Carson Investment Research has released its Midyear Outlook 2024: Eyes on the Prize. It’s been quite a year so far, with continued job market strength (although with some slowing), strong earnings growth, and stock gains that surprised many to the upside, outpacing even our out-of-consensus views for continued market strength.

As we put together the Outlook, we kept in mind our basic values. You will always know what we’re thinking and we’ll always follow the data, not the crowd, looking underneath the hood to understand what’s really going on in the economy and markets. That’s helped us for well over a year now, as the crowd even in early 2023 saw a recession coming not in a few years, but in a few quarters and for many just around the corner. The pessimism briefly retreated, but it’s back in many places. The numbers are still telling us we’re just not there yet, even if risks around a policy mistake (the Fed cutting too late) have increased.

Here’s a quick look at what we said in our Outlook 2024, penned back in November, what’s actually happened, and what we’re seeing here at midyear.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

The Economy

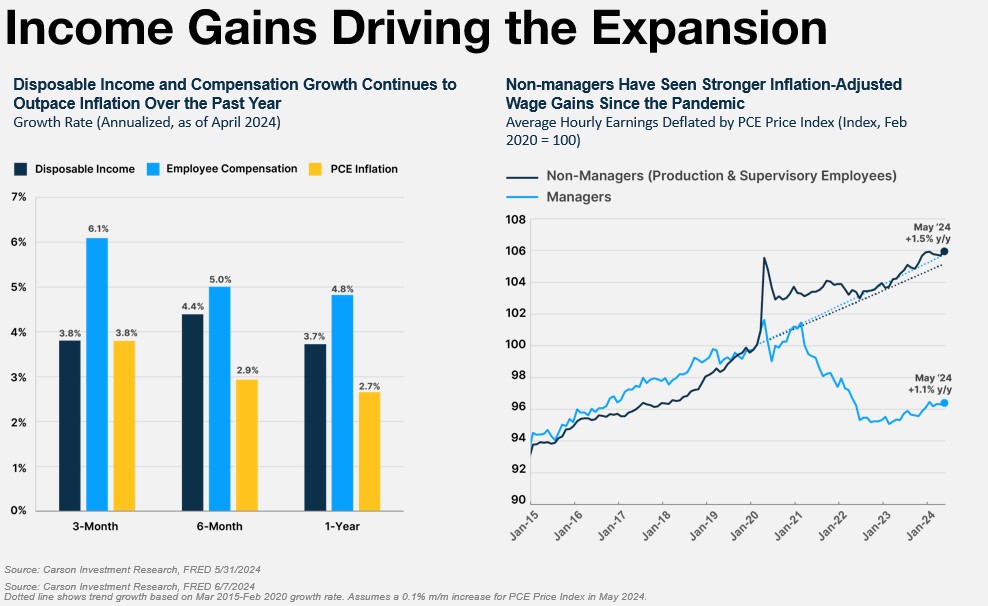

Our Outlook 2024 forecast: “Overall, in 2024, we see productivity growth compensating for slower job gains in the U.S., which together form the foundation of continued economic growth … All told, the economy looks nicely positioned as we head into 2024, with continued consumer strength providing the foundation and the massive headwind of Fed policy potentially turning into a tailwind. Much of the economic uncertainty from late 2022 / early 2023 has receded, and we believe the probability of a recession in 2024 is low.”

What happened: Most importantly, we are not in a recession and see little sign of one around the corner even with the on-going normalization of the labor market. (See Sonu’s blog for our take on the most recent job numbers.) Unexpected strength in the labor market has played a stronger role in extending the expansion than productivity growth so far this year, but we think the potential for productivity growth to play a meaningful role is still there. Consumer spending has played the role expected well, supported by job gains.

Our Midyear Outlook 2024 update: “The economy remains resilient supported by job gains, income growth, and strong consumer balance sheets as well as productivity gains on the business side.” Our basic view of the economy hasn’t changed, although seeing the Fed start to cut rates before the end of the year has become a more important factor in sustaining the expansion. We still see strong potential for productivity gains to help sustain the expansion and will be watching the numbers carefully in the second half.

