DeepSeek, a small Chinese Artificial Intelligence (AI) startup, shook the AI world last weekend. In short, DeepSeek created an AI model that appears to be as powerful as the existing ones out there. And most importantly, they did it with much less money. DeepSeek’s AI chatbot also soared to the top of the Apple App store, overtaking OpenAI’s ChatGPT.

Until now, it looked like there would just be a handful of mega tech companies able to compete in the AI space: Microsoft-backed OpenAI (with ChatGPT), Alphabet (Gemini), and Amazon-backed Anthropic (Claude). The thinking was that only these companies had the immense technological and financial resources required. And subsequently, they would be able to monetize AI by charging users who wanted to use these proprietary, “closed source” AI platforms.

Well, DeepSeek just upended this.

The good news is that costs are likely going to be much lower for AI, which is likely to pull in a lot more users. But one person’s spending is another person’s revenue (and profits). So, falling prices means companies providing the AI infrastructure could potentially lose out. Of course, there’re huge open questions, including:

- Are the Chinese ahead of the US in AI?

- Do US firms continue to spend billions on capex (and chips)?

- Which firms are the winners and the who are the losers?

A Deep, But Not Broad, Sell-Off

The uncertainty over the answers to these questions led to a big selloff in tech stocks on Monday. The market seemed to think the companies providing the backbone of AI infrastructure are the immediate losers. Semiconductor stocks got hammered. NVIDIA shares fell 17.0%, losing almost $600 billion in market cap and going from the most valuable company in the world to 3rd place. Other semiconductor firms that lost out included Broadcom (-17.4%), Marvell Tech (-19.1%), and AMD (-6.4%).

Even power companies saw big pullbacks. Constellation Energy fell 20.9% — they inked their largest power purchase agreement with Microsoft last year, agreeing to restart the Three Mile Island nuclear plant to provide power to Microsoft for AI workloads. Talen Energy, which signed a deal to provide nuclear power to Amazon, fell 21.6%.

However, the sell-off was mostly confined to the technology and utilities sectors. A few large technology companies gained, including Apple (+3.2%), Meta (+1.9%), and Amazon (+0.4%). As you can see from this Finviz heatmap, there was a lot of green on the board. 350 stocks in the S&P 500 actually gained.

All said and done, this wasn’t a broad-based sell-off. Far from it. The S&P 500 fell because of its huge weight to NVDIA and Microsoft, but the Dow gained 0.65%. It goes to the point that DeepSeek likely makes widespread AI use even more likely, and perhaps sooner rather than later as the cost of AI infrastructure collapses. But let’s walk through DeepSeek itself, putting its announcement within the context of the global macroeconomy.

Who and What Is DeepSeek?

The company was founded by a quantitative trading firm in China, one of China’s largest (they had $15 billion of assets in 2015, but this dropped to $8 billion by 2021). The founder of the trading firm, Liang Wenfeng, went into AI research two years ago in May 2023 — apparently with 10,000 NVIDIA chips they had acquired by 2021, before export controls were imposed by the US. They also pulled together the smartest young Ph.D.s across China’s top universities.

DeepSeek has been releasing several large language models (“LLM”) over the last few years. These LLMs are what drive chatbots like ChatGPT. So, they didn’t “come out of “nowhere.” But on Christmas Eve last year (2024), they introduced DeepSeek-V3, which by itself was impressive as it matched ChatGPT & Gemini’s capabilities. They also released a key paper, highlighting how they built the platform using only a fraction of the chips the US AI companies use to train their models. DeepSeek used ~ 2,000 NVIDIA chips, whereas the big US firms use ~ 16,000 chips or more. DeepSeek said they needed only $6 million in raw computing power to train their new system, about 10 times less than what Meta spent building its latest AI model! Interestingly, the DeepSeek paper had a whopping 139 technical authors – that’s a huge technical team. This is not a tiny group working in a Chinese basement.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

DeepSeek-V3 could do standard issue stuff, meeting benchmark tests, including answering questions, solving logical problems, and writing computer code. But earlier this month, OpenAI released OpenAI-o3. It’s designed to reason through math, science, and coding problems — something V3 could not do. But last week, on January 20th, DeepSeek released DeepSeek-R1, a significantly more advanced reasoning model, which impressed experts. That is what sent US investors into panic, albeit only after digesting the information over the weekend. Note that OpenAI is yet to release o3 widely, but it’s supposed to be very impressive — meaning America likely “hasn’t lost its lead” in AI. But things are close.

How Did DeepSeek Get Around Technological Constraints?

Under the Biden administration, the U.S. had limited Chinese companies access to advanced chips, though this started only in October 2023. Still, DeepSeek’s researchers had to get more creative, and use what they had more efficiently. And turns out they did. Here’re a couple of examples.

Traditional AI models rely on supervised fine-tuning, whereas DeepSeek uses reinforcement learning, i.e. models learn through trial and error, and self-improve (incentivized by algorithmic rewards). This is similar to how humans learn from experience, by interacting continuously with others and their environment, and receiving feedback. This allows development of reasoning abilities and better adaptation.

