We are now within four weeks of election day, although early voting is already taking place in an increasing number of states. My colleague Sonu Varghese provided an excellent update on the election Tuesday. If you read it, you’ll notice it’s called Part 1. Watch for Part 2 next Tuesday.

One of our top market takeaways in our election commentary has been don’t let your political views shape your market views. It’s not a popular take. People across the political spectrum really seem to want the election outcome to have a meaningful impact on markets, even if their interpretation of what that would be differs. There are in fact ways the election matters, but it’s easy to get carried away. (See the always insightful Ryan Detrick’s “16 Charts (and Tables) to Know This Election Year” to get some of that history.)

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

It’s not that policy doesn’t matter to markets or to the health of the economy. It’s just that policy is often dominated by larger economic forces or simple business fundamentals, and markets price in what policy effects there are at a pace that can be quite different from what many investors expect.

The 2016 Case Study: Donald Trump’s Election Win

Donald Trump’s 2016 election win makes a nice case study in the market response to elections. The initial immediate market reaction was probably a purer representation of Trump’s policy impact than we usually get following elections. There are a couple of reasons for this. First, the conventional wisdom was that Trump was a meaningful underdog heading into election day, so markets had at least partially priced in a Hilary Clinton win, even if there was still a lot of uncertainty. Second, we knew the results on election night so the market could respond relatively quickly. Major press outlets called the election at about 2:30 am ET on Wednesday, November 9. At 2:35 am, Clinton called Trump to concede the election. Trump than gave a brief victory speech that was among his most gracious and pragmatic.

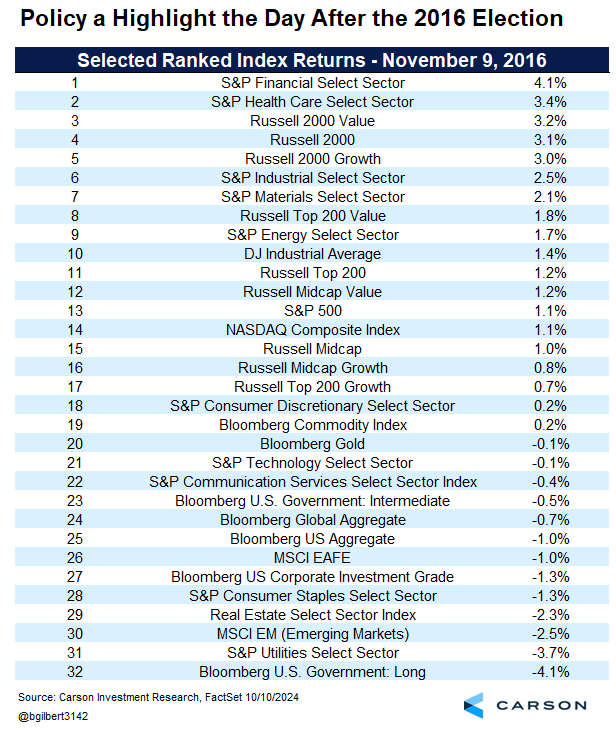

Given the quick outcome and reversal of expectations, markets arguably exhibited a relatively pure Trump policy response on the day after the election. After an initially reactive overnight response where S&P 500 futures fell over 5%, cooler heads prevailed. And it was pretty much what you would expect. Sectors that were likely to benefit most from a shift from a Democratic to Republican regulatory backdrop (energy and especially financials) saw active buying. Economically sensitive areas of the market (small caps, value stocks) outperformed. Yields rose (which means bond prices fell) in anticipation of better growth and potentially higher inflation. If you looked at the top of the individual stock leader board you would also see some standout performance from sub-industries, like for-profit prisons and for-profit education, that were considered Trump-oriented plays at the time.

