“Americans will always do the right thing – after exhausting all other possibilities.”

-Winston Churchill

The Carson Investment Research Team began covering the election back in March with our “16 Charts and Tables) to Know This Election Year.” With Election Day now 11 days away and early voting taking place in many states, we thought it would be worthwhile to go back and look at those 16 charts, both as a reminder of market-related election history and to evaluate where things stand now. (For all our election-related content, visit the team’s election landing page, with more to come as we close in on November 5.)

There’s still a lot of uncertainty around this election. The presidential outcome remains as close as any in modern history. The House is still a near toss-up. The Republicans are likely to take control of the Senate but it’s far from a lock.

We do know whatever happens we’ll be inaugurating a new president on January 20, 2025. Well, sort of. Former president Donald Trump would be the 47th president of the United States, but he was also the 45th. Vice President Kamala Harris would be a new president but would also be from the same party as a president leaving office after four years. So, I guess there’s some ambiguity even there.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

One place where we do have clarity? If you had followed our charts back in March, you would have known that the odds were pretty good that this would be a solid year for markets. Election years tend to be good for markets, especially election years of the type we’re having in 2024 (see charts 1, 5, and 9). A Democratic president with a split congress has historically been one of the best combinations for overall market performance (see charts 12, 13, and 14). And so much more.

Some charts even hinted at the potential outcome (see charts 15 and 16), but we would take that with a whole shaker of salt. In the end, historical data, models, and polls don’t pick the president. Voters do. We encourage all our readers to go out and vote.

My grandfather used to tell his grandchildren there were three things he wanted them to do for him. Try to take a walk every day. Take your vitamins. And vote. I still think it’s some of the best advice I’ve ever received.

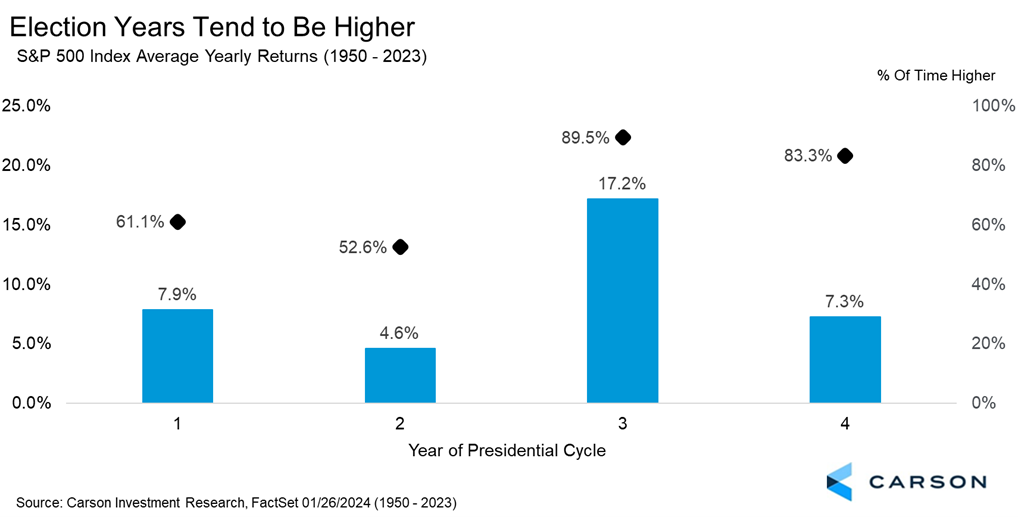

Chart 1: Election Years Tend to Be Higher

What we said then: “The best year for stocks is a preelection year (like 2023), while midterm years (like 2022) are the worst. Election years gain 7.3% on average, but are higher a very impressive 83.3% of the time.“

What has happened: The election year has held true to form and then some, with the S&P 500 up 22.9% on a total return basis as of yesterday’s close.

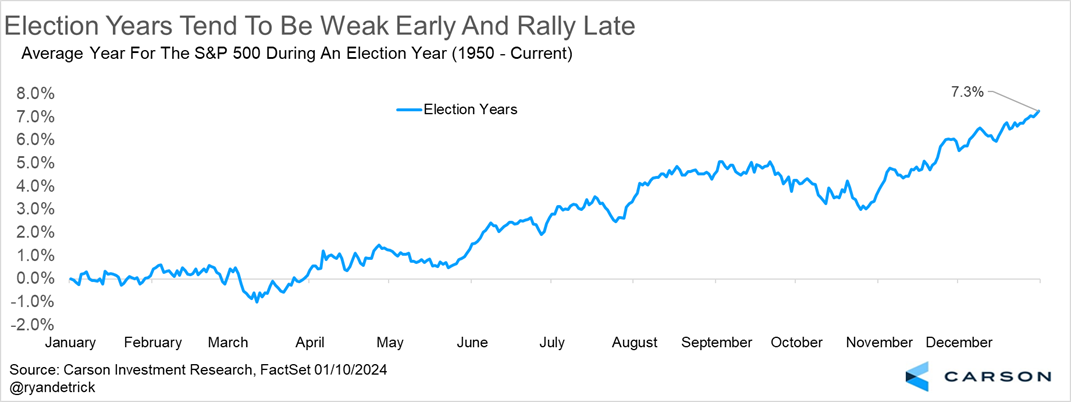

Chart 2: Election Years Tend to Be Weak Early and Rally Late

“I don’t make jokes. I watch the government and report the facts.” Will Rogers

What we said then: “Be aware the majority of that 7.3% gain tends to happen later in the year, as stocks are historically down for the year in March of an election year. After solid mid-year gains, the S&P 500 has stalled, on average, in the immediate preelection months when uncertainty is at its highest, before rallying after the election into the end of the year as markets gain clarity on what they have to work with, both in the White House and in Congress. But gains are steadier throughout the year (after a slow first quarter) when a president is up for reelection (see below).”

