Super Micro Computer may have flown under the radar a year ago, but it has since captured headlines with a staggering 1,000%+ rally and inclusion in the S&P 500. Surpassing even Nvidia, the top performer in the S&P 500 with a 250% surge over the past 12 months, Super Micro’s meteoric rise underscores its emergence as an AI darling. With its market capitalization skyrocketing from $6 billion to $60 billion amid the rally, its presence in the index is a natural fit. For now, shares will also remain in the Russell 2000 Index, even though its size dwarfs every other company in the small cap space.

In a reflection of the narrative witnessed over the past year, Zions Bancorporation will be removed from the index to accommodate Super Micro. Zion’s shares have lost nearly half of their value since 2022 as regional banks struggled to adapt to higher interest rates. Ironically, with a market cap of roughly $6 billion, Zions will move aside to make space for the enabler of artificial intelligence, Super Micro.

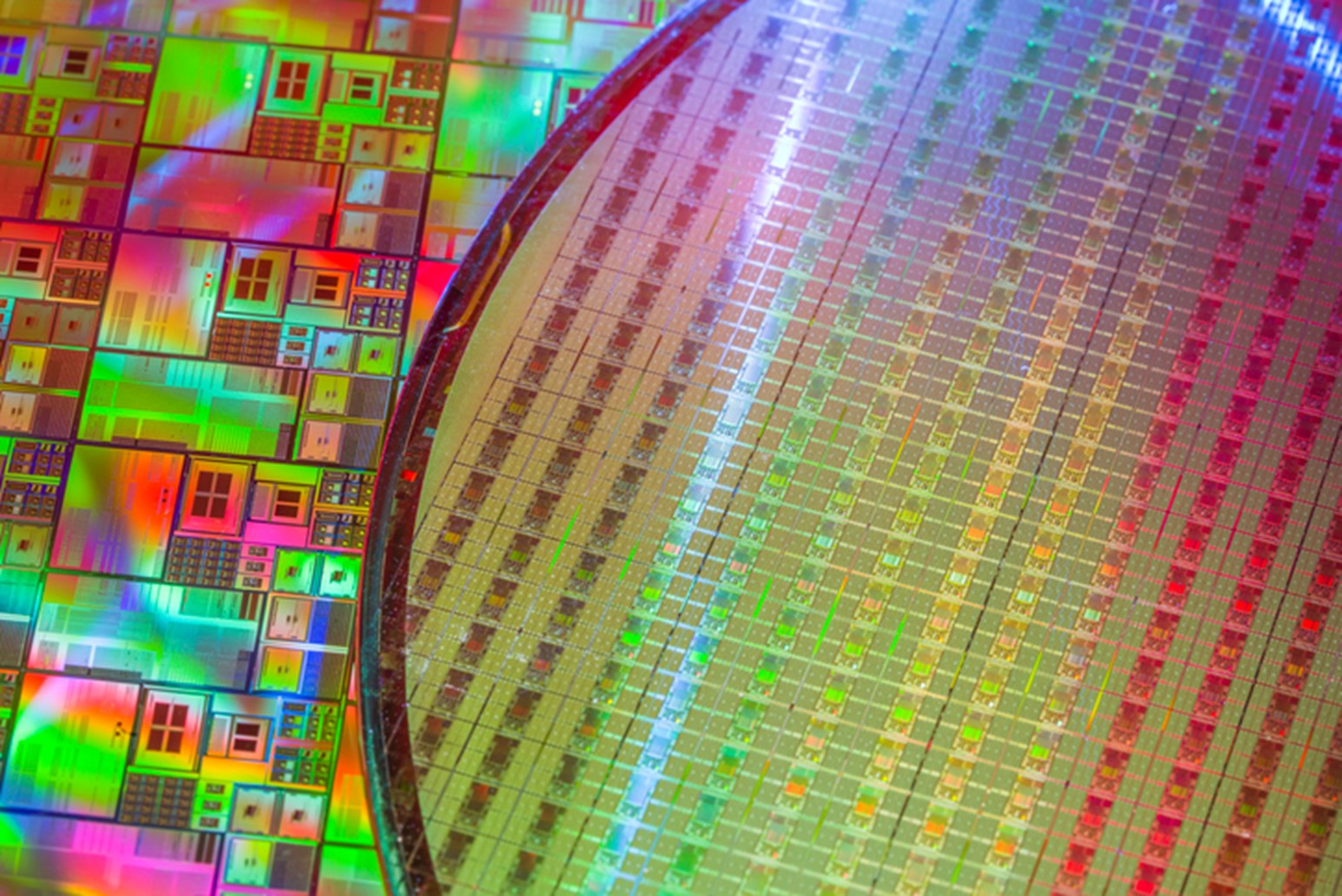

Super Micro serves as a one-stop shop for those seeking AI hardware. It offers high-end servers and hardware solutions crucial for building AI infrastructure, particularly hardware from Nvidia. Established in Silicon Valley in 1993, alongside Nvidia, Super Micro boasts a longstanding partnership predating the recent surge in AI-related investments. Customers opt for Nvidia’s chips via Super Micro because it provides complete systems, inclusive of networking, connectivity, and cooling components, that are optimized and integrated for AI. With claims of nearly 50% greater efficiency than competitors like Dell and Hewlett Packard, demand for Super Micro’s integrated systems is insatiable. Riding the coattails of Nvidia is not a bad plan, especially given demand for AI-related hardware solutions are accelerating.

The impressive rally in the stock is underpinned, somewhat, by rapidly growing fundamentals. Super Micro’s earnings should soar to $22 per share this year, up materially from the $2.48 they reported just two years ago. I typically eschew companies that assemble third-party hardware because they operate with tight margins and are even more susceptible to shifts in inventory than the hardware producers themselves. With only a 15% gross margin, Super Micro’s profitability is relatively modest. However, when sales balloon, even a modest margin can yield substantial returns. As long as the company can maintain an efficiency edge over its rivals, who also have access to Nvidia’s chips for system assembly, it should continue to reap the rewards of the AI infrastructure buildout.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

While investors are captivated by exceptional stories like the meteoric rise of Super Micro, it’s essential to recognize the broader trend of Artificial Intelligence shaping businesses globally. From agriculture to insurance, industries are leveraging AI to enhance efficiency, with its prevalence expected to become even more widespread in the coming years. While it may seem like you’ve missed the boat on opportunities like Super Micro, the emergence of AI is nascent and represents a significant tailwind for stocks and economies in the long term.

For more content by Jake Bleicher, Portfolio Manager click here.

02150678-0324-A