The Federal Reserve

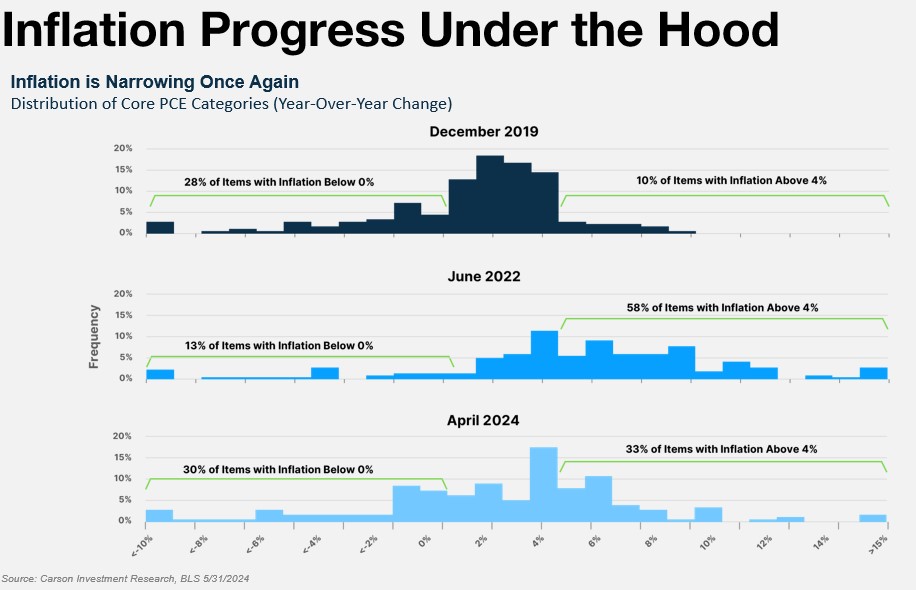

Our Outlook 2024 Forecast: “All signs point to inflation easing back to the Fed’s target in 2024. As a result, the Fed is unlikely to raise rates again, and in fact, by Spring of 2024, they could even start thinking about rate cuts. If inflation is on a sustainable path lower, there’s no need to keep policy rates as restrictive as they are now, especially when there’s a risk of breaking the economy. At the same time, we don’t think the Fed will cut more than 3-4 times in 2024, since our base case is for no recession.”

What happened: The Fed ended its hikes, but inflation remained more stubborn than expected in the first half of the year, although we think this is partly related to challenges around measuring shelter inflation and some idiosyncratic one-off factors. But there were still signs that the inflation picture was improving under the surface, which has been playing out in the more recent headline numbers. We were out of consensus and quite conservative in the number of expected rate hikes heading into 2024 compared to the market, but stubborn inflation meant even our expectations were too high.

Our Midyear Outlook 2024 update: “Inflation will continue to fall and the Fed will begin cutting rates in the second half of the year, with a base case of two cuts in 2024. The Fed’s view of the “neutral rate” will be revised upward, keeping us in a higher for longer rate environment.” Some of this has already come to pass since we wrote the Outlook. At this point, we think that a rate cut in September is not only likely but called for as inflation continues to subside. At the same time, the Fed has raised its expectation of the neutral rate, which will likely keep us in a higher for long environment compared to the 2010s, especially in the absence of a recession.

