“There was a statistician, and he stuck his head in a bucket of ice and feet in the oven. They asked him how he felt, and he replied, ‘about average.’”

Old statistics joke.

First, I wish everyone a happy 2023 and hope you had a great holiday season with family and friends!

I love using that joke above in a presentation, as it always gets a good laugh. But there is something to it, especially when looking at stock returns. The truth is that average returns aren’t so average, while larger moves happen more than we probably expect.

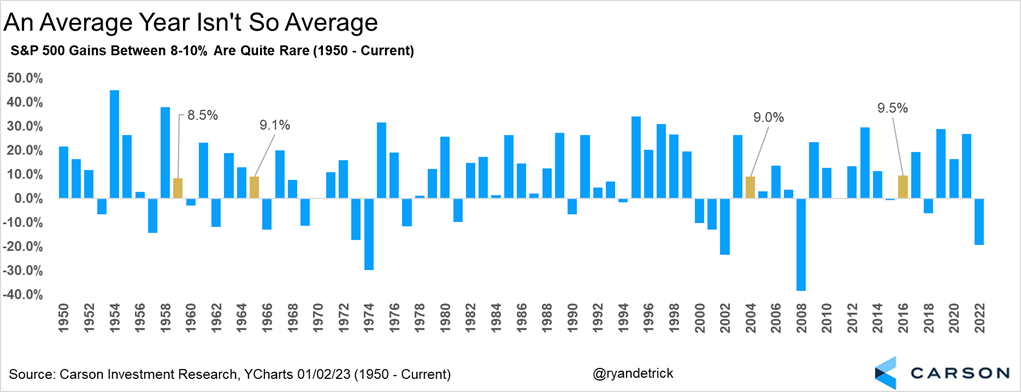

If you go back to 1950, the S&P 500 is up 9.1% on average. So let’s say that an average year for an investor is between 8 and 10%. Sounds fair, right? Incredibly, stocks have gained between 8 and 10% only four times (or 5.5% of the time)! The years that hit the average market were 1959, 1965, 2004, and 2016. That’s incredible if you ask me, as I would have assumed we’d have a few more in that average range.

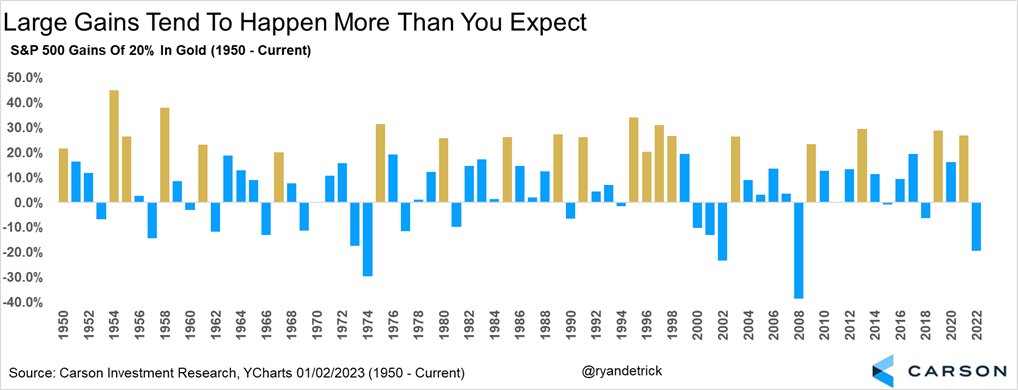

This tells us one thing: larger moves are more likely to happen, and the good news is that most of the big moves historically have happened to the upside. This time I looked at all the 20% gains since 1950 and found 20. This comes out to an impressive 27.4% of all years’ gains of at least 20%. I do this for a living, and I point this out each year, but it still somewhat surprises me.

What about the negative years? Or, more specifically, the large negative years?

- There have only been three 20% losses, and those were in 1974, 2002, and 2008. But, of course, last year just barely missed this dubious feat.

- Five years lost at least 15%, and 12 years lost at least 10%.

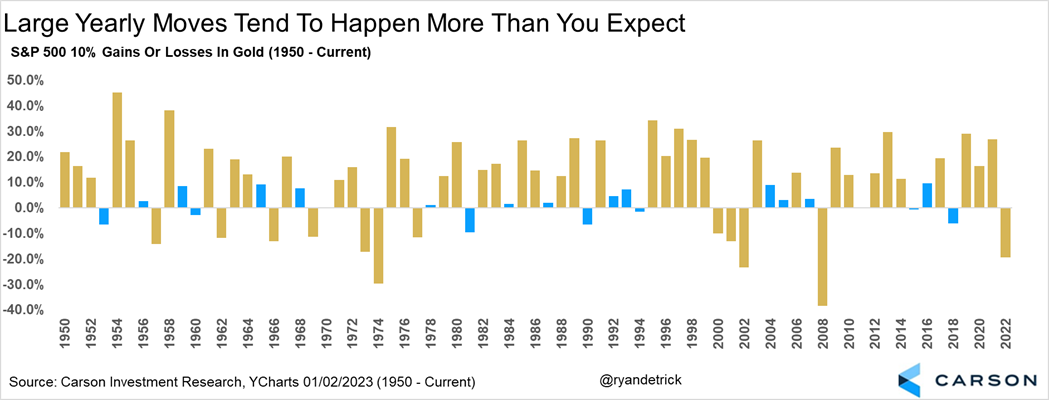

What about 10% moves up or down? 51 years saw stocks either gain or lose at least 10% (39 up and 12 down). That is 69.9%% of all years see a move of greater than 10%.

As the great Ohio State football coach Woody Hayes once said, “Statistics remind me of the fellow who drowned in a river where the average depth was only three feet.”

Investors need to take Woody’s advice and remember that averages are important, but there is usually a lot more to the whole story. The bottom line is we could gain between 8 and 10% this year, but the odds favor it’ll likely be a good deal, more or less. I know it is a lonely call, but we are in the camp. It may be more, which we will discuss in our Outlook 2023 next week.

Lastly, as a Buckeye fan, I’m still shocked over losing that game to Georgia. I apologize for any typos, as I’m probably still thinking about the litany of close plays that could have swung it the other way…