“Don’t count the days, make the days count.” -Muhammad Ali

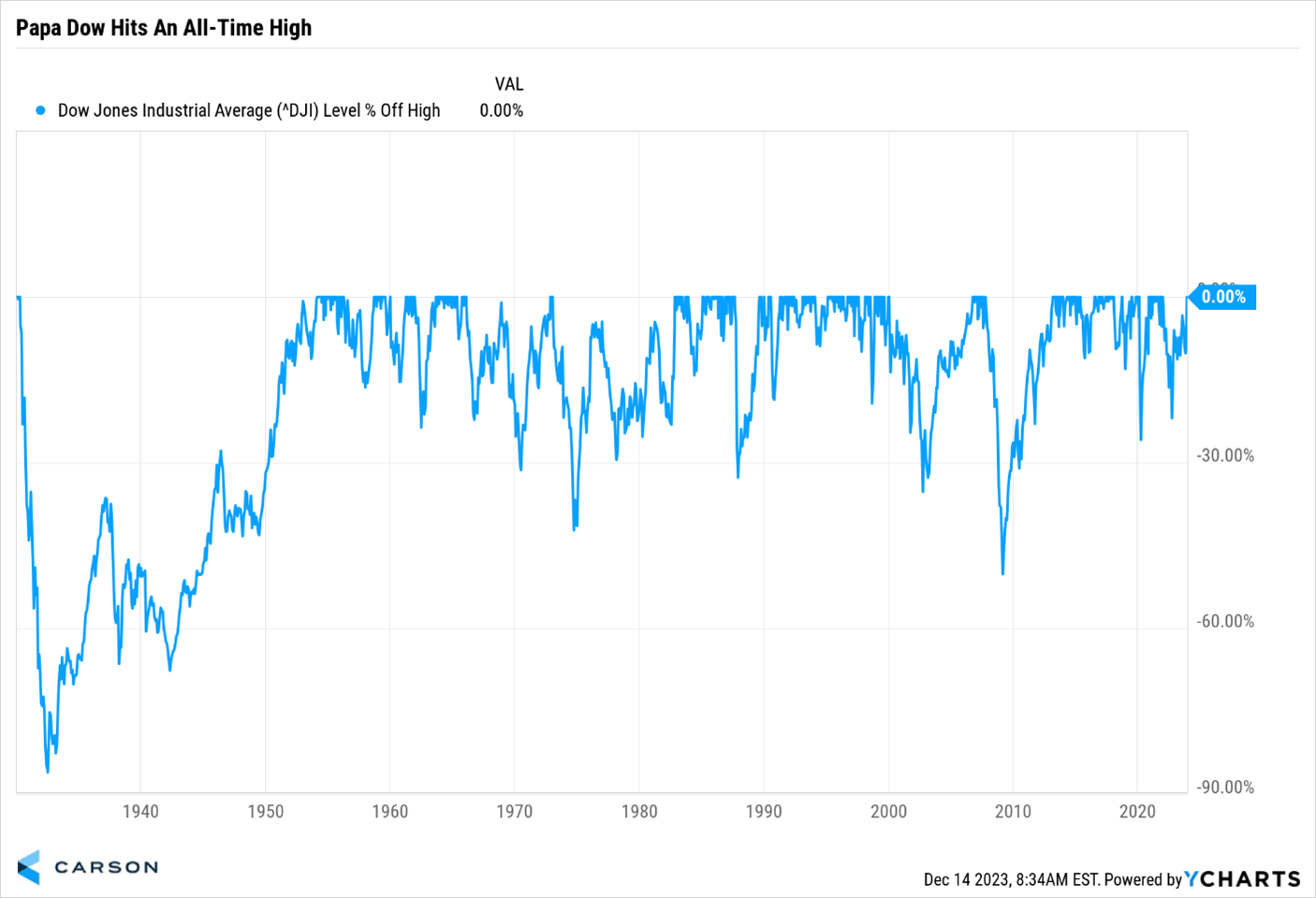

In the face of many worries, stocks have put together a historic year in ’23. To top things off, the Dow just hit a fresh new all-time high, its first new high since January 4, 2022.

