The next jobs report comes out on August 2. There is a chance the report may trigger a recession signal called the Sahm rule, with an accompanying viral explosion of misinterpretation and misinformation. While the Sahm rule may not trigger, we thought it would be useful to get ahead of things and provide some thoughts on what a Sahm rule trigger would mean.

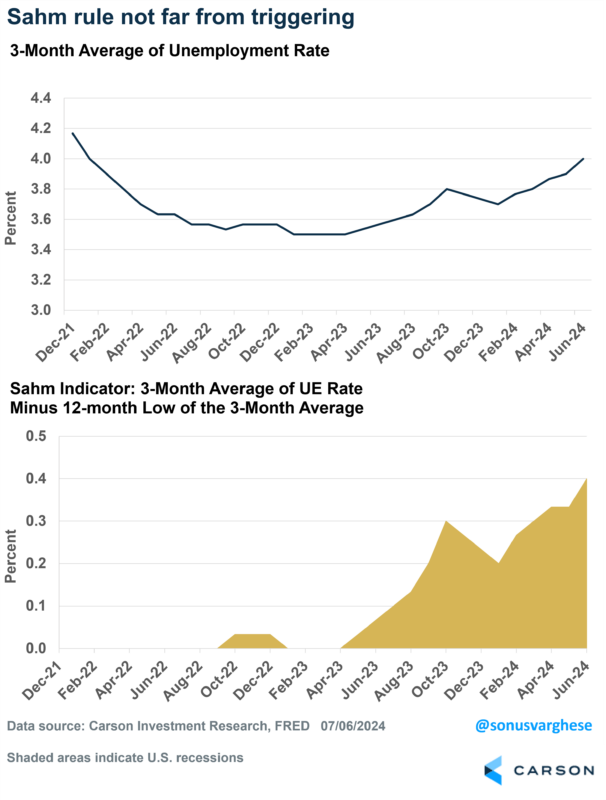

The Sahm rule is named after Claudia Sahm, who is currently the Chief Economist for New Century Advisors. She developed what is now called the Sahm rule for a paper in a Brookings Institution volume on fiscal policy responses to recessions. Part of the Sahm rule’s potential appeal for policymakers is its clarity. The rule says that when the 3-month average of the unemployment rate moves 0.50 or more percentage points above the lowest point of that average over the last 12 months, the economy is likely in the early months of a recession.

Ryan and Sonu had a conversation with Dr. Sahm on their Facts vs Feelings podcast back in November. It’s a great conversation. Take a look.

The Sahm rule was added to the Federal Reserve’s Federal Reserve Economic Data (FRED) database back in 2019. Here’s what it looks like based on vintage data (the data available in real time).

Dr. Sahm provides an accessible overview of the Sahm rule in a blog called “The Sahm rule: I created a monster.” Even though it was penned back in 2022, she already understood the risk of the rule being misinterpreted, especially in the off-kilter post-pandemic environment of economic extremes and overcorrections.

Dr. Sahm cautions, “Repeat after me: the Sahm rule is an empirical regularity. It’s not a proposition; it’s not a law of nature.” If fact, she highlights another traditional informal recession signal that did not work in the current economic environment, two consecutive quarters of GDP decline, which we had in the first half of 2022. Since then we can throw in some other traditional recession signals that did not work as many expected, including the Conference Board’s Leading Economic Index, yield curve inversion, and M2 mania.

In fact, one strength the Sahm rule has had over those other signals is that it did not throw off a false positive, or at least not yet. Meanwhile, those other signals sent many bow tie wearing economists into a frenzy of recession calls for over two years now. (Apologies to Dr. Sahm if she occasionally sports a bow tie. As the spouse of a French historian, I’ll say emphatically that scarves don’t count. In fact, the world could use more scarf-wearing economists. Maybe there would have been more sound market advice than what we’ve seen over the last couple of years.)

One of the reasons we weren’t calling for a recession when other economists were is closely related to why the Sahm rule didn’t trigger. The labor market was just too strong.

