Carson House View Sector Rating: Overweight

Carson’s House Views are the foundation of our asset allocation recommendations. Our partners and clients can utilize these directly through our proprietary House Views models or expressed independently using various ETFs available on our platform. Currently, we’re overweight the industrial sector due to a favorable economic and fiscal policy backdrop, solid fundamentals, and reasonable valuations. While this area outperformed in 2022, falling about 5.5% compared to an 18.1% decline in total return for the S&P 500, Carson Investment Research believes that industrials are positioned to continue performing well over the coming years.

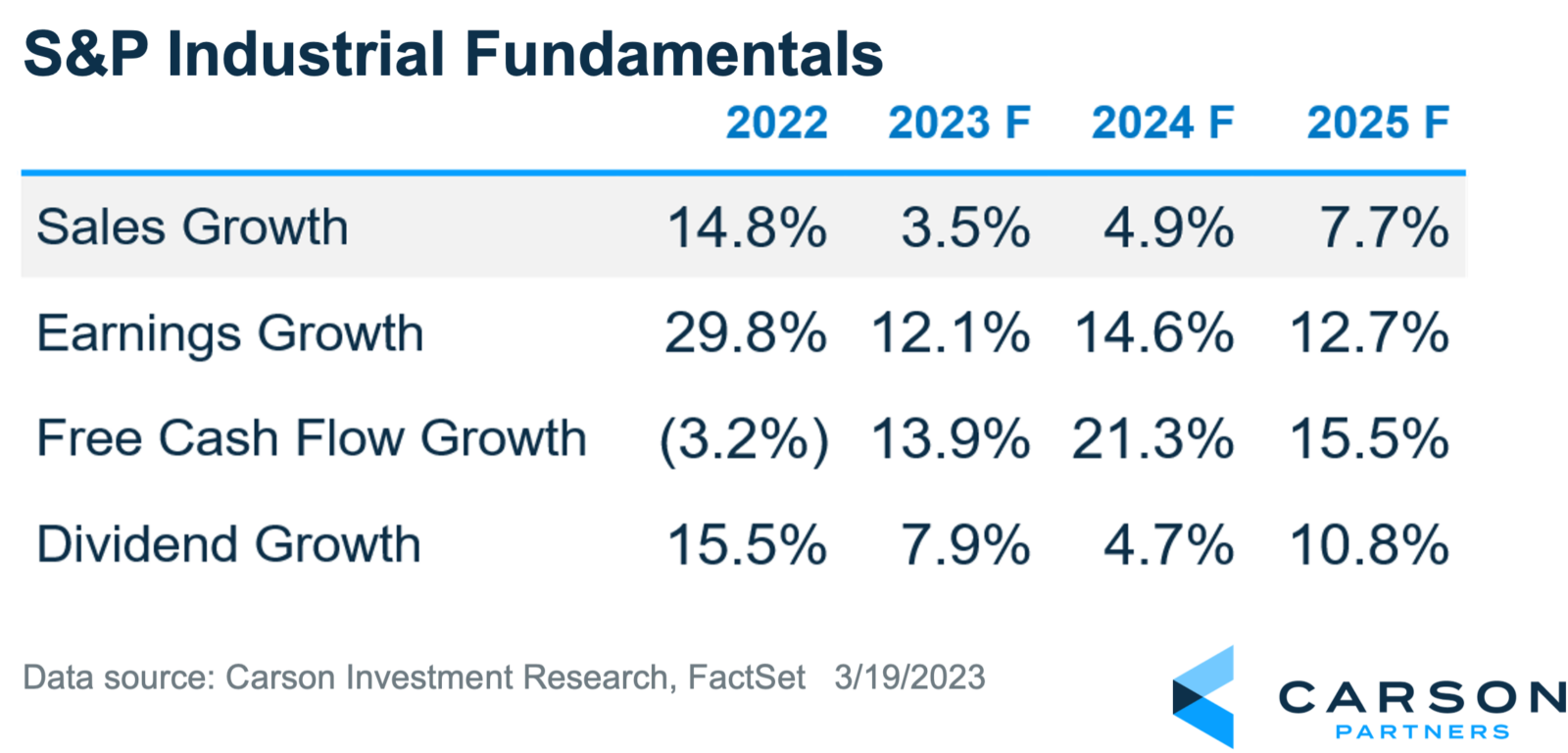

Fundamental growth is expected to remain healthy

It’s been interesting times for the industrial sector recently. While demand has rebounded strongly since the pandemic, but supply chain bottlenecks have moderated sales growth and margins for many. However, these now appear to be lifting. This, coupled with the movement to re-shore manufacturing, favorable fiscal policies like the 2021 Infrastructure Investment and Jobs Act, and rising military budgets from the Russia/Ukraine war, bodes well for future growth.