What has happened: There have been some periods of modest volatility during the year, but the first three months of the year were very strong, the S&P 500 up over 10% in the first quarter on a total return basis. We would temper expectations for the strength of a post-election rally given gains year to date, but history still supports further post-election gains (more on that below).

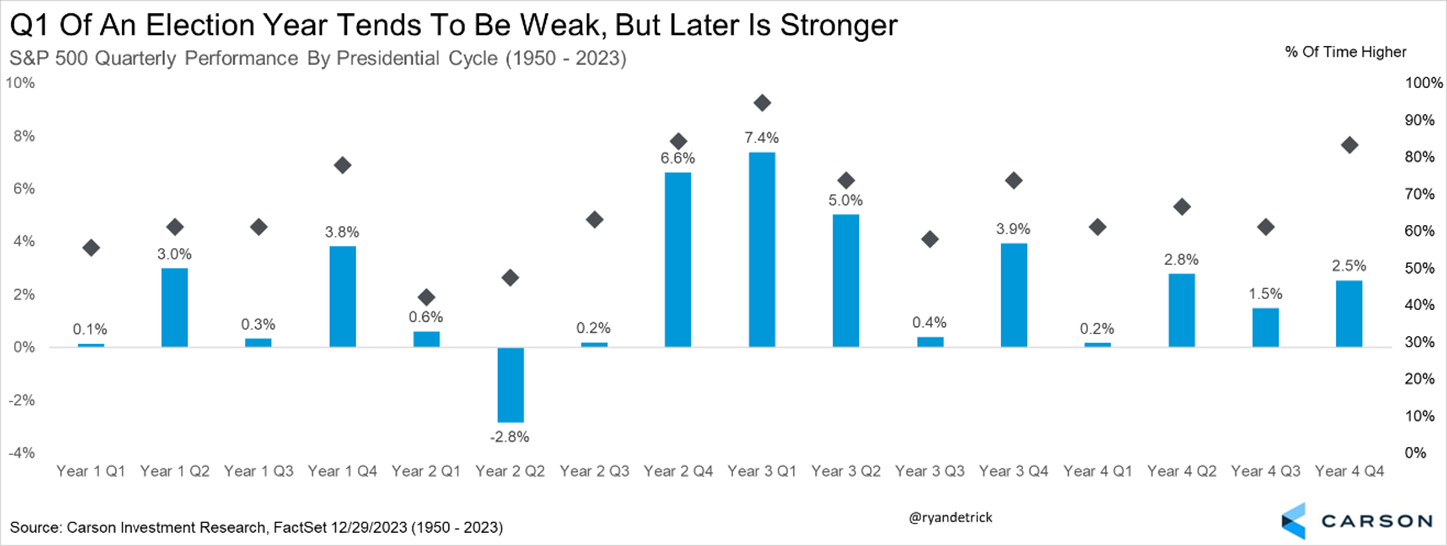

Chart 3: Q1 of an Election Year Tends to Be Weak, but Later Is Stronger

What we said then: “Breaking down the four-year presidential cycle by quarters shows the first quarter of an election year usually isn’t very strong, while the best quarters are the fourth quarter of a midterm year and early in a pre-election year, exactly how things played out this time.”

What has happened: Similar to above, election year gains have held true overall but we’ve had more early strength than average. Nevertheless, we still think there’s plenty in place to support fourth-quarter gains, including post-election clarity, options positioning, earnings strength, economic momentum, and Federal Reserve rate cuts.

