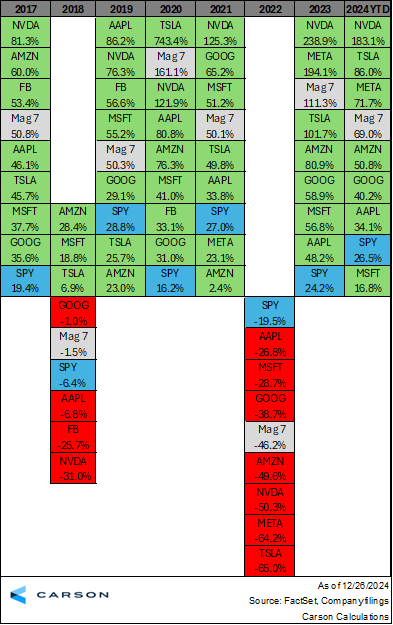

2024 has seen continued outperformance from the ‘Magnificent 7’ group of stocks. Year to date through December 24th, an equal weight portfolio of these 7 stocks has returned 69.0% versus a gain of 26.5% for the S&P 500 (FactSet data). This year builds on years of outperformance for this group as an equal weight portfolio of these stocks, rebalanced at the beginning of every year, has outperformed the broader market all but one year since 2017, with the exception being 2022.

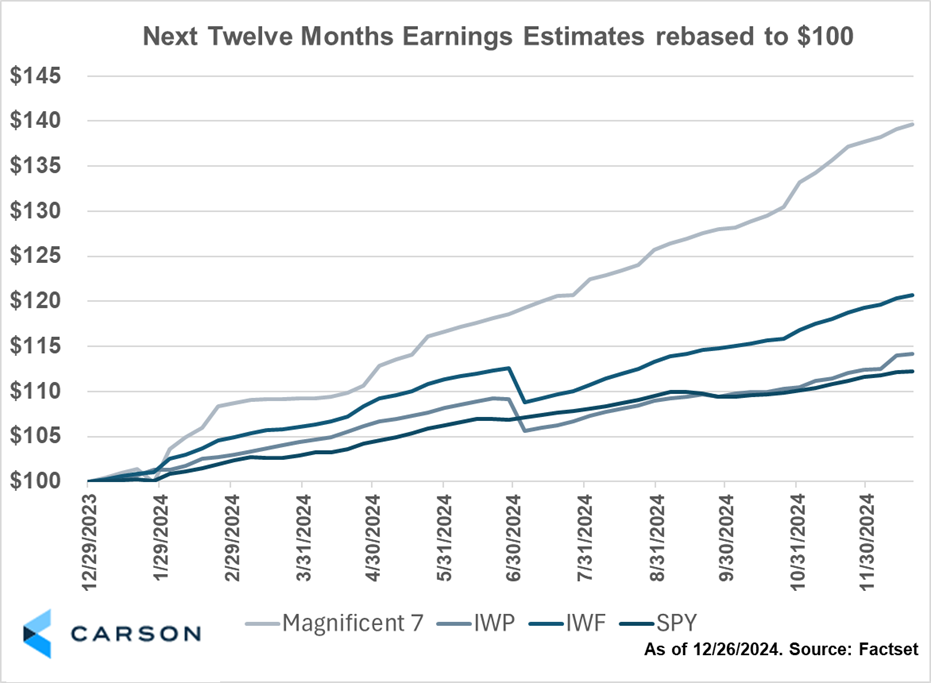

These technology and tech-related stocks may have outperformed the broader S&P 500 because of their ability to grow earnings per share. Earnings revisions and expected earnings for the Mag 7 have far outpaced broader market-cap weighted indices. If we rebase analysts’ next twelve months earnings expectations for an equal weight portfolio of the Mag 7 to $100 on 1/1/2024, analysts now estimate the Mag 7 to earn $139.7 over the coming 12 months. Said differently, the Mag 7 is now expected to earn 39.7% more over the next twelve months than the previous 12 months. Meanwhile, the Russell 1000 Growth Index (proxied by IWF) has seen its forward earnings estimates grow by 20.4%, and the broader S&P 500 index (proxied by SPY) has seen a revision of 12.2%. Even the ‘growthier’ Russell Mid-Cap Growth Index (proxied by IWP) has lagged the Mag 7 earnings growth, with the index’s next twelve months estimate only increasing 14.1%. The Mag 7’s exceptional 2024 price return may be attributable to the growth in their earnings expectations.

The rise of Artificial Intelligence (AI) has been the latest growth driver for this group of stocks, with every company developing proprietary algorithms or monetizing their advanced data. There are two earnings stories from 2024 that, to me, illustrate the durability of growth for these stocks.

Nvidia has powered the Mag 7 this year, contributing the most to the group’s return. It’s worth revisiting why this company is at the center of AI innovation and is seen as a crucial contributor to the future of earnings growth. I wrote about their latest earnings report largely delivering against a high bar. And if there’s one message that, in my opinion, sets up the company for an exceptional 2025 it would be Jensen Huang’s commentary that “demand for Blackwell is expected to exceed supply for several quarters.” Blackwell is Nvidia’s next generation chip that is rumored to be significantly more powerful than previous chips. It means AI-computing is potentially about to get charged up, and Nvidia’s customers are already lining up to take deliveries.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Speaking of Nvidia’s customers, Microsoft’s results continue to impress. While the company may be the worst performing Mag 7 stock this year, investors may be well served to assess their commentary. Microsoft’s CEO Satya Nadella has emphasized that “demand [for AI compute] remains above capacity” on numerous of the company’s earnings calls this year. Nvidia’s Blackwell may be just the cure for Microsoft to increase its capacity in order to meet customer needs. It also means that Microsoft’s earnings estimates could continue to rise when they turn the chips online and capture demand.

2024 may go down as another Magnificent year, with the Magnificent 7 group of stocks again outperforming broader market indices. These companies have been rewarded by investors for peering into the future, this time developing AI-based technologies that were previously unimaginable. It has resulted in earnings estimates for these companies substantially outpacing their peers. And forward commentary from Nvidia and Microsoft suggests that there may be even more good news to come. This momentum underscores the potential for sustained growth, as these industry leaders continue to redefine innovation and shape the future of technology.

For more content by Blake Anderson, Senior Analyst, Investment click here.

02572386-1230-A