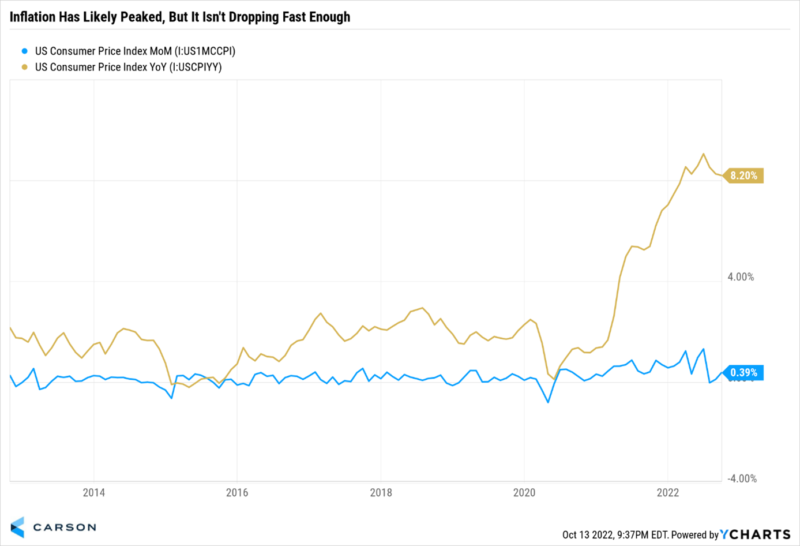

Another inflation report and more signs that inflation is staying stubbornly high. The September Consumer Price Index (CPI) rose 0.4% month-over-month, well above the 0.2% that was expected and above 0.1% last month, while the year-over-year number was 8.2%, down slightly from last month’s 8.3%.

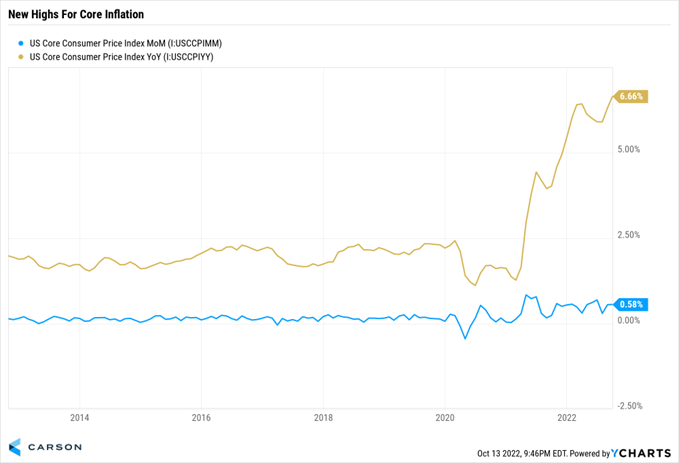

Meanwhile, core CPI (ex-food and energy) soared a huge 0.6% from last month versus the 0.4% expected. The year-over-year increase was a fresh 40-year high of 6.7%, up from 6.3% last month. That 6.7% is actually rounded from 6.66%, yet another ‘you can’t make this up from 2022’ statistic.

What does it all mean? Well, for starters, it gives the Federal Reserve plenty of room to continue the aggressive rate-hiking regime. It nearly cemented a fourth consecutive 75 basis point hike in November, with Fed funds futures putting a 97% probability of that now happening, up from 81% at the start of the day. But the bigger move was the likelihood of another 75 basis point hike in December, now up to 62% from 33%.

Following the lead from the producer inflation we saw earlier in the week, the services sector was much of the reason for the high inflation number, as shelter was one of the biggest drivers, along with large increases in medical care and medical and vehicle insurance. Services ex-energy were up 0.8%, the largest increase in 40 years. Think about it, during the pandemic, everyone bought goods and little services (no one was flying around and buying hotels), but now things are shifting to services. This logically makes total sense, but it is just the numbers are still higher than anyone wants.

Shelter makes up about 40% of the core inflation basket, so this is a very big deal when it runs hot and it held steady at 0.7% month-over-month, while owners’ equivalent rent was up 0.7% month-over-month, the highest since July 1990. Of course, shelter makes up only about 17% of the core PCE deflator (the Fed’s favorite measure of inflation), so this shouldn’t impact that nearly as much when that important data is released.