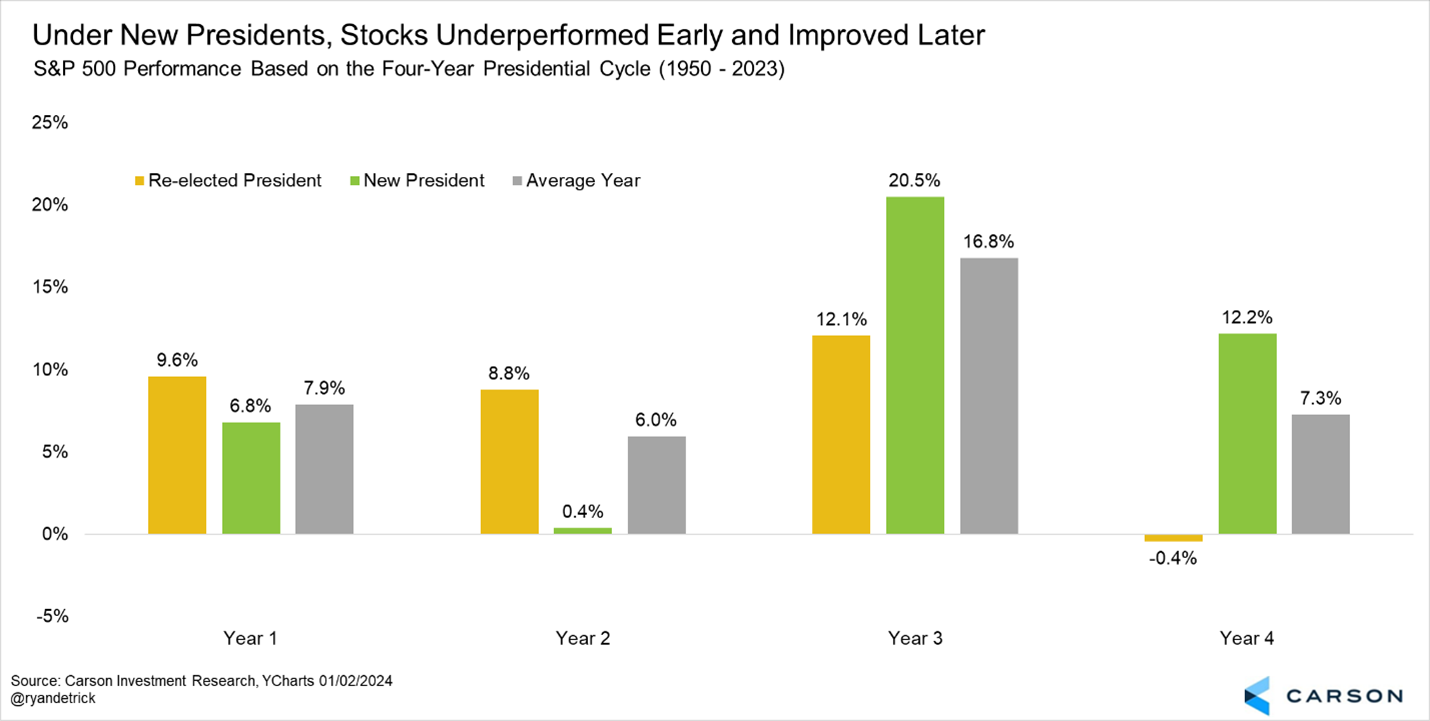

Chart 4: Under New Presidents Stocks Underperformed Early and Improved Later

“The problem with political jokes is they get elected.” Henry Cate VI

What we said then: “Historically, stocks have done much better in a pre-election year under a president in their first term (up more than 20% on average), while midterm years for a new president do much worse (virtually flat). That played out this time, with stocks down big in 2022 and bouncing back big in 2023. What matters now is election years, which have seen stocks do much better when a president is up for reelection versus a lame duck president.”

What has happened: This one has certainly held true to form when looking at 2024, with markets shining so far in an election year (2024) under a new president (Biden).

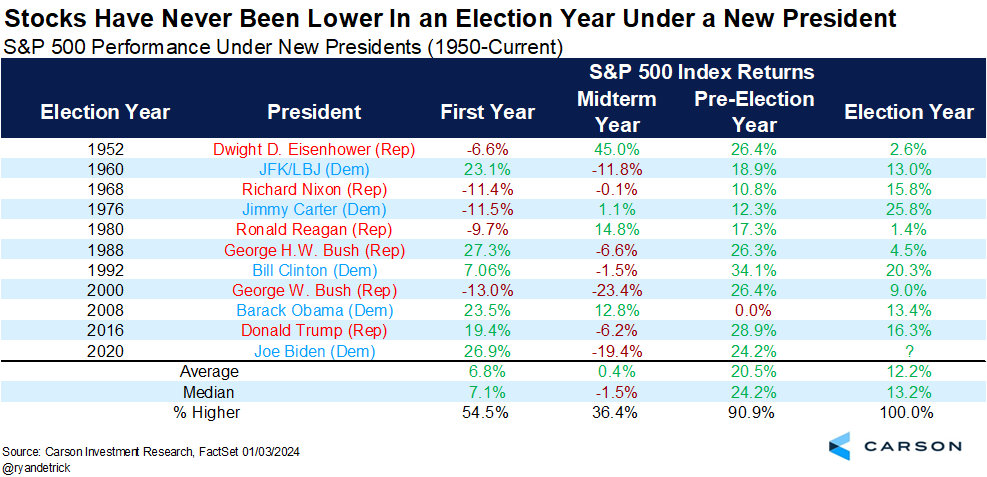

Chart 5: Stocks Have Never Been Lower in an Election Year Under a New President

“Americans will always do the right thing – after exhausting all other possibilities.” Winston Churchill

What we said then: “Breaking this down more showed that stocks gained during an election year the past 10 times when the president was up for reelection. Not to be outdone, pre-election years have been higher nine of the past 10 times a president was up for reelection.”

What has happened: With the S&P 500 up over 20% so far in 2024, this one is very likely to hold true.

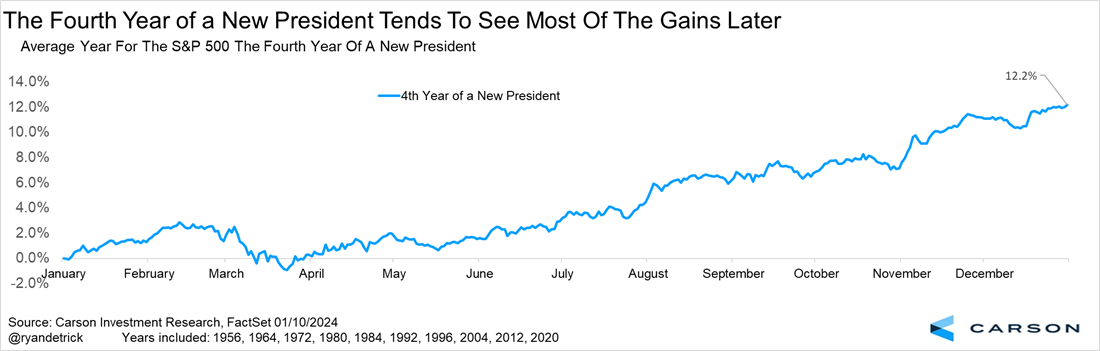

Chart 6: The Fourth Year of a New President Tends to See Most of the Gains Later

What we said then: “The majority of those 12.2% gains an election year of a first-term president indeed tended to happen later in the year though, as we show below.”

What has happened: As discussed above, what volatility we’ve had has come in the second and third quarters, but those two quarters have still been pretty good so we would call this one on the mark.

