Berkshire Hathaway’s market capitalization stands at $1,032,347,000,000 (FactSet data) as of Tuesday’s close. It is the newest addition to one of the most exclusive clubs in the world – the Trillionaire Club. Notably, it is the only financial stock so far to gain entry to this club, whose membership is largely populated by technology-related stocks. Berkshire’s rise to the four-comma club cannot be fully encapsulated in a single blog, but it’s worth highlighting some of the fundamentals of the business that Warren Buffet and the late Charlie Munger have built.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

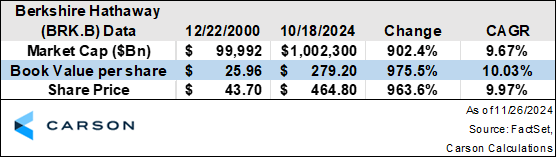

The rise of Berkshire’s share price has been supported by the growth of book value of equity per share. In fact, the two nearly perfectly mirror each other. Let’s examine Berkshire Hathaway’s rise from $100 billion market cap to $1 trillion market cap. The last day Berkshire had a closing market cap below $100 billion was on December 22, 2000, when the Class B share price was $43.70 and the reported book value per share was $25.96 (all FactSet data). As of October 18, 2024, the closing price of Berkshire’s Class B stock was $464.80, with a reported book value per share of $279.20 – marking the first week the company’s market cap closed above $1 trillion (FactSet data). Over this period, book value per share grew 976%, while the share price increased 964%. A nearly exact match! I believe it underscores how Berkshire’s own investor base embraces Buffett’s philosophy of focusing on a company’s fundamentals to derive value.

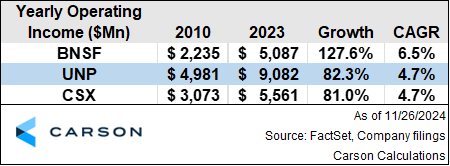

One of Berkshire’s pillars of growing shareholder equity is to acquire and optimize businesses across a range of industries. I believe the results Berkshire has produced in its BNSF segment illuminate their operational expertise that they bring to all their businesses. Berkshire famously bought the railroad in the wake of the 2008/2009 Great Recession; it currently operates one of the largest railroad networks in North America. Since the purchase, Berkshire has implemented strategies that have enabled BNSF to grow its operating income at a higher rate than industry competitors, as shown in the table below. I think this serves as a prime example of Berkshire’s business acumen and integration expertise across its operations.

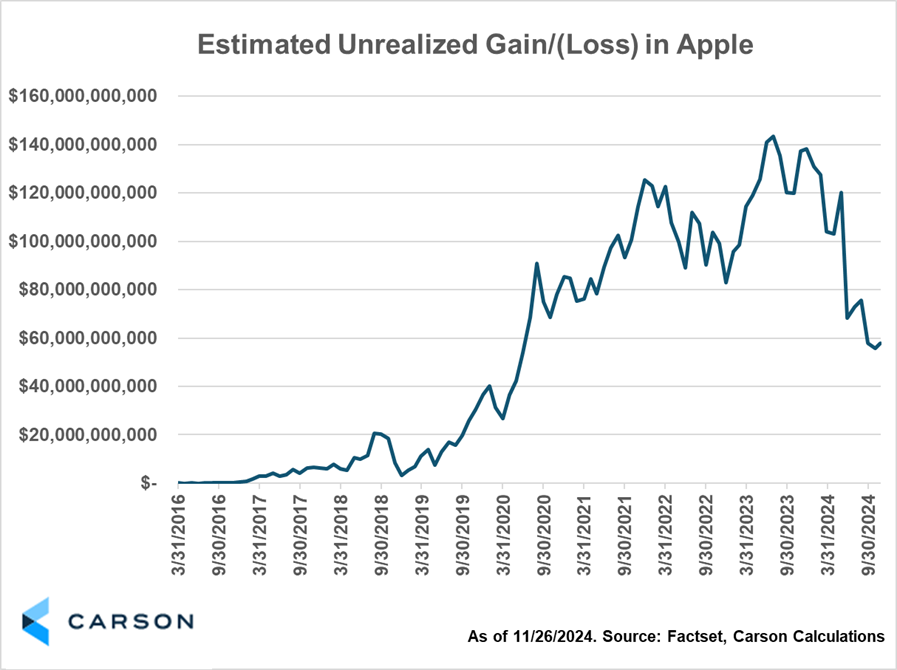

Another pillar of Berkshire’s rise to the $1 trillion milestone is the renowned investing insights Mr. Buffett and the late Charlie Munger are known for. If Berkshire can’t outright acquire a business they find exceptional, they might invest in the publicly traded equity of that company. This approach has led Berkshire to invest in American stalwarts such as American Express, Coca-Cola, and, most notably, Apple. Since Berkshire’s initial investment in Apple in the spring of 2016 at roughly $24.75 per share (split adjusted), Apple has largely maintained the title of largest company in the world (though recently lost that title to Nvidia) and has seen a price increase in its stock of nearly 850% (FactSet data). It could be called a home run investment.

The results of this investment are eye-watering. I estimate, based on FactSet data of 13-F filings, that Berkshire may have seen as high as a $143.3 billion unrealized gain on their investment. We may never know precisely what Mr. Buffett, Mr. Munger, and their investment team, saw in Apple to make such a significant and long-term bet. But the results are undeniable. It is likely that, on an after-tax basis, Berkshire’s investment in Apple has contributed approximately 16% of the company’s current book value of equity.

Berkshire Hathaway’s journey to a $1 trillion market capitalization is a testament to the operational expertise and disciplined investment philosophy that Warren Buffett, the late Charlie Munger, and all managers within the company have championed. From acquisitions like BNSF to astute investments in companies like Apple, Berkshire has consistently delivered value to its shareholders.

For more content by Blake Anderson, Senior Analyst, Investment click here.

02531658-1224-A