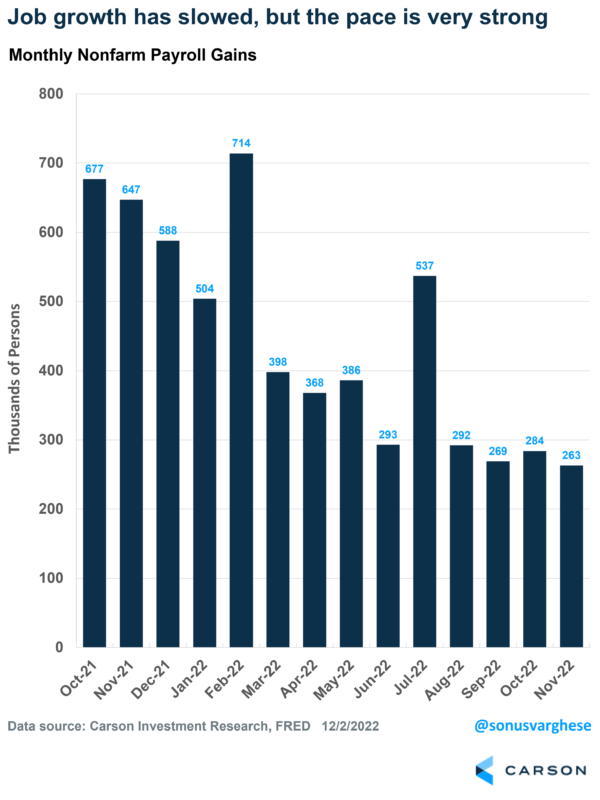

The big headline for the November payroll report was that 263,000 jobs were created last month, well above expectations for a gain of 200,000. Job growth has slowed since the beginning of the year, but make no mistake, this is still a very strong pace of job growth. As Fed Chair Jerome Powell noted in his comments a few days back, they think monthly job gains of 100,000 are required to keep up with population growth. We’ve been well above that recently.

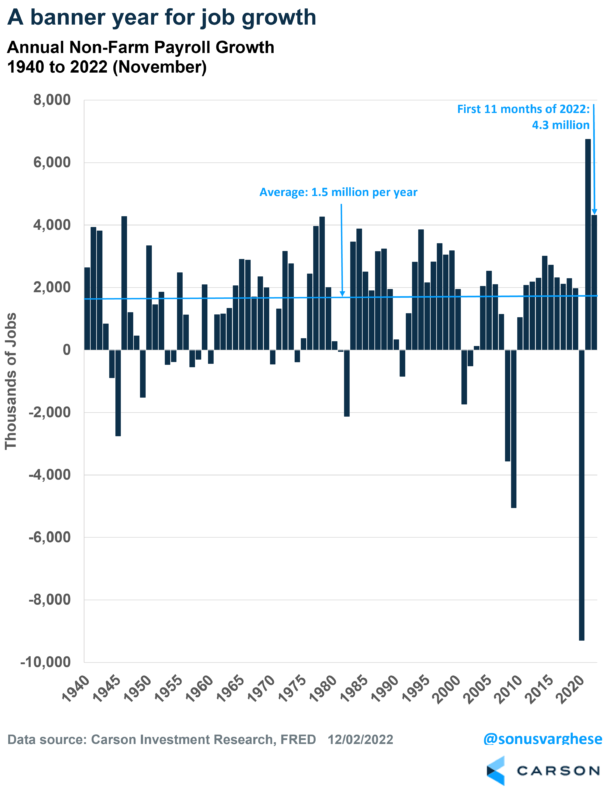

Overall job growth in 2022 totaled a whopping 4.3 million, putting it in line for the 2nd best year for job creation in 83 years (only last year was better). Also, the unemployment rate is currently at 3.7% – close to a record low.

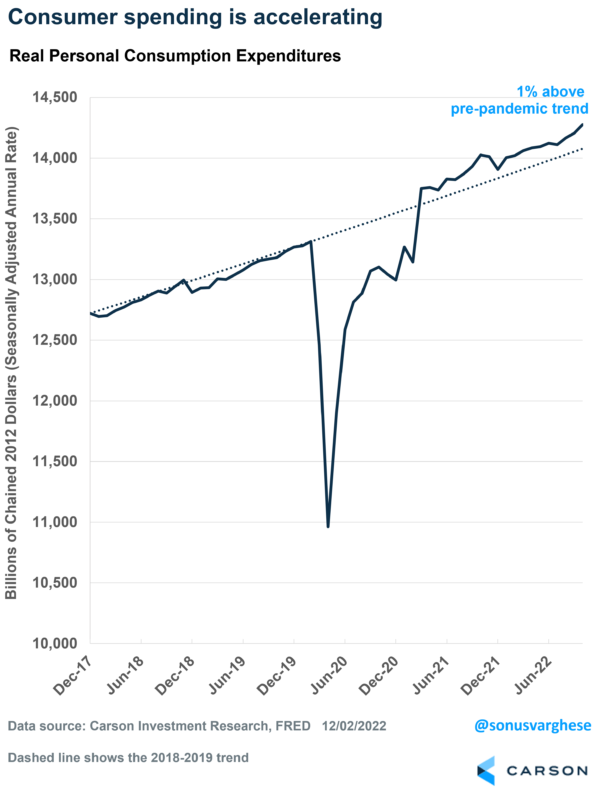

This means it should not be a surprise that consumption is strong. Real personal consumption, i.e., after adjusting for prices, is accelerating once again. A lot of this is on the back of vehicle sales, which are rebounding as production recovers. Keep in mind that consumption makes up about 70% of the economy.

