“American Consumers: Have money, will spend“

That, in a nutshell, is the story of the economy right now.

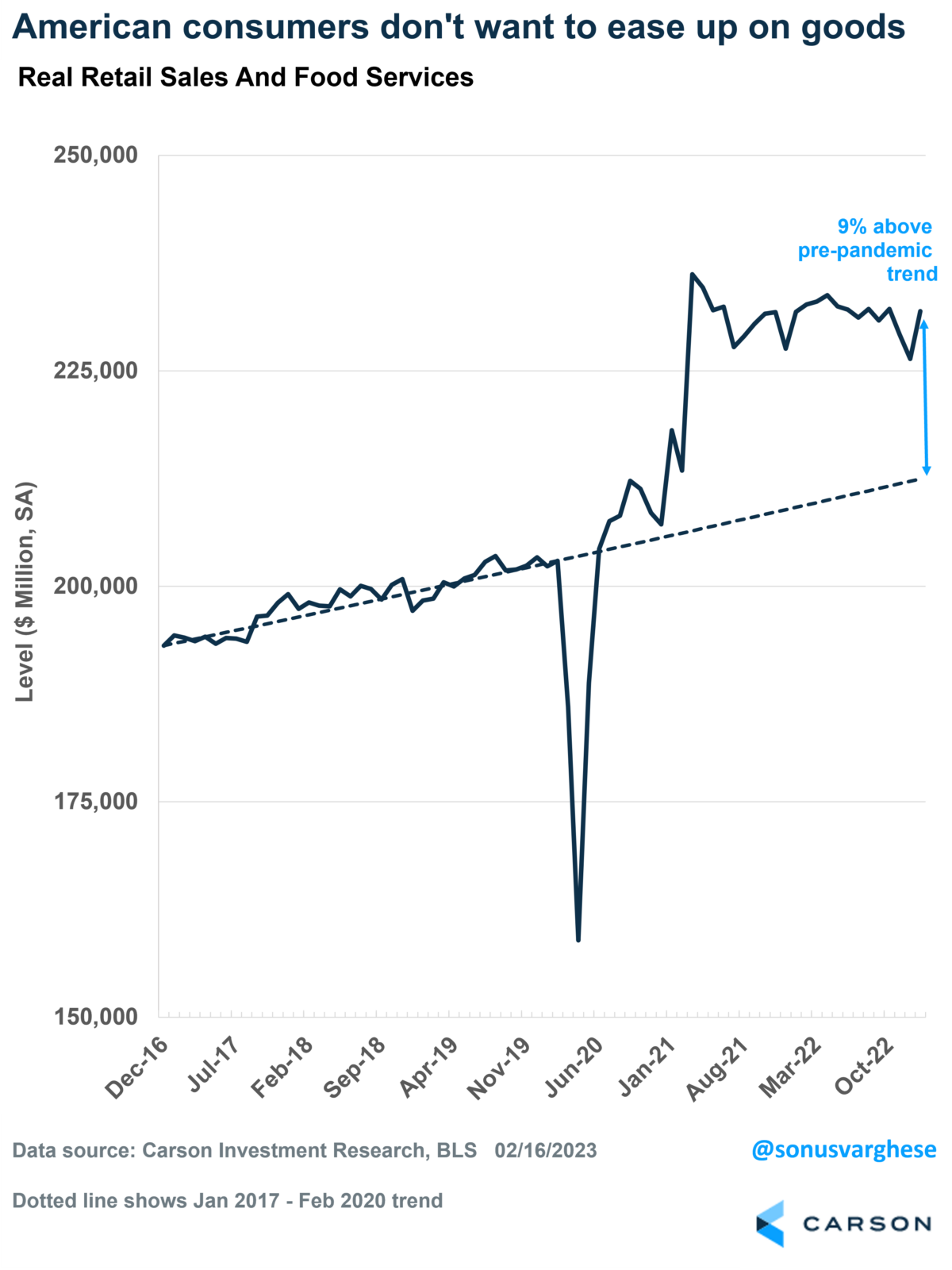

Retail sales and food services surged 3% in January, making a mockery of expectations for a 1.7% gain. This is the largest monthly increase since March 2021, but that came on the back of stimulus checks. So excluding the 2020/2021 recovery period (when we saw large drops and gains), you have to go back to October 2001 to find a month with larger gains. And even that was a rebound after a depressed September.