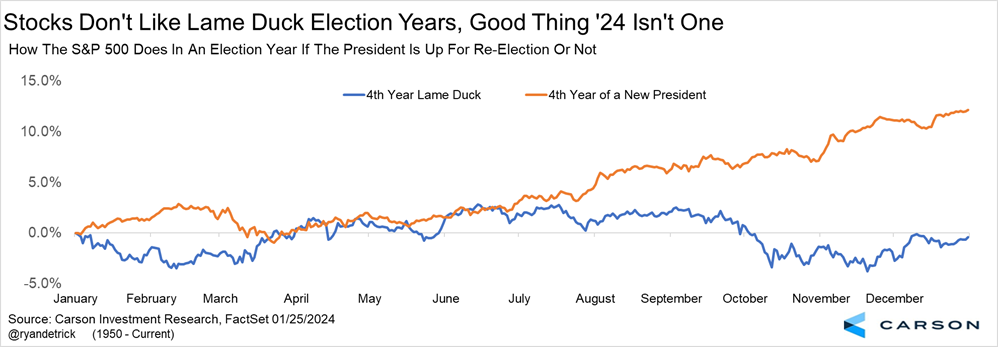

Chart 7: Stocks Don’t Like Lame Duck Election Years; Good Thing ’24 Isn’t One

“George Washington was the only president who didn’t blame the previous administration.” Source unknown

What we said: “Here’s another way to show how election years do based on whether the president is up for reelection, or we have a lame duck president. It’s pretty clear things go better when a president is up for reelection. “

What has happened: Maybe with this one we work backwards. Is this a lame duck election year? Yes and no, as discussed above, but markets suggest we not treat it as one, so let’s just stick with the idea that this is an election year under a new president. From that perspective, the year has held true to form.

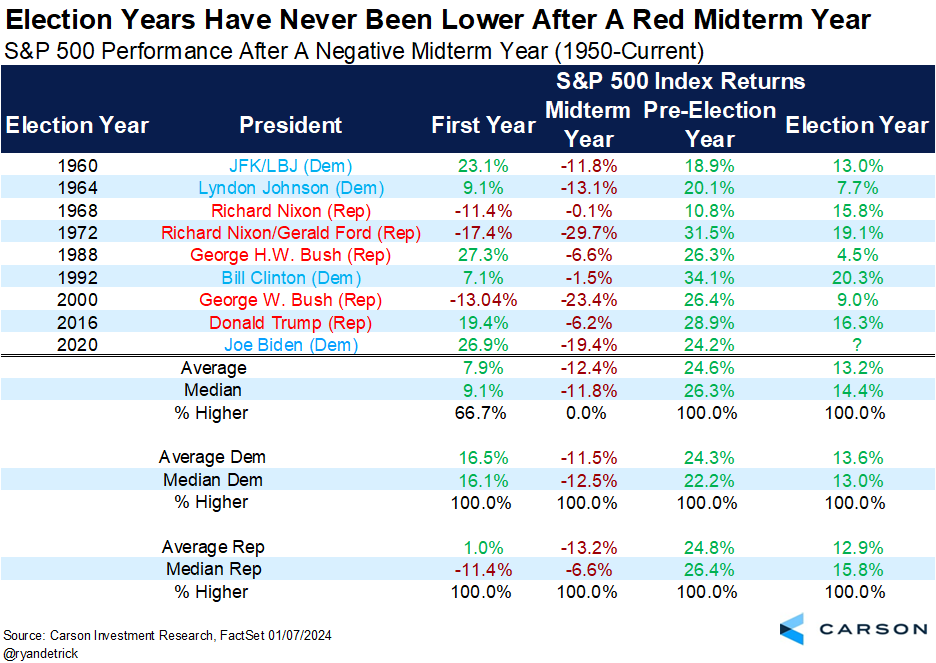

Chart 8: Election Years Have Never Been Lower Under a Red Midterm Year

“The best argument against democracy is a five-minute conversation with the average voter.” Winston Churchill

What we said then: “Interestingly, a negative return in a midterm year (like we saw in 2022) has been followed by a higher pre-election and election year every single time. That is 17 out of the past 17 pre-election and election years higher after a negative midterm year. Do you really think this will be the year this amazing streak ends? We don’t and are looking for 18 out of 18.”

What has happened: Odds heavily favor this particular data point holding true and that we will indeed be 18 out of 18 at the end of the year.

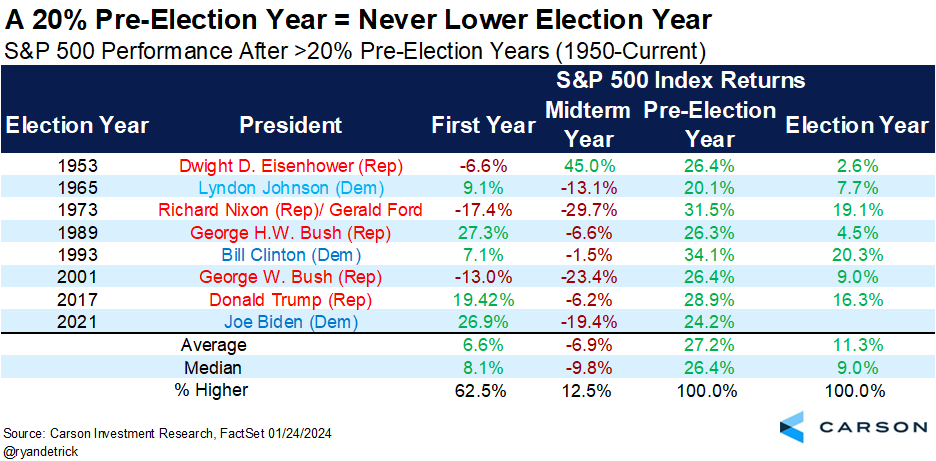

Chart 9: A 20% Pre-Election Year = Never Lower Election Year

What we said then: “Another angle on this is after a 20% gain in a pre-election year, we’ve had a higher election year the past seven times going back to 1950. Also, look at how normal it is to have red in a midterm year, then a big bounce the following year. If this tendency continues to play out, it’ll be more good news for 2024.”

