Today’s blog is a follow-up to Carson’s VP, Investment Strategist Grant Engelbart’s insightful recent discussion of factor investing and alpha opportunities, “Enhancing Portfolio Management.” Factors are a theme we regularly return to. Grant also covered factor investing in a piece earlier this year called “Factor Investing 2024,” and our Portfolio Manager Mike Lawrence covered the low volatility factor in “The Low Volatility Anomaly: Sometimes Less Is More.”

But before returning to factors, we want to take a look at a market event that’s received a lot of attention since yesterday’s market close, the longest losing streak for the Dow Jones Industrial Average since 1978.

Why We Don’t Fear the Dow Decline

On Tuesday, the Dow fell for the ninth consecutive session, something it hasn’t done since Jimmy Carter was president. It also ducked beneath its 50-day moving average for the first time since the election.

The Dow is one of the oldest stock indexes and is still widely followed. It consists of 30 large, well-established companies and was created to be an easy snapshot of US markets when there wasn’t really anything similar around. The Dow uses price weighting, an idiosyncratic weighting scheme that’s closer to equal weighting than market cap weighting. Price weighting is easy to calculate, an advantage in the early days of indexing, but has no real underlying economic meaning and is no longer really used today.

Should we fear the Dow decline? We don’t think so. First, the decline has not been confirmed by other major indexes. The S&P 500, even with recent weakness, is only just off its all-time high and had an up day as recently as Monday. The Nasdaq Composite also was up on Monday as well, even making a new all-time high.

Second, even with the nine-day losing streak, the Dow has not even fallen even 5%, clocking in at an ordinary 3.5% decline.

Also, with only a small number of stocks and its unusual weighting scheme, the Dow can be heavily influenced by the idiosyncratic behavior of one stock. In this case, it’s been UnitedHealth Group, which has accounted for about half the decline.

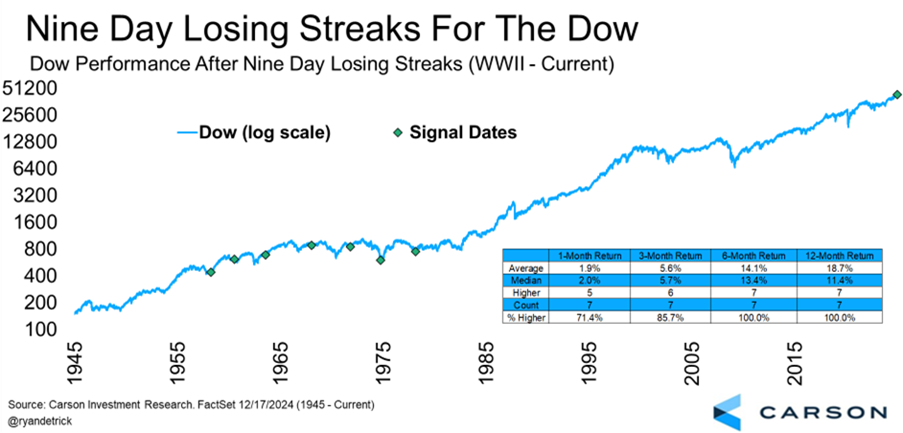

Finally, as always, our Chief Market Strategist Ryan Detrick has the numbers on what losing streaks like this for the Dow have meant in the past. Ryan went back to 1945 and while there aren’t many similar cases (only seven of them), the Dow was higher a year later all seven times with an average return over 18% and a median return over 11%. It seems this losing streak shouldn’t be feared — if anything, it should be embraced.

Factor Investing Revisited

The factor perspective on investing is invaluable but also can be a minefield. As Grant pointed out in his blog, the number of factors, with lots of variations for each one, has exploded.

Factors are quantifiable stock characteristics that may yield a long-term risk-adjusted return advantage. The idea behind them is that they are persistent market anomalies that are some way structural and therefore exposure to the factor may be beneficial across most market cycles.

There is a lot of debate over whether awareness and promotion of factors lead to the decay of their usefulness. The underlying structural issues that created the factor anomaly may still exist, but may be offset, or even more than offset at times, by the added buying pressure from more widespread use. Certainly this must be true at least to an extent. Though keep in mind that the momentum “anomaly” was brought to our attention way back in the early 1990s, and momentum’s outperformance has persisted even over the last 30-years “out-of-sample”. It’s also worth noting this is less likely to be true on the short side (shorting the factor’s evil doppelgänger, stocks where that factor is most notably absent), and there may be better opportunities to take advantage of factors through effective long/short portfolio management than the likely less robust long only approach.

