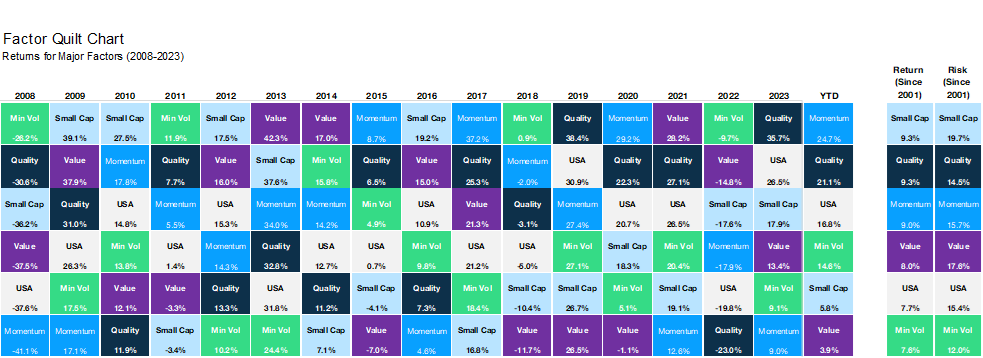

Investment factors are characteristics of securities that explain their risk and return profiles over time. Factors such as value (buying inexpensive stocks), momentum (systematically owning recent outperformers), quality (high margin, low debt, high return on capital businesses), minimum/low volatility (stocks exhibiting lower beta or standard deviation), and size (small caps- lower market cap stocks), have historically been rewarded over time. These factors have outperformed the broader market-cap weighted index through various cycles, as you can see in the chart below. There has been a spread of more than 15% on an annual basis between the best and worst performing factor, and the best performing factor on a given year has outperformed the parent index by nearly 9%. With this kind of dispersion, harnessing the power of factor investing has been a long-sought after objective of many investors, and a long-standing approach to investing at Carson.

Sources: Carson Investment Research, Morningstar, MSCI 8/19/2024

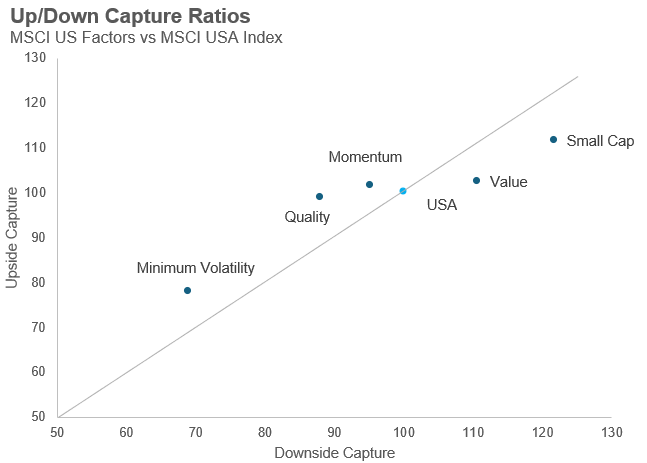

Factors can generally be thought of in two ways – return enhancing or risk reducing. Occasionally, a certain factor can represent both, but that may not be a lasting or reliable situation. The chart below looks at one way to display this characteristic. On the left-hand side we have upside capture, measured by the degree to which each factor outperforms the parent index (MSCI USA) when it is positive on a monthly basis going back 20 years. The opposite is true for downside capture. As you can see, factors such as value and small cap fit clearly in the return-enhancing camp, and quality and minimum volatility fall more into the risk-reducing camp. Momentum can behave like any of these other factors depending on what is working and what the environment looks like.

Sources: Morningstar, MSCI 20-year period ending 7/31/2024

We provide a number of strategies that take advantage of the risk premiums provided by factors. These can be categorized in a couple different ways as it pertains to our investment platform:

-

Single Factor ETFs

There are a number of ETFs that target a single factor, and many are passively managed. They are not all created equally, however. Index construction becomes very important. For example, some momentum indices rebalance semi-annually, while others rebalance quarterly, and they may even stagger the portions of their holdings that are rebalanced. This can create meaningful performance differences based on when the last rebalance occurs – especially when we see rapid rotation in the market like we have in the past month. This is one major reason why we tend to allocate to multiple complementary ETFs within our Mission Asset Class strategies.

-

Multi-Factor Stock Strategies

We utilize two different multi-factor stock strategies at Carson. One focuses on a lower risk profile (QBI) and the other (FEI) focuses on balanced risk across factors. Stocks are looked at on a bottom-up basis, where each stock is evaluated for its combined factor exposures to create the ideal ending portfolio. If you are a Carson Partner, be sure to check out the latest mid-year review for factor strategies on the content hub.

-

Multi-factor ETFs

We also have added several multi-factor ETFs to our offering. In many ways, these can be looked at as a replacement for an active manager within an asset class. One of the more prevalent approaches in the industry has been to tilt towards value, smaller stocks, and higher profitability. Rather than being index-based, this approach (utilized by Dimensional and Avantis) is actively managed, yet still systematic. This allows firms to run their process every single day and make adjustments as needed instead of relying on an index provider and a quarterly rebalance to make changes.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

So far this year, momentum and quality have led the way in factors, while small caps and value have lagged – even lagging minimum volatility. The strength in the largest stocks, Nvidia in particular, has propelled momentum and quality-based indices higher. Since early July there has been rotation in the market and the largest drawdown of the year so far. Through this volatility – not unsurprising – minimum volatility has outperformed all other factors by the tune of 4%+. Minimum volatility strategies generally focus on the lowest risk stocks and also lowest risk overall portfolio while keeping sector weights within designed bands, low volatility on the other hand seeks out the lowest volatility stocks regardless of sector concentration. Low volatility has performed even better during this period. Momentum fell the most during the recent downturn but is also recovering quickly from the lows a few weeks ago.

As you can see, factors are very important tools for investors to use to allocate portfolios as well as measure portfolio risks. Even most fundamental active managers today want to understand where their factor exposures lie in order to better manage portfolio risk. As such, factors are very important in our risk management and portfolio construction process, as well as how we are thinking about our ETF platform. Please reach out with any questions on factor strategies or ETFs and the best ways to use them in portfolios.

For more content by Grant Engelbart, VP, Investment Strategist click here.

02377672-0824-A