Over the last two years, markets have been able to tune out a pretty dour national mood, with the S&P 500 gaining 25%+ in 2023 and 2024. In fact, real GDP growth clocked in at 2.9% annualized over the last two years, above the pre-pandemic trend. Sentiment was downbeat, but this didn’t really crimp consumer spending. In our 2025 Outlook, we wrote that we expected this momentum to continue into 2025, with a potential boost coming from a turn in the national mood, i.e. “Animal Spirits.” We weren’t exactly calling for unleashing of these animal spirits but saw an opportunity for it to materialize. Well, we’re now close to Valentine’s Day, and animal spirits are yet to show up. Ryan wrote about a few market-based indicators that are flashing a yellow sign (beyond tariffs and the Eagles winning the Super Bowl!). Beyond those, the surveys are also not showing a pickup in confidence.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

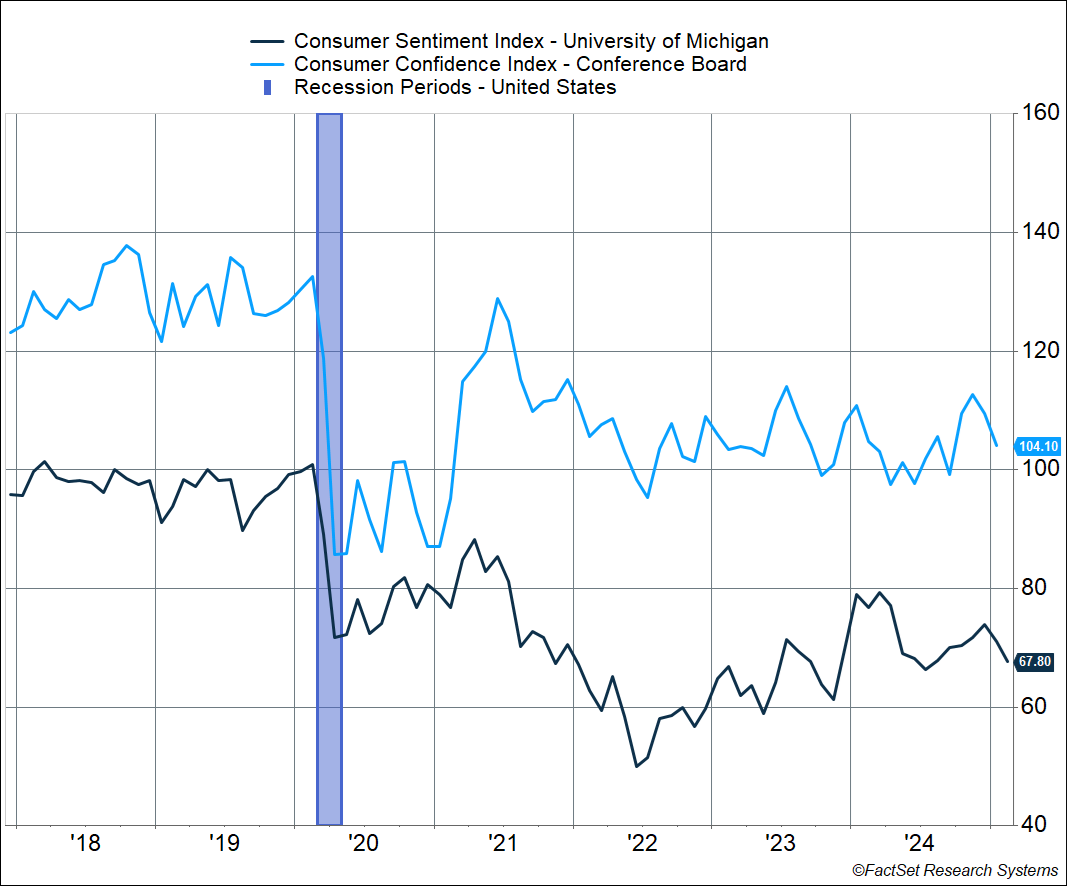

The University of Michigan Index of Consumer Sentiment pulled back over 3 points in February, falling to 67.8. That’s the lowest level since last August, and more than reverses the post-election bounce. The index is currently sitting well below the lows we saw during the height of the pandemic in April – May 2020. Another consumer confidence measure released by the Conference Board tells the same story. We have yet to get updated February numbers, but it fell 5.4 points in January to 104.1, the lowest level since last September.