The other ways to try to solve for this problem are 1) factor timing, which is very difficult (AQR has thrown their significant research capabilities at this, but have come up empty), and 2) strategically combining factors. The idea behind combining factors is to find factors that you believe will persist over a full market cycle but are also complementary — there’s a tendency for one to work when the other isn’t. This approach takes patience, since it means you’re willing to have something that isn’t “working” in your portfolio at any given time, but that’s actually part of what effective portfolio managers try to do.

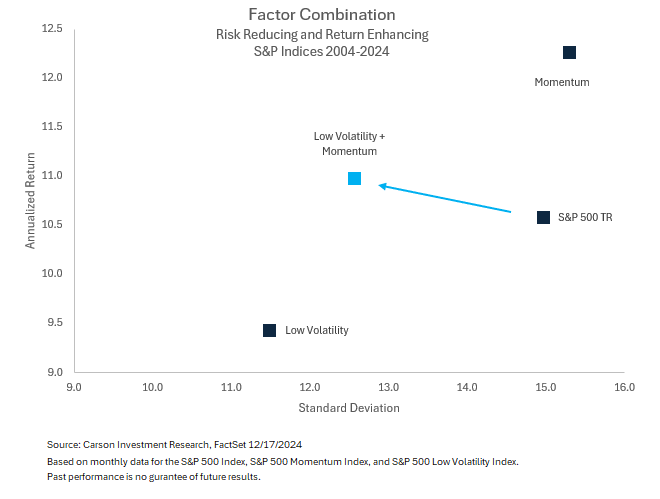

Grant provided an example of this in his blog, looking at the S&P 500 Index, the S&P 500 Momentum Index, the S&P 500 Low Volatility Index, and a 50/50 combination dating back to shared index total return inception in 2004.

A few things to notice here. First, for this period if you were indifferent to risk and just wanted return, you would have wanted to be in the momentum portfolio. However, momentum also has its periods of underperformance, sometimes getting hit quite hard. Also, higher volatility, even when it results in higher returns, is more likely to lead to common investing mistakes.

The low volatility portfolio did what it was supposed to do (dampen volatility), but there was also a return sacrifice. This also brings out interesting use cases in multi-assets portfolios (e.g. with stocks and bonds), where low volatility can be used as a diversifier in lieu of bonds (partially), while being overweight stocks – this is an approach we use in our own Carson House View portfolios.

Coming back to the momentum and low volatility portfolios, both had a better “Sharpe ratio” (return per unit standard deviation) than the S&P 500 and both had positive alpha, another measure of risk adjusted returns.

As a result, the simple 50/50 combination historically gave you a higher return than the S&P 500 (unlike the low volatility portfolio) at a lower risk level (unlike the momentum portfolio) and a Sharpe ratio that was better than all three indexes alone.

We had also said we wanted the indexes to be complementary. Here’s what we ended up with:

- For the 163 months the S&P 500 was up it averaged a 3.22% monthly return. The momentum portfolio also averaged a 3.22% monthly return, but the low volatility portfolio averaged a 2.29% return.

- For the 77 months the S&P 500 was down, it averaged a -3.91% monthly return. The momentum portfolio averaged a -3.48% return, better than the S&P 500. The low volatility portfolio averaged a -2.32% return, much better than the S&P 500.

The result is interesting. Since momentum emphasizes the best performing stocks over the last year, it is prone to getting whipsawed when the market turns. But if a downward trend becomes extended, it can take on more defensive characteristics while still generally keeping pace on the upside, which has not been easy with the S&P 500 over the last decade or so as it increasingly became dominated by a small number of megacap technology-oriented stocks.

In addition, the returns for the momentum and low volatility indexes above or below the S&P 500 had a correlation of near zero (0.13). That means there was no particular tendency for the factor indexes to perform well or poorly together over the whole time period versus the S&P 500. They each had their own path, which has been good enough for them to act as effective complements.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

While this blog is not a thorough test of which factors may serve as effective complements, this small case study captures the basic idea. Finding complementary factors can potentially be a strategic play within a well-diversified portfolio, since it may offer a way to improve both absolute and risk adjusted returns without having to time factors, or the market for that matter. There may even potentially be opportunities to enhance this strategic approach where factor investing can be implemented on both the long side and the short side, but we believe the long-only approach with complementary factors may still offer a meaningful edge. Carson Investment Research does already implement versions of these ideas in some multi-asset portfolios and individual equity portfolios. And while the approach is strategic, strategic positioning is a good starting point for a more tactical portfolio as well, which could then incorporate shorter-term tactical ideas.

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here.

02558110-1224-A