There’s always been talk about the U.S. dollar (USD) losing its dominant currency status globally, but lately, the chatter seems to have increased, especially since Russia’s invasion of Ukraine, which saw the US impose severe and expansive sanctions on Russia and Russian officials – enabled by the fact that the US treasury has jurisdiction over any transaction that involves the flow of USD. Rising tensions between the US and countries like China and Saudi Arabia have also raised concerns that these countries could price oil sales in Chinese yuan, denting the USD’s dominance in the global oil trade. Never mind the fact that these talks have been going on for several years now.

The reality is this: the USD’s dominant role is not going to end any time soon, especially since there’s no good alternative. Let’s walk through 3 reasons why, using some great data from a recent Federal Reserve report.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

1. The World has confidence in the US, and thereby the U.S. dollar

This confidence doesn’t come out of nowhere. As the Fed report notes, a key function of a currency is:

“A store of value which can be saved and retrieved in the future without significant loss of purchasing power.”

The US has the world’s deepest and most liquid financial markets thanks to the following:

- The size of the US economy

- The strength of the US economy

- Open trade and capital flows, with fewer restrictions than a lot of other countries

- Strong rule of law, and property rights, with a history of enforcing them

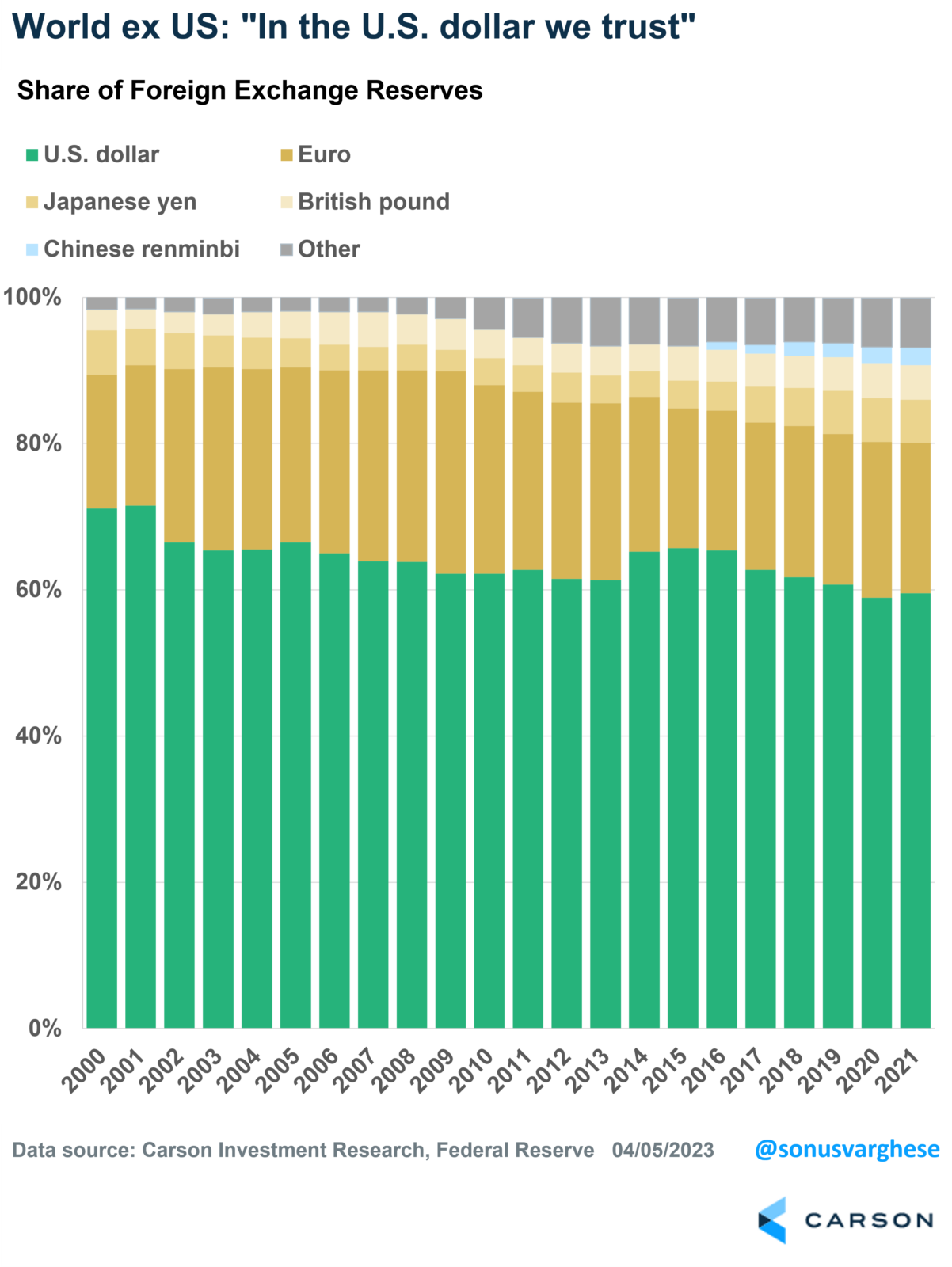

This is why, despite the US making up just about 25% of the world economy, about 60% of global foreign currency reserves are denominated in USD. This has fallen from about 71% in 2000 but is still far ahead of other currencies, including the euro (21%), yen (6%), British pound (5%), and Chinese renminbi (2%). And the decline has been taken by various other currencies, as opposed to a single other one.