DeepSeek uses something called “mixture of experts” (MoE) architecture, activating only a limited fraction of parameters to solve a given task. Think of a team of experts, with different specialties. When asked to solve a task, only relevant experts are used. Which is essentially what DeepSeek does, leading to significant cost savings and better performance.

These relatively creative approaches (amongst others) reduced computational resources needed for training. Leading to much lower costs. Contrast all this to brute-force scaling that typically occurs at American companies, mostly because they can afford to, as vast resources are available (money and chips).

DeepSeek is also open source, without licensing fees, leading to community-driven development. Developers can access, modify, and deploy DeepSeek models for free, promoting wider adoption of the models. And it also allows for transparency and accountability.

Some highlights of DeepSeek

- It’s open source, with the goal of eventually giving everyone access to Artificial General Intelligence (AGI). They’re the only advanced AI team releasing cutting-edge research

- The chatbot is free, with no ads, and it appears to be as good as the other chatbots

- It allows you to see how it’s “thinking” as it gives you an answer. Not to mention it helps you understand, and trust, the answer more. It also helps you tailor your queries and get to better results

- The API pricing is lot lower than competitors. The R1 API costs $0.55 per million input tokens (versus $15 for ChatGPT) and $2.19 per million output tokens ($60 for ChatGPT).

What Next?

At the end of the day, you still want to have more chips than less, since it’ll allow for faster utilization and inference. Also, the wider use case of AI, as costs plunge, could lead to more demand. This is called as “Jevon’s Paradox”. When technology advances, it makes a resource much more efficient to use. But as the cost of the resource drops, demand increases, causing resource use to increase. In fact, Microsoft’s CEO, Satya Nadella, tweeted this after the DeepSeek news, saying as AI is commoditized, we’ll need much more of it (some of this could also be cope).

What could end up happening is even more capex spending on AI, including on chips. In which case stock prices for chip companies that got hammered should recover, although the timing of demand could be different. But at this point, it’s likely too early to tell. Also, a lot of companies aren’t just selling the AI infrastructure. Companies like Apple, Amazon, and Meta are potential users of AI. These companies will likely benefit from the lower cost of AI.

Ban DeepSeek?

As I noted above, DeepSeek is open source. Which means it cannot be banned, unlike something like TikTok. Of course, the chatbot that surged to number 1 on the Apple app store can be banned. But the DeepSeek API can be downloaded and run “locally” on one’s own computer, or be accessed via API. Which is why the “gotcha” questions folks have been asking DeepSeek are irrelevant. DeepSeek chatbot doesn’t provide answers to questions about Tiananmen Square and other issues disfavored by the Chinese government. But this is just the chatbot, and that’s subject to Chinese censors. As Joe Weisenthal at Bloomberg pointed out, the open source version of DeepSeek that you can download and run is not censored — you can ask it whatever you want.

China Is a Tech Powerhouse, That’s Already Eaten Everyone Else’s EV Lunch

There’s a notion that China is a central command and control economy, and puzzlement about their technological prowess. But this hides some important details about how China works. The central government, and CCP (Chinese Communist Party), certainly has a lot of say in the economy. But it’s mostly via setting targets for spending, and even GDP, which is why GDP growth in China is an “input,” as opposed to an output, of natural economic activities. Especially important is the fact that the government facilitates this with “industrial policy,” including significant subsidies and cheap state financing for entire sectors like hi-tech manufacturing. This is combined with protectionist policies that prevent foreign competition.

However, at the ground level, competition for the money is intense. A good example is the electric vehicle industry, which has benefited from massive subsidies from the Chinese state, giving domestic firms a massive leg up over Western companies that don’t benefit from subsidies. Yet, there are over 100 EV companies intensely competing with each other. A true market economy wouldn’t be able to support them all. But generous government funding supports them, allowing scalability. While also dropping costs significantly.

China’s subsidies also went toward building out the local supply chain, and so Chinese companies don’t rely on imported parts. Chinese EV juggernaut, BYD (which Warren Buffet has a stake in), has a mostly local supply chain that gives it a big leg up. Even for Tesla, 90% of the parts for its Shanghai factory are sourced from within China.

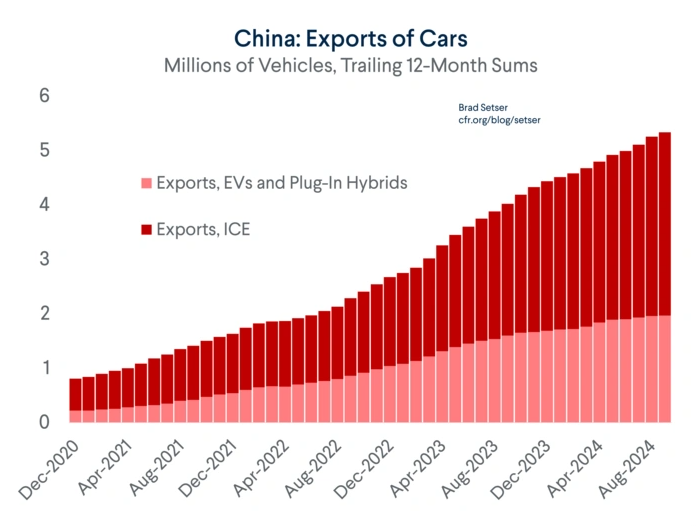

I’ve previously written about how China has taken over the global auto manufacturing sector in under 5 years. China exported 6 million cars in 2024. It was under 1 million 5 years back in 2019.

