We’ve been hearing many of the same myths over and over, yet we don’t think they are the big worry that the media and many make them out to be. These are legitimate concerns and have many investors worried, but we think the chances of them becoming larger issues are smaller than many expect. We are going myth busting today and here are seven of the biggest ones we’re targeting.

Myth 1: Credit Card Debt Is Out of Control

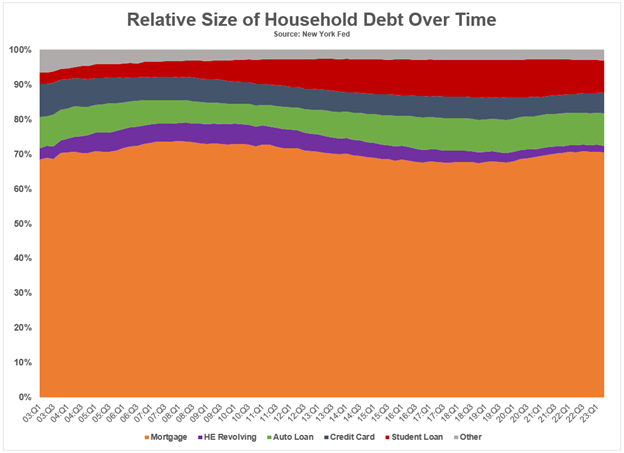

We hear a lot about how credit card debt cracked $1 trillion for the first time ever and the only reason the economy is growing is because people are buying everything on credit cards. We discussed this in detail here, but the truth is equity and net wealth have also increased, so it makes sense people have more debt. Also, credit card debt as a percent of overall debt has remained steady over time.

Myth 2: Student Loan Repayments Will Lead to a Recession

After not having to pay student loans for years, those repayments are starting back up in Octobber, with many expecting this to lead to a crash in consumer spending overall.

Americans paid $70 billion toward student loans in 2019 and it isn’t like this will all start right back up.

- First off, many people continued to pay their loans and didn’t use the government’s free pass to stop paying.

- We don’t expect to start right back up at $70 billion though, more likely in the $20-$30 billion range.

- The Biden administration recently cancelled $39 billion in loans on 800,000 borrowers.

- Also, you don’t have to pay all of your student loans at once. It’ll allow consequence free nonpayment for the first 12 months after restart, meaning they won’t be reported to collection agencies credit bureaus, etc.

- Lastly, the administration released a new plan called Saving on a Valuable Education (SAVE) that could benefit up to another 20 million borrowers, with the administration estimating that payments will be cut in half. It will also forgive loan balances after 10 years of payments, versus the prior 20 years.

The bottom line is the loan repayments won’t come in near as much as the media makes it sound, likely not upsetting the strong consumer.

Myth 3: Excess Savings is Gone and Trouble Is Coming

After people stayed in during the pandemic, they didn’t spend nearly as much as they would have. Additionally, the government gave people money, so there was a lot of excess savings, peaking at an estimated $2.3 trillion, which is nearly all gone. Many are claiming this will mean the consumer is tapped.

First off, this is a good thing, as we are getting back to normal. There have been many expansions that didn’t see trillions in excess savings, so it is possible for the economy to grow with little excess savings. Additionally, people hold a historic level of liquid cash (think savings, CDs, money market fund shares). This myth is also a function of how excess savings is calculated and to us, we’d think one should include liquid cash in the whole pie.

