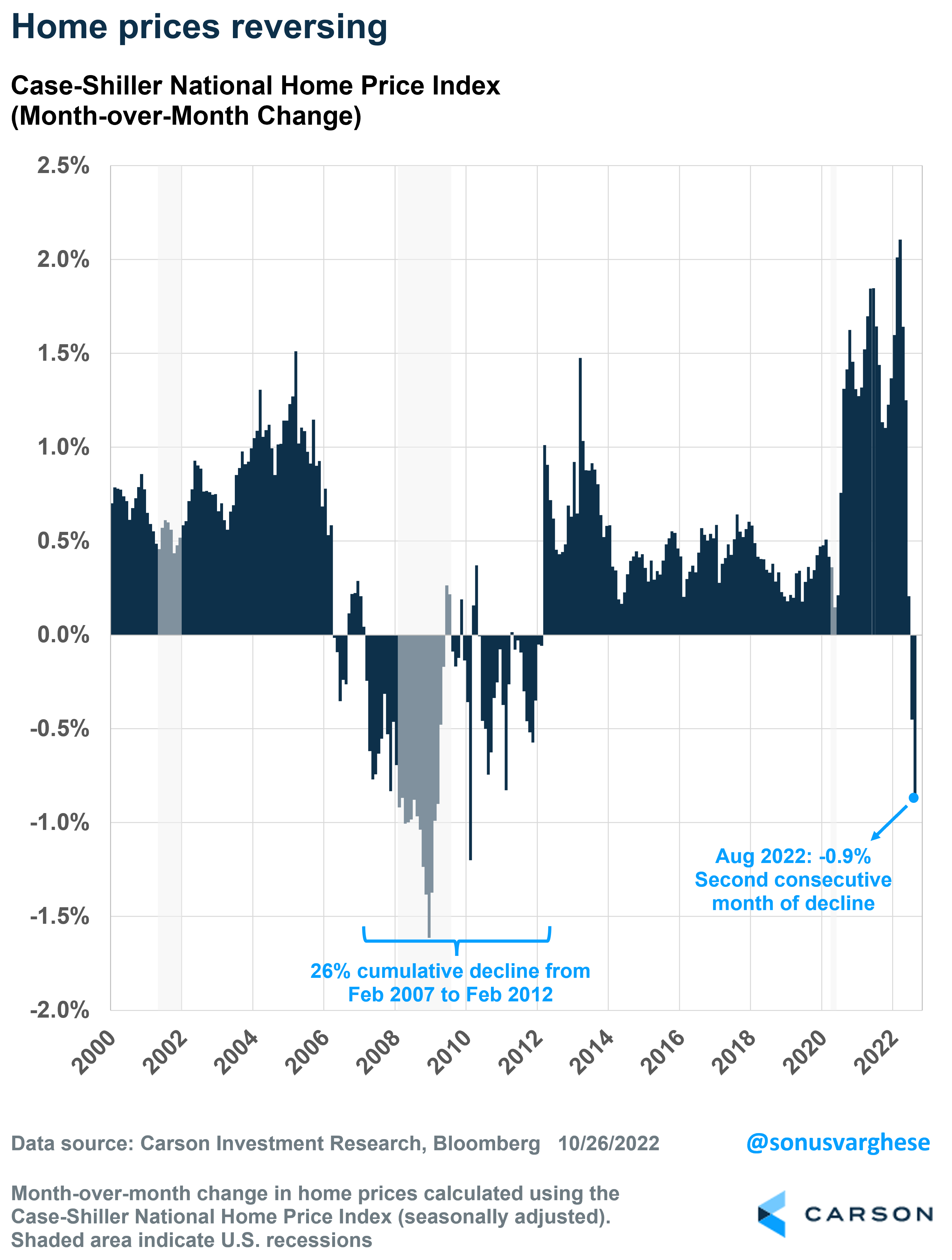

Last week I wrote about how the housing market is in big trouble amid surging mortgage rates. Sales have collapsed and so have housing starts and building permits, indicating builders are pulling back. Prices have started to fall, with the Case-Shiller national home price index falling 0.9% from July to August, the second consecutive monthly decline and something we haven’t seen since 2012

But what is curious is all of this is currently happening in the single-family housing market. The multi-unit segment is going in the opposite direction. At least so far.