New Highs Happen More Than You Think

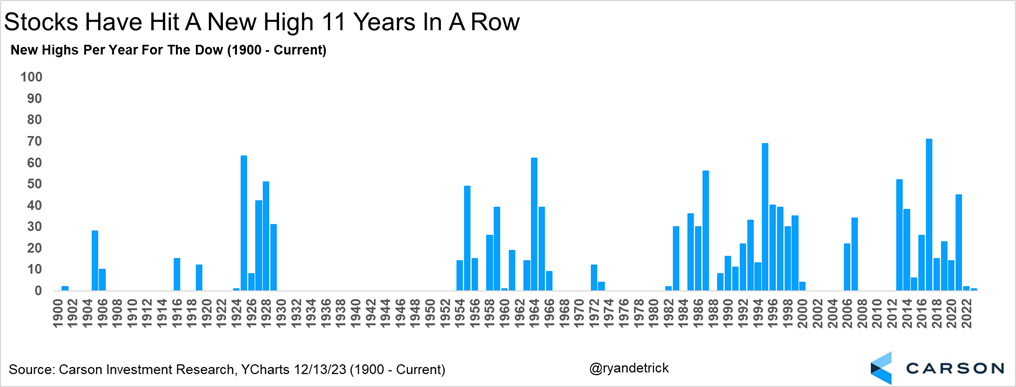

Interestingly, this marked the 11th consecutive year that the Dow made a new high, the second longest streak ever! Of course, the previous two calendar years have had a total of only four new highs, but it still counts.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Since 1900 there have been nearly 1,400 new highs, which actually comes out to 4.5% of all days since 1900 closing at a new all-time high. That is probably much more than most people expect.

Stocks Lead the Economy

Since markets are forward looking, stocks tend to lead the economy. This can work on the way up and way down, so for us new highs right now is suggesting the economy is on firm footing heading into ’24 and a stronger economy (with no recession) could be the play next year.

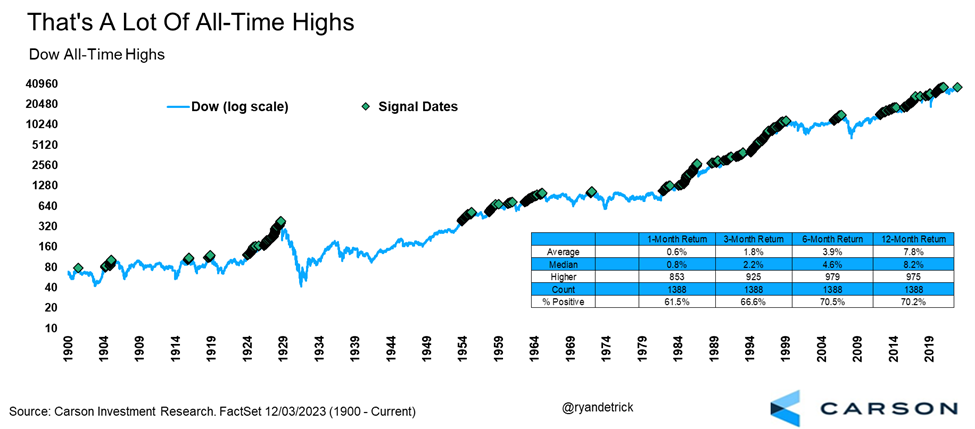

Sure, there are always some examples of that ‘final new high’ right before trouble (1929, 2000, and 2007), but looking back at history, new highs rarely suggest impending doom right around the corner.

Since World War II, there were 227 months that saw at least one new high for the Dow. A recession started within a year of one of those months only 26 times, or 11.5% of the time. Compare this with the economy being in a recession 13.9% of the time since WWII and new highs could be a subtle positive sign for the economy next year.

