Last month I wrote about how the housing market is rebounding, which is a really good sign for the economy. As I noted in that piece, residential investment has been a drag on the economy for 8 straight quarters. No surprise why: The Federal Reserve (Fed) began its most aggressive policy tightening cycle in 40+ years, as they looked to get on top of inflation. That sent mortgage rates from 3% to 7% in less than a year, freezing the housing market. Affordability collapsed due to higher rates and elevated home prices. Amid decreasing demand, builders reduced their involvement in new construction projects.

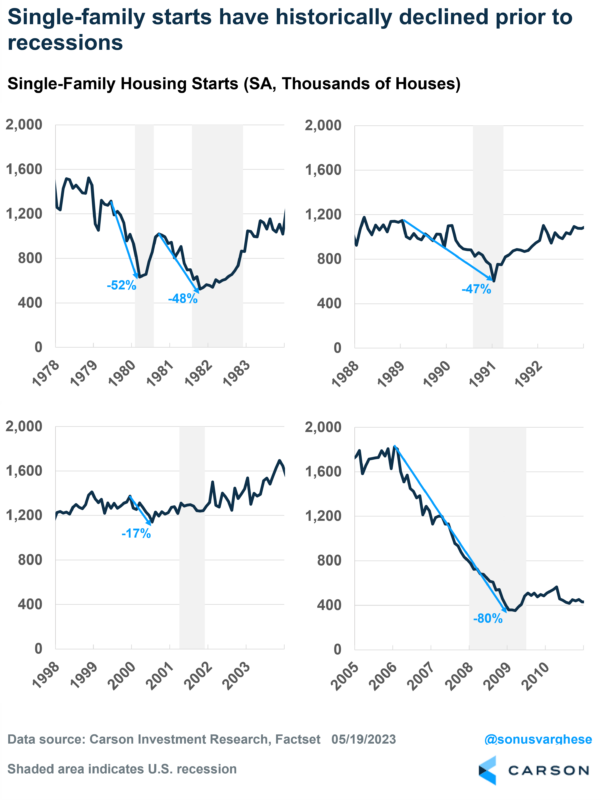

Historically, declining housing activity has foreshadowed recessions. Between 1980 and 2010, we had 5 recessions, and each one was preceded by a huge decline in single-family housing starts. Housing starts measure the start of construction on a new residential unit. This precedes sales of new homes as well as spending on appliances, furniture, and other home goods. It tells you a lot about builders’ sentiment for investing in new projects and how consumers view their personal financial situation (since buying a house a is big deal).

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

I looked at single-family housing starts across the 5 recessions that preceded the pandemic-led 2020 recession, including 1980, 1981-’82, 1990-’91, 2001, and 2007-’09. As you can see in the chart below, single-family starts declined significantly prior to each of those recessions. And these were typically preceded by aggressive Fed tightening.

But here’s something that’s also important: housing historically bottomed prior to the end of a recession and has typically led the economy out of one. It typically coincided with the Fed reducing interest rates in response to a slowing economy.

Coming to the current cycle, housing activity collapsed last year amid interest rate hikes. That by itself increased the odds of a recession, but the economy clearly dodged a bullet there.

Now we’re on the other side of the housing crash

A housing turnaround has been on the cards for a couple of months now, with homebuilders raising guidance for the number of homes they are able to sell. In fact, homebuilder sentiment, perhaps the best leading indicator for housing activity, has been surging since the end of last year. They’re clearly feeling much better about future demand.