Look at building permits authorized for housing units, which is an indictaor of future supply. Single-family permits are down 17% over year through September, whereas multi-unit authorizations are up 23%. Multi-unit data is certainly more volatile but the divergence is stark. This is quite a contrast to past periods when multi-family permits fell along with single-family permits during broad housing downturns, which typically began amid aggressive Federal Reserve policies.

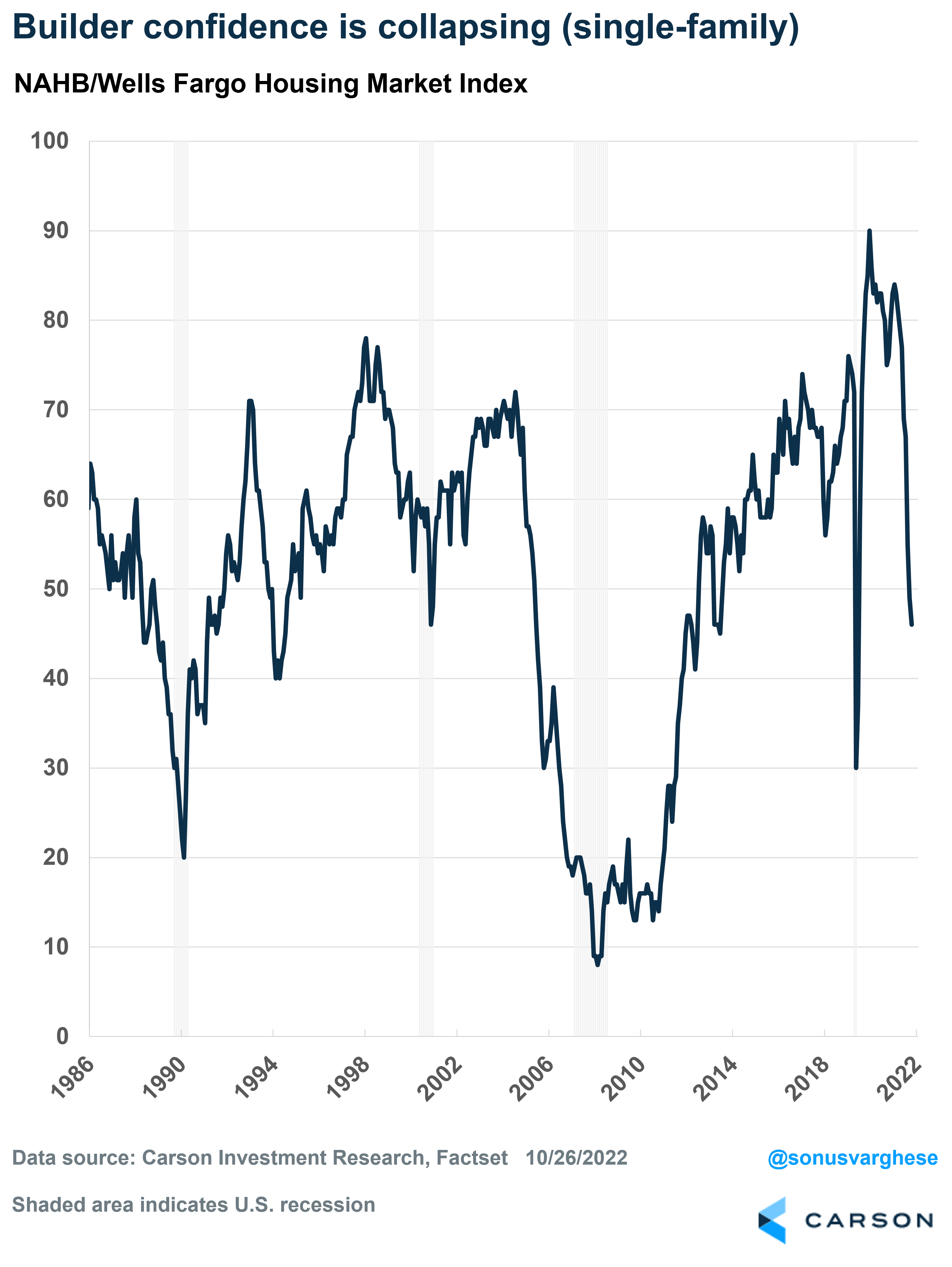

Builder confidence in the single-family market is crashing, as you can tell from NAHB Index, which just fell for the ninth month in a row to the lowest level since May 2014 (excluding the Covid pullback). This is a survey that asks their members to rate market conditions for the sale of new homes at the present time and in the next six months as well as the traffic of prospective buyers of new homes.

