Whether you’re engaged with the market every day or only once in a while, sometimes it’s easy to miss the forest for the trees. We just finished the third quarter of 2024, and really it was an extraordinary quarter. If I had to pick out one theme, it would be expanding market breadth, something we highlighted in our 2024 Outlook and an important piece of support for a durable bull market.

The Bull Market Has Accelerated in Year Two

The bull market will be two years old on October 12. In the first year, it gained 23.7%. With just a few weeks to go, in its second year so far it has gained 34.3%. The bull market has taken place over a period of tremendous skepticism about the economy. While that’s made good decision-making harder for many investors, skepticism is often the fertilizer out of which bull markets grow. As the old saying goes, markets climb a wall of worry. Gains were substantial for the S&P 500 in the third quarter, which posted a total return of 5.9%. (Annualize that out, and you will get over 25%.) But the S&P 500 was not the only show in town.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

With a strong run for stocks and bonds over the last four quarters, we just had the third-best rolling four quarter for a traditional 60% stock, 40% bond portfolio (“60/40”) since 2000. Using the Russell 1000 and Bloomberg Aggregate Bond Index, the 60/40 returned 25.7% over the last four quarters, which was topped only by the four quarters ending in Q1 2021 (34.2%) and the four quarters ending in Q1 2010 (32.8%). What is the difference between then and now? Those were both the first year off bull market lows.

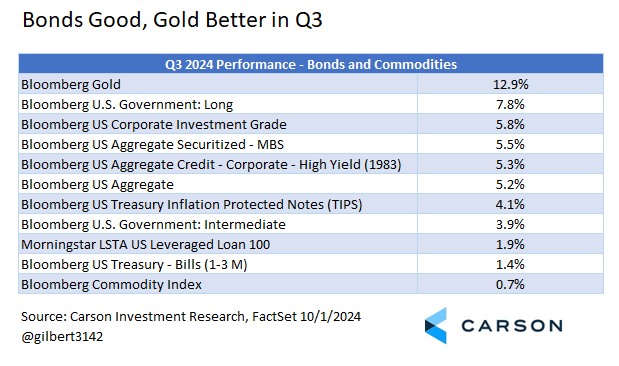

Best Four Quarters for the Bloomberg Aggregate Bond Index Since Q1 2003

While the track record for the Bloomberg Aggregate Bond Index (“Agg”) will be marred for many years by the historic sell-off in 2022, did you know that we just completed the best four-quarter stretch for the most widely used US bond benchmark in over 20 years? The Agg returned 5.2% in Q3, just a shade behind the S&P 500, to make its total return over the last four quarters 11.6%. That’s the best since the four quarters ending in Q1 2003. Of course, it was much better to be in stocks, or gold (more on that below) over the last year, but a year ago many investors were still heavily in short maturity cash-like instruments. That didn’t hurt you by any means. The Bloomberg 1-3 Month Treasury Index provided a nice 5.5% return over the last four quarters. But if you had a choice between having timed rotation from cash to bonds or overweighting stocks, choosing stocks over bonds had the much bigger payoff.

The ”easy money” (and it’s never really easy) on the bond side has probably already been made. Unless there’s a deflationary recession, not at all our base case, we wouldn’t expect another large move down in intermediate to long bond yields. But with short-term rates set to decline with Fed easing and longer maturity bonds’ potential ability to play some defense in most kinds of down markets, we think the yield for the Agg remains attractive.

Best Year for Gold on Record

The record isn’t very long, but using the Bloomberg Gold Index, which goes back to 1991, we just had the best four quarters for gold on record, with a 41.7% four-quarter return through the end of Q3. The fundamentals for gold can be difficult to parse out. Central banks have been buying. Emerging market demand has also helped. China’s demand, outside central banks, has been boosted by increased concern about real estate as a store of value amid increased economic challenges, while strong economic growth may be increasing demand from India. Anticipated declines in real yields as well as prospects of a less mighty dollar may also be prompting some demand. And when fundamentals are good, sentiment increasingly becomes a driver as well. We don’t think gold needs to provide the kind of gaudy returns it’s seen over the last year to make a small position as a portfolio diversifier worthwhile. But keep in mind that gold can be volatile and historically has had more bond-like returns over time.

