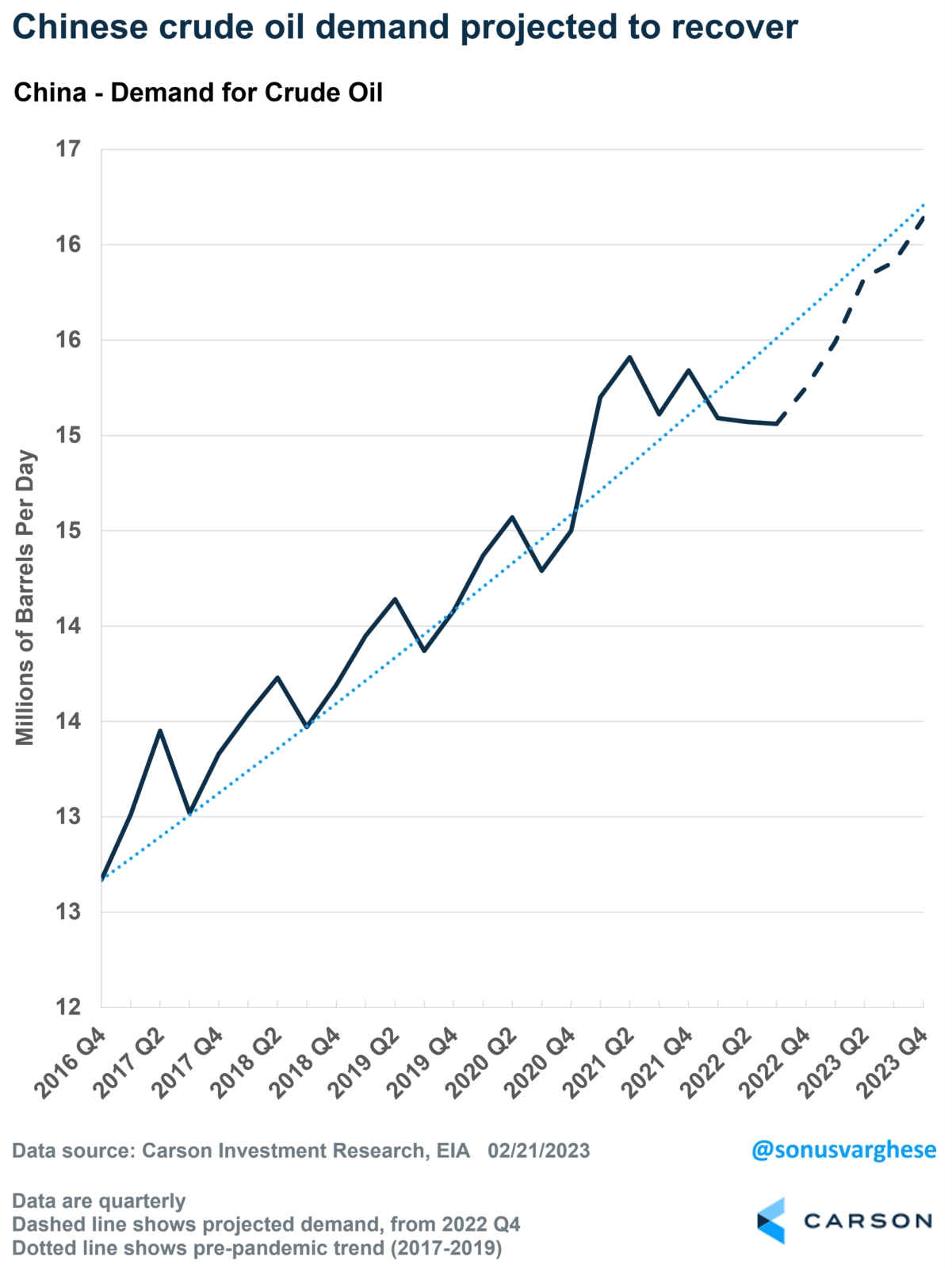

Carson’s House Views are the foundation of our asset allocation recommendations. Our partners and clients can utilize these directly through our proprietary House Views models or expressed independently using various ETFs available on our platform. We’re overweight commodities strategically and tactically due to improving demand as global economies recover from a difficult 2022 and China re-opens its economy. Arguably the most important commodity is oil, which has dramatically recovered from its pandemic lows. While energy prices have since come off the boil due to global growth concerns, we believe both the macro and micro views are favorable from a demand and supply standpoint. In short, we’re bullish on oil.