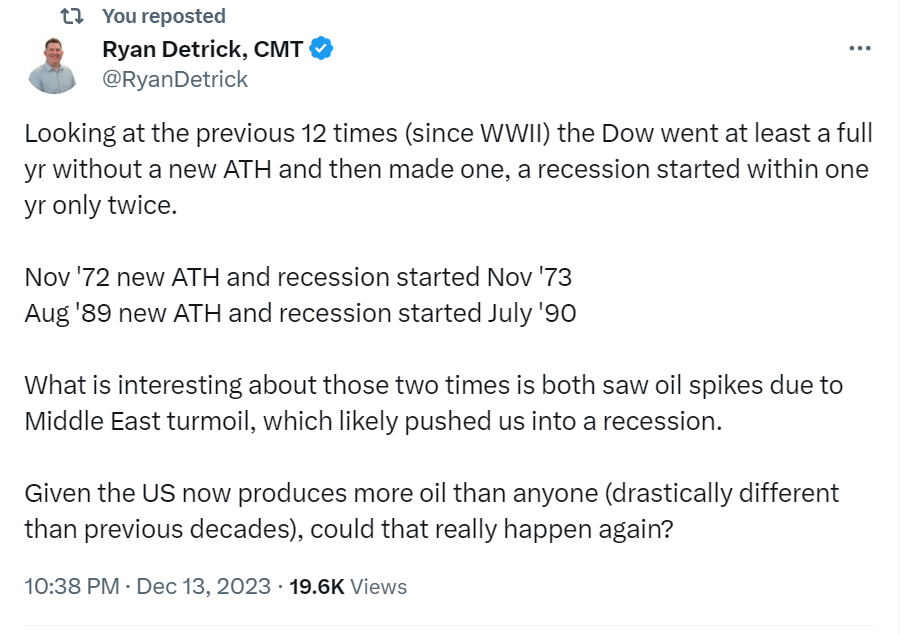

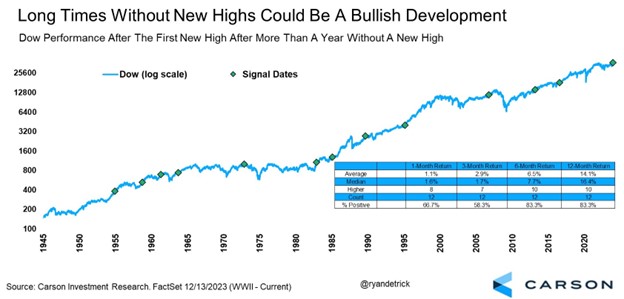

The last new high for the Dow was nearly two years ago, so what happens after the Dow goes a long time without new high? I found 12 times since WWII it went at least a full year without a new high and then made one, and only twice did the economy fall into a recession within a year of that new high.

What stood out about those two times was both saw Middle East turmoil and a spike in crude oil, likely contributing to the recession. Given the US now produces more oil than anyone, does it makes sense to bet against history and treat this new high as an exception? Here’s a tweet I sent on this idea.

Now What?

Plain and simple, new highs aren’t bearish events. In fact, you tend to see new highs take place during bull markets, with more advances potentially ahead. We’ve been calling this a new bull market for over a year now. As far back as last November we said the lows were in and there would be no recession in 2023 (with many arguing with us the whole way up).

In fact, here’s an interview I did six months ago with Scott Wapner on CNBC’s Closing Bell. When he asked me what my biggest worry was, I said it was that too many people were bearish and weren’t embracing this bull market.

So what do new highs mean by the numbers? By itself, a new high doesn’t appear to signal any warnings. In fact, things look about average after new highs. There are the nearly 1,400 new highs since 1900 and a year later the Dow was up 7.8% on average and higher 70.2% of the time. Compare this with the average year since 1900, which was up 7.4% on average and higher 65% of the time.

But the Dow’s long break without a new high until now improves the outlook historically. Looking at those 12 times (since WWII) the Dow went at least one year without a new high and then finally made one, ol’ Papa Dow was higher a year later 10 times and up an average of 14.1% with a very solid median return of 16.4%.

For more of our views on this bull market, the economy, and why good news is good news, please listen to (or watch below) our latest Facts vs Feelings podcast as Sonu and I break it all down.

For more of Ryan’s thoughts click here.

2026858-1223-A