Happy Pi Day to all those math fans out there! Math is nothing new to traditional finance (Tradfi), and math serves as a cornerstone of the blockchain technology that underpins the world of cryptocurrencies, perhaps more appropriately referred to as digital assets. Blockchain technology and it’s features such as security, immutability, decentralization, and ever-increasing use cases in the real world are perhaps just as obscure as fiat on-ramps, cold storage, and web3 wallets. But owning the world’s first and largest digital asset has never been easier through the launch of spot Bitcoin ETFs, which have been trading now for two wild months.

Bitcoin has continued off the strong rally in 2023 to surge higher this year (+71.5% through 3/11/24), surpassing the previous all-time-high of nearly $69,000 reached in 2021. In fact, for a brief moment on Monday, March 11th, Bitcoin had even surpassed A.I. darling Nvidia’s year-to-date surge (and people complain about market breadth!).

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

What is behind the recent jump in price?

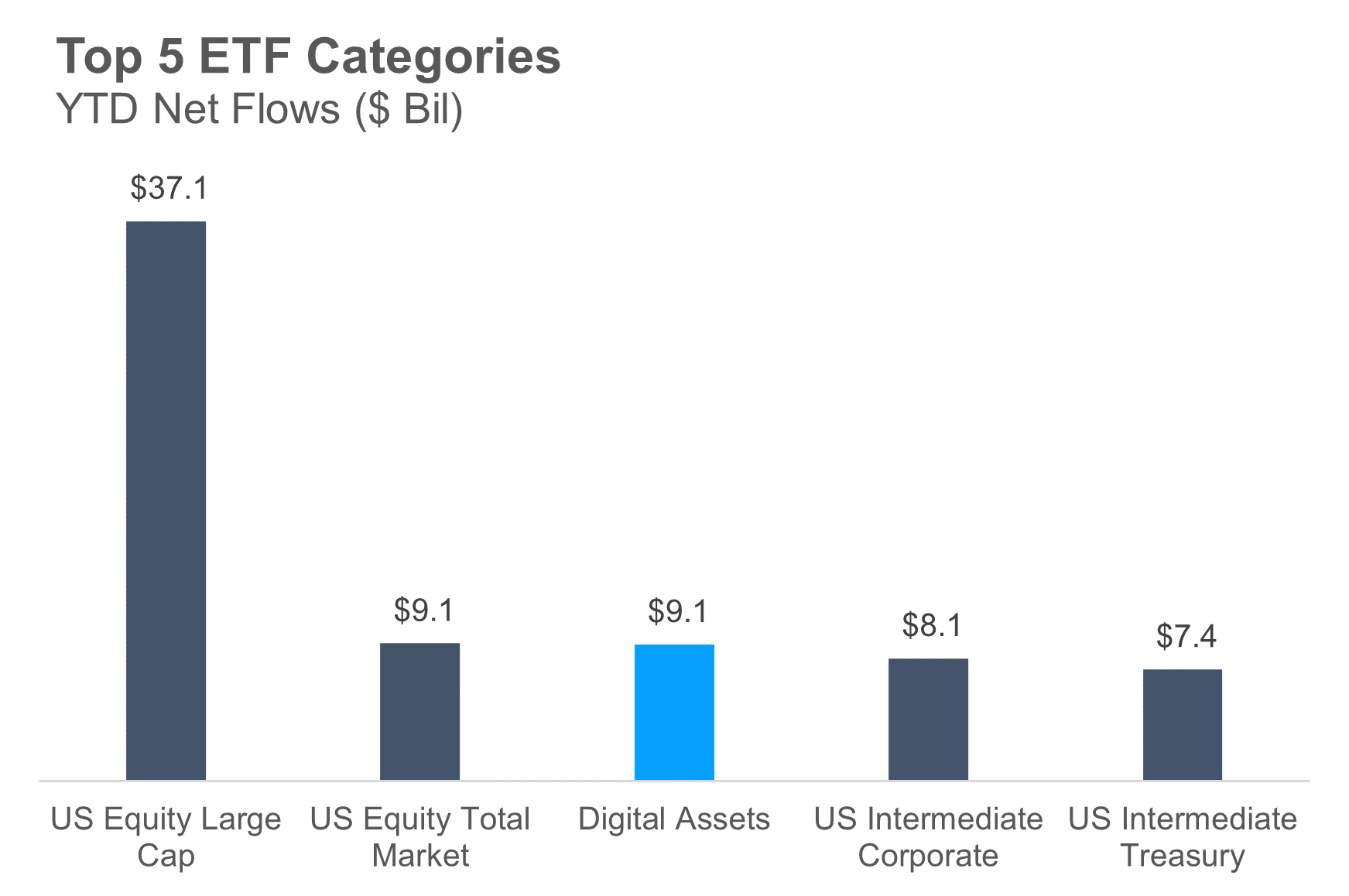

While explaining a move in price of any asset class can sometimes be just as difficult as predicting it, we can point to a few price impacts. Bitcoin ETFs have garnered significant assets in a short period of time. In just two months, we’ve seen more flows into Bitcoin ETFs than any single fixed income ETF category! While these flows are somewhat offset by outflows in the largest cryptocurrency ETF (GBTC), there is clearly new demand entering the market through these products and creating buying pressure on price.

Sources: Factset, Carson Investment Research 3/12/2024

There is also likely spillover from the craze in A.I.-related and other technology stocks that have awoken the animal spirits when it comes to speculation, something many did not imagine happening with the fed funds rates north of 5%.

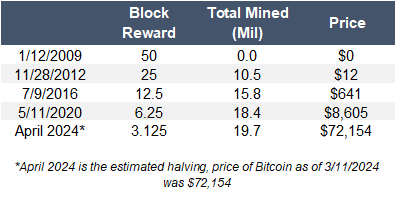

Perhaps the most fundamentally important catalyst of the price surge may be the upcoming Bitcoin ‘Halving’. Bear with me here for just a minute…. The Bitcoin halving is a series of events (roughly every 4 years) built into the original Bitcoin code that ‘halves’ the reward paid and raises the difficulty level (math!) for mining new Bitcoin. There will only ever be 21 million Bitcoin ever mined, and we are approaching that level. While further details are a topic for another discussion, the basic premise is reduction in supply (or at least the pace of new supply), at a time when demand is very strong. Economics 101 says that prices rise as a result, and that is what has happened historically – however, the timing and scale of those price increases always varies.

What do we expect next?

