We are winding down an absolutely awesome time at Carson’s Excell experience in Las Vegas. It has been a ton of fun meeting with our advisors, learning more about our industry, presenting our investment views, but best of all making new friends. If you want to come to the very best conference for advisors, please be sure to make it next year in Nashville.

Here’s a quick blog I put together (take note I’m running on fumes out here) that looks at seasonality and why late September and into October is one period that investors need to be aware can be bumpy.

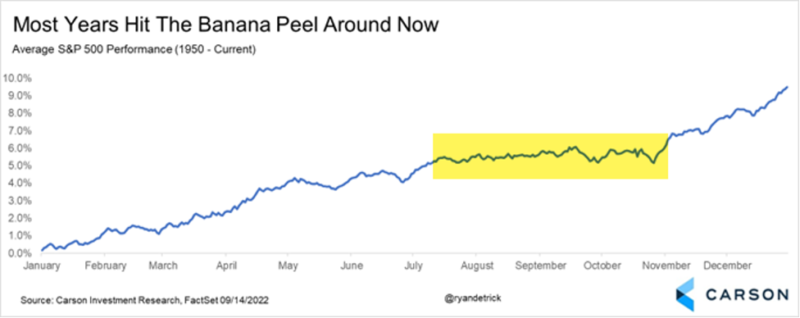

First off, here’s your average year for the S&P 500. This time of year is fairly choppy, as stocks tend to catch their breath before the end of year surge.

Here’s a similar chart, but it looks at midterm years. Yes, right about now isn’t historically a bullish timeframe, but check out what tends to happen once you get later in the year and past the uncertainty of the midterm election. We are optimistic that history could repeat itself once again.

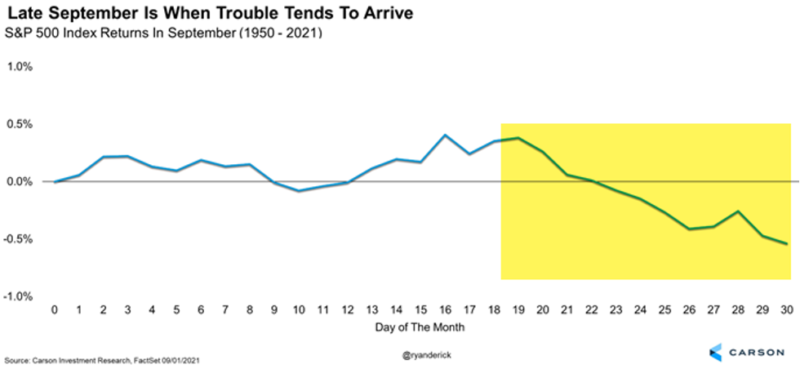

Zooming in some and it becomes even more clear that late September can be a slide down.

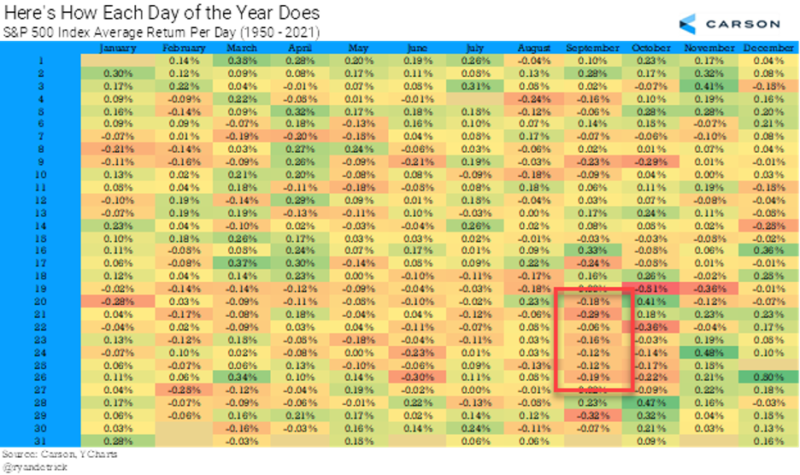

Another look at this is a popular chart we’ve shared before, but it really does a nice job of showing just how weak some of the upcoming days are for the S&P 500.

So buckle up, as the calendar isn’t doing to any near-term favors, but we remain overweight equities and think the low for the year is in and once we can get past this seasonally weak period, a nice end of year rally is quite possible.