Consumer expectations of their financial situation have risen significantly over the past year, but they’re still well below what we saw pre-pandemic and we haven’t seen a post-election surge in optimism about the future. Via a household survey from the New York Federal Reserve:

- 6% of respondents expect finances to be “somewhat better off” or “much better off” a year from now — higher than 34.2% a year ago, but below the 42.9% in February 2020.

- 21% expect finances to be “somewhat worse off” or “much worse off” a year from now — down from 23.5% a year ago, but well above the 10.5% in February 2020.

- The difference between the two was 15.6%-points — better than the 10.6%-point difference a year ago, but well off the 32.4%-point difference in February 2020.

Expectations appear to have plateaued, and simply put, that’s not great for animal spirits.

It looks like uncertainty over regulations and tariffs are hitting business confidence and outlooks as well. 146 out of 302 S&P 500 companies have referenced tariffs in their earnings calls so far, the most since Q2 2019. Most of them have yet to quantify the impact of it in their guidance, but that underlines the uncertainty, since we don’t have much clarity around tariffs. Half of the companies that reported also brought up currency issues in their earnings calls, saying that a strong dollar is putting pressure on overseas revenues (40% of S&P 500 company revenues originate outside the US). This is a risk we highlighted in our Outlook, i.e. a strong dollar (on the back of elevated rates and tariff rates) threatening S&P 500 profits.

A recent WSJ piece highlighted that tariff news (and whipsaws) have hit business leaders’ confidence. Priorities have shifted now to navigating tariffs and other policy issues, including settling new supply routes. They have to decide whether or not to raise prices, and remember, all this is before we have any idea of eventual policy that will be implemented (or lack thereof).

Uh, Oh Inflation

The consumer price index (CPI) rose 0.5% in January, above expectations, partly driven by a massive 15% increase in egg prices in just one month. Egg prices are up a whopping 53% since last year, thanks to a worsening bird flu situation. Even Waffle House went so far as to explicitly add an egg price surcharge of 50 cents on their menus. Energy prices have also crept higher, rising 1.1% in January. It’s still up just 1% since last year (gas prices are actually slightly lower), but households are never happy when energy prices go up, along with food prices.

Consumer expectations of inflation, as measured by the frequently cited University of Michigan survey, surged in February. One year ahead inflation expectations rose to 4.3%, the highest since November 2023 and only the fifth time in 14 years we’ve seen such a large 1-month increase. Five-year ahead expectations didn’t see a similar surge, rising from 3.2% to 3.3%, but even that is well above levels we saw before the pandemic.