2. Network effects: The USD is dominant in trade invoicing and international finance

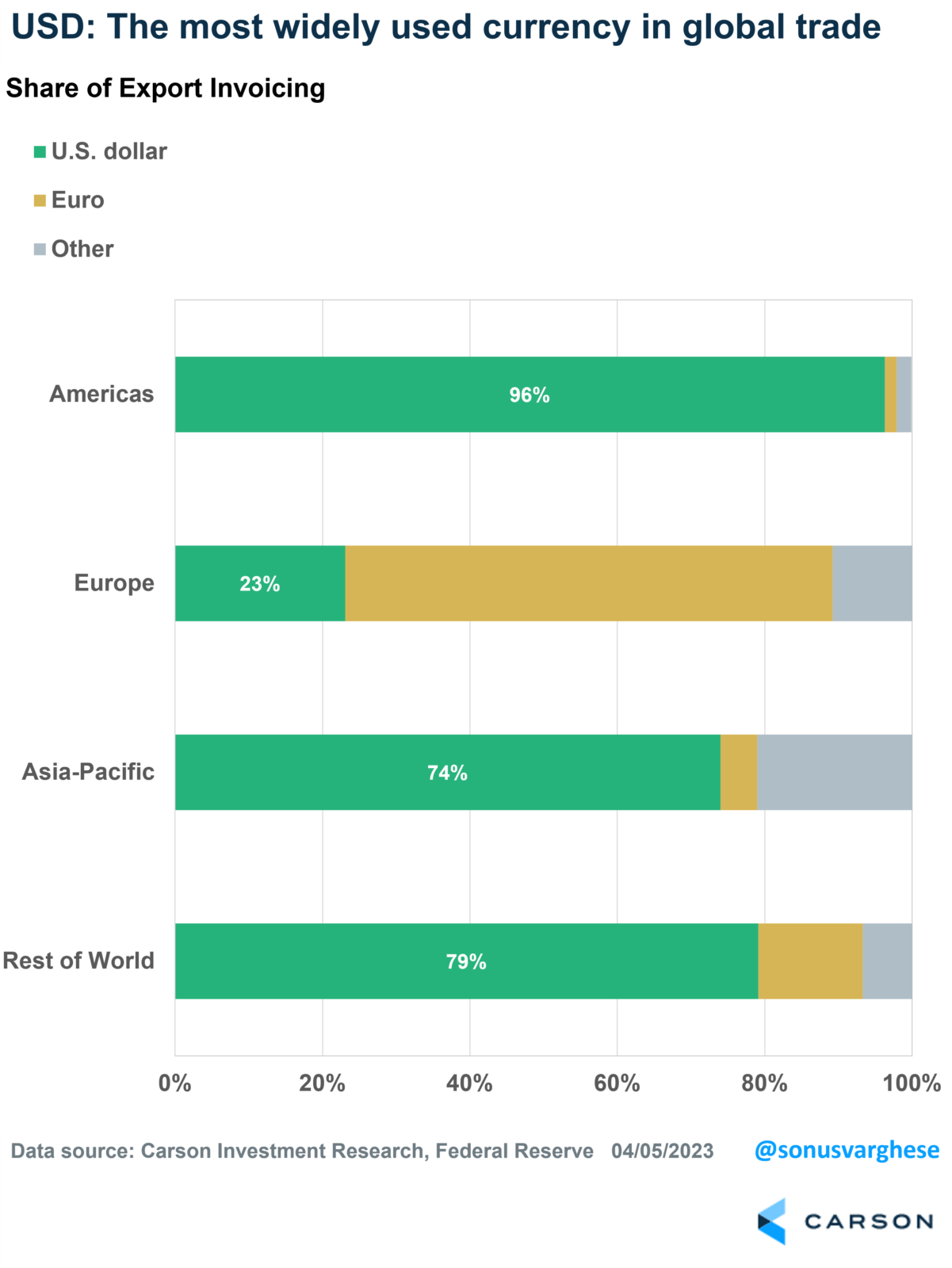

The USD is the world’s most popular medium of exchange when it comes to trade, even beyond North & South America. Outside of Europe, where the euro is naturally dominant, more than 70% of exports are invoiced in US dollars. That’s not likely to change anytime soon, especially with so many countries and companies involved.