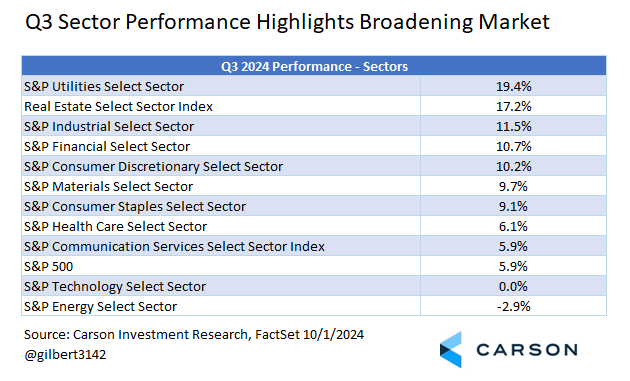

9 of 11 Sectors Top the S&P 500

Every sector (9 of 11) except Technology and Energy outperformed the S&P 500 in Q3. How can that happen? It’s all about the technology sector, which is the largest in the S&P 500, currently making up about 32% on the index. While it’s just one quarter of broad dispersion, that’s the kind of sector rotation and broadening market we’re looking for to make the bull market more durable. Trailing year, four sectors are outperforming the S&P 500, which is closer to the norm, but it’s an interesting mix: Utilities, Communication Services, Financials, and Technology. That’s two growth-oriented sectors and two value-oriented sectors.

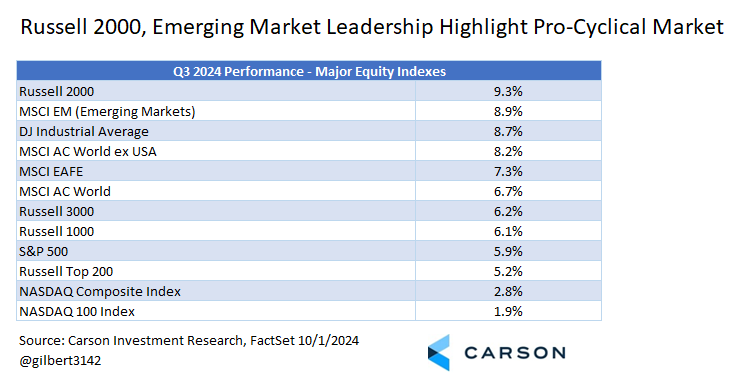

More Signs of Market Broadening from Major Index Returns

Yes, for a long time now the S&P 500, led by the technology-oriented megacap “Magnificent Seven” stocks, as well as the technology-heavy Nasdaq Composite and the Nasdaq 100, have dominated major index returns. One quarter isn’t enough to say that’s over, but Q3 certainly presented a different picture and even intermittent rotation is healthy for the market overall. It’s also noteworthy that the major index leader board has cyclically oriented names at the top, the Russell 2000, supported by an improving economic picture and the start of the rate cut cycle, and Emerging Markets, supported by gains in China following announced stimulus. (See Carson’s VP, Global Macro Strategist, Sonu Varghese’s excellent piece on China’s recent market gains here.)

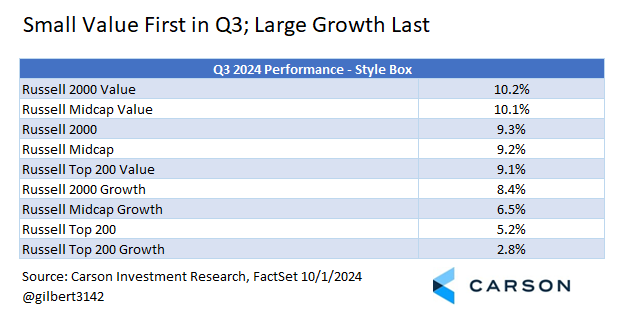

More Broadening from Size and Style

Not surprisingly, we also saw market broadening in style box returns in Q3, with small cap value stocks (Russell 2000 Value Index) leading the rankings and large cap growth stocks (the Russell 200 Growth Index) at the bottom. This reversal does not make much of a dent in the dominance of large growth over small value in the last four quarters (44% versus 26% using the same indexes), but it may be an important step toward better balance.

Market broadening is not only a sign of a healthy market. It can also be beneficial to investors, since it would make it easier to diversify some risk without sacrificing return. At Carson, we are always on the watch for potential portfolio diversifiers that don’t make undue sacrifices on the return side of the equation. Of some of the themes mentioned above, we have a modest tilt toward small and mid-cap stocks, which have attractive valuations, are sensitive to economic growth, and should benefit from lower interest rates. We do have some focused exposure to value-style stocks, but are more focused on the return efficiency that can be found in lower volatility stocks. As discussed in Sonu’s piece linked above, we are still skeptical that the newly announced stimulus package will have a meaningful impact on China’s growth trajectory and remain tactically and strategically underweight emerging markets. But we remain most focused on our equity overweight call and continued emphasis on the US over emerging markets.

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here.

02438882-1001-A