“If pro is the opposite of con, does that make progress the opposite of Congress?” -famous quip

The 119th Congress is being sworn in today, with Republicans taking over majority leadership in the Senate and holding onto the House with the narrowest majority in the history of the Republican party. So we thought it would be an appropriate day to highlight the potential policy mistakes that could undermine our otherwise bullish policy outlook for 2025. Policy mistakes could come from a lot of different places: the incoming Trump administration, Congress, the Federal Reserve, or even the Supreme Court. We review the ones that we think could have the greatest market impact below.

We’ve written quite a lot about our expectation that the overall policy environment will be positive for stocks in 2025. This includes monetary policy (the Fed) and fiscal policy (the presidency and Congress). (Carson’s VP, Global Macro Strategist Sonu Varghese provides an excellent overview of our thoughts in “The Economic Outlook Looks Pretty Good — Part 1” and “Part 2.”) Keep in mind that our sole focus when discussing policy is its impact on markets, and there certainly can be reasons to favor or criticize particular policies outside of that. But our goal is not advocacy of one political viewpoint or another. In fact, we think allowing that perspective to enter into our thinking would make us less effective market analysts. Our job is solely to understand how policy might influence markets in the coming year.

In general, lower taxes, deregulation, higher fiscal deficits, and lower interest rates are all policies that tend to have a positive impact on corporate profits, which in turn support stock gains. There’s also the added factor of a rebound in the subdued economic confidence we’ve seen in recent years. Lingering pandemic fatigue and inflation spiking to its highest level in over 40 years in mid-2022 significantly dampened economic sentiment. In response to that, voters ousted incumbents at a high rate in 2023 and 2024. Liberal or conservative, if you were in power during the period of high inflation, voters said it was time for a change. In the US, that’s despite economic growth over the last eight quarters surpassing anything experienced during either the Obama or Trump administrations (outside the immediate reversal of the pandemic recession). Change for the sake of change when there’s perception of a slump may be an added policy benefit.

But while we think the policy environment will be favorable, it is also not without risks. In fact, much of the risk is just from the opportunities failing to materialize. Keeping that in mind, here’s our survey some of the key policy risks markets may face in the year ahead.

Risk 1: The Federal Reserve Keeps Policy Too Tight

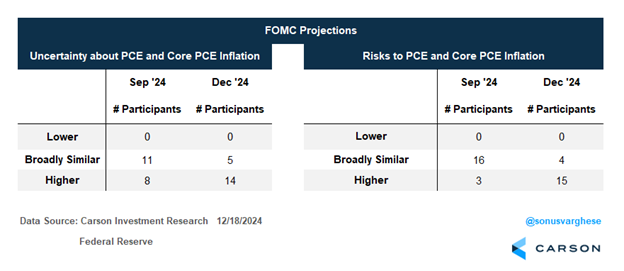

The first risk is not related to the Trump administration or Congress at all, but rather the possibility that the Federal Reserve keeps monetary policy too tight. The Fed is currently in a rate cutting regime, but expectations of the pace of rate cuts have slowed quite a bit. Shifting expectations is mostly due to improved growth expectations, which is a positive, but also a significant rise in inflation expectations, which we think is misplaced. (Sonu covered this at length in his analysis of the Federal Reserve’s recent decision, “The Fed Pulls a Grinch.”) The Fed’s perception of both inflation uncertainty and the direction of risks changed substantially from their survey of FOMC participants in September, as shown below, and that has led to greater caution around rate cuts.

Remember, a fed funds rate target of just 2.25 – 2.50% nearly broke the economy in 2018 – 2019, something President Trump correctly pointed out at the time, and low rates, even after some tightening, were still a major tailwind. Well, right now the target fed funds rate target is 4.25 – 4.50%, two full percentage point higher. The economy has been incredibly resilient despite high rates, but cyclical sectors, including housing, small businesses, and manufacturing, have been under pressure and the labor market, while still strong, has exhibited some underlying risk, although it remains quite stable for now. Productivity growth, which is supported by a tight labor market and has been an important contributor to recent growth, may also be damaged by policy that is too tight if it leads to a rise in layoffs.

We think the current expected slower path of rate cuts is very unlikely to push the economy into a recession on its own, but it will make the economy more sensitive to other shocks. A slower path of cuts also means the incoming Trump administration will need to be more careful about policies that would raise concerns about inflation.