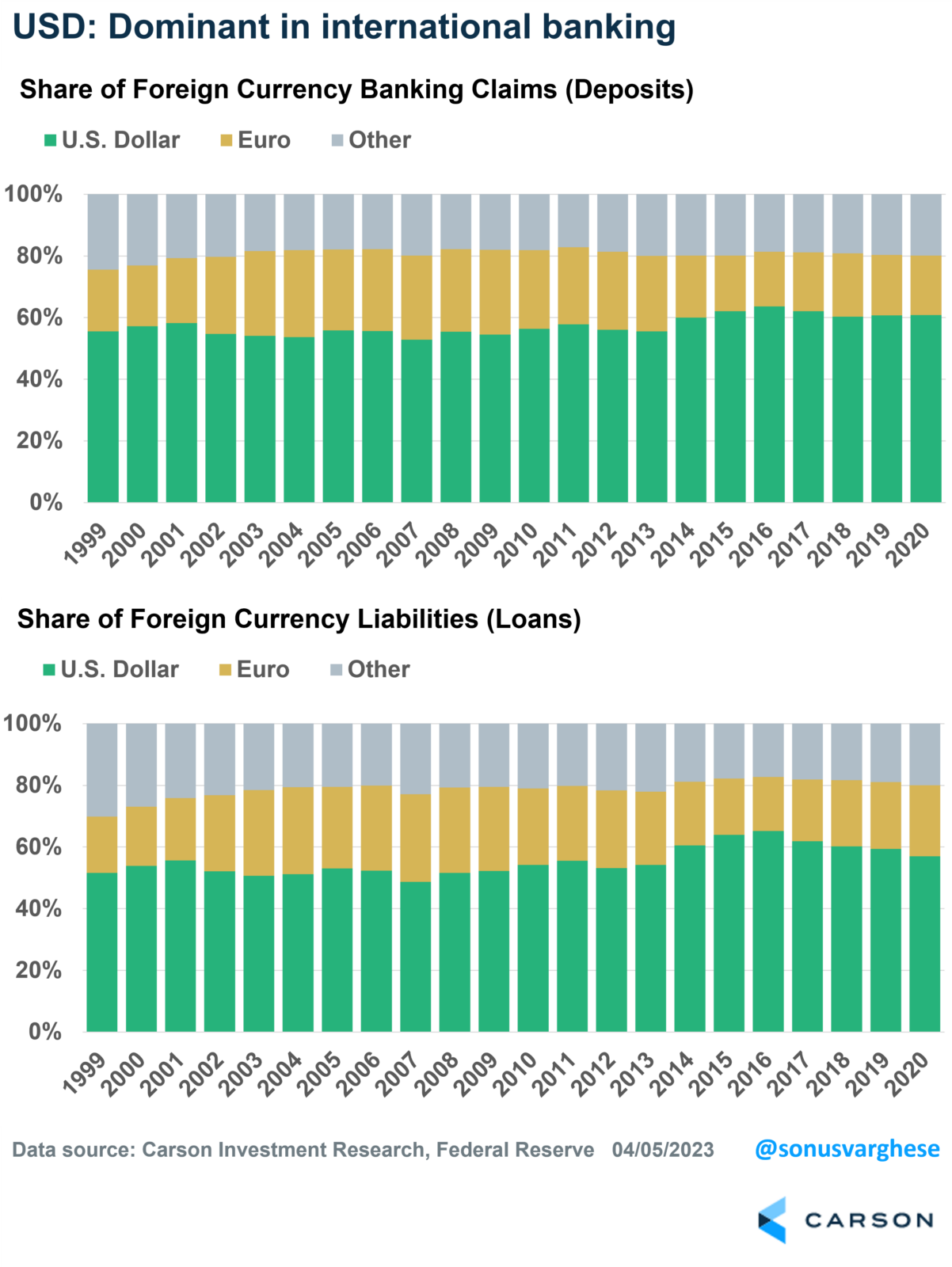

It shouldn’t be a surprise that the popularity of the USD as a medium of exchange means it almost automatically becomes the dominant currency in international banking. Think of all the USD flowing across global banks as companies/customers make payments to each other. 60% of international foreign currency banking claims, i.e., bank deposits denoted in foreign currency, and loans are USD. That’s been fairly stable since 2000 and has increased over the last few years. The euro is second but makes up just about 20%.

Network effects can be extremely hard to dislodge. It won’t be easy to convince people across the world that they have to move their assets from the US dollar to another currency, let alone make the switch without any risk.

3. Most important reason is: The US is willing to maintain massive trade deficits

Here are a couple of statistics (as of Q4 2022)

- The rest of the world held about $7.4 trillion in US treasury securities

- The rest of the world held about $1 trillion in USD banknotes, which is about 46% of all USD banknotes out there

These are all “liabilities” of the US government, i.e., loans to the US government. But the real question is, why do foreigners hold so much of these in the first place?