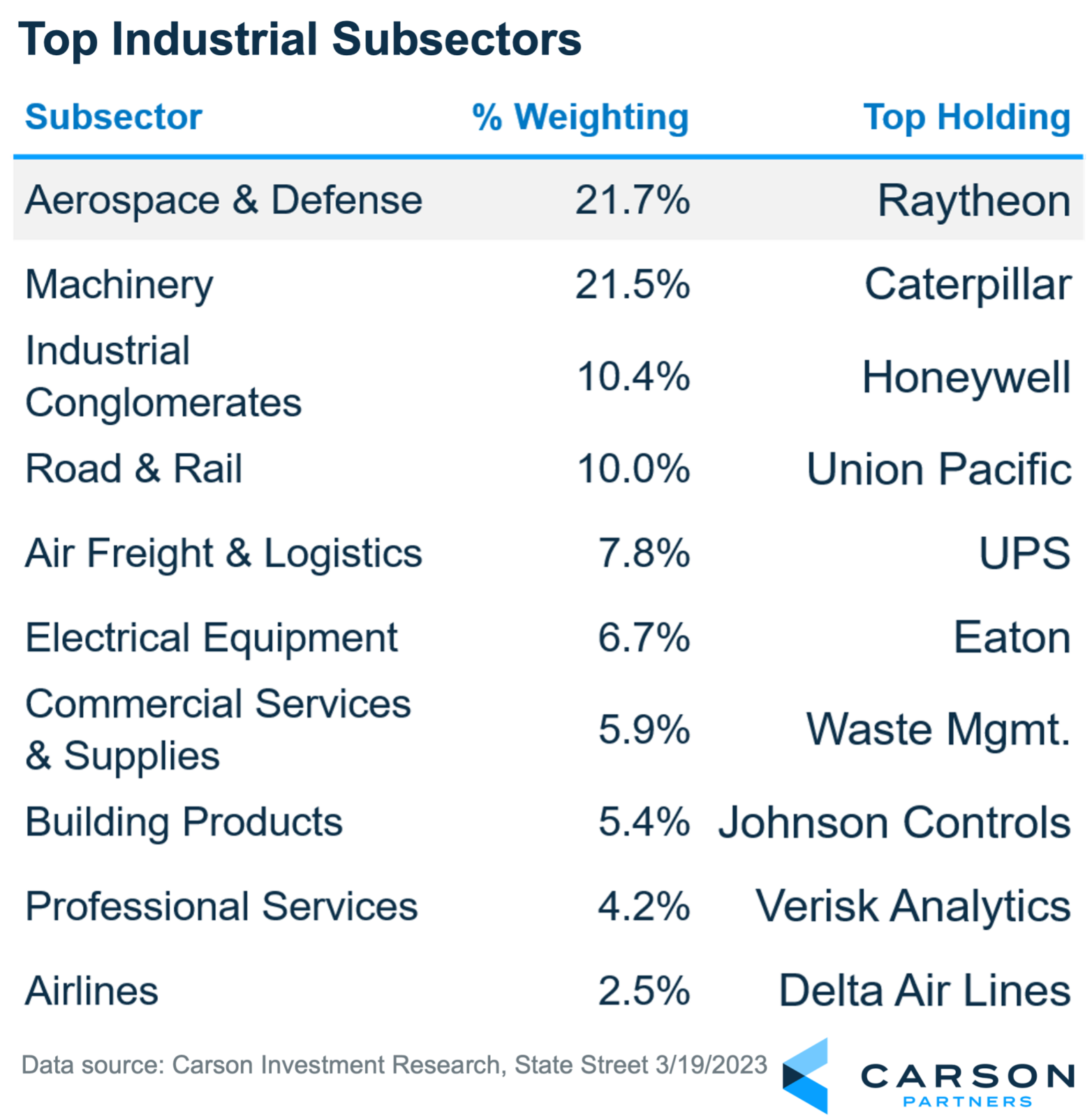

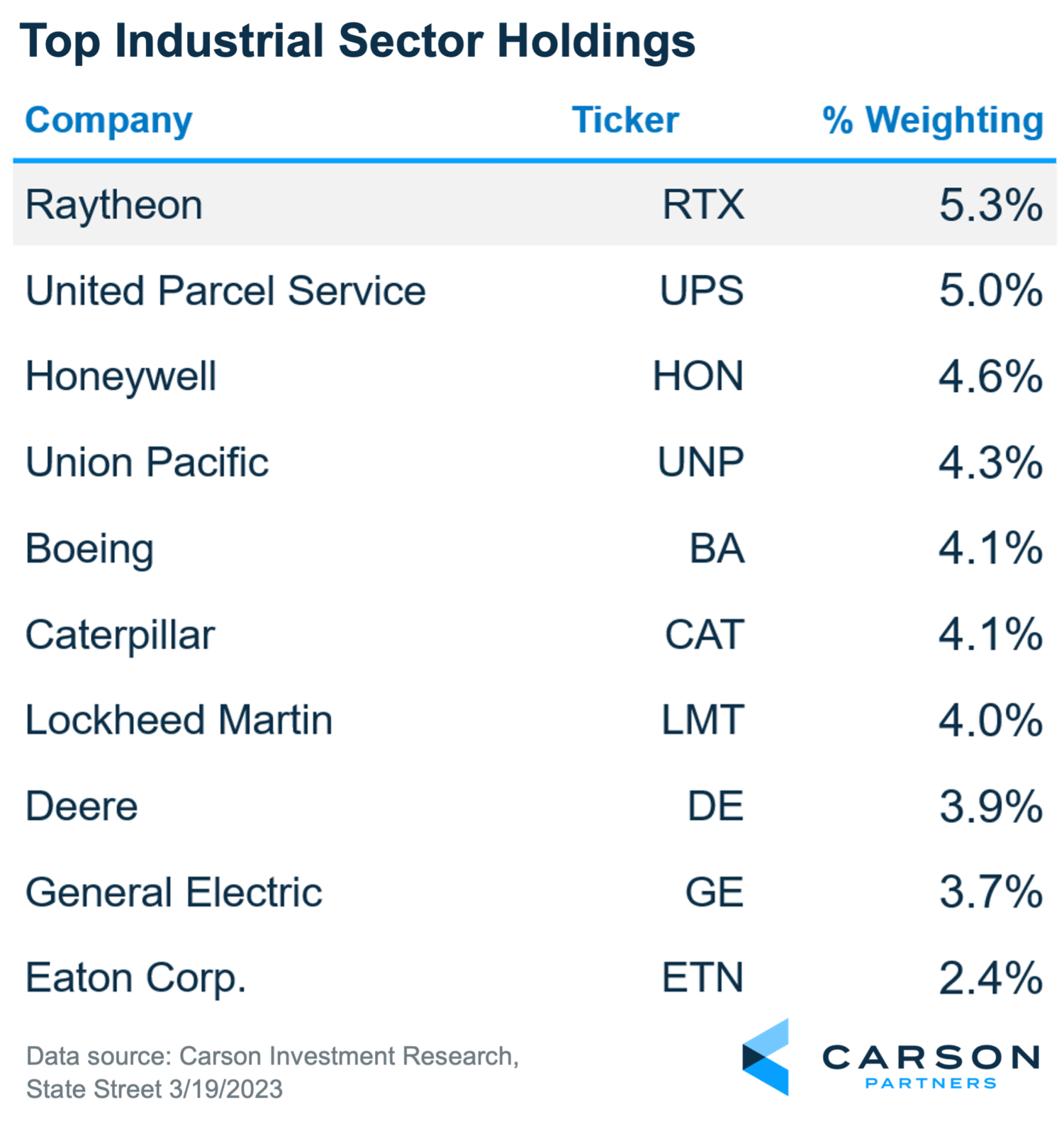

Industrials contain many subsectors

Industrials are somewhat of a catch-all collection of firms that don’t fit neatly into other classifications. There are 12 subsectors that comprise this area ranging from machinery firms like Caterpillar to database companies like Verisk Analytics. That said, manufacturing and transportation are the underlying commonality for most of these companies. The largest subsector is Aerospace & Defense, which not only includes military equipment but also production for commercial aviation. Due to the war in Ukraine, global defense budgets are on the rise with the European Union expected to increase its related spend by over 35% and Japan’s expenditures doubling over coming years.

Machinery is the second largest subcomponent. It’s the most diverse subcomponent with 17 stocks. However, Caterpillar and Deere represent nearly 40% of it. Currently, there’s a mix of headwinds and tailwinds. On the positive side, there’s increased fiscal spending, higher commodity prices, and China’s re-opening. Headwinds include higher financing costs for construction financing and continued supply chain issues. That said, this is an area that will be a long-term beneficiary of technology adoption as tractors and bulldozers are being covered with sensors that help automate operations and throw valuable data into the cloud.

Railroads is another area that we favor. These are inherently great businesses with strong competitive dynamics, pricing strength, and high operating leverage. Re-shoring manufacturing back to the US should be a tailwind for this subsector as well as autonomous trains since labor is one of their biggest expenses after fuel.

Bottom Line

Carson Investment Research is overweight industrials due to our expectations of continued healthy economic growth, constructive commodity prices, rising defense spending, and favorable government programs that are encouraging re-shoring manufacturing back to the US. Valuations aren’t demanding, especially considering the expectations for double-digit growth in earnings and free cash flow over the next three years.