Since news broke on June 12, 2024, that Tesla shareholders voted to reinstate CEO Elon Musk’s pay package, Tesla stock has returned +85.3% versus a gain of +10.3% for the broader S&P 500 (FactSet data, as of 11/12/2024 closing price). The investor base has clearly been catalyzed with recent events that includes the company’s ‘We, Robot’ event and positive sentiment around Tesla’s prospects under the incoming presidential administration.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

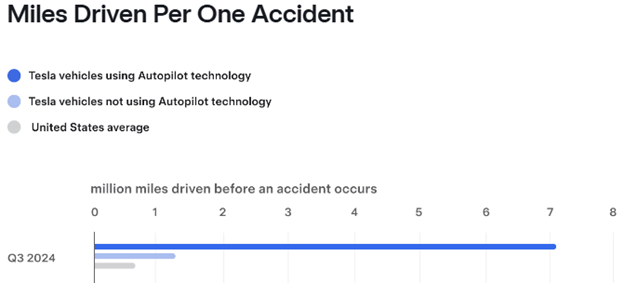

I wrote about Tesla’s Bold Vision in the wake of its October 10th event and detailed some more precise technological capabilities in that blog. In short, Tesla believes that recent breakthroughs in AI computing allow them to produce new products that were previously unimaginable. Chief among these breakthroughs is their Full-Self Driving (FSD) autonomous driving product. Tesla’s automobiles, by observing the driving habits of operators and feeding this video to AI algorithms, are teaching themselves to drive. It has resulted in a remarkable safety breakthrough. Tesla claims that vehicles using this Autopilot technology incurred one crash every 7.08 million miles driven, a significant advantage compared to NHTSA data which shows the average driver in the United States is involved in one crash every 670,000 miles.1

Chart courtesy of Tesla

What is perhaps most encouraging about these results is the year-on-year improvement powered by enhanced computing power. In Q3 2023, Tesla vehicles using Autopilot technology recorded a crash every 5.88 million miles. In just one year, Tesla’s using Autopilot recorded 1.2 million miles more between accidents, an improvement of 20%.

Tesla investors have been eagerly waiting for the company to monetize this technology. However, the process to gain approval in order to commercially operate autonomous driving technology is cumbersome. Currently, prospective operators of autonomous driving applications must gain approval from local jurisdictions, typically a local transit authority or city council. These local approvals can be onerous on the companies to prove viability. For example, Waymo’s approval in Phoenix and San Francisco required extensive field testing and a public comment period. Both can require time and energy on the part of the operator and act as a roadblock to approval.

But there is new hope of a more streamlined approval process. Tesla investors may be anticipating that the NHTSA will take a more active role in setting nationwide standards for autonomous driving technology. The NHTSA is authorized to “regulate the design and safety standards of motor vehicles and equipment sold in the United States.”2 Thus far, autonomous driving technology has not been clearly delineated into one of these categories, leaving regulation primarily to individual states. However, Wedbush Securities Managing Director Dan Ives believes the incoming administration may fast-track nationwide approval for this technology.3 It could mean that the main roadblock to autonomous driving is removed in short order. Tesla investors may be anticipating this in advance.

- https://www.tesla.com/VehicleSafetyReport

- https://www.nhtsa.gov/laws-regulations

- https://www.cnbc.com/video/2024/11/06/its-a-positive-for-tesla-says-wedbush-managing-director-dan-ives.html

For more content by Blake Anderson, Senior Analyst, Investments click here.

02509279-1124-A