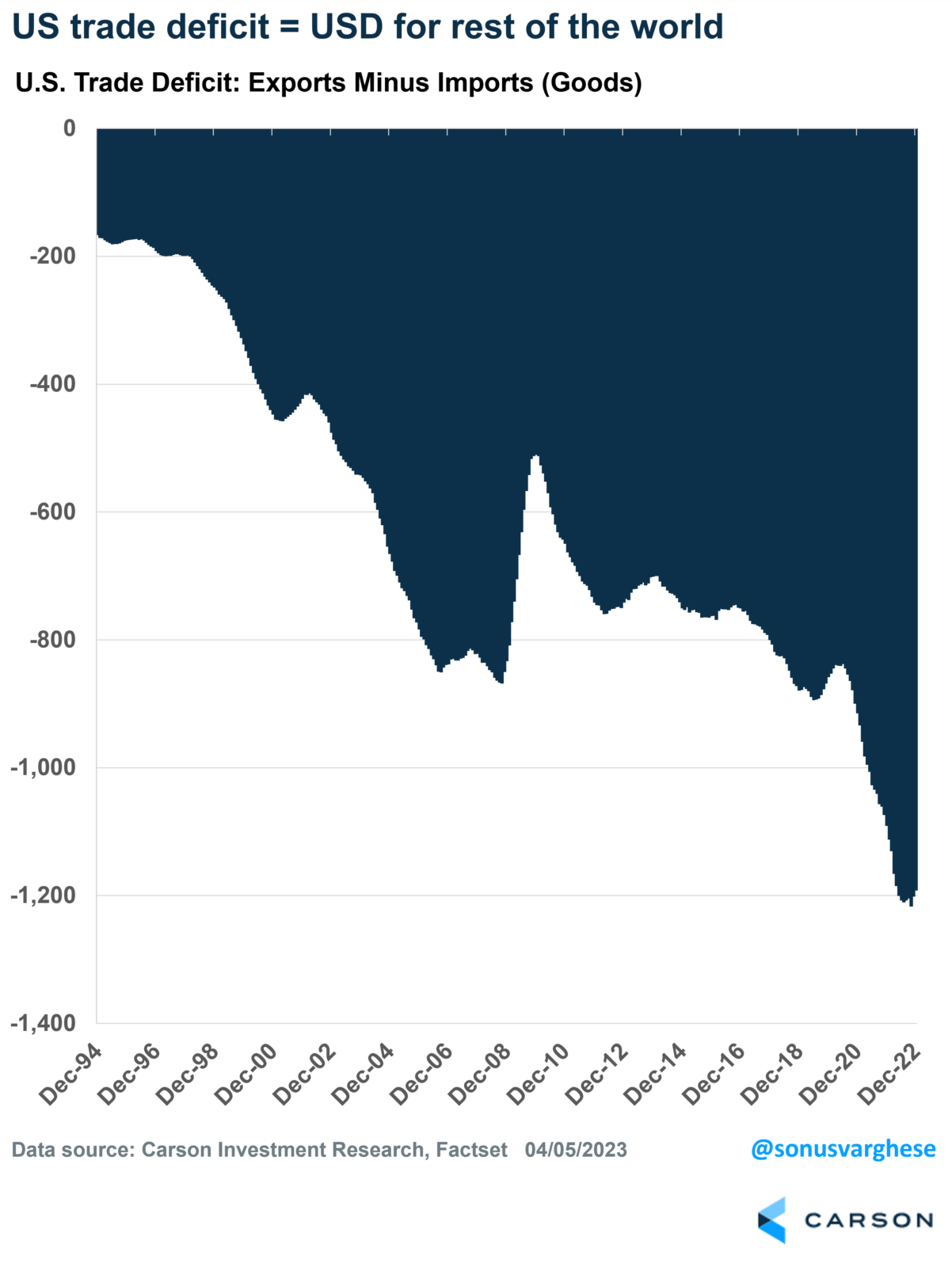

Part of the answer lies in the first two reasons, but here’s another big one. Foreigners sell a lot of stuff to Americans, about $3.3 trillion worth in 2022 alone. And they got USD in return for all that.

In an ideal world, foreigners would turn around and use those dollars to purchase stuff made in the USA, and trade would be “balanced”.

But they don’t. Instead, they bought about $2.1 trillion worth of goods from the US last year.

Which means there was an extra $1.2 trillion that foreigners had. What do they do with it?

The US is willing to supply the rest of the world with treasuries & banknotes

U.S. dollars can only buy goods and financial assets in the US. Foreigners could buy something in Europe or China, but they’d have to convert the USD to euros/yuan first, and then someone else is left holding USD, and then they have to figure out what to do with those USD.

Instead, foreigners turn around and buy the safest, most liquid security in the world: US treasuries. Some of them also simply hold USD in cash (or deposits in their local bank). As I noted above, these are liabilities of the US government that the US is more than willing to issue. No other country, including the Eurozone, looks remotely capable or willing to do that anytime soon.

Which is why there are so many dollars and treasuries held by the rest of the world.

Could that change as countries decide to trade in their own currencies instead of the USD? Sure, but there’s a problem.

Take Saudi Arabia and China, for example. The former could sell oil to China in yuan, but then the Saudis have to figure out what to do with those yuan. They’d have to buy assets in China – but there aren’t too many of that, especially Chinese government bonds.

China has capital controls as well. which means it may not be easy for the Saudis to pull their money out of China in the future, especially during a crisis when the Chinese want to limit outflows. Capital controls are how the Chinese control their currency, and it’s hard to see them letting go of that lever anytime soon.