Here’s why we should be cautious about drawing the wrong conclusion even if the Sahm rule triggers next Friday. The labor market has continued to look fairly healthy lately, but the unemployment rate has been rising. It was at 4.1% in June versus 3.6% a year ago and up from the 3.4% low in April 2023. 4.1% is still extraordinarily low historically, but the increase legitimately raises some concerns.

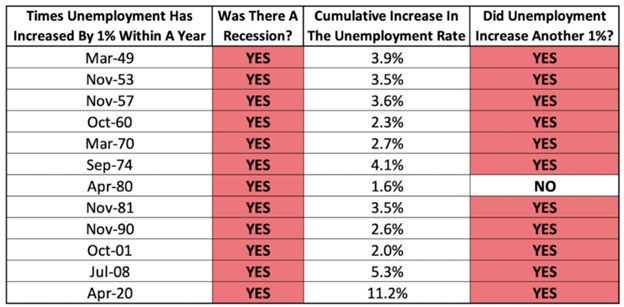

A rising unemployment rate is not welcome, as it can start a cycle of layoffs, which lowers spending, which causes layoffs, and so on. Historically, when the unemployment rate has increased by 1% within a year, it’s gone on to increase by at least another 1% in the next year, as shown in the chart below via our friends at Employ America.1980 was the only exception to this, but even then we got a recession in 1981.

Increases in the Unemployment Rate Can Build Momentum

Source: Employ America 7/24/2024

Even just a 2% increase in unemployment translates to 3 million+ new people out of work. That’s a lot of lost spending, which means a lot of lost income for businesses. That’s why even a “mild” recession is a bad situation. And once you have labor market slack (more people out of work), it takes a long time to recover. We saw this after the 1990, 2000, and 2008 recessions. A slow recovery also means organic productivity growth can lag for years.

This is essentially why the “Sahm Rule” works as well as it does. It has triggered for every recession based on real time data since 1970, on average about three months after the recession has started. That might not sound like much, but in fact it’s not easy to know if the economy is in a recession in its early stages.

NBER, the widely accepted arbiter of U.S. recession dating, typically doesn’t call a recession until 6-18 months after it’s started. NBER’s job, though, is not to call recessions, but to date them. That is, they’re acting as economic historians rather than real-time diagnosticians. NBER will make a call when they believe an economic peak or trough is “not in doubt” and can be accurately dated. That delay is why a real time signal, even if imperfect, is potentially so useful for policymakers.

So where are we now? Currently, the 3-month average of the unemployment rate is 4.0%, or 0.4%-points above the 12-month low of the 3-month average, at 3.6%. Looking forward, the unemployment would have to rise from 4.1% to 4.3% in July for the Sahm rule to trigger. (Some places will say an increase to 4.2% would do it, but that’s using rounded data.)

One reason the Sahm rule hasn’t triggered yet, despite the unemployment rate rising from 3.4% to 4.1%, is that it’s rising really slowly.

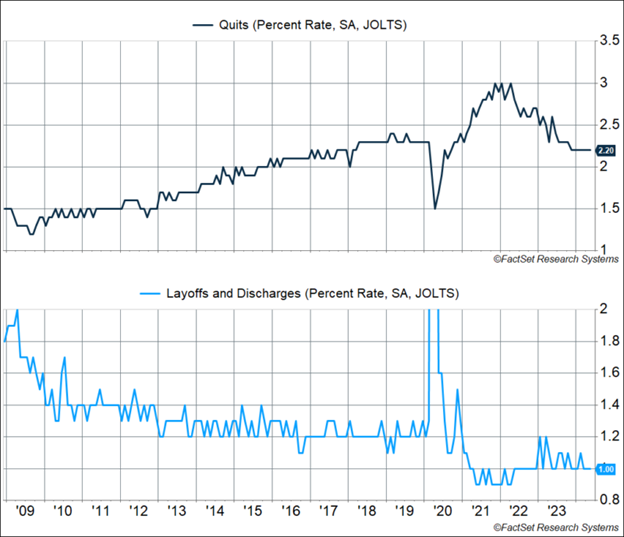

Looking under the hood, one important feature of the recent rise in the unemployment rate is it hasn’t been driven by people losing their jobs. The layoff rate, which is layoffs as a percent of the workforce, is at 1.0%, well below the 1.2%-1.3% we saw before the pandemic. The quit rate has also normalized around 2.2%. All this to say “separations,” which includes voluntary separations (quits) and involuntary separations (layoffs), are low.