Risk 2: Tariffs Push Inflation Higher

There has been a lot of speculation about tariff policy but we expect the Trump administration will have some sensitivity to the potential impact on inflation and will keep tariffs at least somewhat targeted. A strong dollar, partly in anticipation of tariffs but also due to growth rate differentials between the US and other developed economies, can also acts as an inflation buffer. For now, we think the concerns about tariffs and their impact on inflation are being overplayed. Nevertheless, even expectations of higher inflation can actually cause inflation and the Trump administration will have to be careful about how it communicates policy. As a result, credible saber rattling to strengthen the US negotiating position on tariffs could be damaging even if followed by more sensible actual policy. At this point, inflation expectations remain well anchored, but it’s a delicate balancing act. While we are suspending judgment on tariffs until we see what actually gets implemented and tilt moderately optimistic on the actual inflation impact, the potential for a policy mistake is there.

The S&P 500 fell over 6% in 2018 as the Fed tightened policy, and the trade war was raging. We’re still optimistic about markets in 2025, but the path of interest rates and uncertainty around tariffs are risks, and they are not the only ones.

Risk 3: Internal Division within the Republican Party Delays or Limits Policy Implementation

This is a policy risk that has a positive side. We noted during the election that markets tend to like mixed government. The spirit of compromise tends to get us better policy and helps avoid the ideological excesses of both parties. But we won’t have mixed government in 2025. When the new Congress is sworn in today, Republicans will hold narrow majorities in both the House and Senate. As of inauguration day on January 20, we’ll also have a Republican president in the Oval Office.

The majorities will be narrow. Republicans will hold a 53-47 majority in the Senate, as well as the tie-breaking vote by the vice president after January 20. Republicans would have held a 220-215 majority in the House, but Florida Republican Matt Gaetz resigned (he’ll have to do it again for the new Congress) and two Republican House members will take positions in the Trump administration. That will make the Republican majority 219-215 until the members assuming new roles resign and then 217-215 until special elections can be held. (Unlike the Senate, replacements in the House can’t be appointed, only elected.) There is no tie breaker in the House, so at that point Republicans will not be able to lose even a single vote in the House when a vote is along party lines.

We did not get divided government, but there are ways in which narrow majorities keep at least some of the spirit of divided government. Republicans will need their own moderates AND their most hardline conservatives to vote yes to pass policy. There could be a cushion if Freedom Caucus members hold up a bill. Some Democrats could potentially be pulled on board to support a bill if they believe it is in their interest, but would require some compromise.

We saw this in action with the current House’s recent efforts to fund the government. Republicans needed some Democrats to support the bill. Trump intervened using the bully pulpit as president-elect to object to the initial bipartisan continuing resolution (CR). But 38 Republicans rejected Trump’s alternative. A somewhat stripped down version of the original CR was finally passed with more Democratic votes than Republican. Trump’s interventions did lead to some changes, but the overall effect was small. From the perspective of the current House, a narrow majority led to compromise, although things will be somewhat different once Republicans control the Senate and Trump has been inaugurated.

Narrow majorities keep more checks and balances in place, but they also increase the possibility of legislative chaos and will make it more difficult to pass any bill that doesn’t have broad consensus among Republicans. Significant delays that disappoint policy expectations could lead markets to become impatient with congressional infighting. Keep in mind that Congress will have to deal with raising the debt ceiling and government funding in Q1 2025, let alone avoid the fiscal cliff associated with expiring individual tax cuts at the end of 2025.

Risk 4: Deregulation Clashes with the Supreme Court’s Chevron Reversal

One issue receiving relatively little attention is the Supreme Court’s decision in July 2024 to overturn Chevron v. Natural Resources Defense Council. The Chevron decision gave agencies more scope to interpret the laws under which the operate. The decision to overturn Chevron was an extraordinary flip-flop in conservative jurisprudence. In 1984 the Reagan administration was an advocate of Chevron because it made deregulation easier. The Supreme Court decision in Chevron was unanimous, representing a consensus between liberal and conservative justices on how the Constitution should be interpreted. Over time, conservatives became critics of Chevron because they believed it had the unintended consequences of giving the agencies too much leeway. Undesirable political outcomes should not change the Constitution, but even among conservatives fashions change.

Overturning Chevron was great (from a Republican perspective) when Democrats are in power, but it also makes deregulation more difficult, which is why the original Chevron case went to the Supreme Court in the first place. When it comes to deregulation efforts, Republicans may have hoisted themselves on their own Chevron petard. With the decision newly minted, some efforts to lighten regulatory requirements are likely to be met with waves of litigation that may take years to work their way through the court system. We are worse off than the Reagan administration was before the Chevron ruling, because courts will be drawn into the messy process of delineating exactly what the new ruling means. We don’t think there are major risks here, but it may make deregulation under the new Trump administration less robust than markets expect in places.

