“We may not know where we are going, but we better know where we stand.” Howard Marks, Co-Founder of Oaktree Capital Management

A little-known technical indicator triggered in the first quarter, and it could bring smiles to the bulls. This one is known as the December Low indicator, and it is fairly straightforward: when the S&P 500 doesn’t close beneath the December low close in the first quarter, good things have tended to happen the rest of the year. The opposite, of course, is when the December lows are violated in the first quarter. To refresh your memory, that is exactly what happened last year and was one subtle clue that the odds of a dicey rest of ’22 had increased. Given that stocks didn’t break their December low this year, this is one less worry for sure.

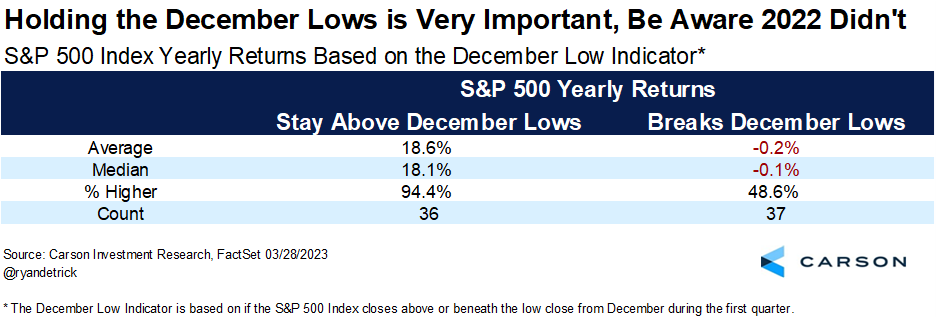

Interestingly, since 1950, stocks held above the December lows 36 times while they broke the lows 37 times. Talk about even Steven. Those are some pretty big sample sizes, and sure enough, the results are quite conclusive.

Those 36 times the December lows held? The full year was up an incredible 34 times and up an average of 18.6%. The times it failed? The full year was down 0.2% on average and higher less than a coin flip.

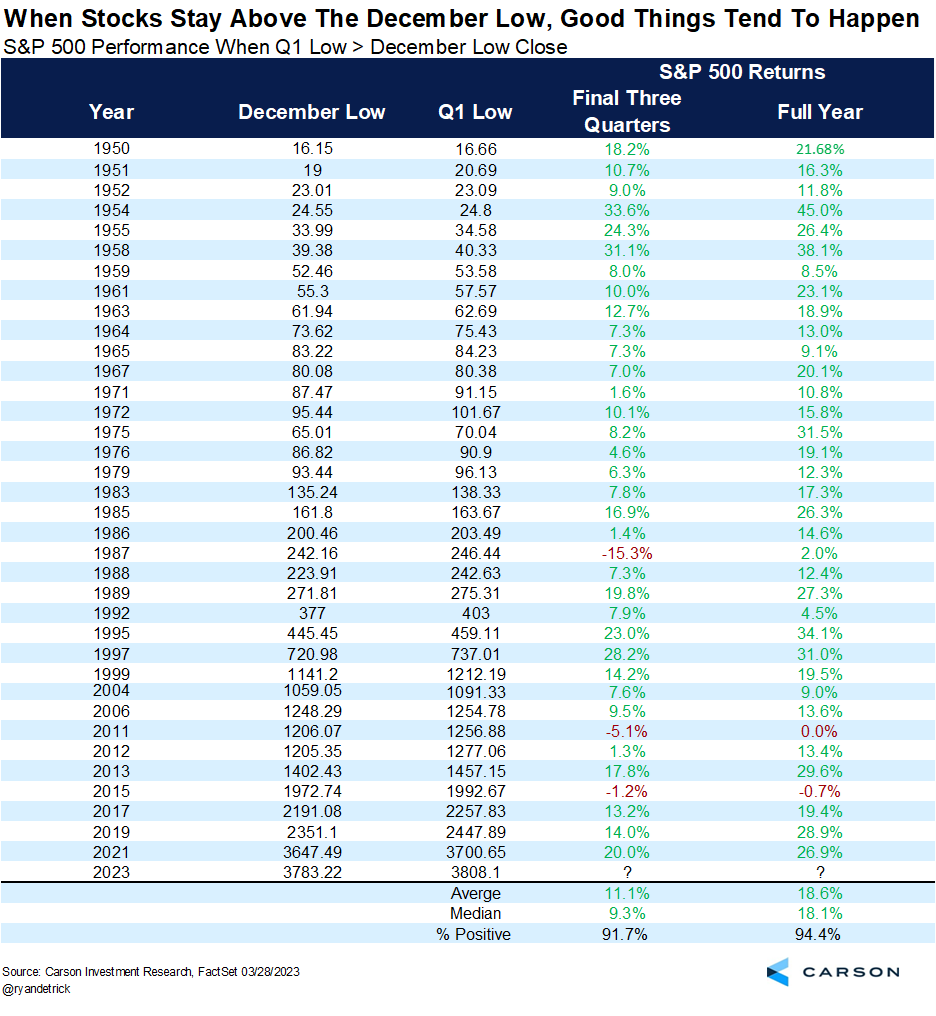

If you wanted to investigate things closer, here are all 36 times it held above the December lows. I added what happened the rest of the year (so the next three quarters) as well, and once again, strong performance was quite normal. We get it. Anything could happen from here, but the truth is it would be quite abnormal to expect a massive bear market and a horrible year for stocks this year.