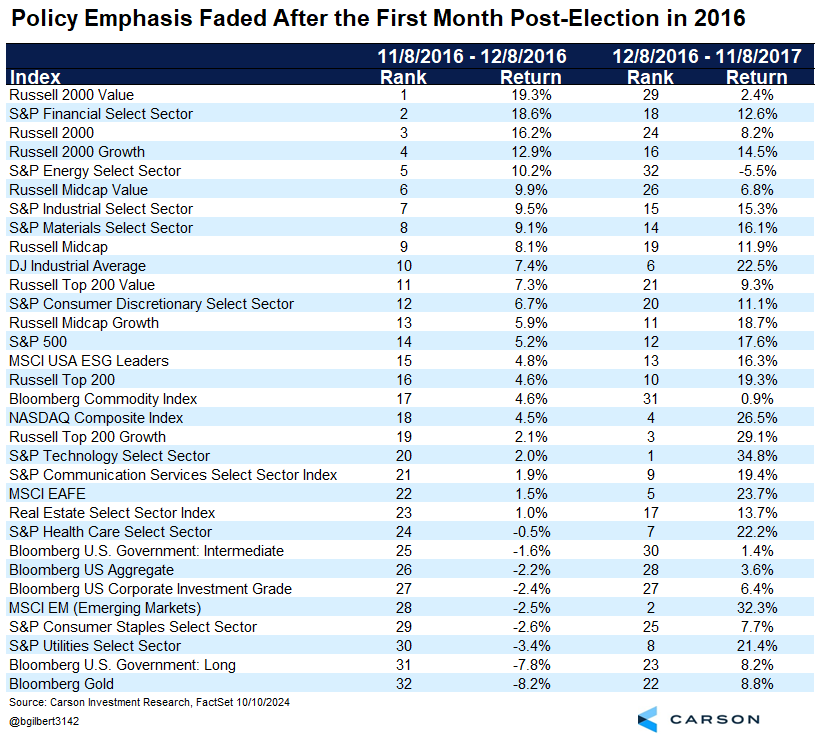

The effect did persist for a while, but as we moved further from election day, it faded and broader economic and market forces came to play a more dominant role. The broader theme in place prior to the election, strength in U.S. technology-oriented large cap stocks, reasserted itself. All this stands out in the chart below, which compares the first month post-election in 2016 with the next 11 months.

Through the Looking Glass: Trump v Biden

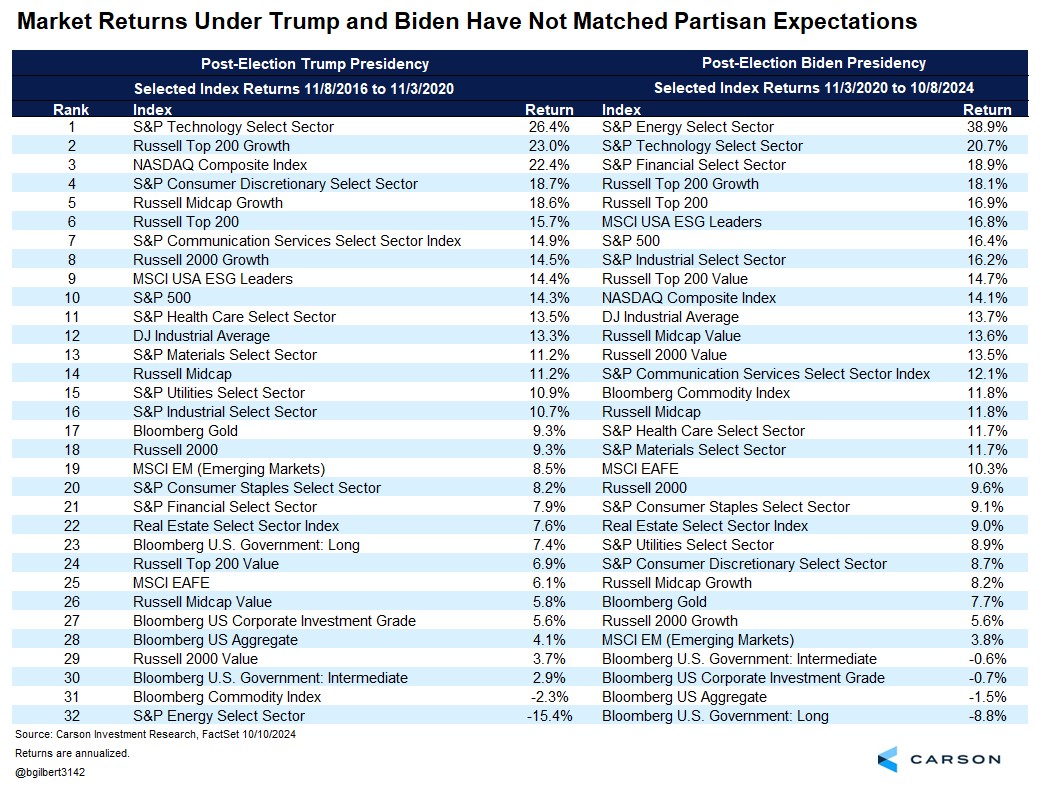

If we want further evidence that larger forces than policy tend to drive markets, we can look at the performance of the same indexes during the Biden administration to date. To keep these parallel, I used election day 2020 as the starting point even though there was a much clearer “Trump effect” immediately post-election in 2016 than a corresponding “Biden effect” in 2020 for the reasons discussed above.

Some observations:

-Markets did well under both presidents.

-The energy sector seemed to love Biden and dislike Trump.

-The financials sector seemed to have a strong preference for Biden.

-Biden was harder on emerging markets.

-Commodities favored Biden.

If you put both these sets of returns in front of an average investor who didn’t know the market history and asked which was Trump and which was Biden, the odds are pretty good they would pick incorrectly. The natural response to the comparison is, “Well, there was a lot more going on.” And I would agree, but that’s really the point. There’s always a lot more going on.

A lot does happen around elections that’s market relevant. It’s just that what most people pay the most attention to, “Who will win the White House?”, isn’t high on the list. As always, it’s important to distinguish the facts from the feelings. Last month Sonu and Ryan had a conversation that did just that. Definitely worth a look.

For more content by Barry Gilbert, VP, Asset Allocation Strategist click here.

2455685-1001-A