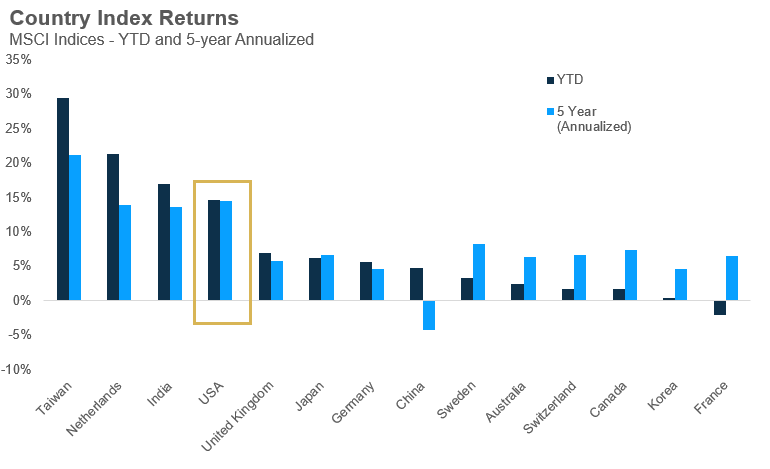

We cover a lot of ground in our 2024 Midyear Outlook, but one area worth diving into more is non-US equities. Over the past 15 years, international stocks have only outperformed the U.S. stock market in 12.5% of rolling 12-month periods, not exactly compelling! This year has not started off any different, with the S&P 500 outperforming broad international stocks by nearly 10% in the first half. International stocks should not be painted with a broad brush, as there are many differences across economies and businesses around the world. Only a limited handful of country stock exchanges have outperformed ours year-to-date – interestingly they have largely done so on the back of the same trend that’s taken over our market here – Artificial Intelligence. Taiwanese stocks, powered by the tech giant Taiwan Semiconductor, and the Netherlands – fueled by semiconductor parts manufacturer ASML – have rocketed up the leaderboard this year. If you think concentration risk in the US market is concerning, both Taiwan Semi and ASML represent more than 25% of their local stock markets (many indices cap the max weight at 25%)! India continues to attract foreign capital as the darling of emerging markets, with continued economic strength and a massive population.

