Most risky assets have had a volatile stretch since the Silicon Valley Bank crisis began. The S&P 500 Index has recovered but is still down about 0.5% between March 8th (the day prior to the crisis unfolding) and March 28th. In a welcome change from last year, bonds have zigged while stocks zagged, with the Bloomberg Aggregate Bond index rising about 1.4%.

But one asset has outperformed during this period: Gold, which rose 8.1% over the same period.

Gold as a crisis hedge

The last 20 days were a period when fears of an economic crisis rose. Economic growth expectations fell, and as we wrote last week, even the Federal Reserve (Fed) acknowledged that they may not have to do as much as they originally expected to slow inflation. Instead, a potential credit crunch is expected to substitute for rate hikes.

As a result, interest rates fell (which is why bond prices rose), and importantly for gold, “real” interest rates fell.

Real interest rates = Nominal interest rates – Expected Inflation

Typically, real interest rates fall when economic growth falters, and investors expect the Fed to cut rates. And over the past 20 days, the 10-year real interest rate, i.e., the yield from 10-year treasury-inflation-protected securities, fell from 1.66% to 1.24%.

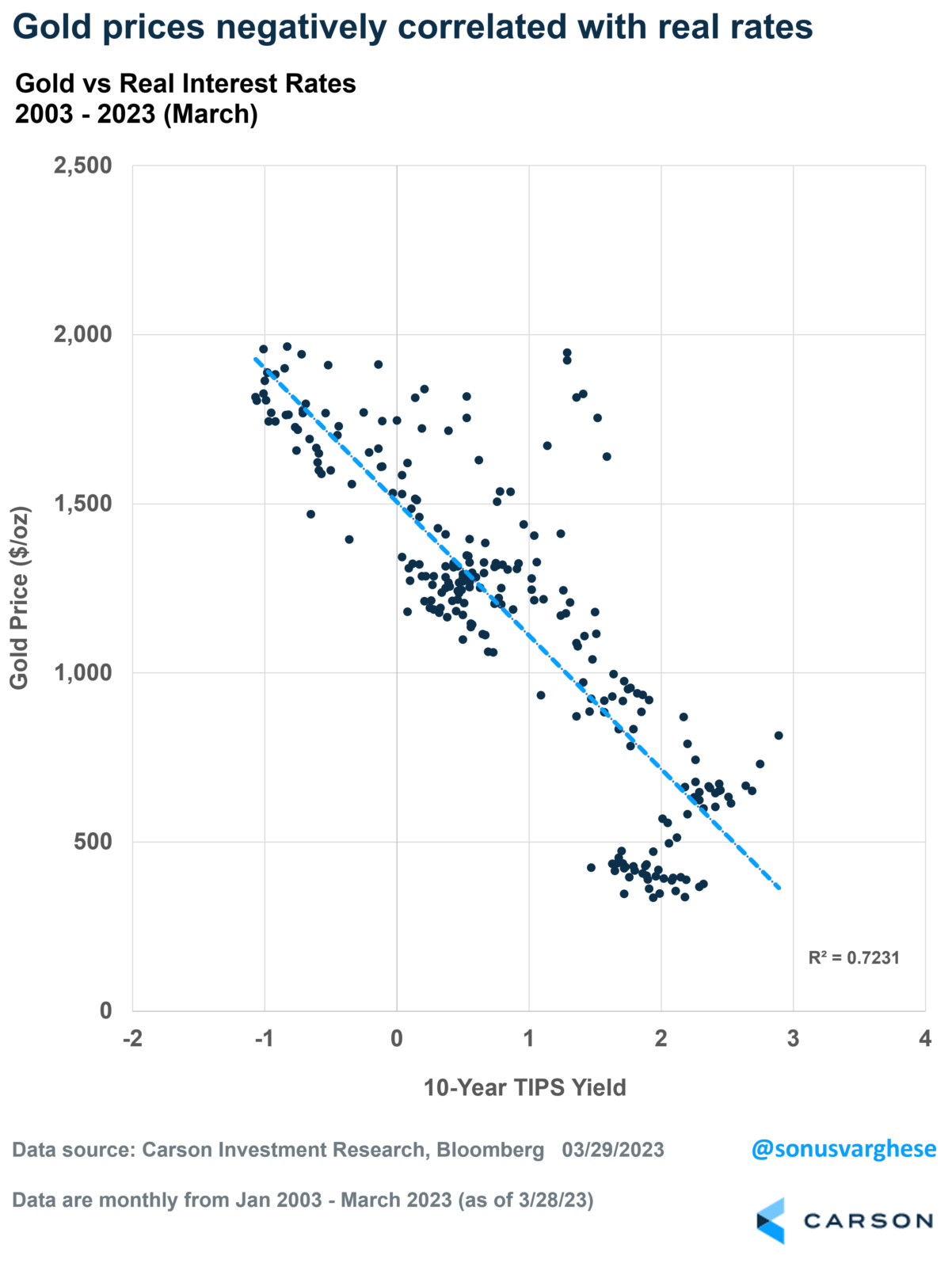

That is a significant drop, and historically such declines in real interest rates have been accompanied by rising gold prices.

Conversely, gold prices have historically fallen when real interest rates rose. Which usually occurs when economic growth picks up and/or the Fed raises rates in a bid to prevent overheating and higher inflation.

The idea is that if real interest rates are high, there is an opportunity cost to holding (and storing) gold. Whereas if real rates are low or negative, the opportunity cost for holding gold falls.

Last year was a strange year for Gold

Gold is typically thought of as an inflation hedge. So, on the face of it, you would think gold would shine during a year that saw a 40-year high in inflation, with headline CPI hitting 8.9%. Yet gold prices were flat across the year.