The Oil Market Remains Tight

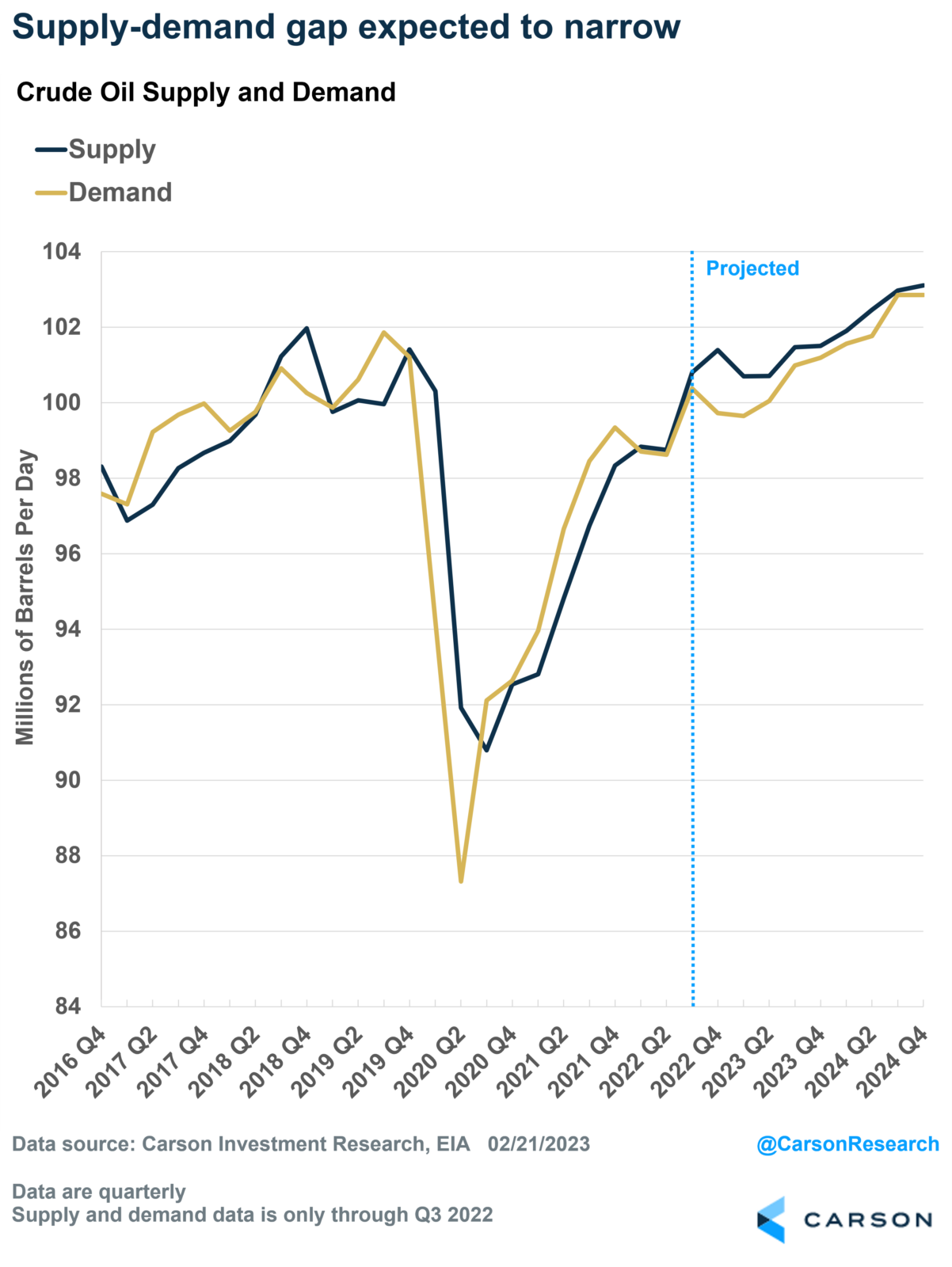

The global oil market is walking a tightrope between supply and demand. Several factors could cause the market to wobble, leading to higher prices. At the end of 2022, drillers produced about 1 M barrels more than the world consumed. That’s only about 1% of the excess supply! This balance is expected to tighten in 2023, potentially leading to a slight shortage by 2024. Of course, that forecast assumes everything goes as planned, which rarely happens in the oil patch.

Where’s the Supply?

Supply isn’t easy to come by. The conflict between Russia and Ukraine puts about 10 M barrels of global oil supply in a precarious position. Russian oil continues flowing for now, but any interruption could knock oil markets off the tightrope and lead to significant shortfalls. The Saudi-led OPEC cartel claims it can increase oil production by 3 M barrels daily, but there is scant evidence to back that. The US is the swing producer or the country with excess economic supply. US producers are reluctant to increase production because they’ve been whipsawed by prices over the past decade, often losing money and being ousted from investors’ portfolios. To increase production, drillers and investors need confidence that oil prices will remain resilient.

Can future demand remain supportive?

We think the world will keep chugging and guzzling black gold in 2023. Oil prices have fallen over the last six months as the Fed hiked rates and fears of a global recession weighed on expectations for future demand. With China re-opening and the global economy averting recession, demand could likely exceed expectations. While softer-than-expected demand could cause oil prices to dip, underinvestment in new supply over the past decade will lead to supportive prices for several years.

Bottom Line

The oil market is already tight, and disruptions to supply could lead to a shortfall. However, even without a supply shock, modest growth in demand could tip the balance and push prices higher. We think this will disproportionately benefit US producers. Partners in our House Views models have exposure to oil via Invesco’s Diversified Commodity ETF (PDBC). For those curious about direct exposure to US oil-producing companies, check out the Energy Select SPDR® (XLE) now available on our platform.

A special thanks to Carson Research portfolio manager Jake Bleicher, CFA, for his contributions to this article.