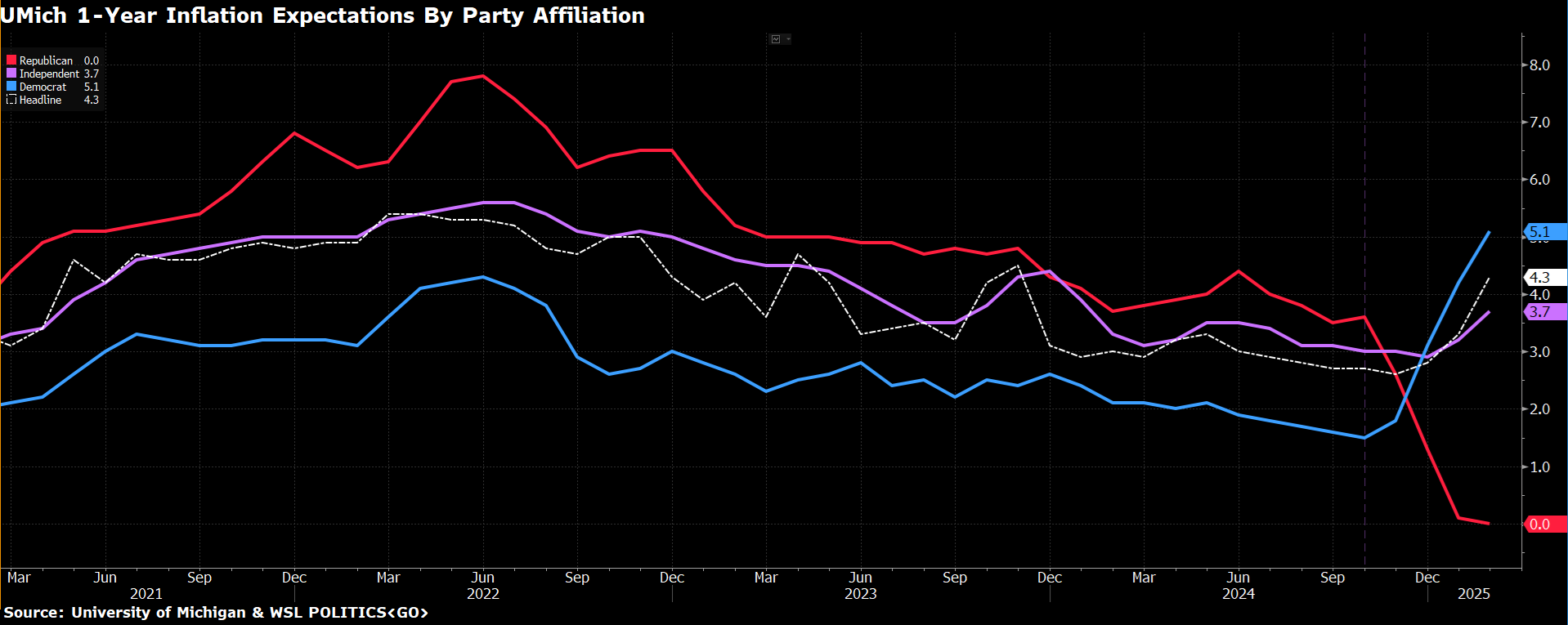

Now one big issue with this survey is that it’s “contaminated” by politics. If you separate 1-year ahead expectations of inflation by party affiliation, this is what it shows:

- Democrats: 5.1% (up from 1.5% in October)

- Republicans: 0.0% (down from 3.6% in October)

In short, Democrats are expecting a big surge in inflation, whereas Republicans appear to be expecting a deflationary recession, which would be the scenario under which inflation hits 0% (though people who answer the survey probably don’t realize it’s an implied recession call).

Expectations for independents may hold a bit more signal here. They expect 1-year ahead inflation to be 3.7%, the highest level in a year. Usually, you see this kind of move only when gas prices surge, but nationwide average gas prices have risen just 10 cents to $3.14 since the beginning of the year. More likely, it’s the uncertainty about tariffs.

