Let’s get it on the table. Of all the charts that raise concerns for me about the economy right now, despite a still solid base case, the one below worries me the most. Not for what it represents in itself but for what it says about where we are in the cycle in general. The unemployment rate has been rising. When it rises, it could mean trouble. At the same time, it should not be misconstrued. Economic momentum remains well in place, policy still has strong potential to keep that momentum going, and we still have strong conviction that the expansion continues in 2025.

But there is increasing risk that some of the opportunity from a rise in animal spirits that we discussed in our Outlook 2025 may be squandered. But even so, that likely would mean just an ok rather than a good economy, as discussed yesterday in a thoughtful post by our Global Macro Strategist Sonu Varghese, “DC, We Have a Problem.” And an ok economy would be plenty to support profit growth and equity markets.

Still, there is some risk at the margin that an uncertain policy environment actually suppresses animal spirits, and policymakers, including the Federal Reserve, Congress, and the president, should be mindful of this chart. We are not in late 2016, when unemployment was falling but a slowing economy had created an economic springboard that amplified the impact of a business-friendly policy environment. To the contrary, unemployment has already started rising while the economy over the last few years has actually been pretty good. Despite short-term interest rates rising to their highest level in over 20 years, the US economy grew robustly in 2023 – 2024, outpacing (by just a small margin) the pre-pandemic period from 2017 – 2019. The levers for policy to have an impact are there, but it won’t be as easy this time around and policymakers should stay laser focused on the economy.

This chart does warn that rising unemployment off its low can have a snowball effect, but there are also times when the unemployment rate has remained relatively stable at a low level for years or even made a new low. Still, you’re at greatest risk of a snowball effect when you’re at the top of a hill, not the bottom. The economy is strong right now and that creates some vulnerability to shocks because there’s a lot to potentially unwind if things get rolling. At the same time, we do not see the extended extremes in confidence, borrowing, or spending that mark the most vulnerable economies.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

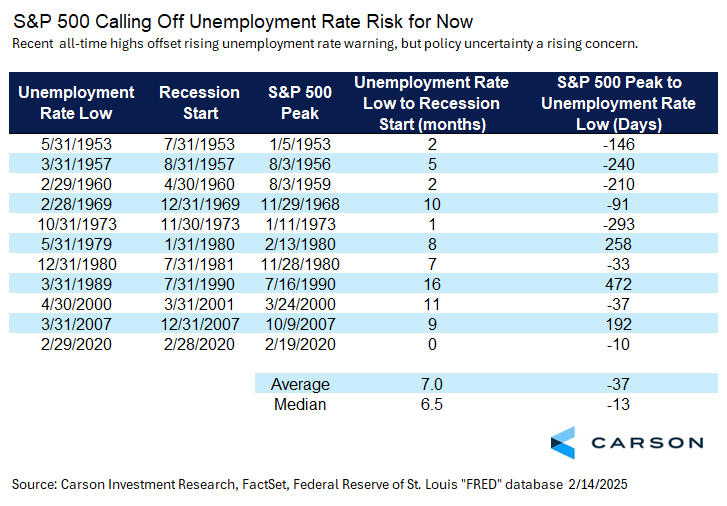

For some context, since 1950 the unemployment rate has reached its low a median of seven months before the start of a recession, but has been as early as just being coincident (2020) and as delayed as 16 months early (1990). Be careful with that stat, because we don’t know for sure that we won’t still establish a new low for the cycle. The current low of 3.4% was reached in April 2023, 21 months removed from the latest data point. But rather than taking that as a warning that a recession is “due,” we should take it as a sign that there are some risks but there have also been some stabilizers in place, some of which we highlight in our Outlook. Economic expansions don’t die of old age, but the longer it goes on, the greater the likelihood that complacency, and perhaps excesses, build up.

In fact, that’s what markets have been telling us as well. To show that we should never get too caught up in one signal, the unemployment rate low has historically roughly coincided with the market peak before a recession. Markets are forward looking and often very good at sussing economic risks and they have often detected when good news is bad news. That’s not what markets have been telling us in the current expansion. Markets have been sending a strong signal that economic risks are still fairly muted. In fact, the last S&P 500 all-time high was on January 23 and we may get a new one today (and believe it’s likely we see additional gains throughout the year).

So we take this all to be more of a cautionary tale. The flurry of activity from the Trump administration since inauguration day on January 20 has increased uncertainty for businesses in the near term, making it more difficult for them to plan and more reluctant to take risk. Because of that, as discussed in Sonu’s piece, we have actually seen signs of the initial surge in animal spirits become more muted. However, more pro-cyclical fiscal policy lies ahead and could be significant. At the same time, we think the Trump administration, Congress, and the Federal Reserve should be aware of economic risks and more focused on supporting the economy. Right now it feels a little like Republicans are making the same mistake that led to Democrats losing the presidency and Senate in 2024. Democrats neglected to put the economy at the center of their platform. Surprisingly, Republicans seem to be doing the same thing, just from the perspective of the other side of the aisle. But it’s still early and there’s plenty of time to get back on track.

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here.

7643751-0225-A