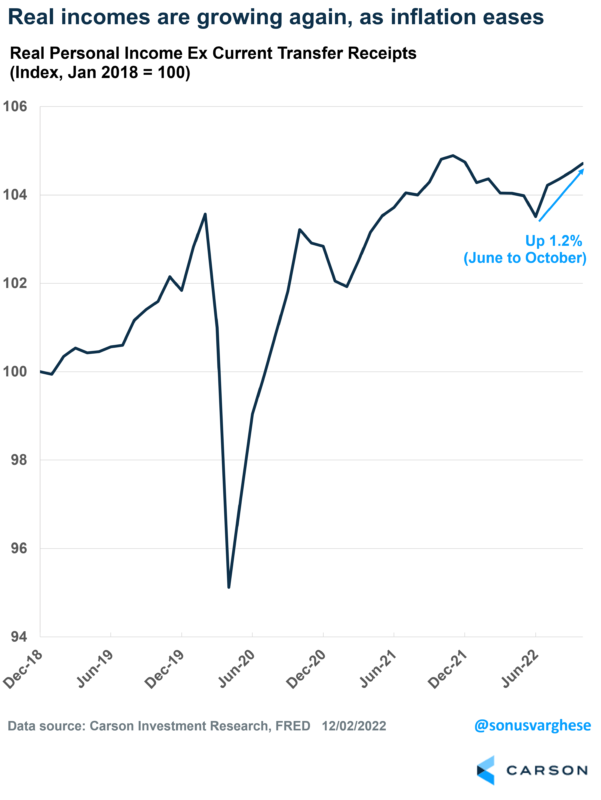

The biggest reason for accelerating consumption is that incomes are rising again after adjusting for prices. Real personal incomes have increased by 1.2% over the five months through October.

In short, inflation is easing; meaning incomes are rising on a real basis, allowing consumers to spend more (and they are). We believe this will continue into 2023 as inflation pulls back even more. Note that consumers still have excess savings from the pandemic – they’ve pulled about $1 trillion out of it over the last year, but that still leaves more than $1 trillion left over.

None of this is what you would expect if the economy is, or was, close to a recession.

Anything to worry about?

Yes, there is—the Fed.

Fed Chair Jerome Powell made important comments in his speech last Wednesday. The headline was that they were going to ease the pace of rate hikes, which is great. Also positive was the fact that they were encouraged by the pullback in goods inflation. He also acknowledged that official rental inflation lags the sharp deceleration in rents that we see in private data (which my colleague Ryan Detrick and I have written about; see here and here).

However, they’re still worried about everything else, i.e., services inflation outside of housing – we’re talking about things like medical care, personal care services, insurance, financial services, education, childcare, etc. These make up about half of core inflation (ex-food and energy). While these categories did see a pullback in October, that’s just one month. The key is that Powell and company believe these will ultimately be dependent on the labor market, especially wage growth.

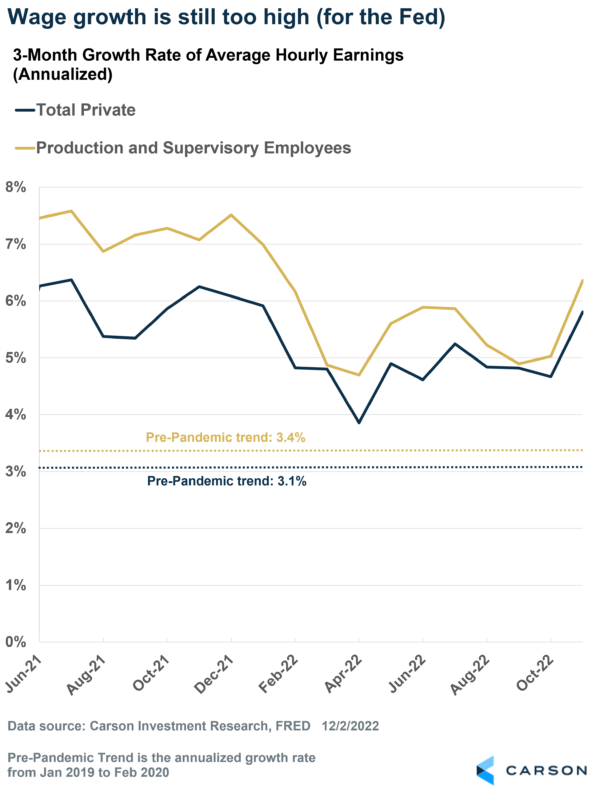

The November payroll report did not have great news concerning this. Wage growth accelerated, rising 0.6% for all private workers (versus the expected 0.3%) and 0.7% for non-managerial employees (who tend to spend relatively more of their incomes). On a 3-month annualized basis, hourly wages are running at an annualized pace of 5.8% for all private workers and 6.4% for non-managerial workers. These are well above pre-pandemic averages, which is probably where the Fed would like it to be.

I do want to note that wage growth by itself is a good thing. It’s just that the Fed believes stronger wage growth will keep upward pressure on inflation. Color me a little skeptical about this, especially given all the other data we’re seeing. But it doesn’t matter what I think. We need to follow their framework, which means there is still a risk that the Fed overtightens and pushes the economy into a recession.

Our base case is that the economy is strong enough to handle the aggressive rate hikes for now. All the data that came out this week confirms the likelihood of that. Plus, it looks like the Fed is going to slow down the pace of rate increases. This is important because it buys time for inflation to ease even more, hopefully convincing the Fed to back off in early 2023. Markets may be sniffing out this bullish possibility, as Ryan discussed in his latest blog.