Executive Summary

- 2023 S&P EPS estimates are falling (now $222), but stocks have added to YTD gains

- Don’t forget that stocks have been anticipating a slowdown since early 2022, when the S&P 500 fell nearly 20% despite a ~6% rise in EPS.

- Two reasons for the rally:

- Most companies have given encouraging 2H outlooks, allowing investors to “look through” disappointing first half-of-the-year forecasts, marking a possible floor.

- Fed Chair Powell seemed less focused on “pain” as inflation eases.

After a volatile and challenging year, equity investors have been looking for clues regarding the slowdown stocks began anticipating last year and how severe it will be. Sure, we get regular economic data, surveys, Fed meetings, etc., which Carson’s Global Macro Strategist Sonu Varghese and Chief Market Strategist Ryan Detrick digested and put into great context. However, nothing beats hard P&L numbers, management commentary, and corporate forecasts (at least for us stock geeks).

The anticipation was worse than the reality

Is “the waiting” over? According to our 5th Principal, it’s never that simple. However, we did get some clarity, which was much needed after imaginations ran wild in 2022 regarding how severe things could get. The reality is that most companies are seeing a notable slowdown in the first half of 2023 but see second-half improvements. This helps establish a possible earnings floor and lowers the chance of a “crash” scenario. This, coupled with easing rates, helped fuel the rally in higher beta names where investors questioned their ability to survive such conditions.

More than a “bear market” rally?

As the saying goes, “don’t listen to what people say; watch what they do.” Unlike in 2022, investors began this new year by buying stocks, even on so-called “misses.” According to FactSet, 82% of S&P 500 companies that issued guidance for the coming quarter gave a negative forecast, which is well above the 5-year average of 59%. In other words, stocks had every reason to sell off, but they rallied. As a result, there has been a notable change in investor sentiment that we have not seen in over a year.

Lowered expectations set up nicely for the 1st half of the year, but the second half needs to deliver

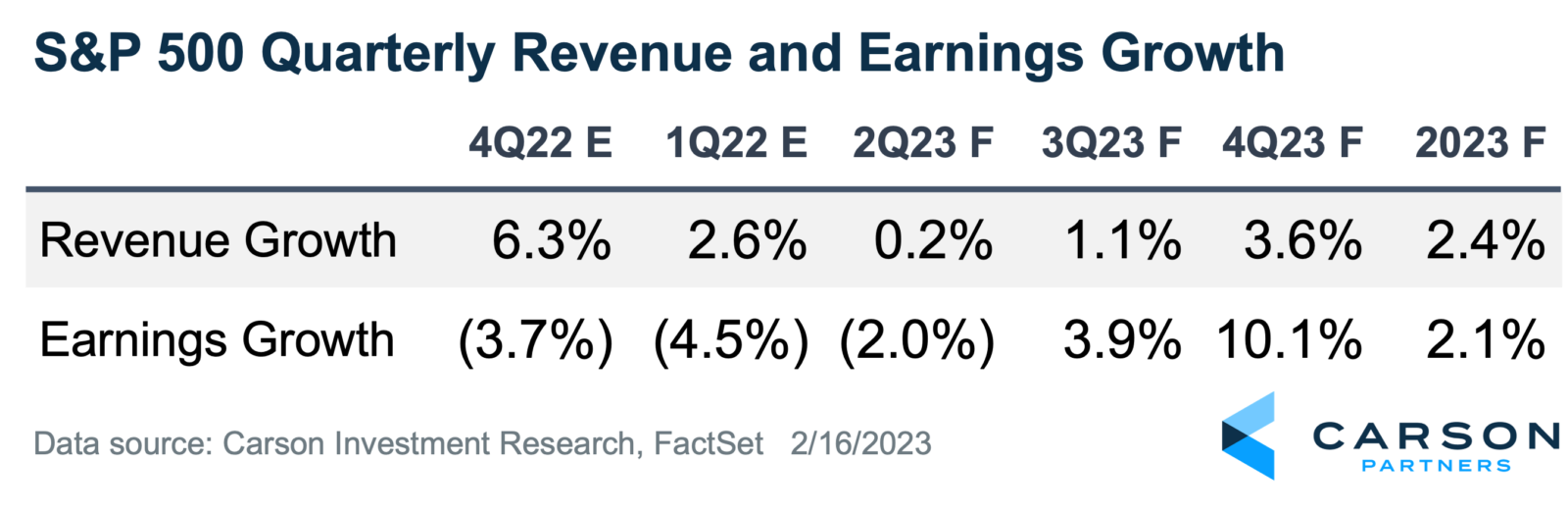

Earnings expectations have fallen meaningfully, especially during the first half of 2023. We see this being both positive and negative. First, lowered expectations set up for a potential “beat and raise” period for a good chunk of the year. However, the second-half ramp we highlighted in our earnings preview has become steeper. This is especially true for Q4, where consensus expects a 10% EPS rise, albeit against a more straightforward comparison to last year’s ~4% decline that was just reported.

