Due to a stable economy, higher interest rates, and low investor expectations that have become even lower, Carson Investment Research is upgrading the financial sector to overweight. We feel that the recent volatility ignited by a handful of regional banks is probably not over. However, we feel that investors searching for the next “big short” could come up empty-handed in this area as crises tend not to repeat in the same form and fashion. Today’s banks are much different from those during the Global Financial Crisis some 15 years ago. In fact, we would argue that the top firms in this sector are probably more beneficiaries of this current stress rather than a victim of it.

Carson’s House View is our transparent way of communicating to advisors the consensus of our Research Team’s perspective. These underpin our investment recommendations and are conveyed through our pro-sourced House Views models. Our partners who prefer to co-source model management can express these views with ETFs available on our curated platform.

The top bank components are “too strong to fail.”

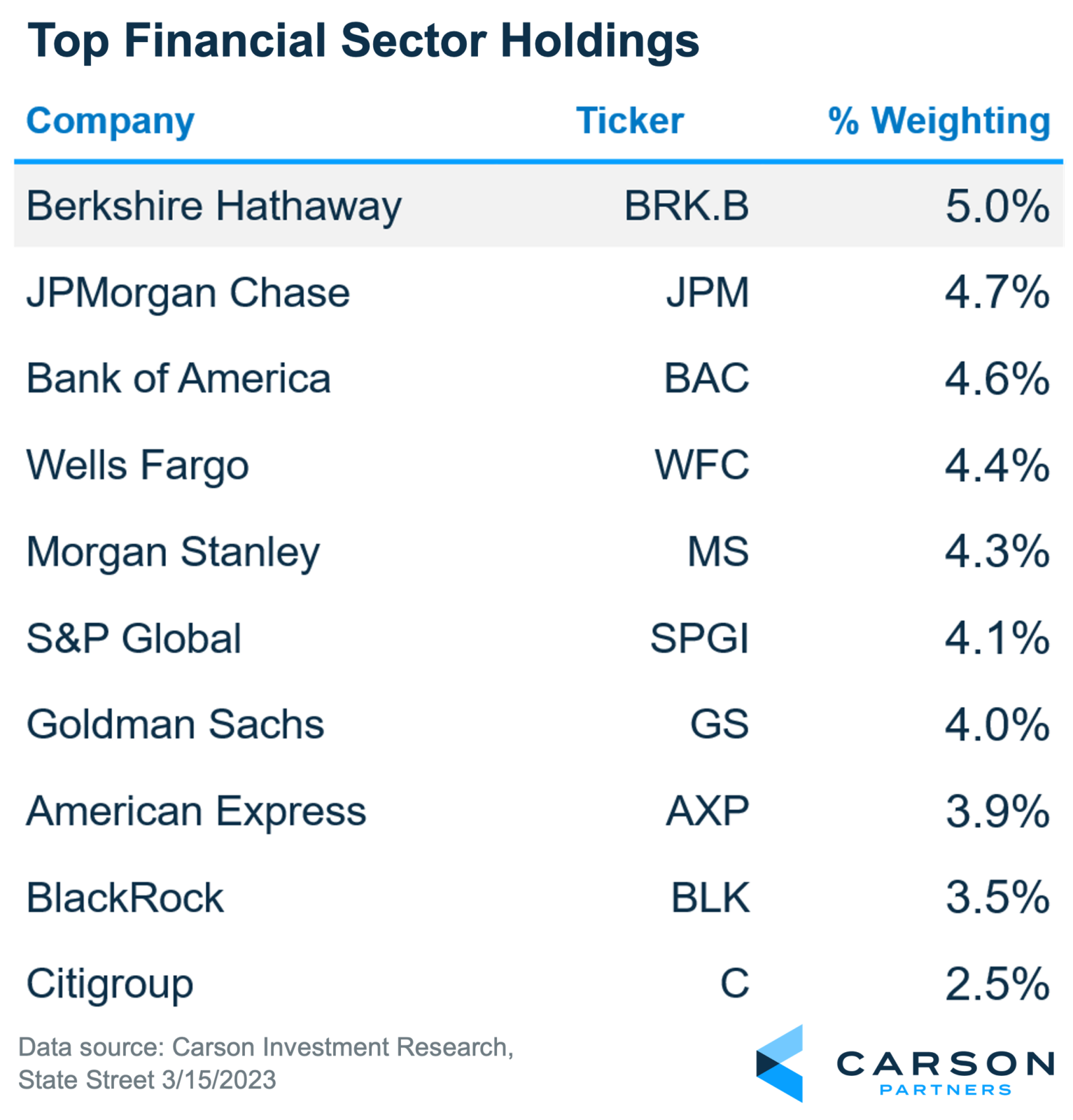

While the Global Financial Crisis coined the term “too big to fail,” this latest stress may show that the major financial components are “too strong to fail.” According to the Financial Select Sector SPDR fund (XLF) that seeks to replicate the financial sector of the S&P 500, banks represent about 31% of ETF. Smaller regional banks are only 7.5%, while the top four major banks account for ~24%. These top four face more stringent capital regulations and are subjected to rigorous stress testing that is passed without issue. Also, the top banks have consistently been gaining share for the past five years, which may now accelerate due to the recent failures of several regional players.

The remaining subsectors look to be fairly insulated from the recent stresses that regional banks are facing. Sure, there are a few areas within insurance and capital markets that may have some duration mismatches and unrealized losses, but that doesn’t become problematic unless there are liquidity issues. Of course, this could change, but at this moment, the remaining subsectors of the XLF look to be beneficiaries of a healthy economy and interest rates higher for longer.