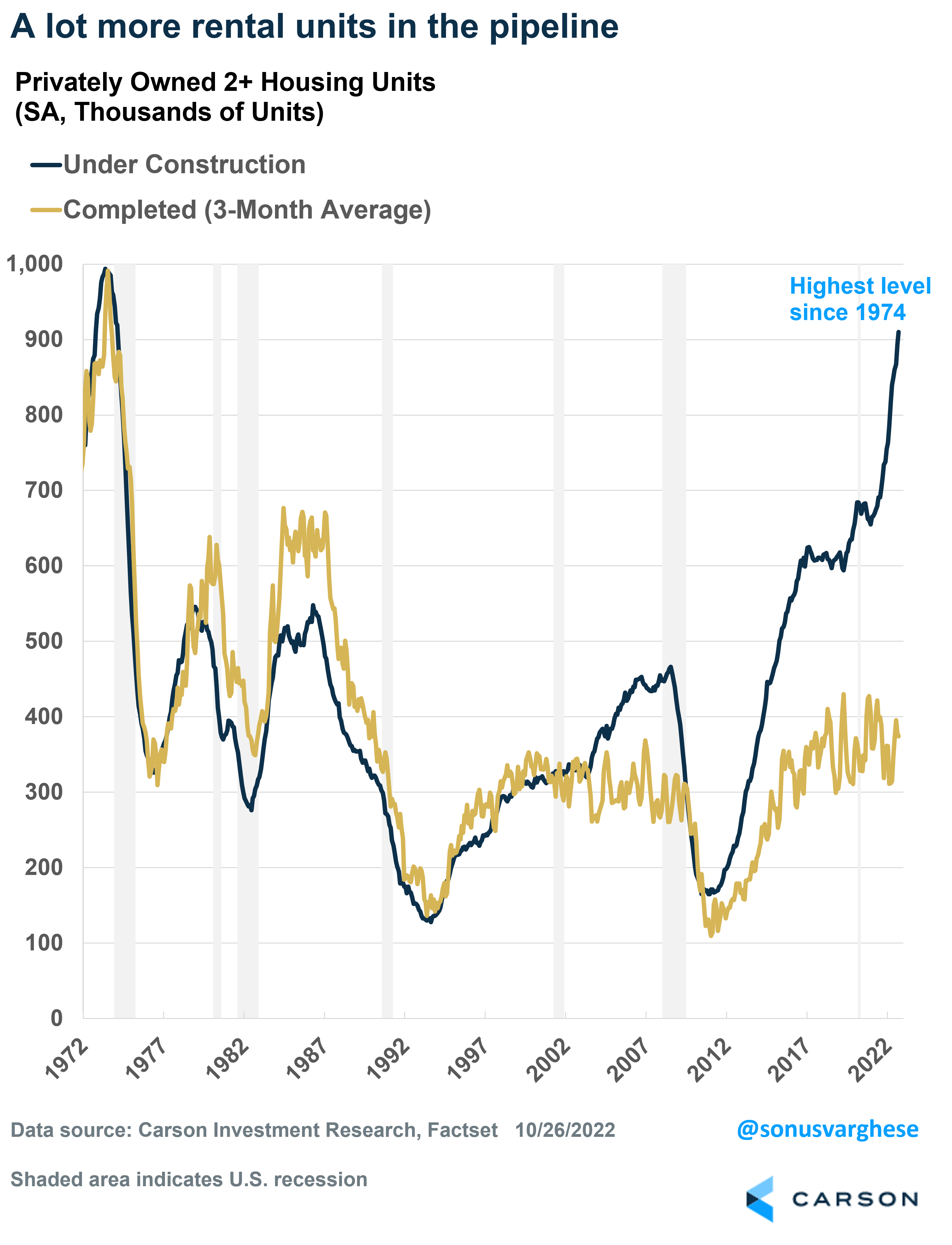

However, builders are clearly more confident about the multi-unit market. Multi-unit starts are now outpacing completions by 12%, whereas in the single family markets, starts have fallen 15% below completions.

The one problem is that a lot of potential supply in the multi-unit segment is under construcion. Units under construction are up 27% from a year ago, and are currently at their highest level since 1974. There is also a massive gap that’s opened up between units under construction and completions. Typically this would be a sign of over-building, as in the mid-2000s, but this time around its because of supply-chain issues in procuring the materials required to wrap up construction.