Such a large number should immediately get your antennae up, and there certainly are seasonality issues. For three years, we’ve seen retail sales drop in December only to surge in January.

But don’t miss the big picture: consumption is running strong

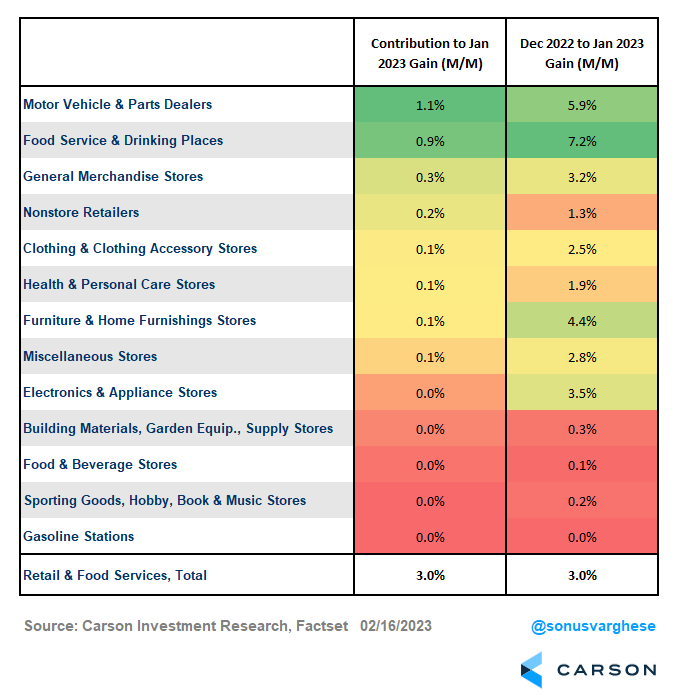

Vehicle sales were the big driver, accounting for over a third of the overall gain. But there was broad strength everywhere, including general merchandise stores, e-commerce, clothing stores, and even furnishings (despite the slowdown in housing activity).

Spending at restaurants and bars rose by a whopping 7.2%, and it wasn’t because of prices (up 0.6% last month).

“Real” retail sales and food services, i.e., after adjusting for inflation, rose 2.4% in January. It’s currently running 9% above the pre-pandemic trend. Make all the seasonality-related adjustments you want—no denying that consumption is strong. The only surprise really is how strong goods consumption is running, even as we get further away from the pandemic. The expectation was that consumption patterns would normalize by now, and goods spending would head back towards trend.

Consumption is strong because real incomes are rising

It really doesn’t get much simpler than that.