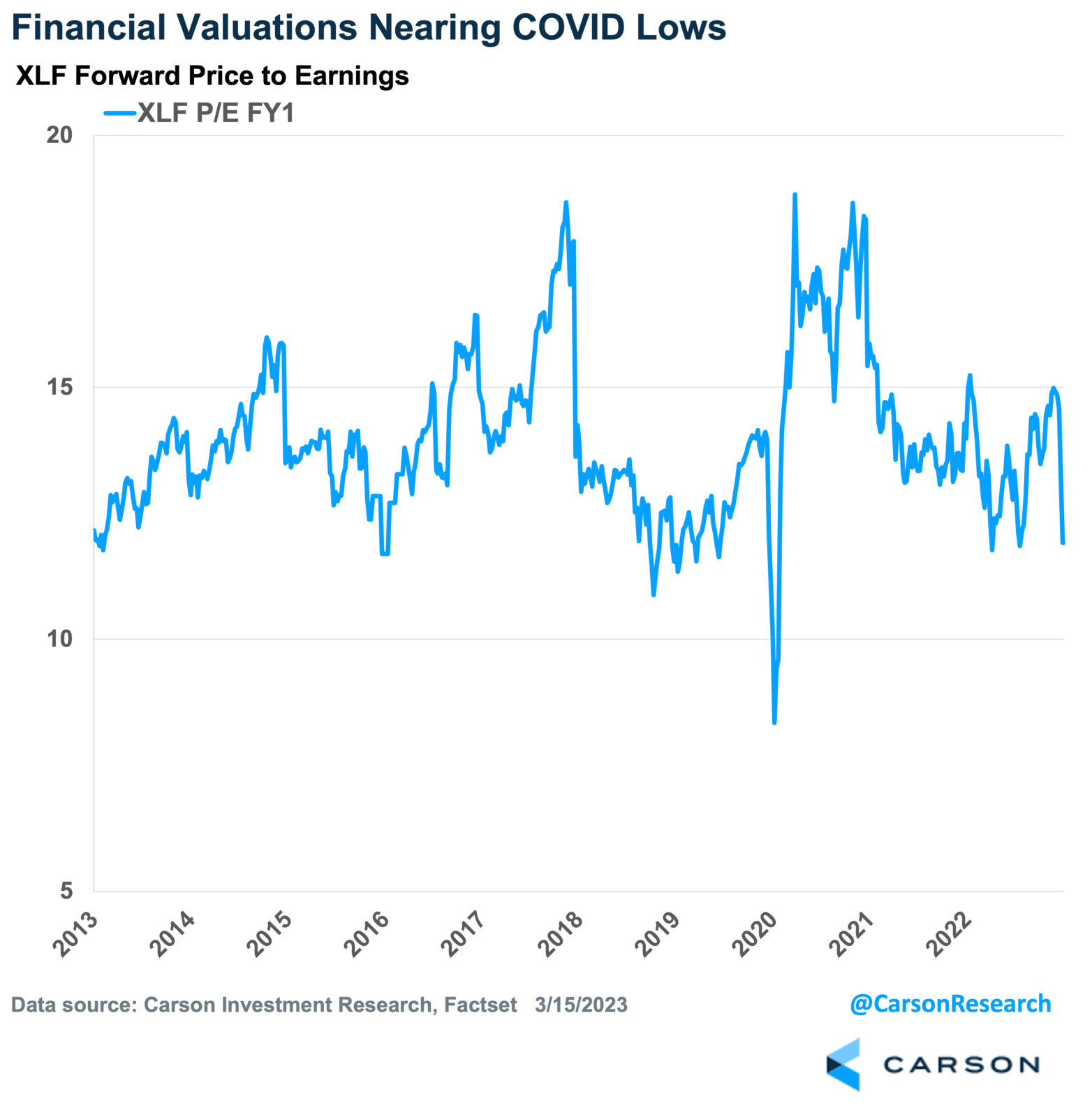

Already low investor expectations have become even lower for financials

We’re well aware that our overweight rating on financials is a contrarian call, even before this recent flare-up. However, therein lies the opportunity. We feel that many investors are expecting a repeat of the Global Financial Crisis. With a healthy economy, beefed-up capital requirements, and a higher for longer rate environment, we don’t see the same parallels. Currently, the Financial Select SPDR ETF (XLF) trades at a forward P/E multiple of 11.5x. This is down from ~15x at the beginning of the year and nearing the pandemic-lows of 9.5x when the economy was shutting down for an unknown amount of time. If we’re right that this isn’t GFC part II, we believe that there is a material upside from current levels.