We will not be publishing any price targets for Bitcoin anytime soon. The range of predictions for Bitcoin’s price in the industry ranges from $0 to over $1 million (seriously)! Many are targeting the $100,000 level as the next major milestone, but opinions are as volatile as the asset itself. Always important to remember that Bitcoin has a history of 60-80% drawdowns as recently as 2021-2022 (-77%).

In terms of digital asset products, many eyes have now moved to spot Ethereum ETFs, the second largest cryptocurrency by market cap and a very different underlying value proposition. May is the next target date for the SEC to decide on several spot Ethereum applications. At this point it does not appear that approval is as likely quite yet. While there are Ethereum futures contracts, they lack liquidity and correlation with the spot market, something the SEC went on to discuss at length in their Bitcoin ETF approval letter.

Sources: Morningstar, Carson Investment Research as of 3/8/2024

How should we be thinking about Digital Assets for clients?

Carson Group has approved 4 spot Bitcoin ETFs on our curated ETF platform. We want to provide the tools needed for advisors to allocate client portfolios in the most appropriate way based on their risk tolerance, preferences, and interests. Studies suggest (take that with a grain of salt) nearly 20% of Americans own cryptocurrencies in some form, and there are indications that number is above 40% of millennials. Gauging client interest in cryptocurrency can sometimes be difficult. However if clients are interested, we now have options to add small allocations within the context of their overall portfolio and do so in a risk-controlled way.

While we are not suggesting the use of cryptocurrencies, if utilized be sure to remember risk management. Limit the size of the allocation relative to the client’s risk tolerance, rebalance appropriately to resize both overweight and underweight positions, and ensure client alignment and proper education. Below is a chart of the % of portfolio risk that comes from Bitcoin when adding across three different portfolio types. As you can see, Bitcoin begins to drive 2-4x more risk in a portfolio than its weighting would suggest. (Thanks to Sonu Varghese, VP, Global Macro Strategist for this data, which he has shared previously.)

Sources: Carson Investment Research, Factset

Thanks for reading. As clients and advisors continue their journey of education and potentially allocation to digital assets, we want to be a resource for those conversations. Ryan Detrick, Chief Market Strategist and Sonu Varghese, VP, Global Macro Strategist, recently had the chance to talk with Matt Hougan, the Chief Investment Officer at Bitwise Asset Management on their Facts vs Feelings podcast. They covered a lot, and I recommend a listen:

For more content by Grant Engelbart, VP, Investment Strategist click here.

02157713-0324-A