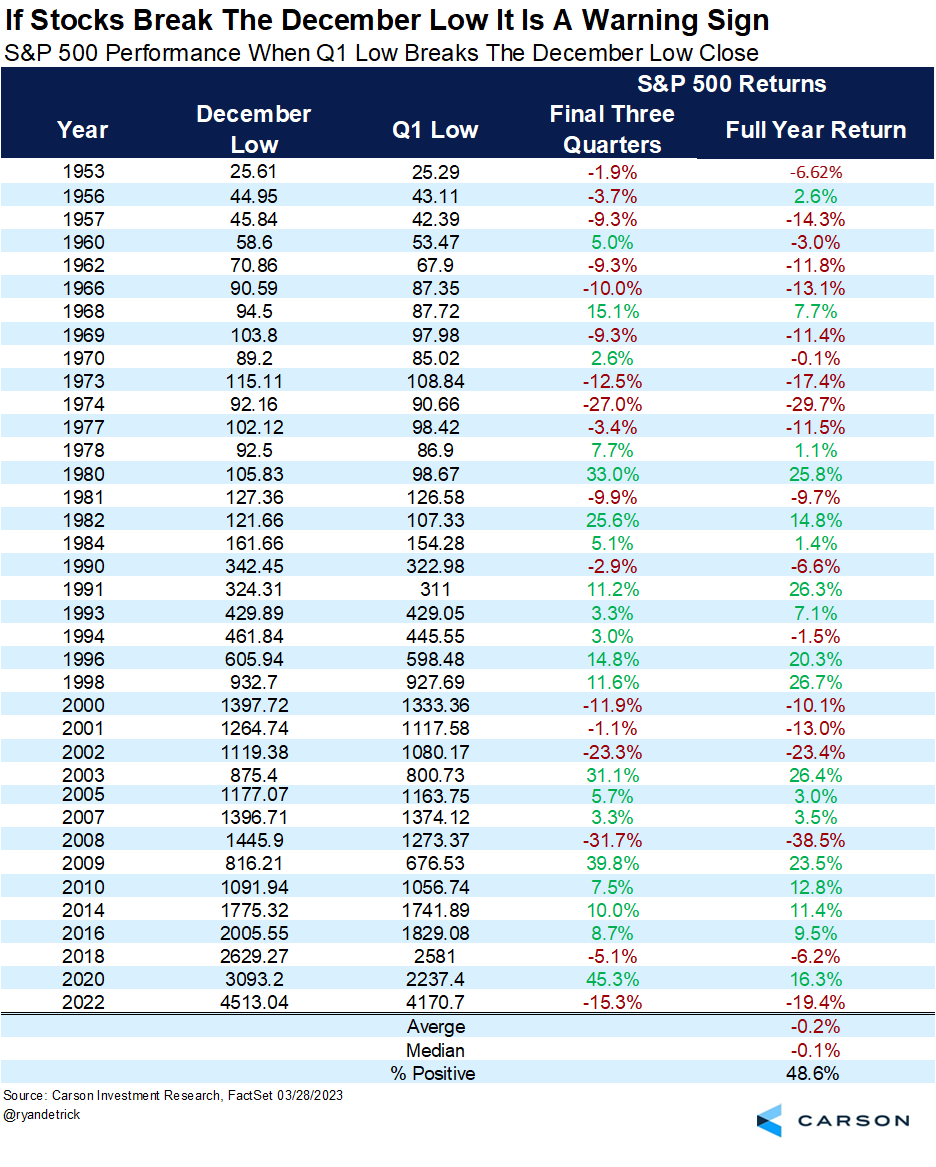

Here’s the other side to things; what happened when the December low was violated? Once again, the full year and the next three quarters’ returns were much different and weaker. Just a quick glance and some of the worst years ever saw the December lows broken. Years like ’73, ’74, the tech bubble, ’08, and ’22 all made this infamous list.

Odds are, as you read this, I will be on a beach in the Turks and Caicos for Spring Break. (You caught me, I wrote this last week.) So as of right now, I’m not overly concerned about this potentially bullish development; I’m more into those fruity drinks with umbrellas in them, but once I get back home, you better believe this will be one that I’ll be focusing on closely. Or, as Howard Marks said in the quote above, we don’t know where we are going, but we do know we stand on potentially a better backdrop for stocks than most think.

Lastly, if you are also on Spring Break this week, here’s to a nice vacation and no sunburns!

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields