“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” Mark Twain

An effect widely known as the January Barometer looks at how the S&P 500 does in January and what it may mean for the next 11 months. It is known by the saying, ‘So goes January, goes the year’ in the media. The late Yale Hirsch first presented the phenomenon in Almanac Trader 1972. Today the Almanac is carried on by Yale’s son Jeff. I’ve known Jeff for years, and I must say, he is great, and I believe the work they do is some of the best in the industry on market seasonality, calendar effects, and many other indicators.

Let’s look at the January Barometer. For starters, three years ago we saw the S&P 500 lower in January and it was followed by a vicious bear market. Then the past two years stocks were higher in January and we saw back-to-back 20% years.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

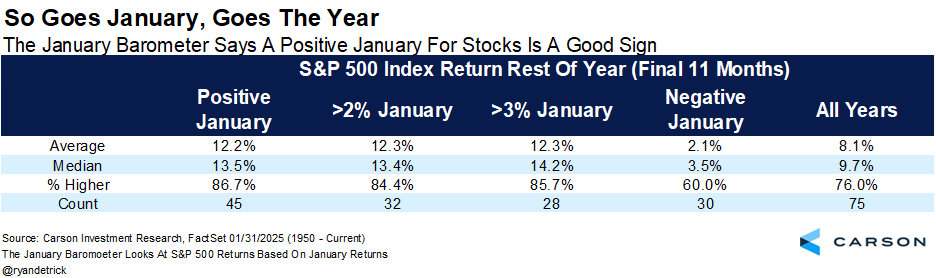

Historically speaking, when the first month was positive for stocks, the rest of the year was up 12.3% on average and higher 86.7% of the time. And when that first month was lower? It was up about 2.1% on average and higher only 60% of the time. Compare this with your average year’s final 11 months, up an average of 8.1% and higher 76.0% of the time, so clearly the solid start to ’25 could be a positive for the bulls. Lest you fear January has been too strong, a good start to January tends to see strong gains the rest of the year as well, as we discuss below.

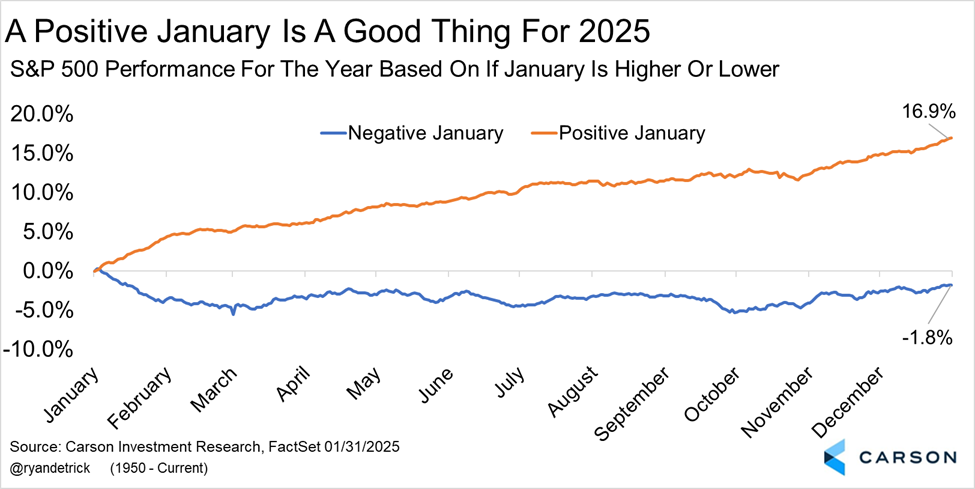

Here’s another way of showing what tends to happen based on whether January was higher or lower. We know markets trend, but my oh my, what that first month does can really pick the direction for the full year.