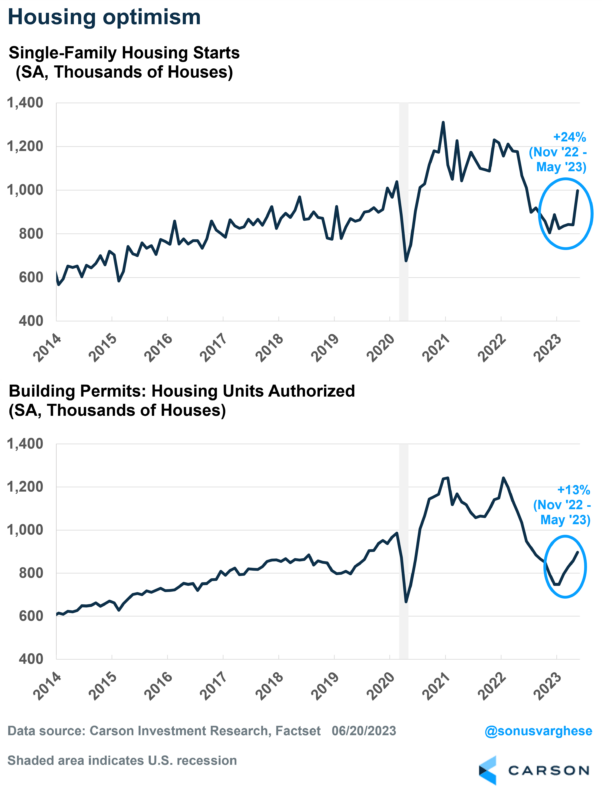

The aggregate housing data confirms what builders have been indicating. We just got some big numbers for May housing starts and building permits. Permits count authorized permits to build new housing units and are a leading indicator of future supply.

Single-family starts surged 19% in May. Meanwhile, economists expected a small fall in starts, once again highlighting the disconnect between what’s happening in the economy and expectations. Over the past six months, single-family starts are up 24%.

Permits rose 5% in May and are up 13% since last November. Builders wouldn’t be looking to get new construction authorized if they were pessimistic about the housing market.

These are numbers you typically see as the economy emerges from a recession. It tells us a couple of things:

- The economy is not in a recession, or very close to one (within 1-2 months)

- It doesn’t look like we’re late in the economic cycle, on the precipice of a recession (within the next 4-6 months)

If anything, the current dynamics are akin to what we see early in an economic expansion, which goes against forecasts that predict a recession soon.

What’s clear is that 7% mortgage rates are not deterring new home buyers. In fact, due to high mortgage rates, most homeowners (who probably bought their homes or refinanced at low rates) are “locked in. So, there’s not much inventory in the existing home sales market.

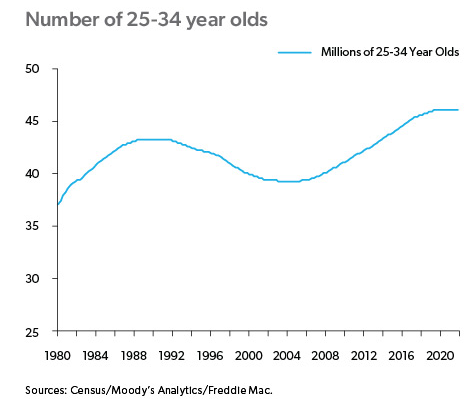

However, there’s a lot of pent-up demand due to a record number of people in the 25-34 year age cohort, which is the prime home-buying age. There are now 18% more people in this age range than there were in 2006. That translates to 6.6 million more potential first-time home buyers, up from 39.5 million in 2006 to 46.1 million today. These potential homebuyers are being pushed into the new homes market.

At the end of the day, if someone wants a house, they’re going to buy a house. They just need to find one. Which is why builders are more confident about demand and ramping up supply in response. The Chairman of Lennar Corporation, the nation’s second-largest homebuilder underlined this last week during his company’s earnings call:

“The economic environment has stabilized as customers have adjusted to and accepted higher-for longer interest rates, the supply chain chaos has normalized, inventories have remained low, and the supply of housing across the country is in very limited supply.”

Economic Tailwinds

All this is good news for the economy, since residential investment goes from being a drag on the economy to a positive contributor. Stack that on top of the following:

- Continued strength in consumption

- Growing real incomes as energy and food prices fall

- The end of the rate hike cycle, with potential for cuts next year (as Fed officials themselves predict)

- Falling core inflation (ex-food and energy)

- Easing supply chain bottlenecks

- Pickup in manufacturing, especially for the auto sector

You can see why we’re optimistic about the economy. Ryan and I talked about a lot of these things in our latest Facts vs Feelings podcast – take a listen.