An effect widely known as the January Barometer looks at how January does and what it may mean for the next 11 months. It is known by the saying, ‘So goes January, goes the year’ in the media. The late Yale Hirsch of Almanac Trader 1972 discovered this indicator. Today the Almanac is carried on by Yale’s son Jeff. I’ve known Jeff for years, and I must say, he is great, and I believe the work they do is some of the best in the industry on market seasonality, calendar effects, and many other indicators.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Let’s look at the January Barometer. For starters, two years ago saw stocks lower in January and it led to a vicious bear market. Then last year, stocks soared more than 6% the first month of the year and ended up having one of the better years ever. Maybe there is something here?

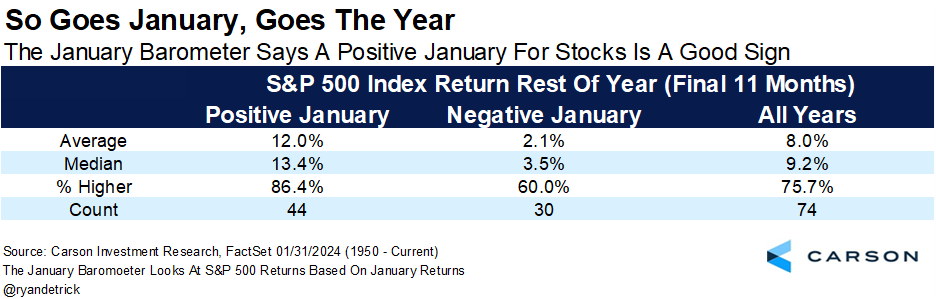

Historically speaking, when the first month was positive for stocks, the rest of the year was up 12% on average and higher 86.4% of the time. And when that first month was lower? It was up about 2.1% on average and higher only 60% of the time. Compare this with your average year’s final 11 months, up 8.0% and higher 75.7% of the time, and clearly the solid start to ’24 could be a positive for the bulls.

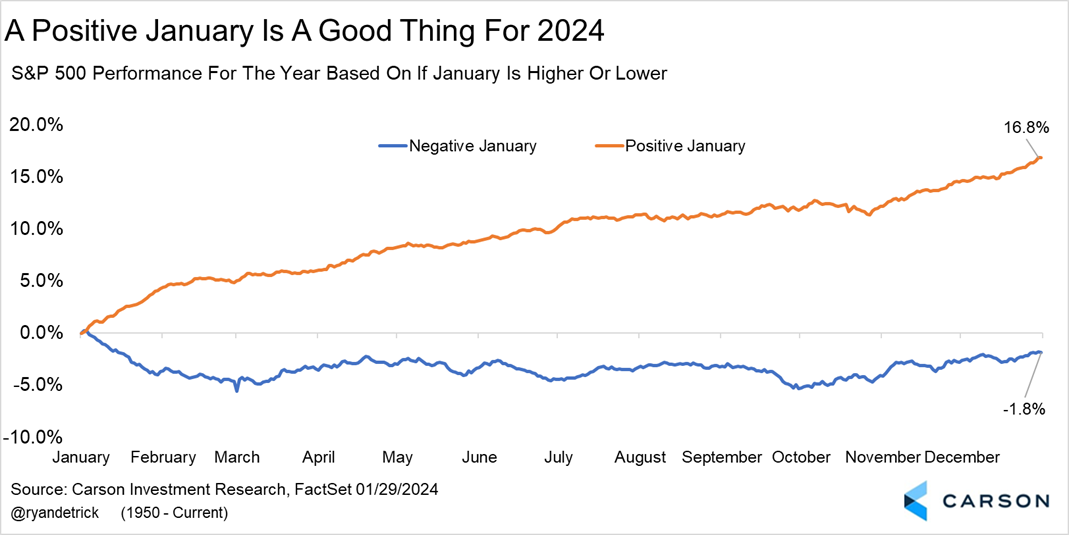

Here’s another way of showing what tends to happen based on whether January was higher or lower. Sure enough, a good first month tends to see better times, while a weak first month can be trouble.

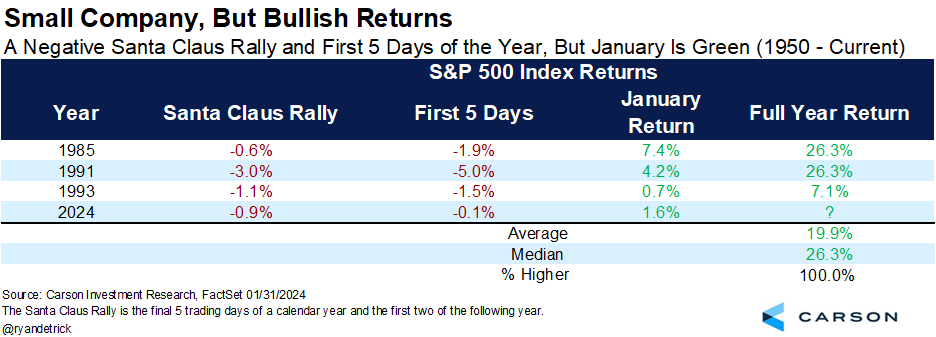

Now, stocks were lower during the historically bullish Santa Claus rally period and first five days of 2024. We wrote about those things more in detail in Some Bad News, and Some Good News, but what does it mean when Santa doesn’t come, the first five days are red, but January is higher? Interestingly, this combo has happened only three other times in history, so we are dealing with a very small sample size. The good news is stocks were higher for the full year each time and up nearly 20% on average.

The huge end-of-year rally last year (remember, the S&P 500 was up 14% in November and December) did suggest some weakness in late December and early January would be perfectly normal. But the bottom line is looking forward, the gains we’ve seen in January matter more.

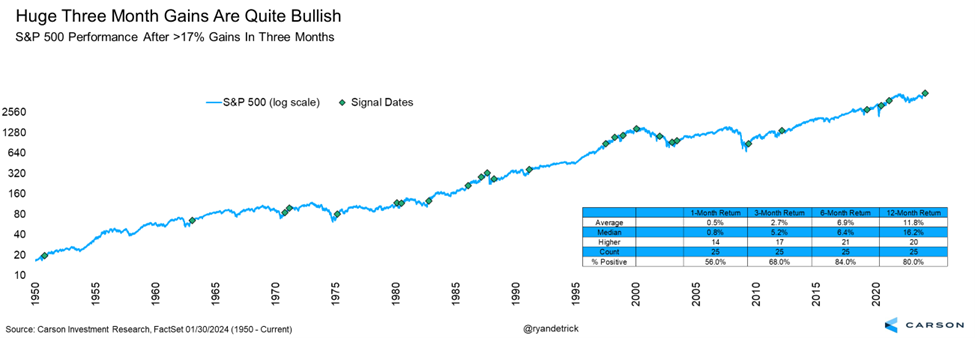

Another feather in the cap of the bulls is we are officially three calendar months off the October 27, 2023 correction lows. Turns out, stocks gained 19.6% during those three months, for one of the best three-month returns ever. I looked at all the times the index gained at least 17% in three months and once again, the future returns after those huge three-month stretches were quite normal for a bull market: higher six months later 84% of the time and higher a median of 16.2% a year later and up 80% of the time.

In short, the strength we’ve seen the past three months isn’t consistent with the end of a bull market or this being ‘just a bear market rally’ like many claim. In fact, it suggests we’ve been in a strong bull market that’s likely to a continue.

I recently joined my friend Brian Sullivan on CNBC’S Last Call to discuss the strong start to the year, what could be next, and more. You can watch the full interview below.

For more of Ryan’s thoughts click here.

02097095-0224-A