My colleague, Ryan Detrick and I, talked with PIMCO’s Head of Public Policy, Libby Cantrill, about the debt ceiling earlier this week. Check out our latest episode of Carson Research’s Facts vs Feelings podcast.

Libby is extremely busy these days talking about the debt ceiling and we were honored to have some time to chat with her.

The short summary is that we’ll get through it, with Libby saying, “it will get resolved”. But it’s going to be a nail biter.

What’re they fighting over?

She did a really nice job in the podcast explaining the debt ceiling and what exactly the two parties in DC are negotiating over.

It comes down to spending.

The problem is that both parties have made the job harder for themselves. They’ve taken most of the budget off the table and so there’s not a lot of room to make cuts.

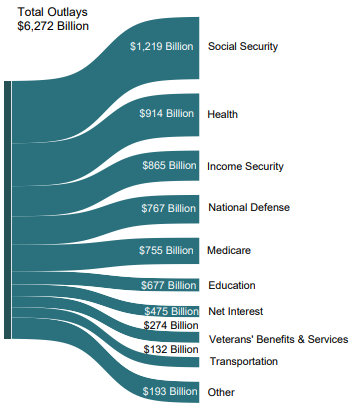

Here’s a chart from Treasury showing how the government spent money in fiscal year 2022 (Oct ’21 – Sep ’22).

To summarize, the government spent $6.3 trillion over that year, of which:

- Social security and other income benefits: $2.1 Trillion (33% of outlays)

- Healthcare (Medicare, Medicaid, etc): $1.7 Trillion (27%)

- Defense: $0.8 Trillion (12%)

Cuts to any of these have been ruled out, and that’s 72% of outlays! Then you rule out interest costs (8%) and things like veterans’ benefits (4%). That leaves just about 16% of the budget to work with, about $1 trillion. What’s called “non-discretionary, non-defense spending”.

Right now, Republicans want what looks equivalent to a $103 billion cut – they want to freeze spending at Fiscal Year 2022 levels, whereas Democrats want to freeze spending at Fiscal Year 2023 levels (~ $6.4 trillion).

A $103 billion cut doesn’t seem like much when you’re talking about a $6+ trillion budget. But it’s 10% of the small portion they’ve constrained themselves to working with.

The good news is that the differences between the White House and House Speaker McCarthy’s team are narrowing. So, it looks like they’ll reach a compromise.

If negotiations get stuck, Libby made an excellent point that we could see Senate Minority Leader, Mitch McConnell, enter the picture. He’s been keeping a low profile so far, but he just said:

“Everybody needs to relax …. The last 10 times we raised the debt ceiling, there were things attached to it. This is not that unusual. It is almost entirely required when you have divided government … The country will not default.”

What next?

The next big step will be passing a deal through Congress, and there could potentially be a vote early next week. Time is a crunch since it looks likely that Treasury will run out of money in early June – we talked about “X-date” in the podcast.

Fair warning: expect a lot of noise from both sides saying “how this is a horrible deal”.

But at the end of the day, President Biden and Speaker McCarthy will probably be able to twist enough arms to vote for any deal they come up with. And yes, it’s going to take a bipartisan vote for this to pass.

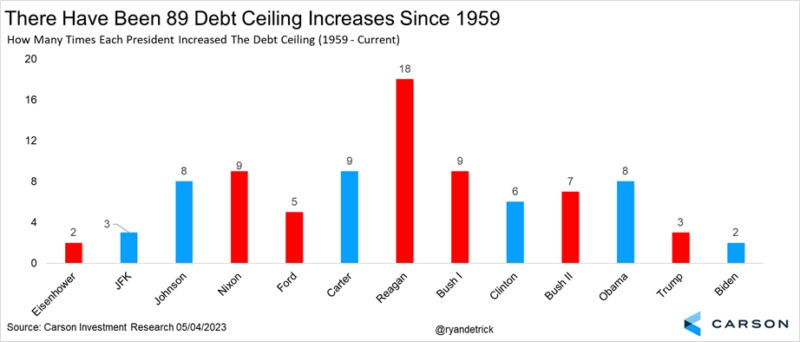

Ultimately, as Ryan pointed out in his excellent piece a couple of weeks ago, we expect the debt ceiling to be increased yet again, for the 90th time since 1959.

Here’s our entire conversation with Libby, where we even looked ahead to 2024 and the Presidential Election. Take a listen.