Risk 5: Immigration Policy Stunts Economic Growth

In my view, this is the most underrated risk but still secondary to tariffs and monetary policy when it comes to the absolute level of risk. Clearly there are some genuine problems with current immigration policy. But the extent to which the resilience of the US economy depends on its ability to attract and absorb global labor is often underestimated. In fact, I would say the two key factors that have led to the structural advantage the US has over other developed economies is a more business-friendly overall policy environment, including labor market flexibility, and its history of acting as a destination of choice for immigrants.

It’s hard to determine the level at which tighter immigration policy becomes a genuine risk, and before it becomes a risk there certainly may be areas where reforms would provide benefits. The aim here is not to determine what the right immigration policy should be, but just to highlight that at some point tight policy can become a significant risk.

Here are just a few of the reasons why I believe immigration policy could pose a risk from an economic perspective:

-If the current level of flow of earners falls due to immigration policy and the chilling effect on new immigration, there’s a direct impact on GDP. A dollar of income lost is a dollar of GDP lost. Policy that leads working immigrants to leave the US, or choose not to come in the first place, is the economic equivalent of exporting U.S. GDP growth to the rest of the world.

-There is a steep implicit regulatory burden on business from tight immigration policy, both by restricting their access to workers and making the cost of labor higher.

-A more restricted labor pool also has the potential to drive wages higher, posing some additional risk for inflation. This effect may be stronger with the prime age participation rate already near a record high. I think this risk is fairly small, but not non-existent.

-Demographics are destiny. Immigration has been the US’s best defense against the challenges of an aging population. According to United Nations data, the old-age to working-age dependency ration in the US in 2022 was 29.4 (29.4 people aged 65 or older for every person aged 20-64). This ratio is important because current workers pay for the Social Security and Medicare benefits of current retirees. For comparison, the dependency ratio in 2022 was 38.0 in Germany and 55.4 in Japan. For the US, that number was 14.9 in 1952. In 2052 it’s expected to be 49.1 The US fertility rate in 2022 was 1.8, a level at which immigration becomes a larger factor in changes in the dependency ratio.

-There are certain areas of the economy that are hit particularly hard by tighter immigration policy. Since the election, housing stocks have fallen considerably despite overall strength in the consumer discretionary sector. This is largely due to higher rates but expected immigration policy is likely also a factor. At the same time, prices of agricultural commodities have been rising, again with multiple factors in play.

Immigration reform is a positive goal, but also comes with some risks. How high those risks are depends on actual policy. It would take a fairly large mistake to have enough of an impact on the economy to weigh on markets, but the potential for a large mistake is non-trivial.

Risk 6: Unpredictability Restrains Animal Spirits

Unpredictability is part of Trump’s MO and he is capable of deploying it very effectively. But while unpredictability can be powerful when negotiating, it can create a difficult environment for businesses. Companies put a lot of capital at risk based on expectations of future profits, and generally want policy clarity. (Of course, if the risk is a better policy environment, the risk associated with uncertainty is lower.) Businesses do not want a president who interferes with capital markets in a fit of pique. An uncertain policy environment can make it harder to do business, although sometimes it does also present opportunities. I would only view this is a small risk. Every policy environment has its element of unpredictability. But with the last Trump administration, for example, we did see tariff policy uncertainty weighed heavily on business investment in 2018-2019 and put a dent in the expected supply-side impact of the Tax Cuts and Jobs Act.

Risk 7: Fed Independence

I would consider this a very small risk, but with the consequences of a misstep potentially large. Trump will try to put pressure on the Federal Reserve to lower rates as soon as he takes office. That in and of itself isn’t a problem. There are mechanisms that help maintain Fed independence. But if there is an effort to overstep or to appoint a loyal and partisan Fed chair when Jerome Powell (himself a Trump appointee) steps down in May 2026, markets will respond. This one is unlikely to be a slow burn. If Trump oversteps, I would expect the market response to be unmistakable. If Trump floats test balloons that cause market jitters but can easily be stepped back, it’s not an issue. But a genuine threat to Fed independence that cannot be walked back could be a problem.

There you have it, seven policy risks that we’ll be watching for in 2025, with tariff unpredictability and the Fed’s rate decisions the most meaningful, but a few others to keep an eye on as well. Our view remains squarely in the camp that policy remains a tailwind, but Donald Trump was elected to be a disruptor, and while disruption can be valuable, it also can often come with unintended consequences.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here.

02577619-0125-A