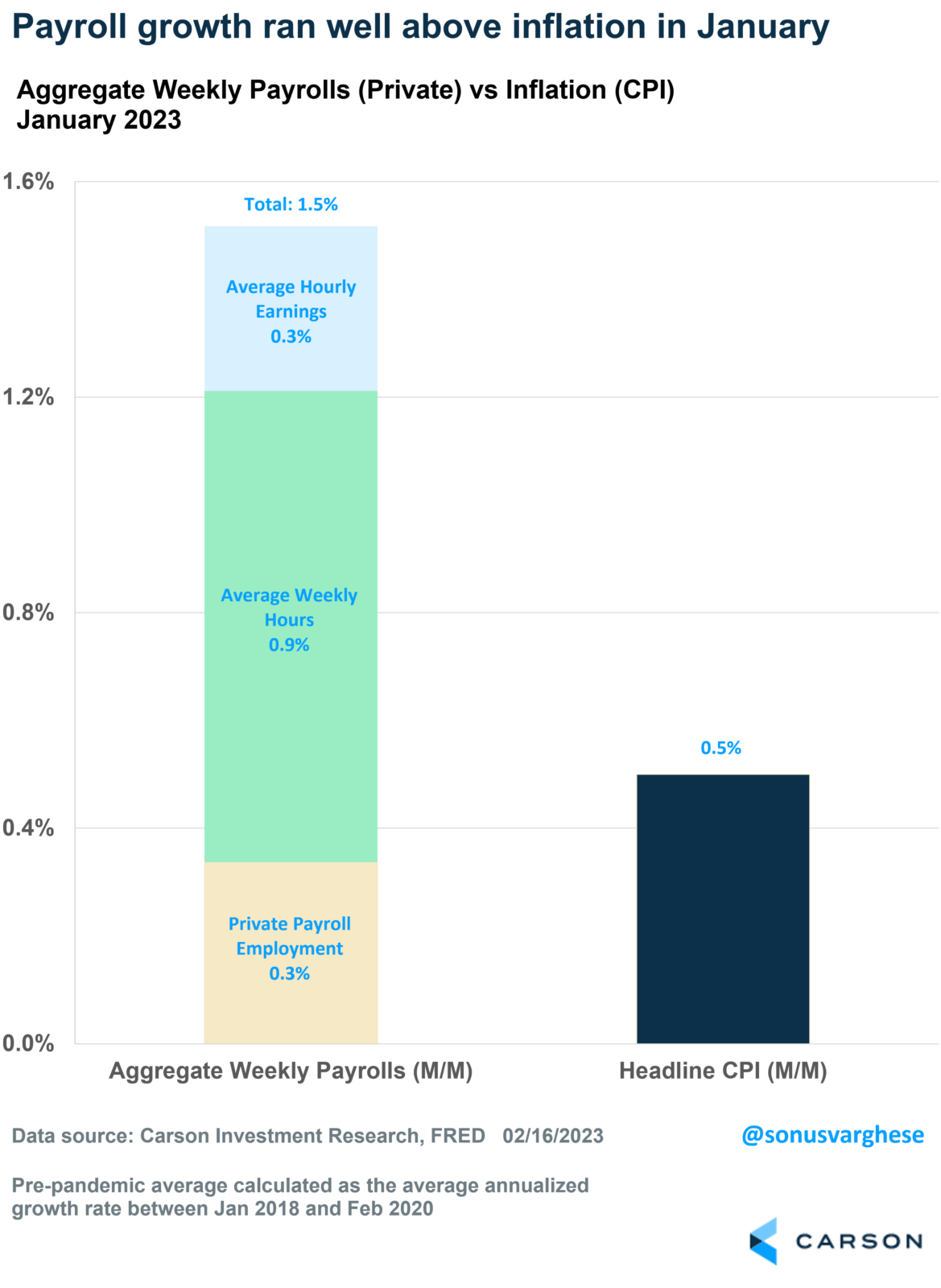

January is a great example. Aggregate weekly payrolls, which should give you a sense of income earned by private workers across the economy, rose 1.5% in January. This was on the back of:

- Rising employment (remember the massive jobs report?)

- More hours worked

- Strong wage growth

Meanwhile, inflation was up “only” 0.5%.