In fact, between March 8th and September 30th, 2022, gold prices fell a whopping 18%, even as inflation surged. The problem was that the Fed got really aggressive with rate hikes after March 2022 as they looked to tame inflation. As a result, the 10-year real interest rate rose by 2.72%-points during this same period, from a low of -1.04% to +1.68%.

Talk about a brutal and abrupt end to the negative interest rate regime that we had experienced for several years.

Interestingly, real yields stabilized from October onwards, thanks to inflation data pulling back and investors expecting the Fed to ease up on the pace of rate hikes. Consequently, gold rallied, rising 15% between October and January.

Prices fell again as real interest rates resumed their uptrend – which followed a series of hot economic data releases in February that sent Fed rate hike expectations higher. This lasted until the SVB crisis hit on March 9th.

Where could Gold go next?

A lot of this obviously depends on what happens with real interest rates. Real rates are certainly lower than they were before the SVB crisis. However, with the Fed backing off the aggressive rate hike path they expected a few weeks ago, we believe real rates may not go much higher than they are now.

This means gold’s downside is potentially limited. Plus, as we saw, gold works quite well in the event of an economic downturn (in which case real yields are likely to fall), which makes the shiny rock attractive as a portfolio hedge at this time.

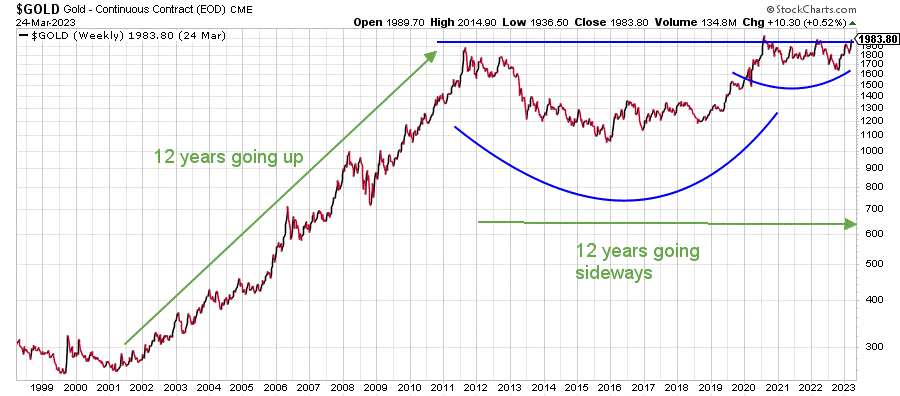

My colleague, Ryan Detrick, pulled the lens further back with a long-term chart of gold. You can see that gold prices were more or less flat over the last decade after stellar returns in the preceding 12 years.

Gold prices surged 508% between 2001 and 2012. Whereas it rose just 9% between 2013 and 2022.

So, gold could be on the verge of a multi-year breakout here, especially if real interest rates don’t rise much further.

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today! "*" indicates required fieldsStay on Top of Market Trends

All returns data are obtained via Factset.