What has happened: Sensing a pattern here?

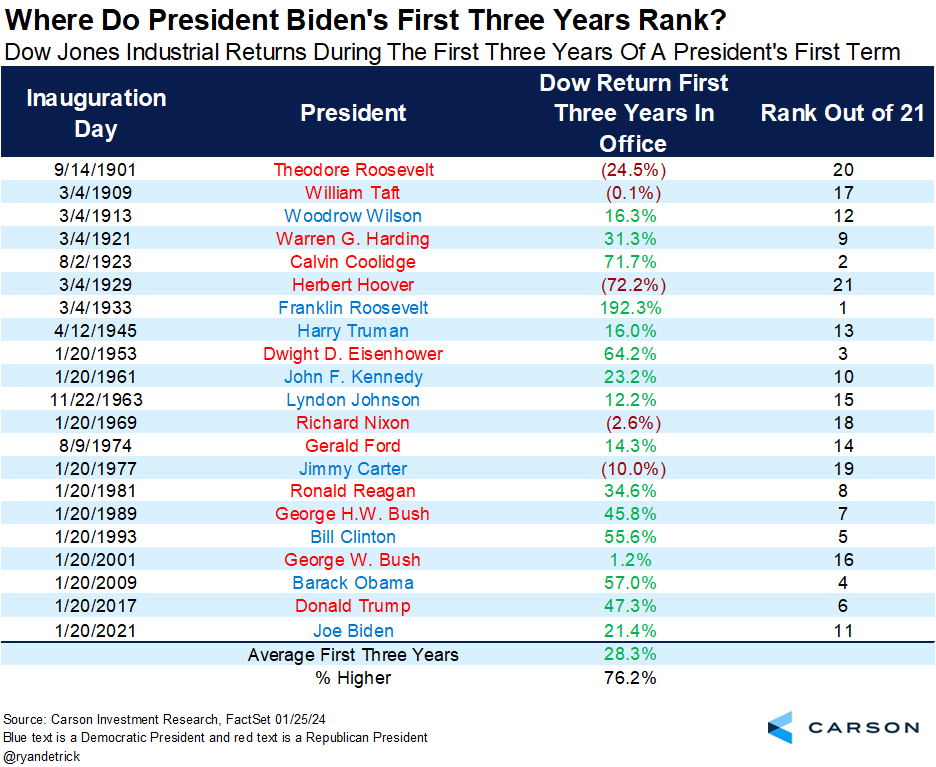

Chart 10: Where Do President Biden’s First Three Years Rank?

What we said then: “How have stocks done under President Biden? Don’t shoot the messenger here, but the Dow was up 21.4% his first three years in office, which ranks 11th out of the past 21 Presidents using Dow data back to 1900.”

What has happened: President Biden’s ranking will likely improve with strong returns so far in his fourth year.

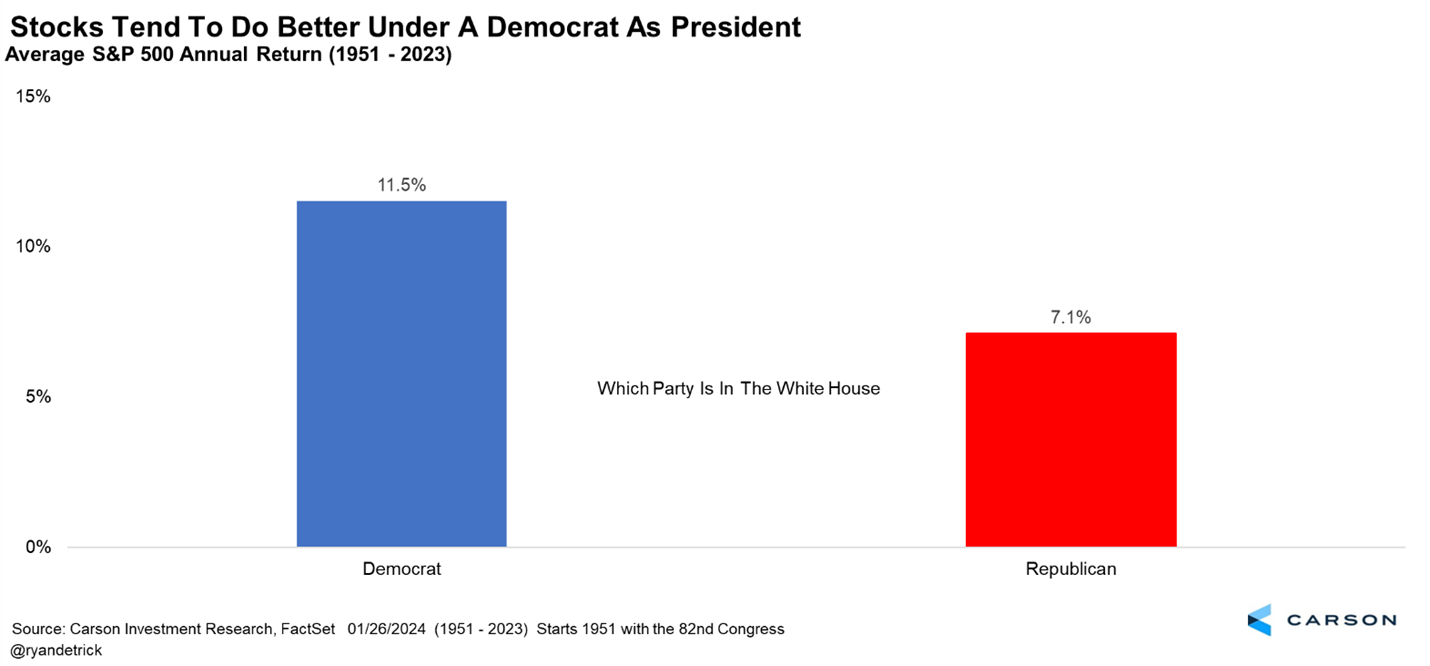

Chart 11: Stocks Tend to Do Better Under a Democrat as President

What we said then: “Another popular question is how stocks do based on which party is in the White House. Now is when people might want to throw something at me, but it is what it is. Historically, stocks have done better with a Democratic president versus a Republican in power. As with many of these numbers, we would take this with a grain of salt. Despite the tendency to view the president as responsible for the economy, the president alone often has a relatively small impact compared to broader economic forces. Do you think the fact that 10 of the last 11 recessions started under a Republican president is because a Republican was in the White House? We don’t.”