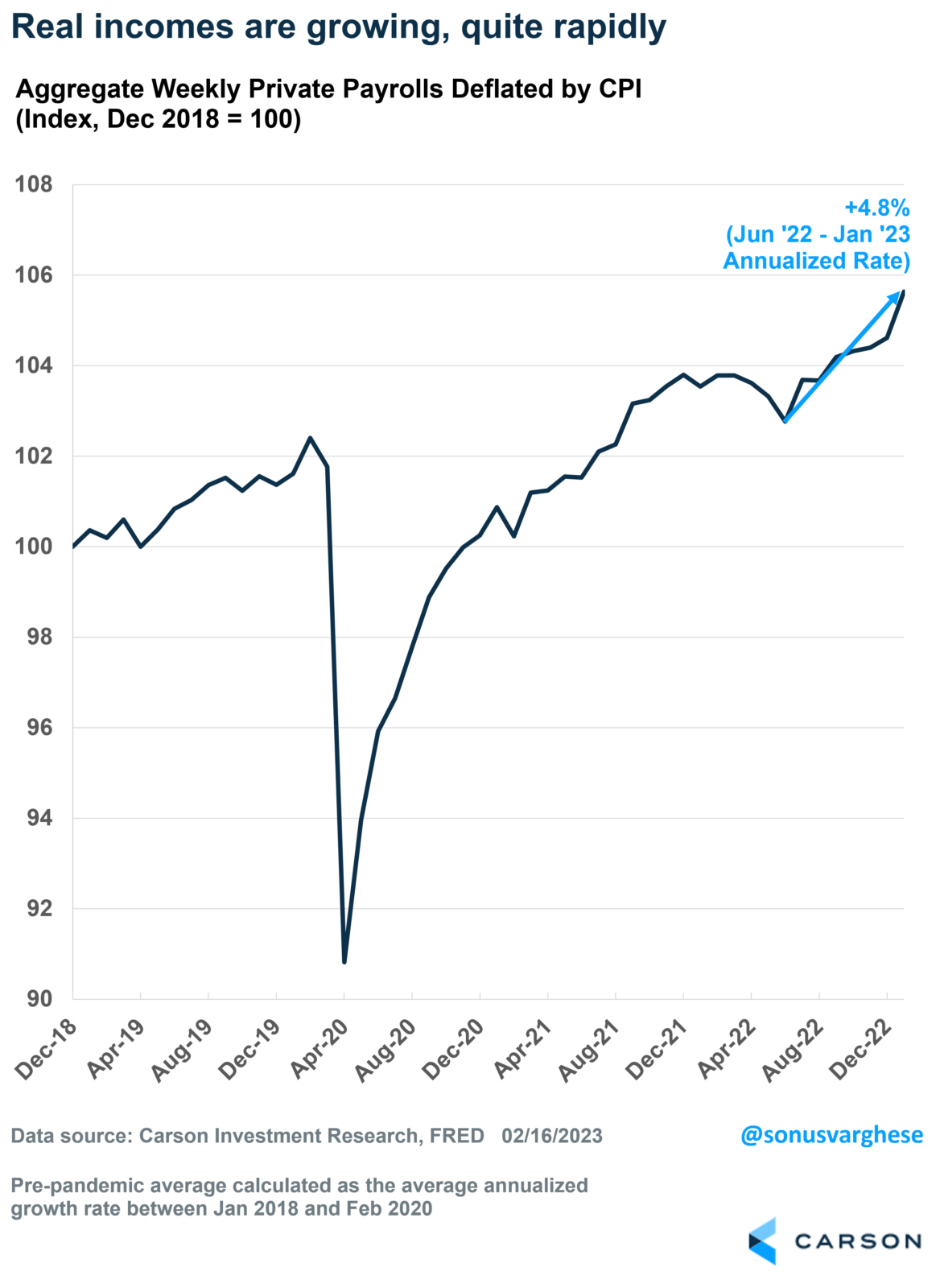

After adjusting for prices, aggregate payrolls have now been rising since last June at an annualized pace of almost 5%. For perspective, this measure of aggregate income ran at an annual pace of just over 2% before the pandemic.

The current pace is hot, to put it mildly, so don’t be surprised if we get a pullback. But if employment continues to rise, wage growth remains strong, and inflation doesn’t surge, real incomes should continue trending higher. And that’s a tailwind for consumption and the economy.

Of course, the other side of solid consumption is that many of the categories where we see strong consumer spending are seeing upward price pressures. I wrote about this after the January inflation report was released – the fact that inflation is running hot in several service sectors and core goods like apparel and furnishings is another indication that demand is strong, especially in those areas.

Good news is good news, finally

Hot inflation in the service sector is precisely what the Federal Reserve is worried about. So, it isn’t a surprise that markets have repriced their expectations for monetary policy, now taking the Fed at their word that they’ll get to the 5.0-5.25% range for the federal funds rate. And stay there for longer.

That repricing is not great for bonds, but unlike last year, the good news is that stocks have held up quite strong in the face of that. This is positive in that good news about the economy is good news for stocks.