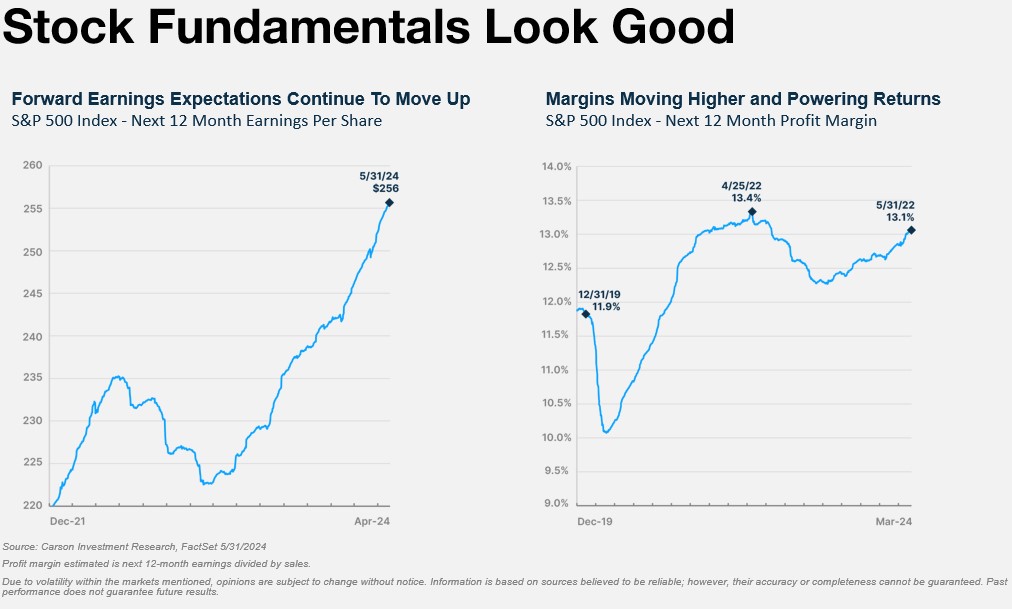

Stocks

Our Outlook 2024 forecast: “What could help drive stocks higher, and likely even to new all-time highs during the first half of next year? At the end of the day, it’s earnings … When companies are posting record profits, stocks tend to follow, something we expect to see in 2024. Potentially even more surprising than expected record profits are improving profit margins … Average election year gains of 12.2% for the past 10 first-term presidents provides a strong script for 2024 and gives us more confidence in our fundamentally driven forecast of potential low double-digit return in 2024.”

What happened: The S&P 500 had a total return of over 15% in the first half of the year, supported by a continued expansion, profit growth, and improving margins. Our forecast was too conservative despite being above consensus, although the basis for the forecast was right on target. Toward the final months of the first half we did see the market starting to narrow but we see no reason to despair. As Ryan highlighted in a recent blog, “According to Howard Silverblatt at S&P, if you removed NVIDIA’s gains the S&P 500 would be up 10.7% and if you removed all of the Magnificent 7, it would still be up 6.3%.” That 6.3%, which excludes the Magnificent 7, was right in line with our target. And the election year script? Still working.

Our Midyear Outlook 2024 update: “We are targeting a total return for the S&P 500 of 17-20% in 2024 … This young bull market will continue, supported primarily by earnings growth. Economic strength will support more cyclical stocks, while catch-up for undervalued areas of the market may contribute to a broadening rally. Stocks outperform bonds.” Our midyear update now looks conservative. But our fundamental story remains the same: As long as the economy and profits continue to grow, we will view risks to our equity forecast as predominantly on the upside.

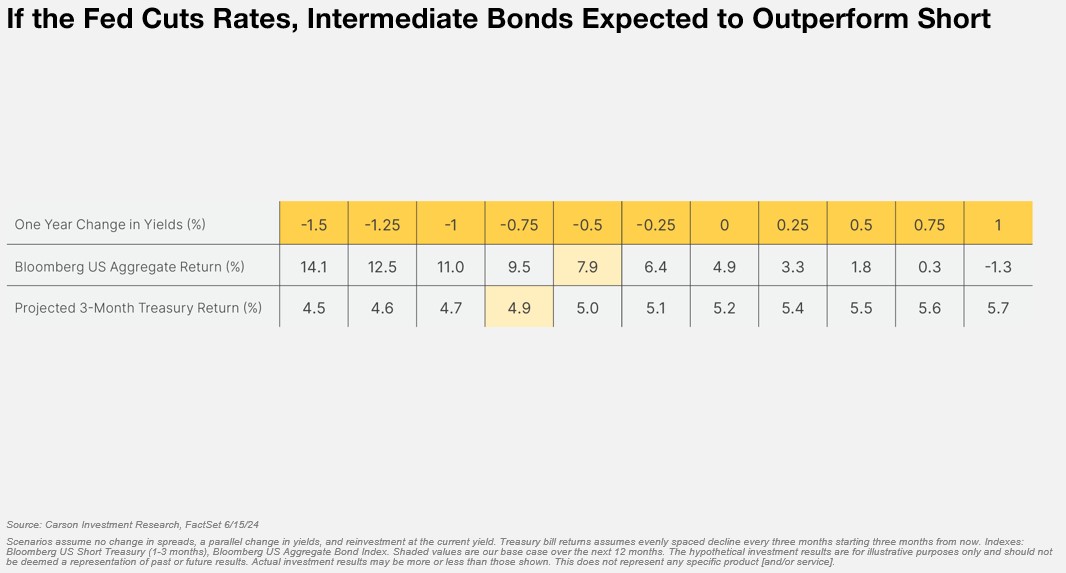

Bonds

Our Outlook 2024 forecast: “Our recommended maturity profile for bond holdings was quite short at the beginning of 2023. We slowly faded rising rates over the course of the year and moved just short of the Agg toward the end of the year. This final move was based on the historical pattern that intermediate maturity bonds start to outperform ultra-short maturity bonds in the six months before the first rate cut after a hiking cycle. This isn’t surprising, as markets are forward-looking. We believe the effect in 2024 may be consistent with the past but somewhat weaker, since many initial cuts historically are in response to an economy entering a recession following Fed overtightening, which is not what we expect to see next year.”

