“The wise make great use of adversity, the foolish whine about it.” Dee Hock, Founder of Visa

The wild market action continues, but at least stocks have bounced and in some big ways the past week or so. Back on Monday, April 7, the S&P 500 opened up down more than 2%, yet stocks finished the week up more than 5% for the best week since November 2023. Did you know the last time we saw a week start off that poorly, yet finish up more than 5% was May 1970, which kicked off a 56% rally? Yes, sample size of one, but I like to share potentially good news and that is good news if you ask me. Here are some other bits of good news I’ve seen lately.

Bounce

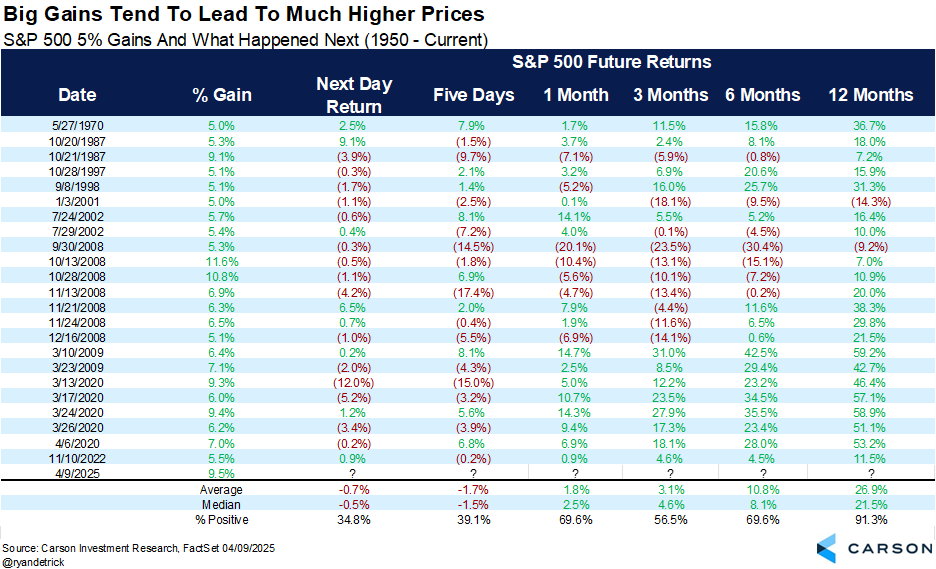

Stocks were flirting with a bear market until President Trump put a pause on all reciprocal tariffs (excluding China) for 90 days on Wednesday, April 9. The S&P 500 responded by gaining 9.5% in one day, the third best single day since World War II. Like a beach ball under the water, once it gets some momentum, it can really start moving. In fact, we found 23 other times (since 1950) the S&P 500 gained more than 5% in one day and the future returns were quite impressive longer term, with stocks up a year later more than 91% of the time and up nearly 27% on average.

Just How Rare Was Wednesday?

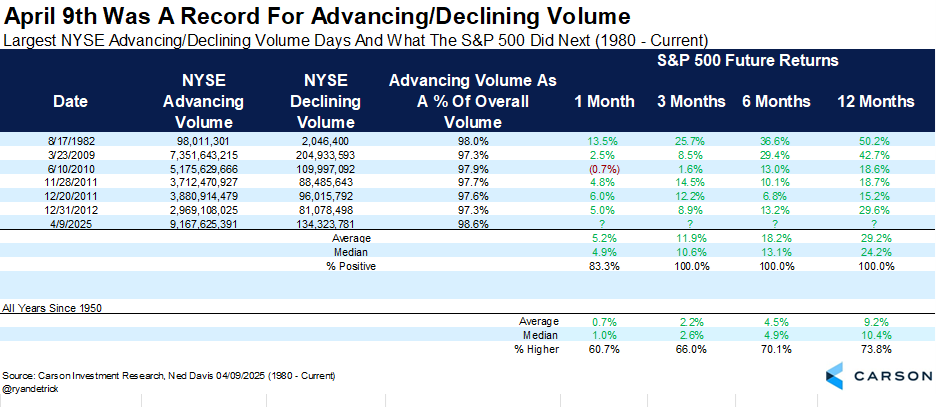

It wasn’t just that last Wednesday saw huge gains. Nearly all the volume on the NYSE was for stocks moving higher as well (something we call a buying thrust). In fact, advancing volume was 98.6% of the total volume, the most in history (using reliable data back to 1980). We found six other times that had extreme levels and the S&P 500 was higher 3-, 6-, and 12-months later every single time. Check out some of those dates. August 1982 and March 2009 really stand out as some historic buying opportunities. This could be another clue that the sellers scared by currently known risks have exhausted themselves and higher prices over the intermediate term could be possible.