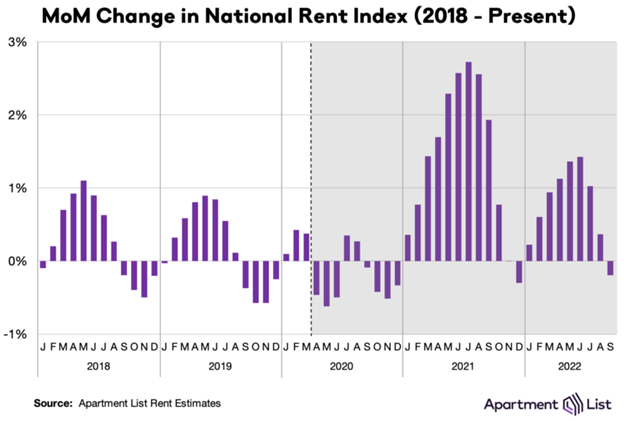

Rental prices jumped 7.2% over the past year, the largest annual increase since 1982 as well. Month-over-month saw rents up 0.8%, after a string of 0.6% to 0.7% prints. The catch is we’ve seen some private measures of rents slowing down considerably, with the Apartment List national rent report showing a 0.2% drop in prices in September for the first time this year. How can this be? The government says one thing, but private measures say another? I’m not saying we shouldn’t trust the government but it does remind me of the 10 most dangerous words according to President Ronald Reagan, “Hi, I’m from the government and I’m here to help.”

Well, the truth is the government looks at both existing and new leases, while private indices consider just new leases. Also, for the official data, rental units are sampled only every six months (given rents aren’t re-negotiated very often). For this reason, we expect CPI rental measurements to lag private indices by about 8-12 months. For more on this concept, read what Sonu Varghese wrote here. The bottom line is rents were bad, but maybe they aren’t as bad as they seem. Think of rents like my 2-3 Cincinnati Bengals.

Some other positives are data from Zillow showed that rent prices rose 0.3% in September, versus a 1.6% gain in September last year. While a report from Realtor.com showed that nationwide median rental prices in 50 large metro areas grew at the slowest pace in 16 months in September. Again, not the story the government data is showing us.

Turning back to the services sector, medical care services jumped 1.0% month-over-month, for the largest jump since February 1984, with much of this coming from the huge 2.1% jump in health insurance. Health insurance is up a stunning 28.2% over the past year. Without getting into all the details, though, the jump in health insurance is more due to methodology. CPI captures healthcare prices by looking at the change in profit margins at health insurers. It is only done once a year, though, around September/October, so the data will have a massive lag, and we expect October to see a large drop that should continue over the coming months.

One other services component worth discussing is airline fares, which jumped 0.8% month-over-month, somewhat surprising given the drop in fuel prices. But as someone who flies often, maybe it isn’t that surprising, as every flight is just packed and nearly every time, they are begging people to take a credit and make room on an overbooked flight.

Some bright spots (and we use that lightly), goods categories continued to slow, with energy down 2.1%, but that wasn’t as much as the last two months’ drops of 4.6% and 5.0%. Used cars managed to fall 1.1%, but not as much as expected. Similar to other reports, private surveys of used car prices have dropped much more than the government reports. Lastly, apparel prices sank 0.3%, but like used cars, this still wasn’t as large of a drop as most expected.

We remain optimistic that inflation has peaked and should start to come back down quicker, especially core inflation. Time to delivery, prices paid, most commodities, rents (using private surveys), used cars (using private surveys), and shipping costs all suggest that the supply chain/higher prices we’ve been dealing with are indeed improving. We’ll be the first to admit that inflation has stayed higher than we expected, but all hope isn’t lost.

Lastly, on the news that stocks staged a historic reversal. Wouldn’t it be something if this was the washout low and end to the bear market? No one knows, but we do know that 3,500 is a 50% retracement of the entire bull market for the S&P 500, and stocks found some aggressive buyers around there, closing more than 5% off the lows. Coupled with fewer stocks making new 52-week lows now than in the June lows and there are clues of potential strength under the surface, with not as many stocks breaking down to new lows along with the indices.

Be sure to subscribe to the Facts Vs. Fiction podcast with Sonu Varghese and myself, as we discuss all of these things and more each week. Listen to our latest episode here.