While in the short run any number of variables can and do move stock prices, over the long run, corporate earnings drive returns. The price investors pay for that stream of earnings is equally as important. While value is generally not a reliable short-term timing indicator, valuations can inform secular viewpoints toward various asset classes. Markets also go through periods of time where investors ignore valuations completely, which can lead to significant unwinds of those overvalued stocks in the future. We have seen this happen in real-time, as the strong rally in late 2020 into 2021 of unprofitable and overvalued stocks came to a firm halt as soon as interest rates began to rise. 2022 was a great reminder that valuations still matter.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

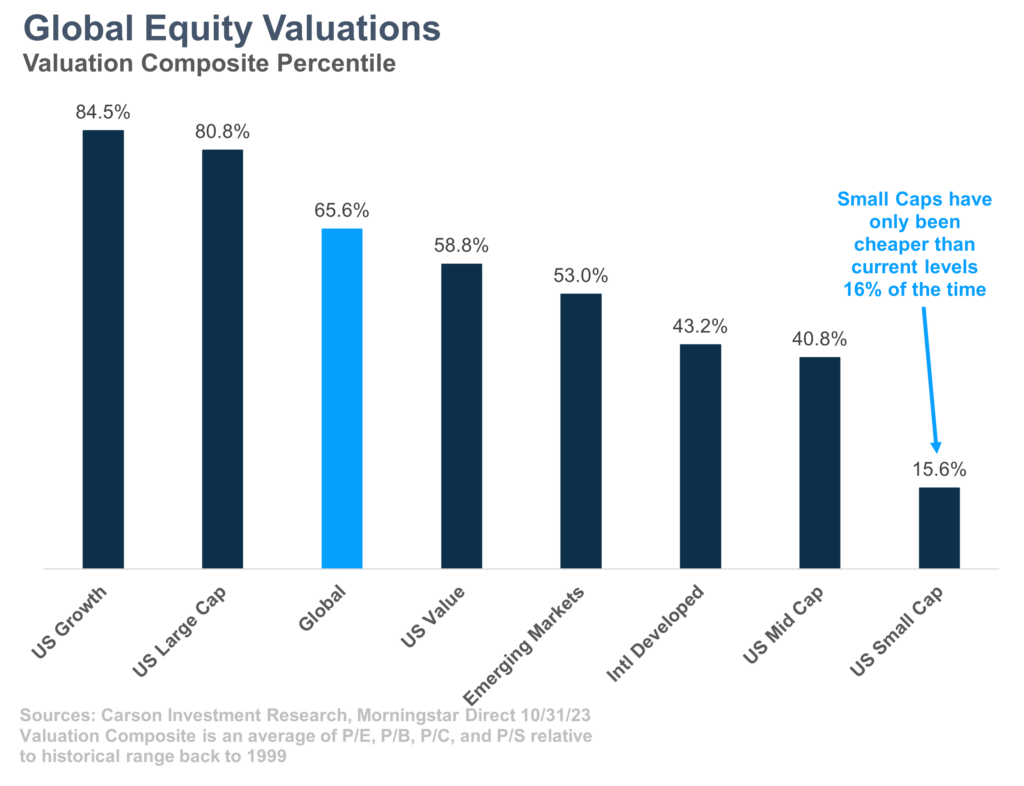

Despite a strong rebound in stock prices in 2023, there remain pockets of attractive valuations across the global universe. We use a combination of different valuation multiples to get a proper read of current levels and to not be overly impacted by various situations that could skew valuations one way or another. The chart below shows the current percentile value of this composite for major equity markets versus the past 25 years (lower values indicate more attractive valuations). By this measure, US mid-cap and small-cap stocks are trading at significantly below-average levels, as well as developed international markets. The strongest performers in recent years, US large cap and especially large cap growth, remain at elevated valuations relative to history. Domestic large cap stocks trade at a premium to the rest of the world and deservingly so, but even relative to the size of that premium historically, they are trading above average.

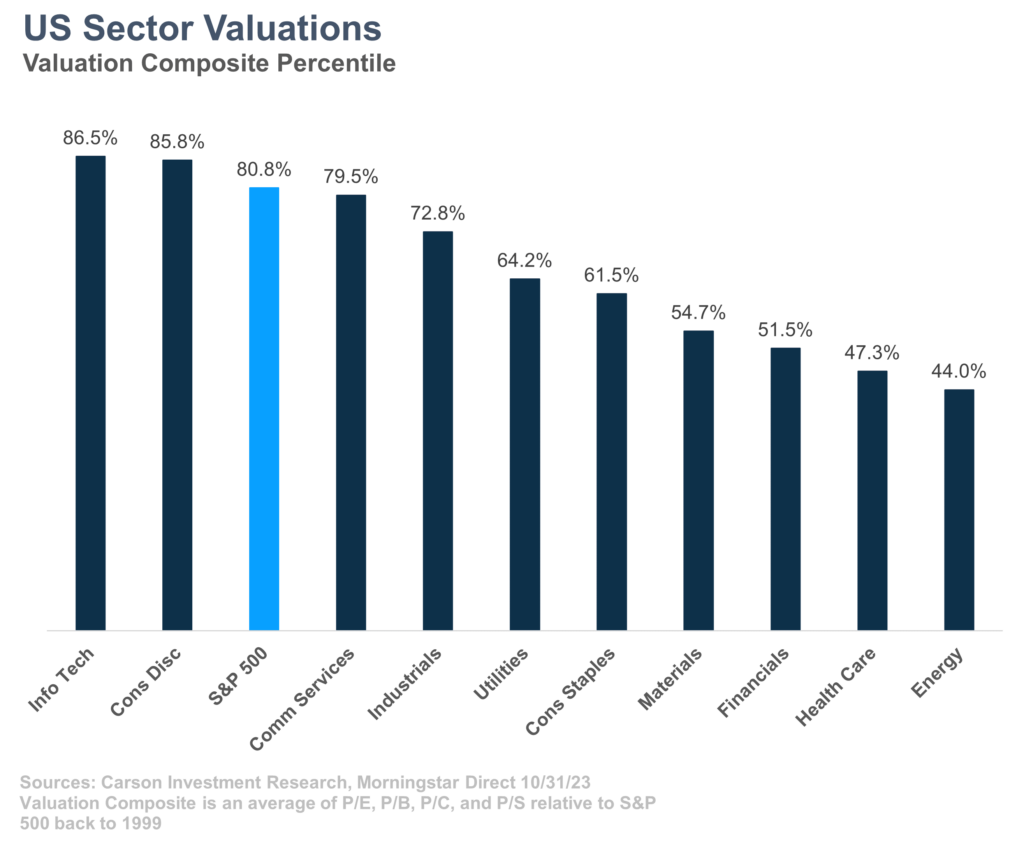

When looking at domestic sectors using the same framework, we see a bifurcated market. The ‘magnificent seven’ hold large weights across technology, consumer discretionary, and communications services, all of which are richly valued relative to their history. Energy – despite being the strongest performing sector the past 3 years – remains the most undervalued, as fundamentals have kept up with performance. Many defensive sectors are near their historical average levels. Financials trade at depressed valuations after the banking crisis in early 2023. As those headwinds fade and the interest rate environment changes, the financial sector could prove to be an attractive opportunity.

Valuations continue to be a consideration for asset allocation opportunities and are part of the mosaic of indicators and factors that go into our decision-making process.

2001559-1123-A