What has happened: While markets have continued to do well under President Biden, our main takeaway from this is simply not to forecast market returns based on who occupies the White House.

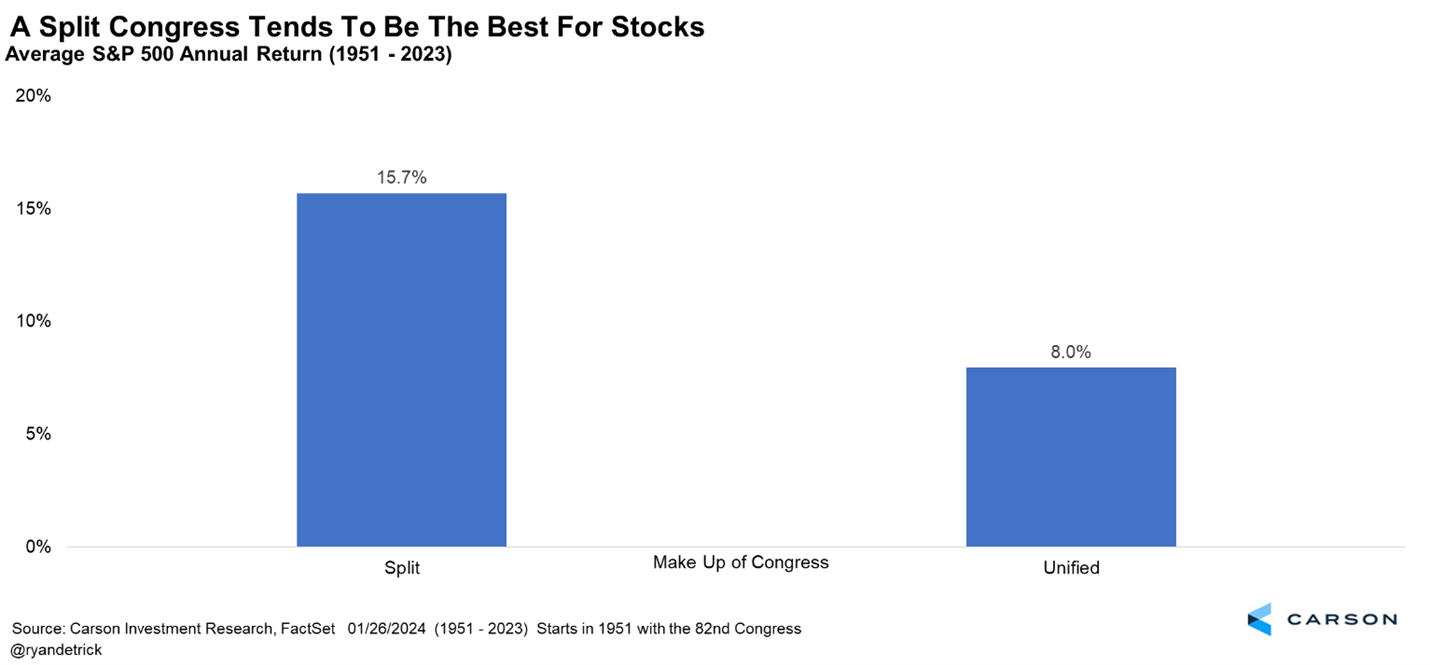

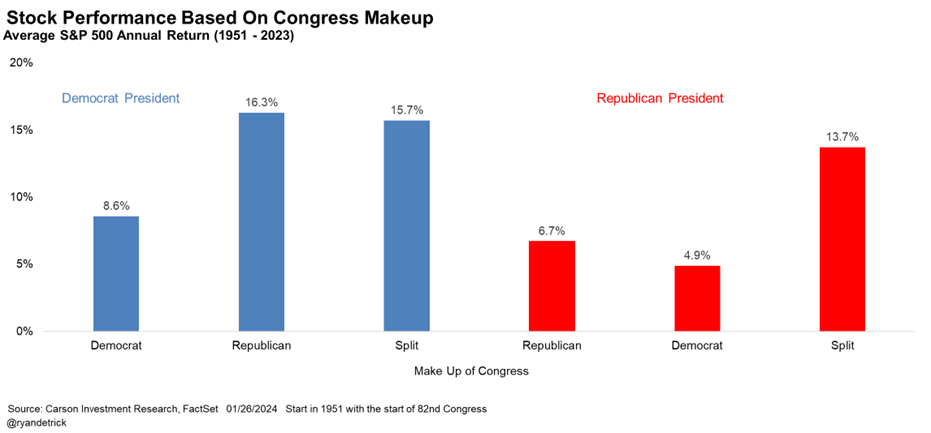

Chart 12: A Split Congress Tends to Be the Best for Stocks

“If the opposite of ‘pro’ is ‘con’, then the opposite of progress must be Congress.” Sam Stovall

What we said then: “Who is in the White House can matter, but we’ve found the make-up of Congress might matter more. In fact, a split Congress has been much better for investors, as stocks incredibly have gained the past 13 times we’ve had a divided Congress! Maybe the best Washington is one that can’t get anything done? Or maybe it’s that what does get done requires compromise and common cause and is not just political overspending to reward constituents. Those checks and balances the founders put in place might be even more important than we realized.”