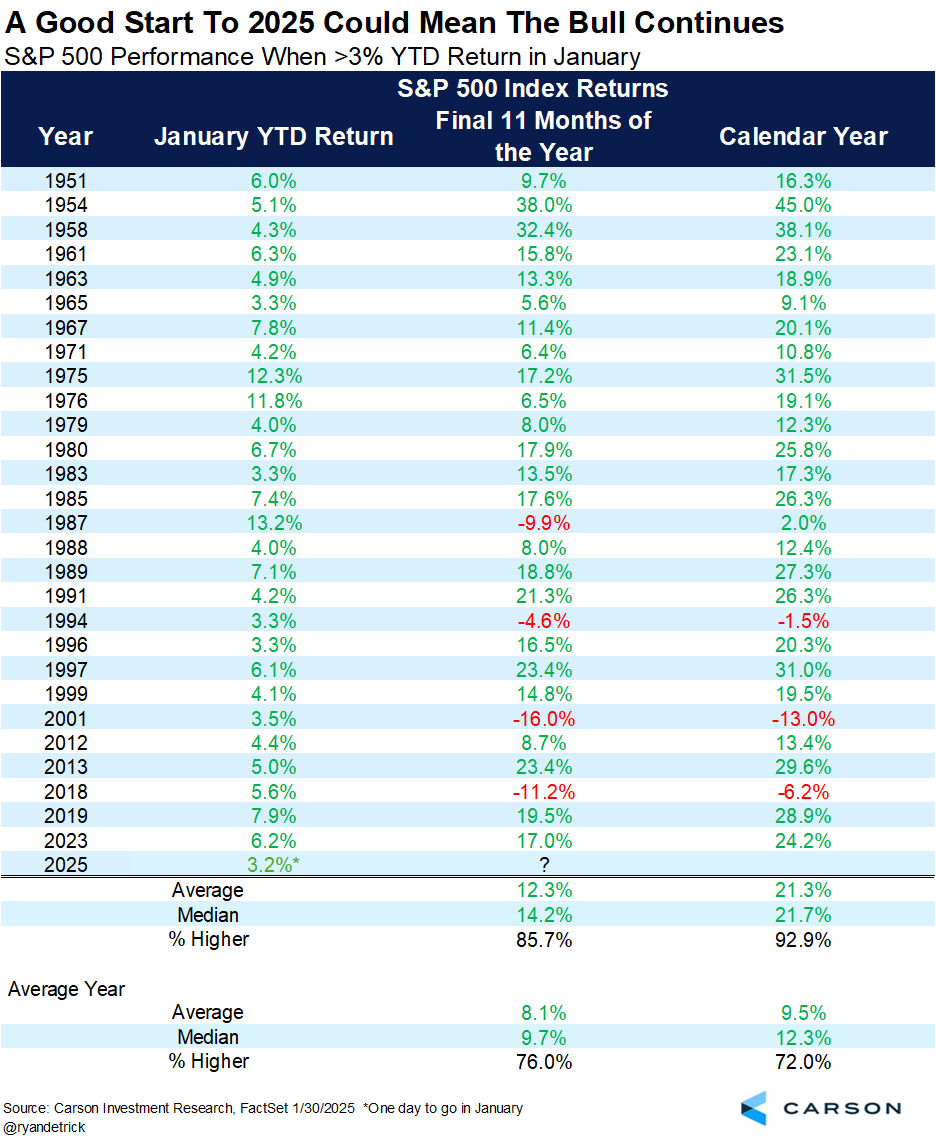

With one day to go in January, the S&P 500 is up more than 3%, which has been a very good sign. Below we show all the times the first month of a new year gained at least 3% and you can see that continued outperformance is perfectly normal. The full year had and average gain of 21.3% and was higher nearly 93% of the time, which should have bulls smiling.

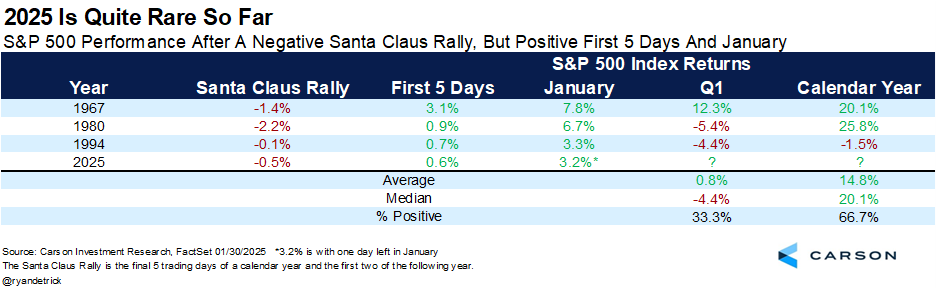

This year saw stocks lower during the historically bullish Santa Claus rally period, but then rallied the first five days of the year and now all of January. I looked more closely at a strong first five days in Some Good News For The Bulls, but what does it mean when we don’t have a Santa Claus Rally, but both the first five days and January are higher? Interestingly, this combo has happened only three other times in history, so we are dealing with a very small sample size. The good news is stocks were higher two out of three times with more than a 20% median return.

We’ve been bullish and expected the late December weakness to be fairly contained, and that has fortunately played out. The data in this blog does little to change our overall optimistic tone in 2025, but be aware that February can be a banana peel month (which I’ll discuss soon enough). For now, enjoy the January returns and have a great weekend!

For more content by Ryan Detrick, Chief Market Strategist click here.

7590475-0125-A