Why this matters for inflation, and the single-family housing market

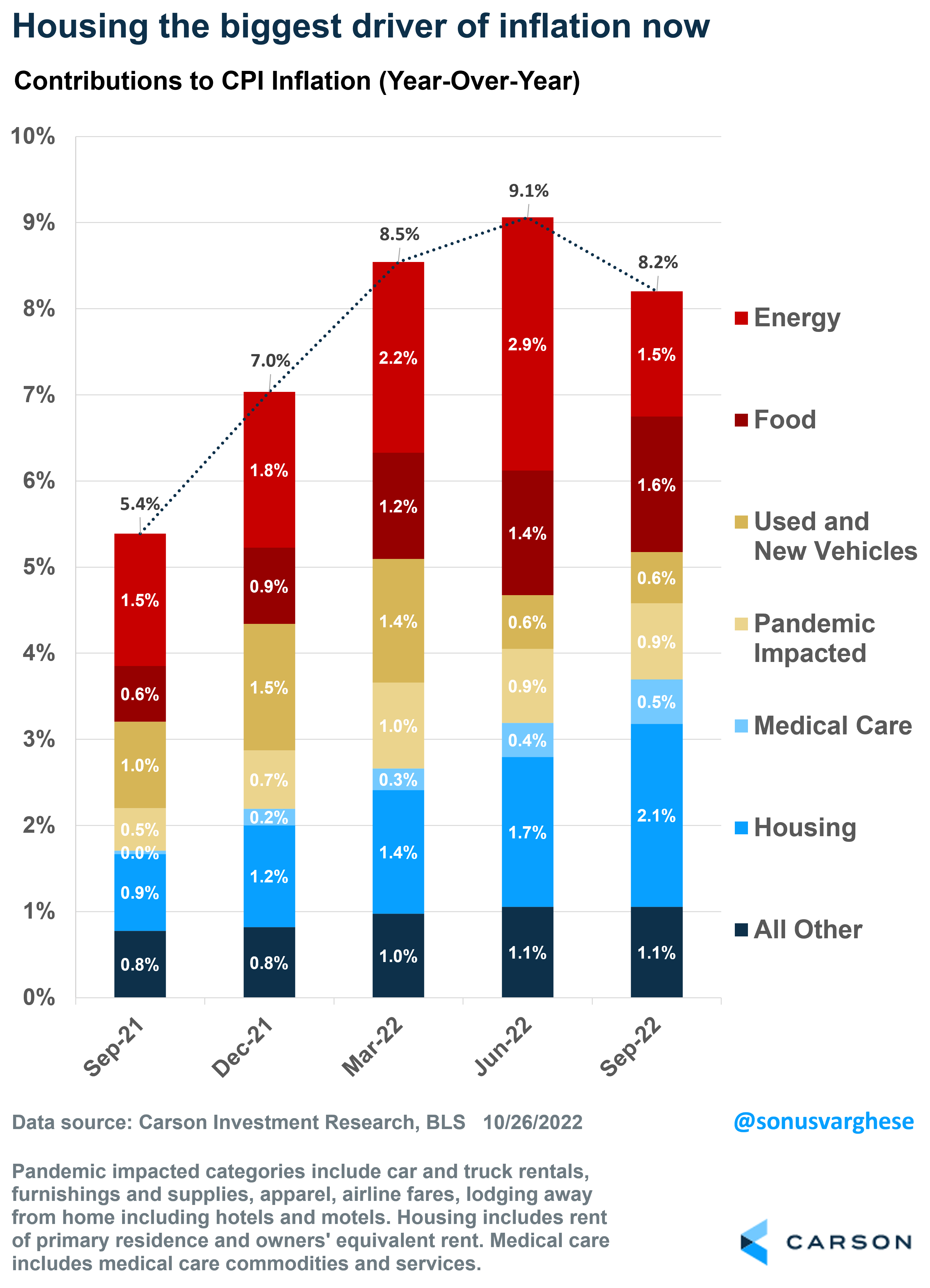

The good news is that a lot of these units under construction will eventually come on to the market, and that’s good news for inflation. As my colleague Ryan Detrick discussed in a blog, the biggest driver of inflation now is housing, whereas a few months ago it was energy prices. As of September, CPI inflation is running at 8.2% and housing accounts for just over a quarter of that.

Because of the way official housing inflation data is measured, what matters is rents (and not home prices). So increased supply of multi-family units should ease upward pressure on rents, and thereby housing inflation.

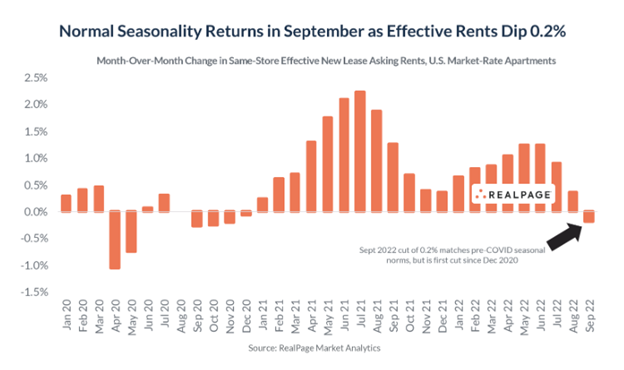

We’re already seeing rents ease. The latest report from Realpage shows that asking rents fell in September in 80 out of the largest 150 metro areas. In September 2021, only 8 of those metro areas saw rents decline. So the rental market appears to be normalizing, just as more supply is set to hit the market. Note that it’s going to take a while for the slowdown to show up in official inflation data (see this blog for more on that).

Ironically, this would also bode well for the single-family market. If rents start to decelerate, and that pushes inflation lower, it will allow the Federal Reserve to pull back from their aggressive monetary policy stance. And that would halt mortgage rates from rising further. In fact, if rates fall back to the 5-6% range, it could potentially unlock more activity in the single-family housing market.

So what happens in the multi-unit housing market is going to be critical to watch.

Before closing, we have some great news to announce here at the Carson Investment Research team! Our brand new podcast called Facts Vs. Feelings is officially on iTunes. My colleague, Ryan Detrick, and I talk about markets, the economy and the Fed. We’ve had some great feedback to this new weekly podcast and it just got a lot easier to listen to each week.