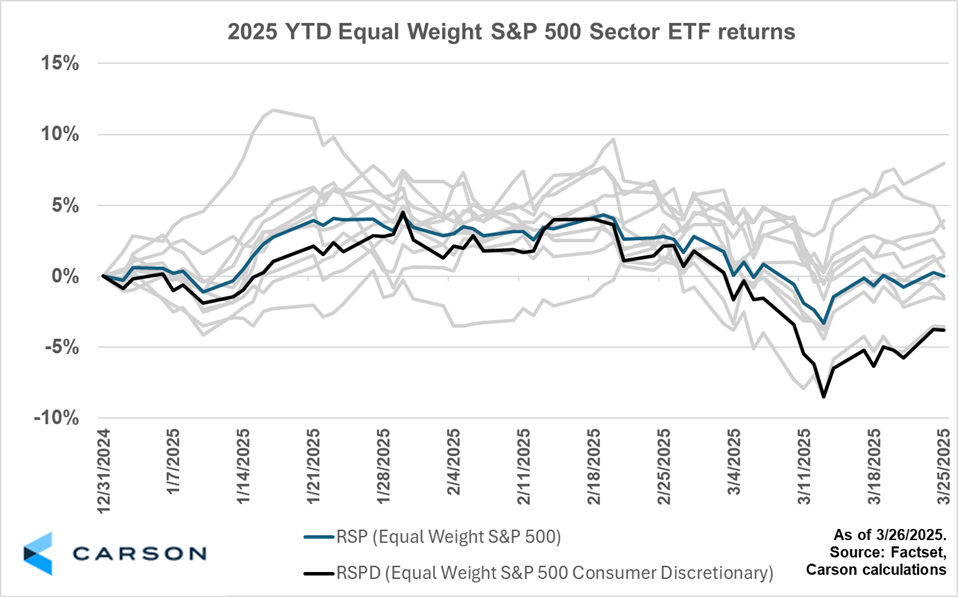

Consumer discretionary stocks are off to a slow start in 2025. Amongst the equal-weight-sector allocations, an equal weight portfolio of all consumer discretionary stocks in the S&P 500 (as proxied by RSPD) has posted the worst return through March 25th. Commentary from several companies in the sector reveals a dynamic business landscape, influenced by the likelihood of tariffs and a more cautious consumer than investors may have previously anticipated. These factors, combined with inflationary pressures and changing spending priorities, have contributed to the sector’s struggles.

Consumer discretionary stocks have underperformed so far in 2025. An equal-weight portfolio of all S&P 500 consumer discretionary stocks (proxied by RSPD) has posted the worst return among equal-weighted sector allocations through March 25th, down -3.8% (FactSet data). That return lags RSP – an equal weight portfolio of all the stocks in the S&P 500 – which is flat on the year, as well as RSPS – an equal-weight portfolio of all S&P 500 consumer staple stocks – which is down 1.4%. The underperformance of RSPD compared to the broader market has become more pronounced in the last month, perhaps weighed down by both potential cost increases due to tariffs and a consumer spending environment that is proving less robust than investors’ expectations.

Many consumer-focused companies used their earnings reports and public investor meetings to discuss the impact of tariffs on their businesses. Product-focused companies, such as Best Buy and Nike, often rely on international supply chains to deliver their offerings are forecasting headwinds. Best Buy CEO Corie Barry noted on the company’s earnings call that China and Mexico remain its top two sources for products and that vendors are likely to pass along some tariff costs to retailers. Nike’s CEO, Elliot Hill, also issued downbeat cost guidance for next quarter, forecasting a 4-5 percentage point decline in gross margin year-on-year partly due to newly implemented tariffs. With both companies’ stock prices near their 52-week lows, investors may be expecting these challenges to persist.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Service-focused companies are seeing their revenues come under pressure. Travel stocks such as Delta Airlines and Marriott, which have benefited from a strong consumer in recent years, are now facing shifts in spending behavior. Both companies noted changes in spending patterns in their latest results. Delta negatively pre-announced earnings on March 10th, with CEO Ed Bastian citing a “recent reduction in consumer and corporate confidence caused by increased macro uncertainty, driving softness in domestic demand.” Marriott CEO Anthony Capuano noted “we saw a little bit of a pullback on the ancillary spend [on] food, beverage and spa…guests are being a little more judicious in their spending.” These signs suggest that discretionary spending may be cooling, even in sectors that previously demonstrated resilience.

The struggles of consumer discretionary stocks in 2025 highlight the challenges of rising costs and shifting consumer preferences. An equal-weight allocation to all consumer discretionary stocks in the S&P 500 is the worst-performing equal-weight sector allocation year-to-date, reflecting broad-based underperformance. As companies navigate uncertainties around a higher cost of doing business and a more cautious consumer, investors may likely continue to focus on how well businesses can adapt to the dynamic landscape. The coming quarters may determine whether these headwinds are temporary or indicative of a longer-term shift in consumer behavior.

For more content by Blake Anderson, CFA®, Associate Portfolio Manager click here.

7799059-0325-A