What has happened: The odds of having a split congress (independent of who is in the White House) is probably slightly better than a coin toss right now. But even if we have a single party controlling both the House and Senate, the majorities are likely to be very narrow, giving the more centrist members of Congress a lot of influence. That will bring some of that spirit of compromise even to unified government and keep both parties from being able to give in to their worst legislative excesses no matter who is elected.

Chart 13: Stock Performance Based on Party Makeup

What we said then: “Speaking of which, let’s not forget what friend of Carson Investment Research Sam Stovall once told us. If the opposite of ‘pro’ is ‘con,’ then the opposite of progress must be Congress! That’s a joke you can use all year now.”

What has happened: Looking at 2024, we do have a split Congress (Democratic Senate and Republican Congress) along with a Democratic president. Historically that has been a policy-friendly mix, and I think it’s fair to say that applies to 2023 and 2024. A narrow Democratic majority in the Senate and the narrow Republican majority in the House limited fiscal excesses while allowing some bipartisan legislation to progress. We discuss above why no matter the outcome of the election, some of the features that make divided government market-friendly will likely still be present in 2025, even if we see a sweep.

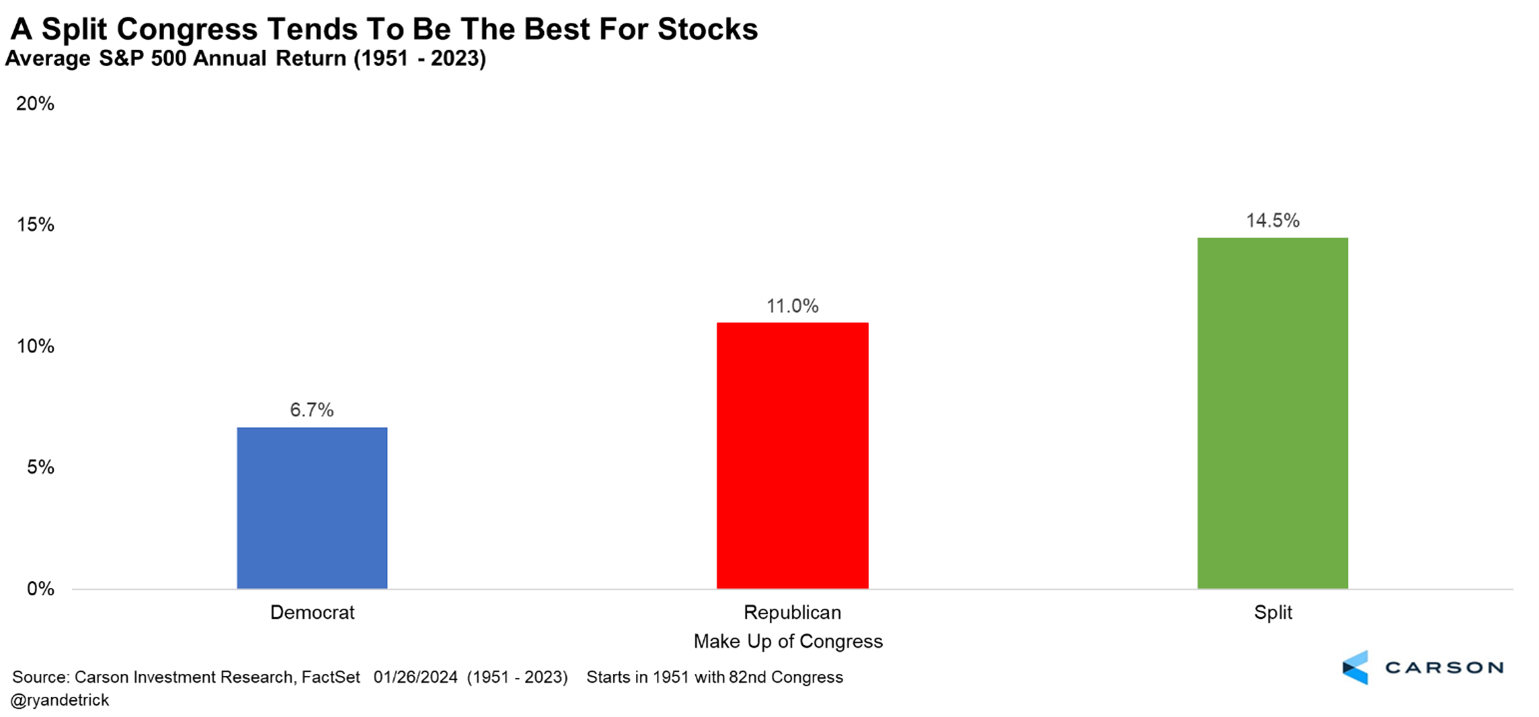

Chart 14: A Split Congress Tends to Be the Best for Stocks

What we said then: “The way we like to put it, it isn’t about red or blue; it’s about green, as you can see below.”

What has happened: It’s certainly been true in 2023 and 2024 and even in the face of a sweep by one party or the other, narrow majorities will give Congress just a little bit of a flavor of a split Congress.