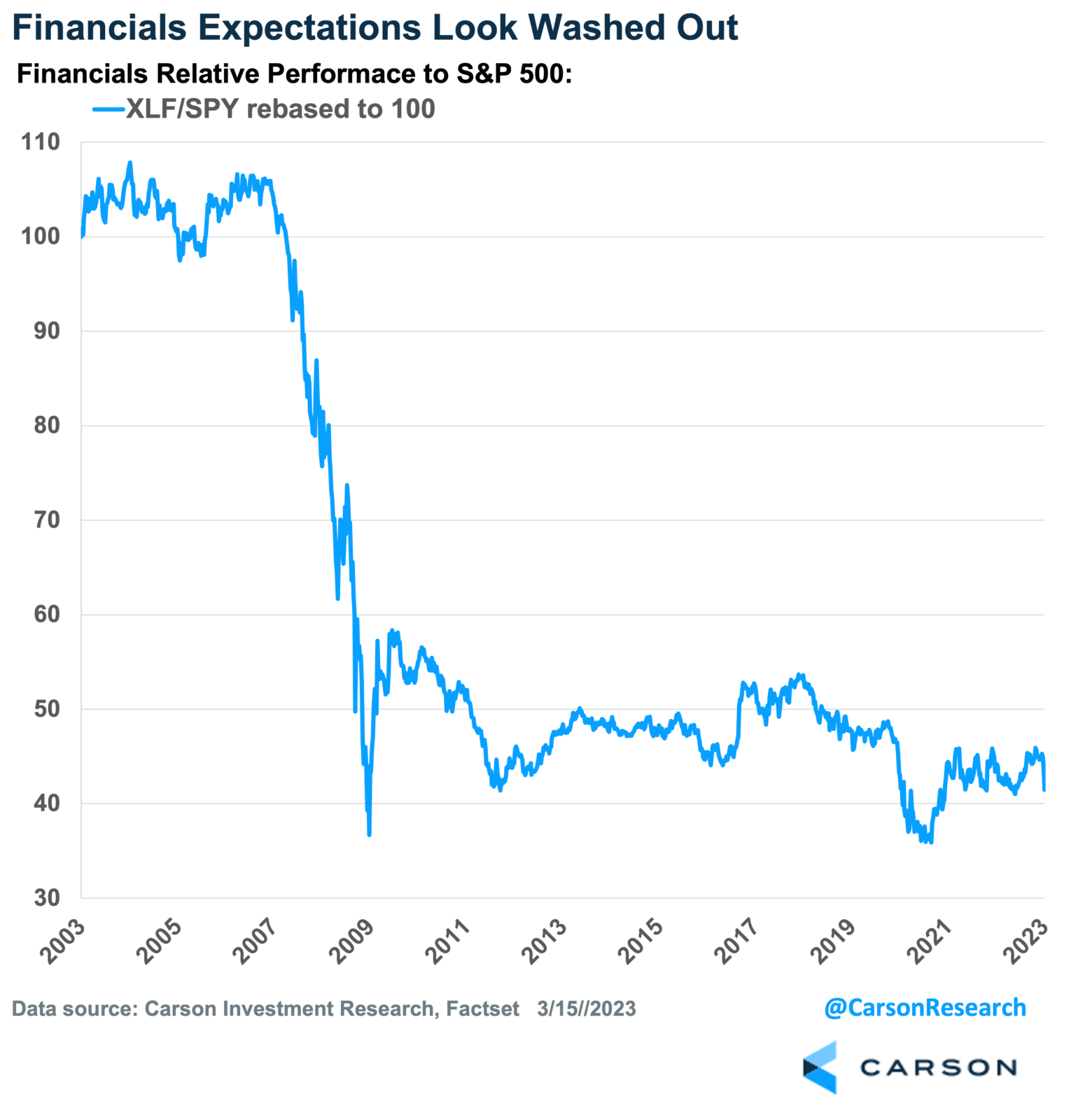

We also point out that the financial sector has been a major laggard in the S&P 500 since 2008. This made sense, considering that earning power of these firms was constrained by regulatory and capital restrictions coupled with a repressed interest rate environment. Instead, these conditions were conducive for technology firms, which have been the dominant outperformers over recent years. As Bob Dylan sang in 1964, we think “The Times They Are a-Changin’.”

We expect higher rates for longer which will benefit the financial sector

Carson Investment Research expects the Fed to hold rates higher for longer to combat persistent inflation. Most components of the financial sector businesses tend to benefit from rising interest rates. Banks earn attractive spreads on lending because the rates paid on loans are rising faster than the rates paid for deposits. Insurers earn higher yields on their float (the money collected for premiums upfront, which are used to pay claims later). Even when the rate hikes stop, the sector should generate attractive returns going forward.

The economy is healthy

The financial sector will continue benefitting from higher interest rates as long as the economy remains healthy, which we believe it will. Economic growth generates more business for the sector and requires additional borrowing. Importantly, the rate of late payments and defaults is within historical standards and should remain stable. The money banks set aside to cover bad loans increased over the past year as the world normalized. While this spooked some investors, it’s important to consider the unusual circumstances preceding the increase. Stimulus payments, eviction moratoriums, and student loan forbearance led to unusually low levels of missed payments. Further, rapidly rising home and auto prices enabled banks to sell defaulted assets at a profit! The industry is returning to business as usual – that’s not a bad thing.

Bottom line

We think the outlook for the financial sector is attractive, and we’ve upgraded it to overweight. These companies will benefit from rising interest rates and a stable economy. Valuations are attractive, and the outlook calls for double-digit earnings growth. Partners interested in increasing exposure to this sector can do so using the Financial Select Sector SPDR® (XLF), which is available on our curated platform.

The XLF yield, share price, and/or rate of return fluctuate and, when sold or redeemed, investors may receive more or less than your original investment.