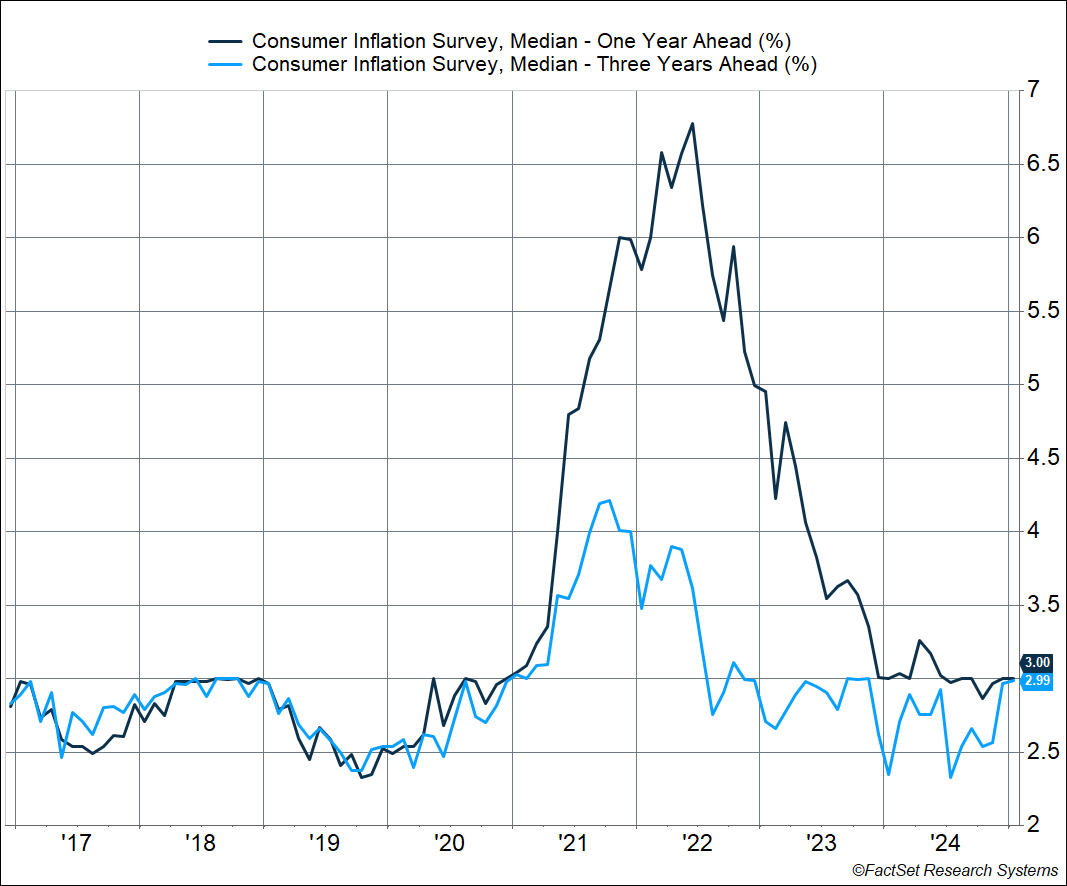

At the same time, a more robust survey from the New York Federal Reserve shows a more benign picture of inflation expectations. The sample size for this survey is larger, amongst other robust methodology choices. This survey showed that median 1-year and 3-year ahead inflation expectations were unchanged at 3%. That’s not too far above what we saw in 2019 (when it averaged about 2.5%). Still, things are on the upper edge of what would likely be comfortable for the Federal Reserve, which pays close attention to inflation expectations and see it as a key potential driver of future inflation.