Separations Remain Low

Source: FactSet 7/25/2024

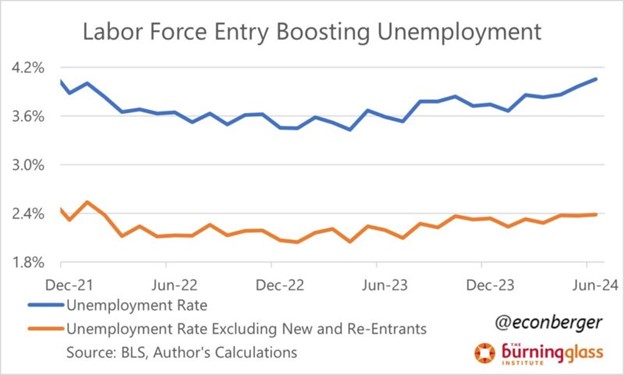

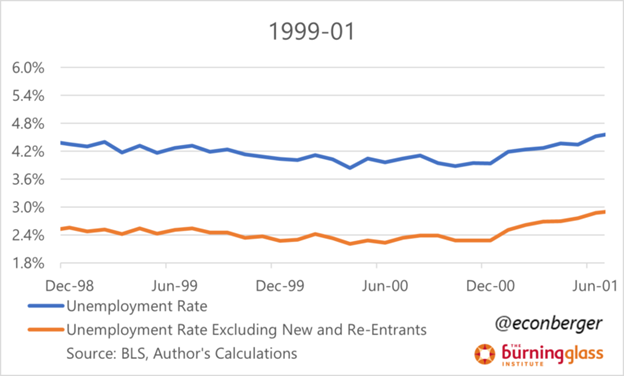

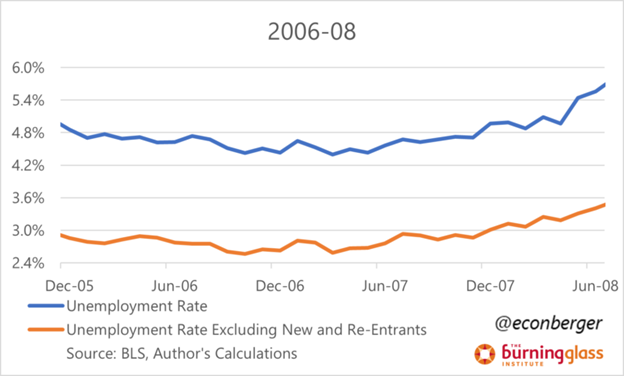

Instead, the unemployment rate is more likely rising because more people are looking for jobs (both new entrants and re-entrants). Since you’re only counted as unemployed if you’re not working AND looking for a job, more job seekers can push unemployment rate higher. Via Economist Guy Berger at the Burning Glass Institute, if you exclude these new job seekers, the increase in the unemployment rate disappears. This type of behavior is not recessionary, in our view.

In 2001 and 2008, the unemployment rate was going up whether or not you included new and re-entrants.

Here’s 1999-2001:

Here’s 2007-2008:

What do we make of all this? This remains a cycle like no other. Really, you can say that of any cycle, but this one even more so. We are very cognizant of the history of rising unemployment feeding on itself, but context is still very important. We don’t want to commit the same mistake with the Sahm rule that many others did with the inverted yield curve, the Conference Board LEI, M2, or whatever other signal in this unusual cycle enticed the bears out of hibernation.

If the unemployment rate comes in over 4.3% next Friday, our reaction won’t be to plaster social media with panic posts and ride the meme to more clicks. We’ll look under the hood and understand the context. Rising layoffs would concern us. Additional new entrants wouldn’t.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Macroeconomic risks have edged higher. But we still think the Fed has the ability to extend the cycle if they focus increasingly on the risks to job growth. If the webocracy goes gaga over the Sahm rule triggering, be patient. It could actually be an opportunity.

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here.

02337851-0724-A