What happened: Stubborn inflation pushed back rate cut expectations, with the 10-year Treasury yield rising from 3.88% to 4.36% over the first half of the year. But much higher starting yields compared with 2022 and some additional compression in credit spreads limited losses for the Bloomberg US Aggregate Bond Index to 0.7% in the first half of the year. That still lagged quite a bit behind the Bloomberg 1-3 Month Treasury Bill Index’s 2.7% return.

Our Midyear Outlook 2024 update: “Bonds will be more resilient in the second half of the year as the Fed begins to cut rates. Historically this has been a good time to shift short term holdings towards more traditional bond allocations…The Bloomberg US Aggregate Bond Index outperforms short-term Treasuries in the second half of the year.” The tendency of intermediate-term bonds to outperform short-term bonds in the six months prior to the first rate cut may still hold true, but we had the timing wrong. Nevertheless, we still think it’s important to keep the principle in mind over the second half of the year. A rate cut in September would put the start of the six-month clock in March, just a little earlier than the current 2024 rate peak in April.

Portfolio Positioning

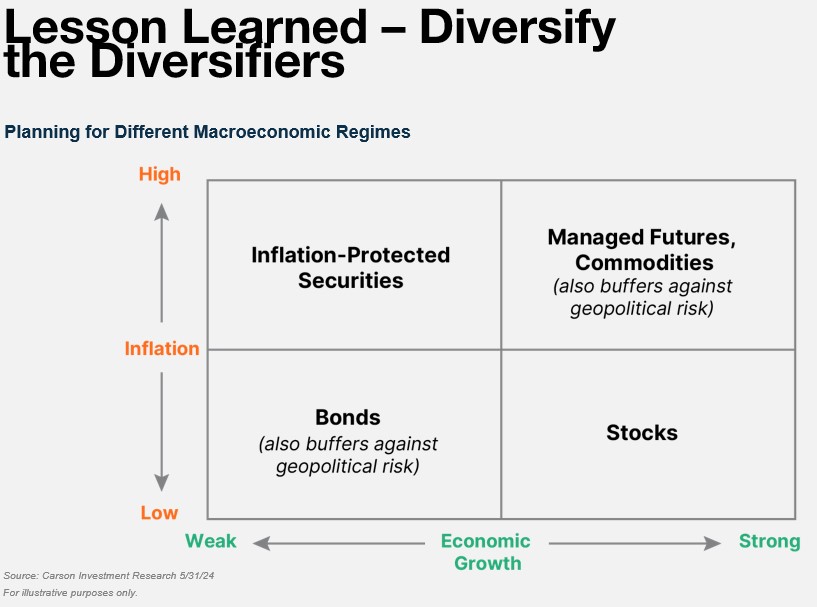

There is so much more to dive into in our Midyear Outlook 2024: Eyes on the Prize, especially with an election ahead. One important section is our discussion of positioning for the “higher for longer” environment. Even though we think bonds will hold their own, historically these kinds of environments have seen more frequent periods of bond volatility. On the other hand, non-bond diversifiers such as some commodities or trend-following futures strategies, have tended to perform better. As a result, we have sought to “diversify our diversifiers,” especially given our recommendation to remain overweight equities. That has resulted in a combination of increasing the rate sensitivity of our bonds, which remain underweight, while also shifting some of our fixed income exposure to other types of assets that have the potential to provide diversification in environments in which bonds may underperform.

Midyear Outlook 2024: Eyes on the Prize

The costliest investing mistakes are often not missed opportunities but straying from a long-term plan to pursue the wrong opportunities at the worst possible time. We chose “eyes on the prize” as our Midyear Outlook theme because recently some of those lessons have been hitting home.

Many investors received some hard knocks due to missed opportunities after the bear market low in October 2022, in part because so many financial industry pundits remained sour on the economy and equity markets. We also saw a recent example of overconfidence, starting back in 2020 following a strong bond rally that led some to believe that bonds would always have a low risk profile. Not surprisingly, there were heavy inflows into bonds at the time.

That long-term focus is so important because a good financial plan (of which investing is only a piece) is in the service of the real prize, the chance to discover and live our best lives and to support and spend time with the people we care most about. That’s a prize worth always keeping an eye on. We hope you find value in our Midyear Outlook. We will continue to communicate our views throughout the year as we monitor the markets and the economy and share what we see ahead.

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here.

02315310-0724-A