In sharp contrast, the Fed is willing to act as the global central bank, supplying dollar liquidity to the rest of the world when there’s a crisis.

The global economic model is unlikely to shift

The Chinese could decide they don’t want extra dollars. So instead of selling all the extra stuff they produce to Americans, they could sell it to Europe, the rest of Asia, and Africa. But the thing is, those countries don’t want too many of those goods either – because consumption is not as big a part of their economies (like the US).

Now, the Chinese could decide not to produce as much, but that is not a recipe for economic success.

Ideally, their own citizens would buy all the extra stuff they produce. But here’s the problem: Chinese households don’t earn enough to buy all those extra goods, and they save a lot more than Americans. They have to since there’s nothing like Social Security or Medicare there. China then channels these savings into investment, which leads to a lot of buildings, infrastructure, and industrial production, which is what drives their economy.

The Chinese government could “fix this,” but that involves a significant shift in how their economy works – essentially redistributing national income away from the government and businesses to households. A massive political project that’s unlikely to happen anytime soon.

It’s not just the Chinese. It’s the Germans, too, along with countries like Taiwan and South Korea, all of whom are reliant on exports to drive their economies.

A shift away from the economic model that these countries are reliant on to a model that is consumption-led is very difficult. As the previous chart shows, its actually gotten worse over the last few years as US trade deficits grew even more.

In fact, it would be better for US manufacturers if other countries do switch their economic model. Because that would mean they could buy more stuff that’s made in the US. And trade would be more balanced.

In any case, there’s no practical alternative to the U.S. dollar right now, and its dominance is likely to remain in place.