China now has enormous capacity to produce cars — over 40 million internal combustion engine (ICE) cars a year, and about 20 million electric vehicles (EVs) by the end of 2024. This means China has the amazing capacity to supply over half the global market for cars. Globally, about 90 million cars are sold a year.

Brad Setser (an economist at the Council of Foreign Relations) points out that China has nothing close to this level of internal demand. The internal market is about 25 million cars, and it’s not growing. Interestingly, domestic EV sales are rising rapidly (expected over 15 million next year). And as a result, ICE vehicle capacity is geared to exports — especially to Europe and other EMs (the US and India are notable exceptions because of tariffs imposed on Chinese vehicles). And China’s massive overcapacity is a revolution for the global manufacturing and auto industry.

What Exactly Is the China Threat

Real GDP growth clocked in at 5% in 2024 for China, right at the government’s target. But make no mistake, this is a slowdown and the underlying details aren’t pretty. Retail sales, a proxy for consumption, was up just 3.7% in 2024, well below the pre-pandemic pace of 8%. On the other hand, subsidies for the manufacturing sector led to industrial production rising over 6.2% in 2024, matching what we saw pre-pandemic.

China essentially has 3 solutions to its underlying economic slowdown

- One, accept it and the lower employment it brings, but this also brings political peril

- Two, recharge the crashing property sector with debt, but they’re reluctant to do this

- Three, promote the industrial sector and boost exports, while limiting imports, which is what they’re doing

Chinese exports grew by 6% in 2024, but imports rose just 1%. As a result, the trade surplus has surged by a whopping 21%, to almost $1 trillion. In short, China is selling stuff to the rest of the world all over the world. But they’re not buying goods in return (a lot of these are EV exports). It also tells you that globalization has not really declined over the last several years. The world is even more reliant on Chinese supply today than 5 years ago, before Covid.

The problem is that China’s policies impact trade partners in a “beggar-thy-neighbor” way. Chinese over-production leads to a collapse in price, threatening profits for companies abroad, let alone the manufacturing industry in other countries. Global manufacturing may remain in a funk due to Chinese overcapacity, along with continued subsidies for the Chinese industrial sector. And manufacturing-dependent economies in particular will continue to struggle. A good example of this is happening now with the German auto industry.

Focus On the Big Picture

Manufacturing is not a big part of the US economy. But China could be coming for US tech now. DeepSeek’s advances shows that China’s advancement is a threat to US technology companies. And tech is an important industry for the US, not least because it matters for the stock market (more so because of current levels of concentration), and household balance sheets which have strengthened partly on the back of stock market gains (as we wrote in our Outlook 2025).

But US companies are not out of the game. Not by a longshot. As I mentioned earlier, you’d still rather have more chips than less. And the closed nature of US companies means we don’t know the extent of their AI advances. OpenAI and Google may not have released their “latest and greatest” models to the public. Famed venture capital investor Marc Andreeson noted on X that DeepSeek-R1 is AI’s Sputnik moment. I disagree. When the Russians launched Sputnik in 1957 (earth’s first orbiting artificial satellite), America was well behind the curve. But it caught up in a year (launching Explorer 1 in 1958). Now, it’s actually the Chinese who appear to have caught up.

A lot of the focus right now is on the winners and losers within the context of DeepSeek’s release. That’s a tough game to play, and thankfully one that we don’t really have to — the market will figure it out. The big picture is that AI is now going to diffuse into the economy much faster, thanks to lower cost. If anything, US companies are likely to ramp up spending on AI even more and recall what I said about one person’s spending being another person’s revenue and profits. That’s ultimately going to be a good thing for the economy, and productivity too. A huge ramp-up in capex can lead to potential problems down the line, but I’ll focus on that another day.

I get the question about “how to invest in AI” all the time. There’s plenty of good managers out there (including at Carson) that focus on that. But the reality is that tech (and tech-adjacent) companies make up a significant portion of the broad S&P 500 index (close to 35-40%). That’s a pretty big bet right there, and the question is whether you want that big of a focused bet, let alone whether you want to add to it.

Even before the DeepSeek news that led to the Monday selloff, there was a good case to be made for diversifying within equities, into areas like mid/small cap stocks and sectors outside tech, to reduce concentration risk. We wrote in our 2025 Outlook that we expect the bull market to broaden out this year based on the fundamentals of the economy and policy opportunities. Our view was that there’s good reason to diversify outside of Tech even prior to this latest news (we’re neutral on tech, not underweight). There’s nothing that’s changed that outlook, and if anything, what’s happened this week has perhaps solidified it.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

7575864-0125-A