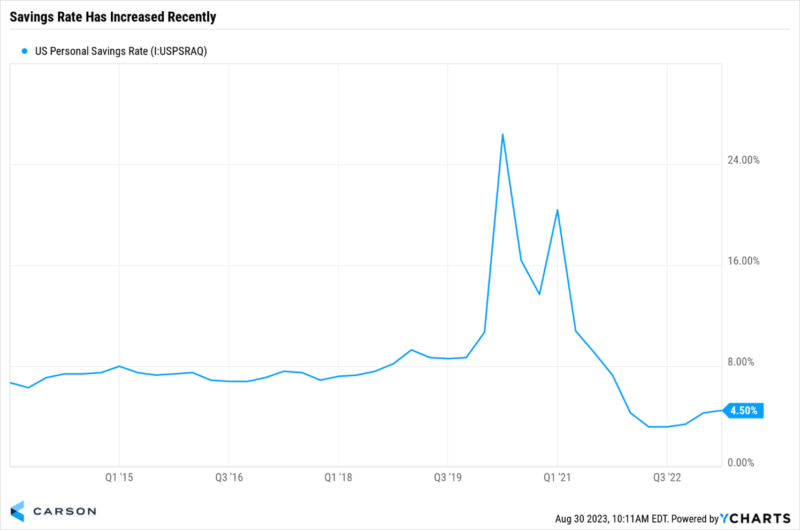

Lastly, the savings rate has increased over the past year, from a low of 3.2% last summer, up to 4.5% right now. Again, without getting too into the weeds here, savings have actually been increasing over the past year, something that you’d never know if all you looked at was excess savings.

Myth 4: High Profile Retailers Blowing Up Means the Consumer Is Tapped

Some well-known retailers had horrible reactions to earnings. Footlocker fell 28%, Dick’s 24%, Peloton 23%, and DollarTree 13%, while Macy’s fell as it noted weakness in consumers and worries over credit cards. So, the logical worry is whether this means the consumer is strapped.

We say no, as there were also some big winners, with Abercrombie & Fitch up 23%, Williams Sonoma up 13%, Toll Brothers guided higher, and Guess adding 26%. We didn’t hear as much about the good news, did we?

Then look at what Wal-Mart said. They noted online sales were strong once again. The truth is consumers simply don’t go to brick and mortar stores like they once did. Additionally, many younger people will quickly tell you they’d rather pay for experiences versus stuff. Add it all up and we don’t think the consumer is in trouble at all.

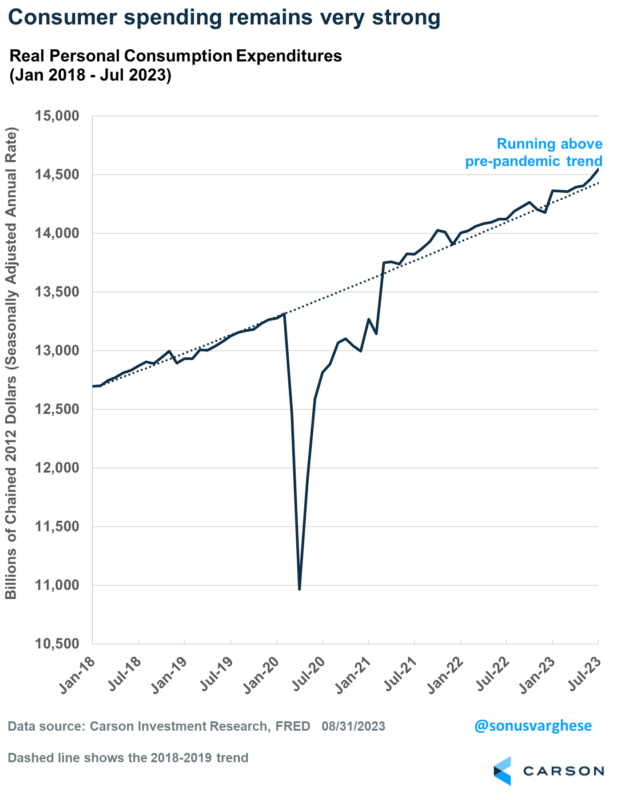

Real consumption continues to run above pre-COVID levels, suggesting the consumer remains quite healthy and resilient. Here’s a nice chart of real personal consumption showing very little slowdown in spending.

