.

Additionally, we don’t anticipate any big holders of our debt to be forced to sell as a result of the downgrade.

Please continue to follow the Carson Investment Research team as we track this and any other major news events that could impact your investments.

Thanks to Barry Gilbert (VP, Asset Allocation Strategist) and Sonu Varghese (VP, Global Macro Strategist) on our team for helping with this blog.

1854966-0823-A