Sources: Morningstar Direct, MSCI 6/30/2024

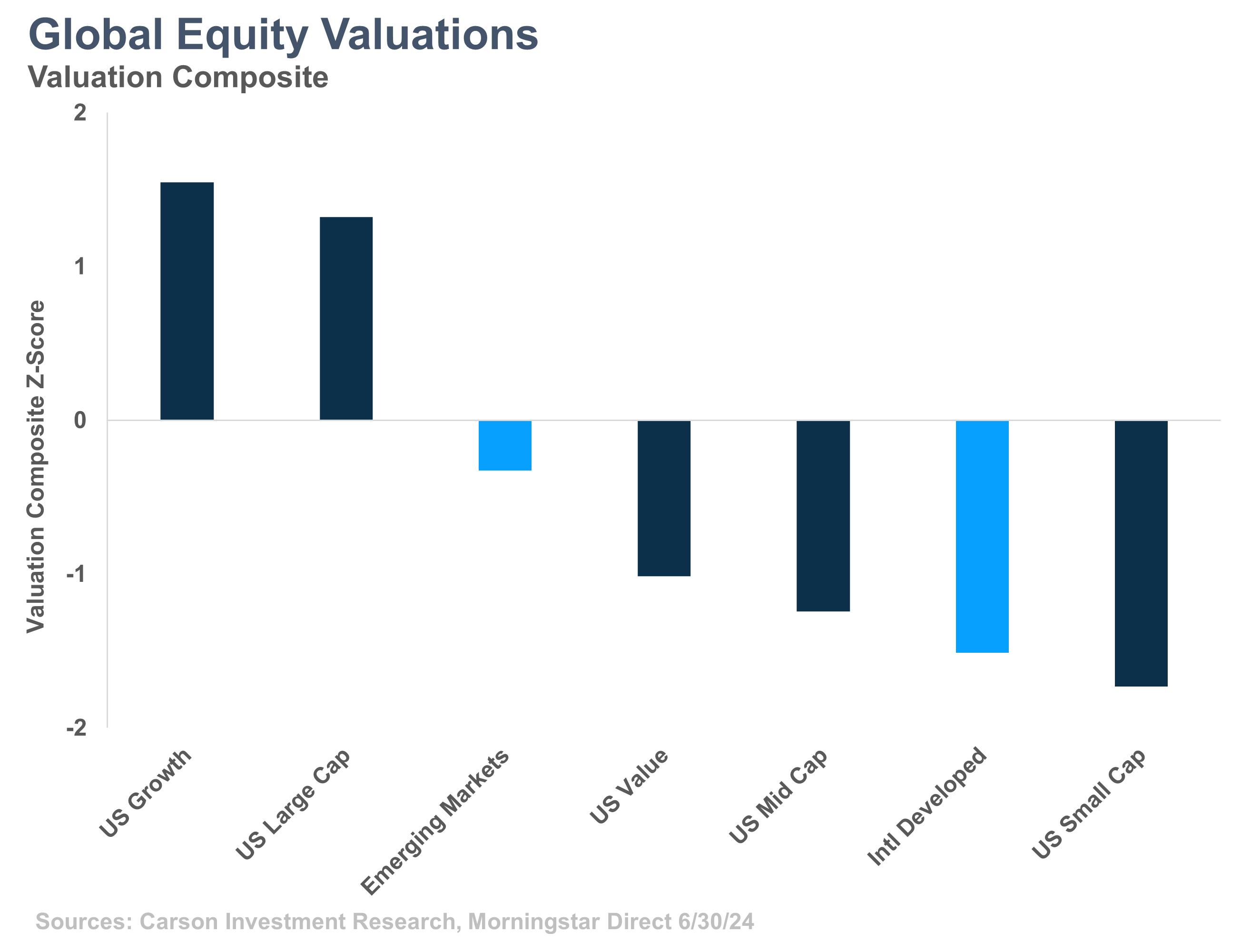

Often cited as one of the stronger cases for investing overseas is the value opportunity. Throughout most of the recent run of lousy international underperformance, overseas equities have traded at lower valuation than those domestically and generally lower than average historical levels. This is further compounded by the complexion of domestic markets becoming more and more tech and growth heavy, further widening the valuation gap. Emerging markets, a historical stalwart in terms of low valuations, no longer trade as cheaply as they have in the past. The emergence of India and outperformance of Taiwanese technology companies has changed many emerging market indices away from the energy, financials, and state-run enterprises of old towards technology and consumer-oriented companies. Despite these index changes, China remains a major part of the asset class and is an area that we remain skeptical of.

Higher or lower valuations are generally warranted for some reason or another. In many ways, the gap between domestic and international valuations can be explained by diverging fundamentals and index concentration. Below we see trailing earnings growth for the S&P 500 and broad international markets. Typically, these lines follow a common pattern of global economic growth but have recently diverged both on a trailing and forward basis. Historically, these earnings growth divergences lead to performance differences (all else equal). The last time international markets outperformed the S&P 500 in a positive year was 2017, where earnings rebounded from declines in 2015-2016.

