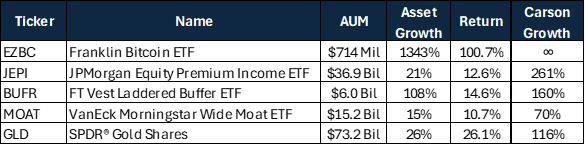

This time of year has no shortage of year-end reviews and year-ahead prognostications, with none other than our own 2025 outlook releasing in mere days. I want to take a look at the year that was through the lens of various Exchange-Traded Funds (ETFs), their asset growth, returns, and problems solved for investors along the way. The ETFs referenced here are available to our advisors on the Carson Investment Platform.

Sources: Carson Investment Research, Morningstar, Factset 12.31.2024

Franklin Bitcoin ETF (EZBC)

One of the biggest stories of the year in 2024 was the final approval and launch of ETFs that track the price of Bitcoin – yet are backed by actual Bitcoin holdings rather than futures contracts. Bitcoin ETFs had tremendous success in both returns and gathering assets last year. Franklin’s Bitcoin product has had a more standard launch trajectory than competitors, but still should be considered a great success as far as ETF launches are concerned. While the differences between many of the available products are difficult to immediately recognize, Franklin committed to the lowest cost structure (even after waivers expired), and as a result returns ever-so-slightly were able to edge out larger competitors for the year. Our advisors have gravitated towards Franklin and Bitwise’s products, viewing them as long-term holds where expenses matter rather than short-term trades.

JPMorgan Equity Premium Income ETF (JEPI)

The posterchild for equity income products, JEPI has amassed significant sums of money and spawned similar products to launch across the industry. JEPI holds a portfolio of defensive, high quality US stocks, and generates income via out-of-the money index call options. By my rough calculations, JEPI has paid its investors more than $6.5 billion in distributions since inception in mid-2020. Since that time, JEPI has returned an annualized 12%, trailing the S&P 500 but outperforming a traditional 60/40 balanced strategy by more than 2% annualized, and done so with less risk than either. Historically JEPI has had between 30-40% less volatility than the overall market, and 10%-20% less volatility than a 60/40. Not a bad way to maintain some equity exposure while increasing overall income production. We have seen significant adoption of JEPI’s Nasdaq-based cousin, JEPQ, as well.

First Trust Vest Laddered Buffer ETF (BUFR)

Speaking of equity participation with less risk, the BUFR ETF has been the ultimate easy button when it comes to defined outcome products. BUFR allocates across the entire 12-month calendar year in traditional ‘buffer ETFs’. These are products that set out to protect against the first 10% of losses in exchange for capping upside participation to a certain level. Rather than reallocating every month or sorting through which product has the most attractive current profile, BUFR delivers an equal exposure to each monthly product. Because each product resets annually to a new buffer level and upside cap, BUFR will therefore have at least a portion of the portfolio resetting every month to the latest protection and participation levels.

VanEck Morningstar Wide Moat ETF (MOAT)

There are only 5 non-market cap weighted large-cap core ETFs that have outperformed the S&P 500 in the past 10 years. Two of which are active mutual fund conversions, the other two are momentum ETFs, and the final product is MOAT. MOAT was launched in 2012 and is about as close to an active ETF as you can get in what is classified as passive. Morningstar analysts developed an index that includes ~50 US stocks (that number has changed over time) with the widest ‘Moats’ – that is barriers to entry and sustainable competitive advantages – that are then put through a valuation screen (based on bottoms-up fair value ratings by Morningstar) and then equally weighted. The index is reconstituted on a staggered basis to be cognizant of turnover 4 times a year. See what I mean by darn-near close to active? (Statistically, MOAT has had a 6% tracking error vs the S&P, in line or above that of many active managers.) The results have been compelling, not many products over the past 10 years have had a value bias and managed to squeeze out a return above that of the S&P.

SPDR Gold Shares (GLD)

The newest mainstream asset class and just about the oldest thing we can own, both in the same list? ‘Digital gold’ and physical gold both made headlines in 2024. Gold outperformed the S&P 500 on the way up in 2024, a feat that occurred in 2020, but prior to that had not happened since 2011 – two years scant with risks of various flavors. Gold rose despite the US dollar having the strongest year in more than 15 years. Gold ETFs took in nearly $3 billion. GLD and the fund’s cousin product GLDM accounted for nearly 2/3rd of that total. The original launch of GLD in 2005 was a triumph for ETFs (a product to invest in physical gold, backed 1-1 by gold bars held in a vault) and one of the most successful ETF launches in history. As we wrote about recently, the iShares Bitcoin product (IBIT) has taken the crown. I should note that we included some Gold in our tactical portfolios way back in March 2023, in a bid to diversify our diversifiers while staying overweight equities.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Last year was generally a success for many investors, owing to large gains in the largest stocks. However, we saw advisors and investors alike begin to look elsewhere for the future returns; whether that is a new asset class, higher current income, equity participation with less risk, careful attention to quality and valuation, or a hedge as old as time – ETFs provide an ever-growing and flexible toolbox for allocators, advisors, and investors to achieve their desired outcomes.

For more content by Grant Engelbart, VP, Investment Strategist click here.

02588514-0125-A