That said, we wouldn’t be surprised if corporate forecasts are too conservative, especially in the first half It would be natural for management teams to give cautious guidance in the face of so much macro uncertainty. They read and hear the same things as all of us. Plus, there’s no better way to establish yourself as a “good CEO” than a string of beat-and-raises on a sandbagged outlook.

“Offensive” sectors outperform “defensive”

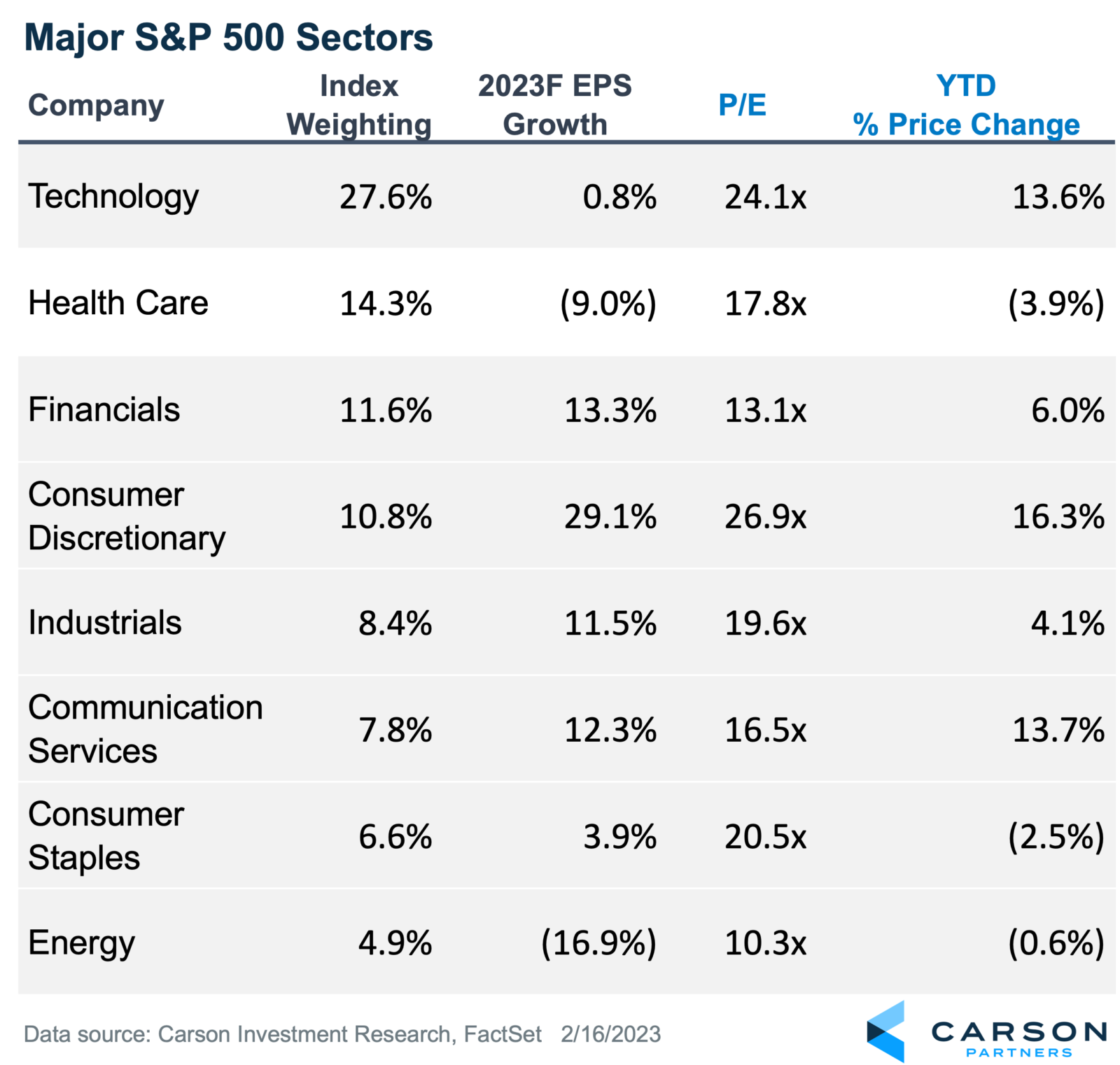

The sectors that struggled last year (tech, communications, discretionary) are off to a strong start. This is another noteworthy difference compared to last year, which makes us think that this could be more than just another bear market rally. Meanwhile, defensive/low beta sectors like health care and staples are lagging behind.

What’s with the Tom Petty obsession?

It’s not just Tom Petty. We love music. It is soothing, inspiring, and uniting, among many other things. It also improves memory. There are many songs that take us back in time, helping us remember where we were and how we felt. This is the goal of selecting a theme song for our quarterly earnings coverage. By combining our passion for markets and music, we not only look to capture investor sentiment through the voice and melody of great musicians but also to help us remember these periods of time. Hopefully, we have some fun in the process, and we look forward to building a playlist as the year progresses.