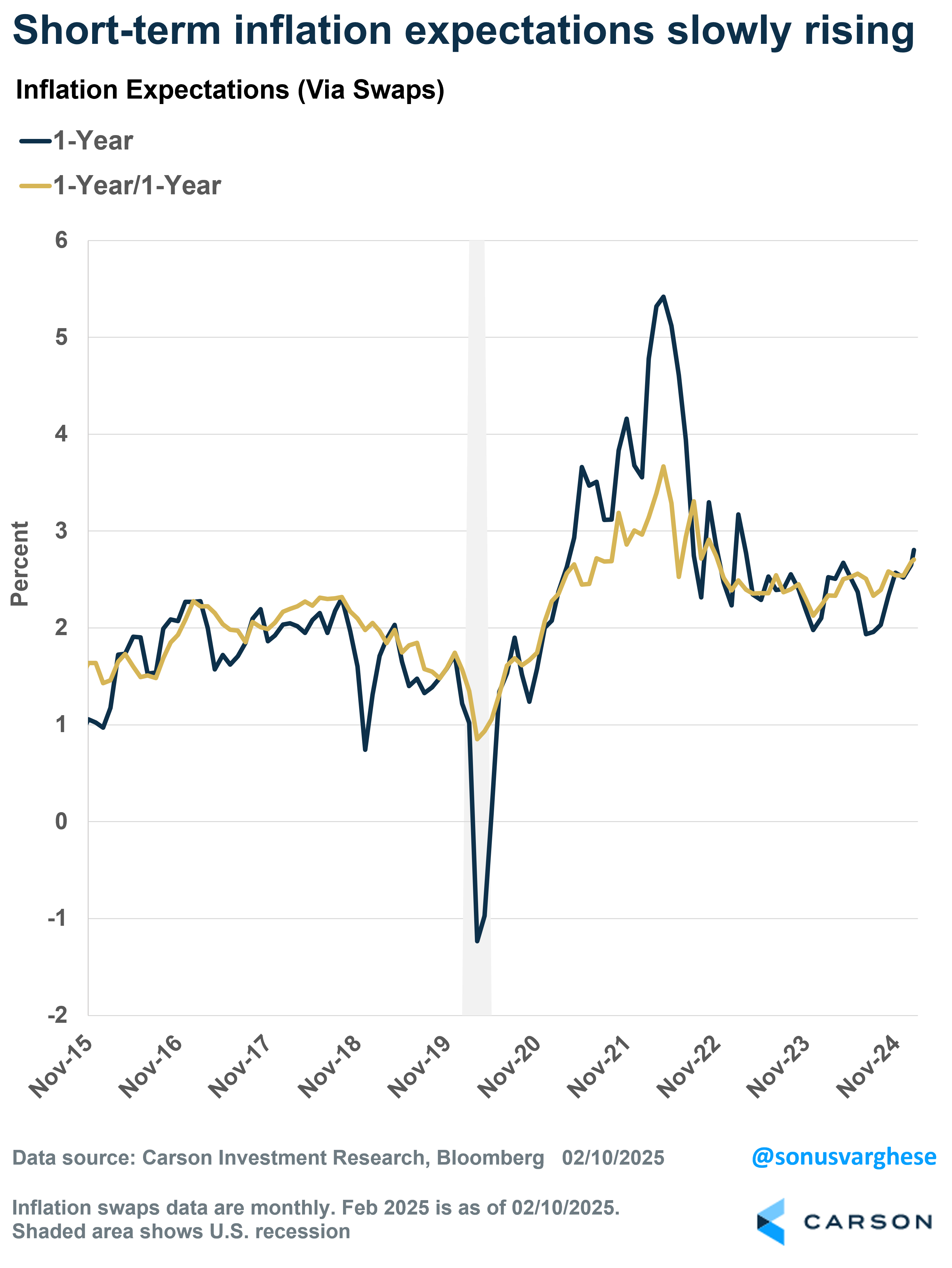

Market expectations of short-term inflation expectations have also been rising recently. 1-year ahead inflation expectations have moved up to 2.8%, the highest since March 2023. I also calculated 1-year/1-year forward inflation expectations, which is inflation expected in the second year from now (roughly 2026). That’s risen to 2.7%, the highest since November 2022. “Normal” levels, at least going back pre-pandemic levels, were around 2.2-2.3%. Again, as I pointed out above, this is not because of higher oil prices (which have hovered in a fairly tight range recently). Instead, this is likely where the tariff uncertainty is being manifested. Interestingly, we didn’t see a similar increase in 2018 – 2019 amid the trade war, but this time around markets may be sensitive to the fact that we’re in a generally higher inflationary regime.

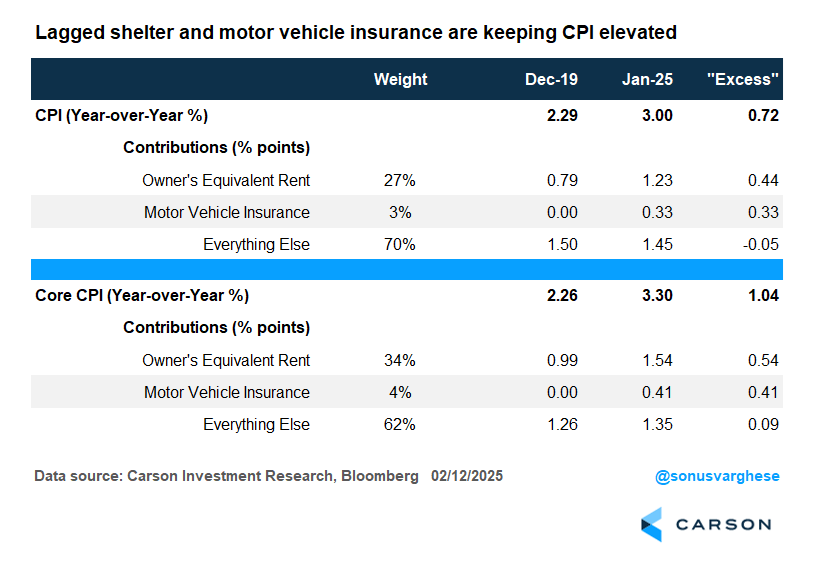

The good news is that longer-term inflation expectations, which is what the Fed cares more about, are consistent with their 2% target, though embedded into these is the expectation that the Fed will have to keep rates higher for longer. And that gets to the January CPI report, which was hot across the board on both headline and core measures (which excludes food and energy). Yet, the big picture is that inflation remains elevated due to lagged shelter and motor vehicle insurance data. Within shelter, it’s really owner’s equivalent rent (OER) that is problematic (the ”implied rent” that homeowners pay, which is based on market rents rather than home prices). OER makes up a big part of the CPI basket, as you can see in the table below, and it’s adding 0.44%-points to excess CPI and 0.54%-points to excess core CPI (excess relative to December 2019). Motor vehicle insurance is adding the rest of what’s excess for both headline and core CPI, while all the remaining categories are neutral.

We’re going to just have to wait for the disinflationary housing trends that show up in more real-time private measures be reflected in the official data. The problem is that this is going to keep the Fed on hold too, as they wait for official inflation data to get closer to their target. Again, the tariff situation only adds to this sense of uncertainty. Markets now expect the first rate cut only in July, with just about coin toss odds for a second cut in 2025. That’s still better than expectations for no cuts at all in 2025, but if the markets start to sniff out that no cuts are forthcoming in 2025, expect more volatility.

All in all, the mood seems dour, whether for consumers, businesses, or even at the Fed. That’s not what we need for a lift in animal spirits. It doesn’t mean the economy will go into a recession — we still believe underlying strengths will overcome some of these headwinds. But it could be the difference between an ok year versus a great year. And it’s not over yet by any means. Positive news on the tariff side, plus progress on a tax bill in Congress, could lift spirits. But that needs to happen first.

Ryan and I talked about a lot of these things in our latest Facts vs Feelings episode. Take a listen below.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

7636345-0222-A