Myth 5: Bankruptcies Are Surging and This Is the First Domino to Fall

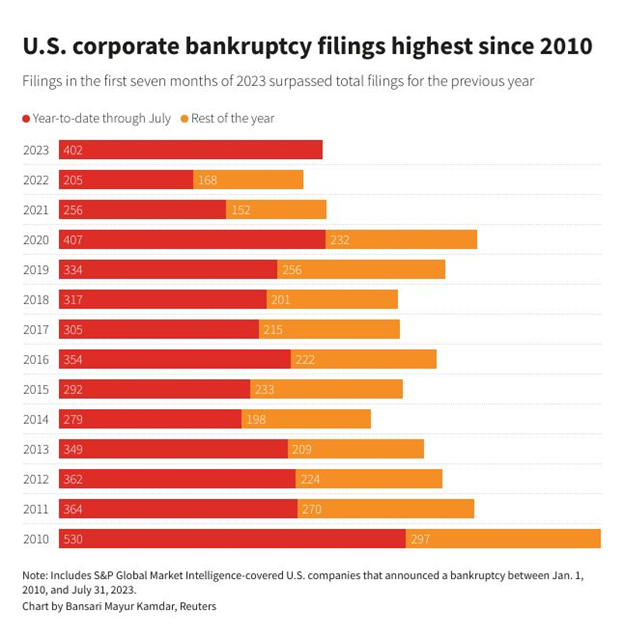

Through July there had been 402 U.S. corporate bankruptcies, compared with only 205 last year. In fact, it was the highest since 2010, which saw 530 in the first seven months.

Here’s what is so surprising, if there really was worry about credit, wouldn’t the credit markets show some stress? High yield corporate bond spreads have been falling since last year, the opposite of what you’d expect if bankruptcies surging meant a bigger issue was coming.

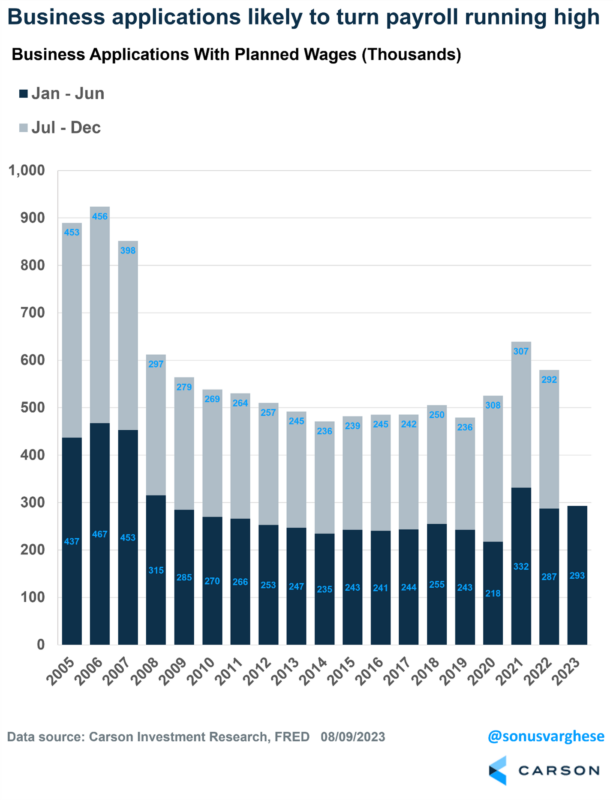

Also, the other side to bankruptcies is entrepreneurship, or creation of new businesses and companies. That’s right, we’ve seen a solid number of monthly business applications the first six months of the year, to the tune of 293,000 business applications with planned wages. This was 21% higher than 2019 for instance and much higher than any other time during the last decade.

Myth 6: Higher Rates Are Bad for the Economy and Stock Market

Rates have soared lately, with mortgages at the highest levels in decades and the 10-year yield recently hitting the highest levels since 2007. This has brought with it many concerns, but once again, we don’t buy it.

Plain and simple, we think rates are going higher because the economy is strengthening, not because of inflation, the Fed, or some other reason. To see rates increasing for the right reasons isn’t a bad thing. In fact, historically a higher trending 10-year yield amid an improving economy has led to strong stock gains.

Don’t forget, the late ‘90s saw mortgage rates above 7% and the 10-year yield consistently above 6%. Stocks and the economy did just fine back then. Let’s be clear, rising rates aren’t good for bonds, but we’ve been (and remain) overweight stocks and underweight bonds all year.

Myth 7: The Government Is Awash in Debt and It’ll Bring the System Down

Our country has more than $32 trillion in debt, but this might not be as worrisome as it sounds. For this, I invite you to listen to our watch our latest Facts vs Feelings where Sonu and I discuss this, along with the other six myths above. Lastly, thanks to Sonu for creating many of the tables and charts in this blog.

1888376-0823-A