Another Near Bear Market

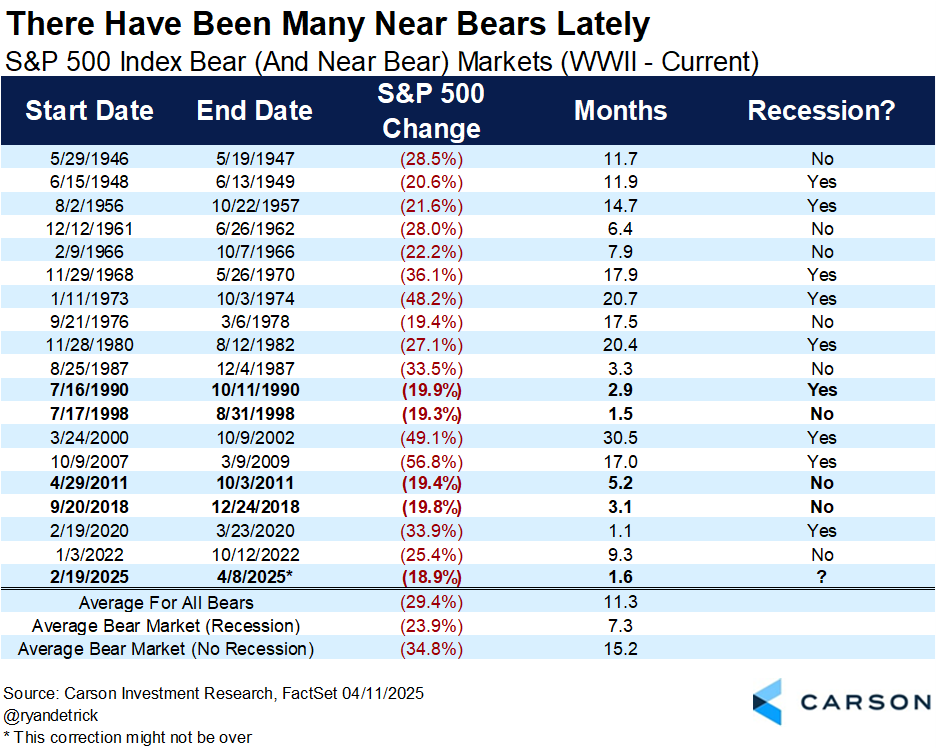

If you watched TV at all early last week, you likely heard how stocks were very close to a new bear market, meaning more than 20% off the February 19 peak. Intraday it did hit down 20%, but on a closing basis it only got to 18.9%, close but not quite there. Yet, for many investors heavy in technology, it sure likely felt like a bear market, with many of those names down much more than 20%. Here’s the thing — we’ve seen many near bear markets lately from a big picture perspective, including 1990, 1998, 2011, and 2018. All of those years had scary headlines and worries, yet managed to barely miss officially going into a bear market. We don’t know if this time will be added to this list, or if more trouble is around the corner and we are delaying the inevitable, but with the big rally on Wednesday and some historic levels of extreme sentiment, it is possible.

Bad Things Have Happened Before

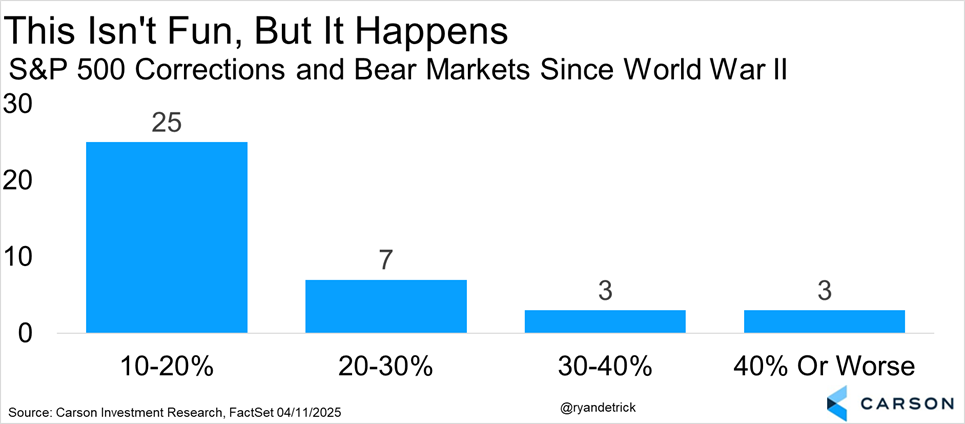

If you’ve invested in equities the past seven weeks it hasn’t been very fun; we can likely agree there. At the same time, after more than a 70% rally from the October 2022 lows and not even a 10% correction last year, we were on record that a 10-15% correction was likely this year. No, we didn’t expect a near bear market with historic volatility, but we also (like many) didn’t expect tariffs to be as high and wide ranging as they have been either.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Here’s the thing, and it is important to remember. Bad times have happened before and they’ll happen again. The other thing to remember is stocks have eventually gotten past the bad news and weak market returns every time in the past and we don’t think this time will be any different.

This hasn’t been fun for investors, but volatility is the toll we pay to invest. For more of our latest thoughts on tariffs, the economy, and more, be sure to watch our latest Facts vs Feelings podcast below.

For more content by Ryan Detrick, Chief Market Strategist click here.

7867993.1-0425-A