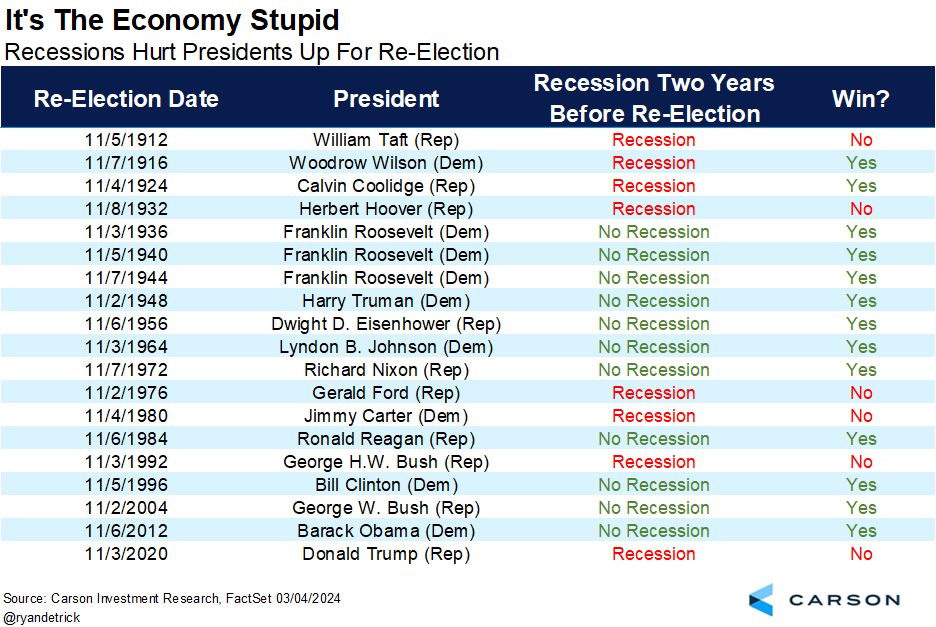

Chart 15: It’s the Economy Stupid

“If voting made any difference, they wouldn’t let us do it.” Mark Twain

What we said then: “How investors feel going to the polls always matters, as we’ve found that if there was a recession in the two years before an election then a president up for reelection usually loses. And if there was no recession, they would usually win. In fact, this has worked every time since Calvin Coolidge way back in 1924, who was reelected despite a recession in the previous two years. But then Coolidge had only become president in August 1923 when President Warren Harding died unexpectedly, and the economy was already rebounding at that point.”

What has happened: Well, this one is forward-looking. We have not had a recession in the last two years, which should favor Harris. In fact, the economy has been pretty good the last two years. Maybe we see this reflected in Harris still being the favorite to win the popular vote. There should probably be a qualifier that voters are very sensitive to inflation and since prices stay “high” even once inflation normalizes, memory of inflationary periods tends to persist beyond their impact, potentially distorting voters’ perception of the economy.

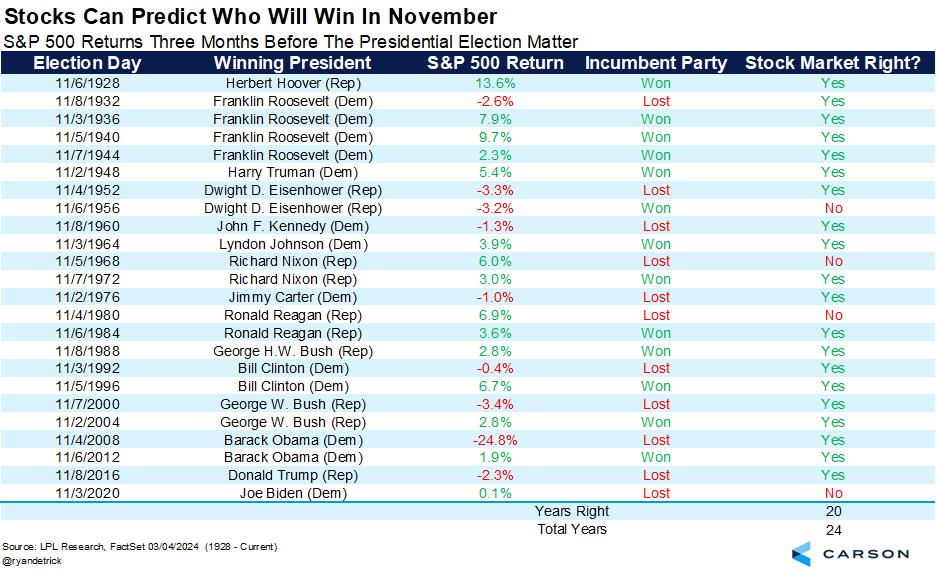

Chart 16: Stocks Can Predict Who Will Win in November

“Bipartisan usually means larger than usual deception is being carried out.” George Carlin

What we said then: “Lastly, how stocks do the three months before an election also has some predictive ability. If stocks are up, the incumbent party usually wins and if they are down, the incumbent party usually loses. This didn’t work in 2020, but it has worked 20 out of the last 24 elections.”

What has happened: This indicator would suggest Harris is the favorite. Stocks are forward looking and have signaled little concern with the economic outlook of late. But the stock market is not the final arbiter of American prosperity and while historically prosperity is the main issue voters have focused on, it’s not the only issue. Ultimately, voters, not markets, will select the next president. Well, technically, the Electoral College, but voters choose the electors.

“In America, anyone can become president. That’s the problem.” George Carlin

In conclusion, we’ve seen many investors let their political beliefs get in the way of their investment choices, to their detriment many times. Some people didn’t like President Obama, but if they let that dictate how they invested they missed big gains. Likewise, some people didn’t like President Trump, but if they got out of the market because of it they also missed big gains. And currently President Biden’s approval rating is quite low, but stocks have soared and are at all-time highs. The bottom line is a strong economy is what will drive stock gains, not who is or isn’t in the White House.

With November 5 just around the corner, watch for more Carson Investment Research election-related content over the next several weeks. Want to see if you missed any? Visit our election landing page and catch up on all our election commentary.

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here.

02478248-1024-A