Source: Factset 6/30/2024

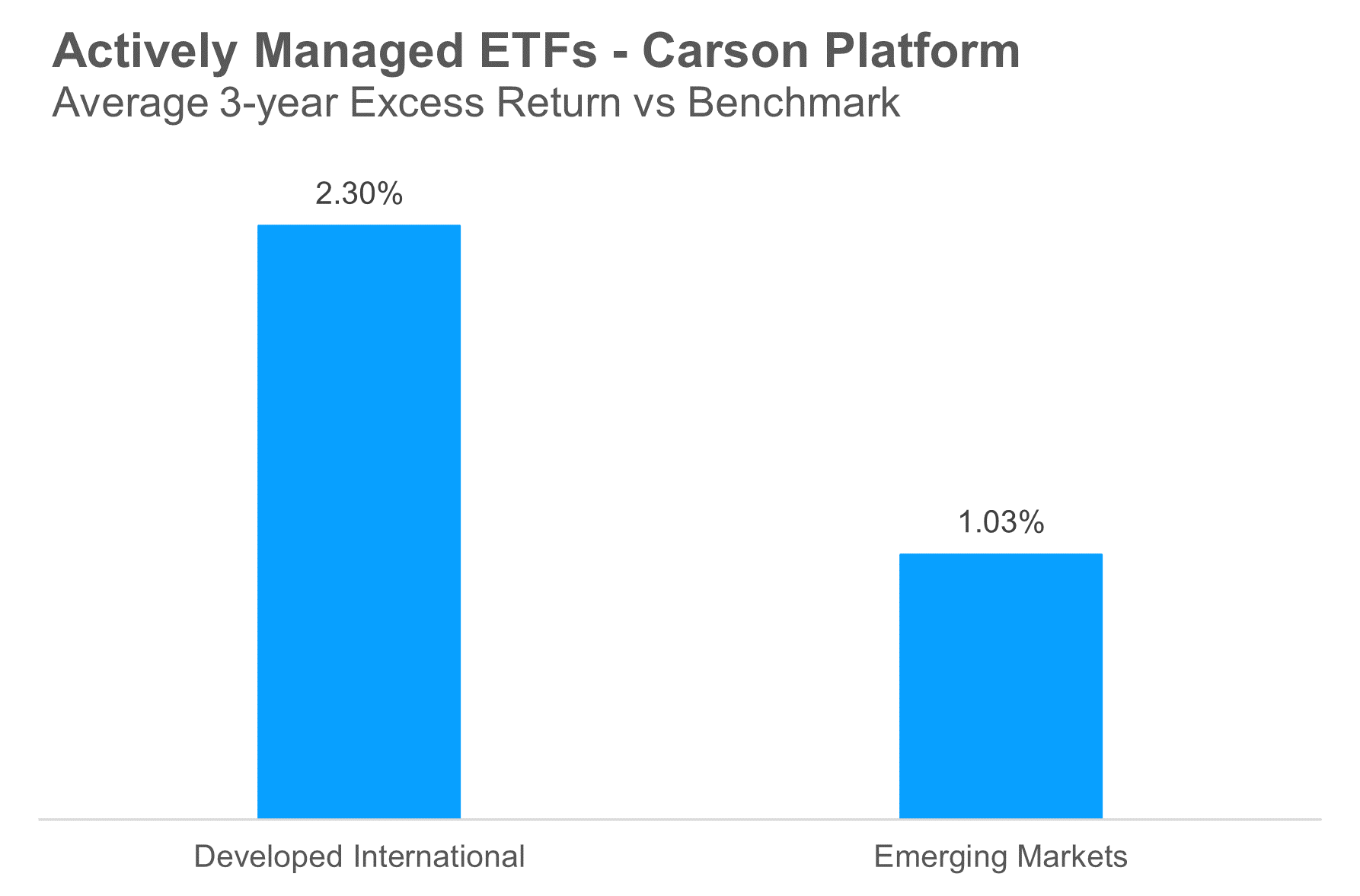

On the positive side, expanding the opportunity set overseas can be beneficial for active managers. More traded securities with different performance drivers and lower analyst coverage can be tailwinds for active managers with the ability to do the bottoms-up analysis necessary. This selectivity is clearly important when looking at the divergence in country level returns on any given year, let alone individual equities. Looking at available active ETFs on the Carson platform with international mandates, all but one ETF has outperformed the product’s respective benchmarks on a 3-year basis, and all have outperformed on a 5-year basis to the extent they have history. The degree of outperformance is also striking, averaging more than 2% in developed markets. This additional alpha can be important to portfolios whether you foresee a rebound in international markets or not.

Source: Carson Investment Research, Morningstar 6/30/2024

Mean reversion can be a powerful force over the long-run, and while a contrarian take can sometimes be tempting, using a mosaic of signals in a tested process is always the best course of action. We do this by measuring global economic strength using our proprietary leading economic indicator, analyzing fundamentals of companies and countries, studying the technical trend for signs of change, tracking the policy backdrop both fiscally and monetarily, and reviewing how investors are valuing various segments of the market. For now, the case to overweight international markets is not compelling enough on a trend change alone, but worth a watchful eye as the Fed begins to ease monetary policy.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For more content by Grant Engelbart, VP, Investment Strategist click here.

02323562-0724-A