“Everything good, everything magical happens between the months of June and August.” Jenny Han, writer of The Summer I Turned Pretty trilogy

After gaining close to 5% in May, the S&P 500 is on pace for another very solid month in the usually weak month of June. We had pushed against the majority view that a rough summer was coming, as we had noted in Buy in May and Stay and Why There Won’t Be A June Swoon, and here we are. In today’s blog I will discuss why we think the surprise summer rally isn’t quite done yet, but first I’ll discuss how rare this month has been and a few other interesting stats.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

This month might not be over yet, but it is close. The worst day all month for the S&P 500 was a 0.31% drop earlier this week. Think about that, the worst day all month was down only 0.31%!? Should things stay this way, this month would be the best ‘worst day of the month’ since February 2017!

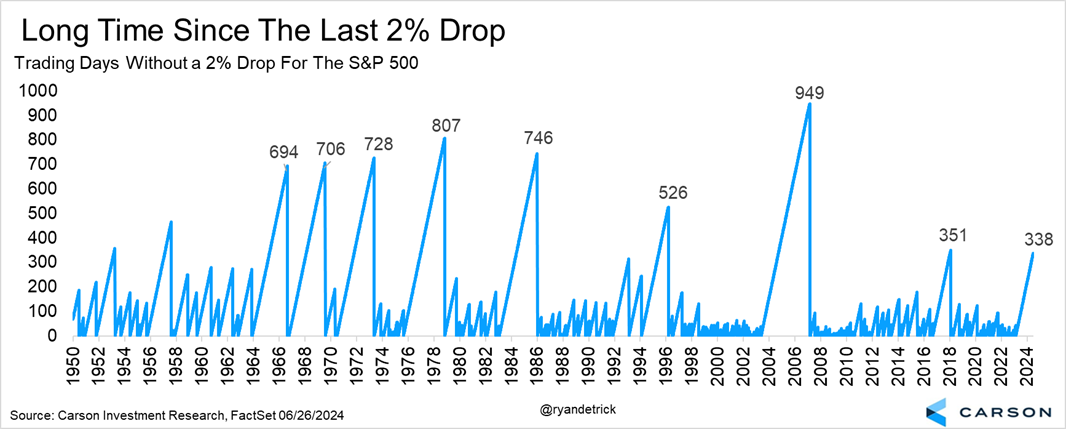

Not to be outdone, the S&P 500 hasn’t had a 2% daily decline for a very, very long time. In fact, the last time it fell 2% or more in one day was way back in February 2023! Although this could suggest we are long in the tooth for some volatility, look at this chart I made that showed there have been some streaks that have actually lasted much longer.

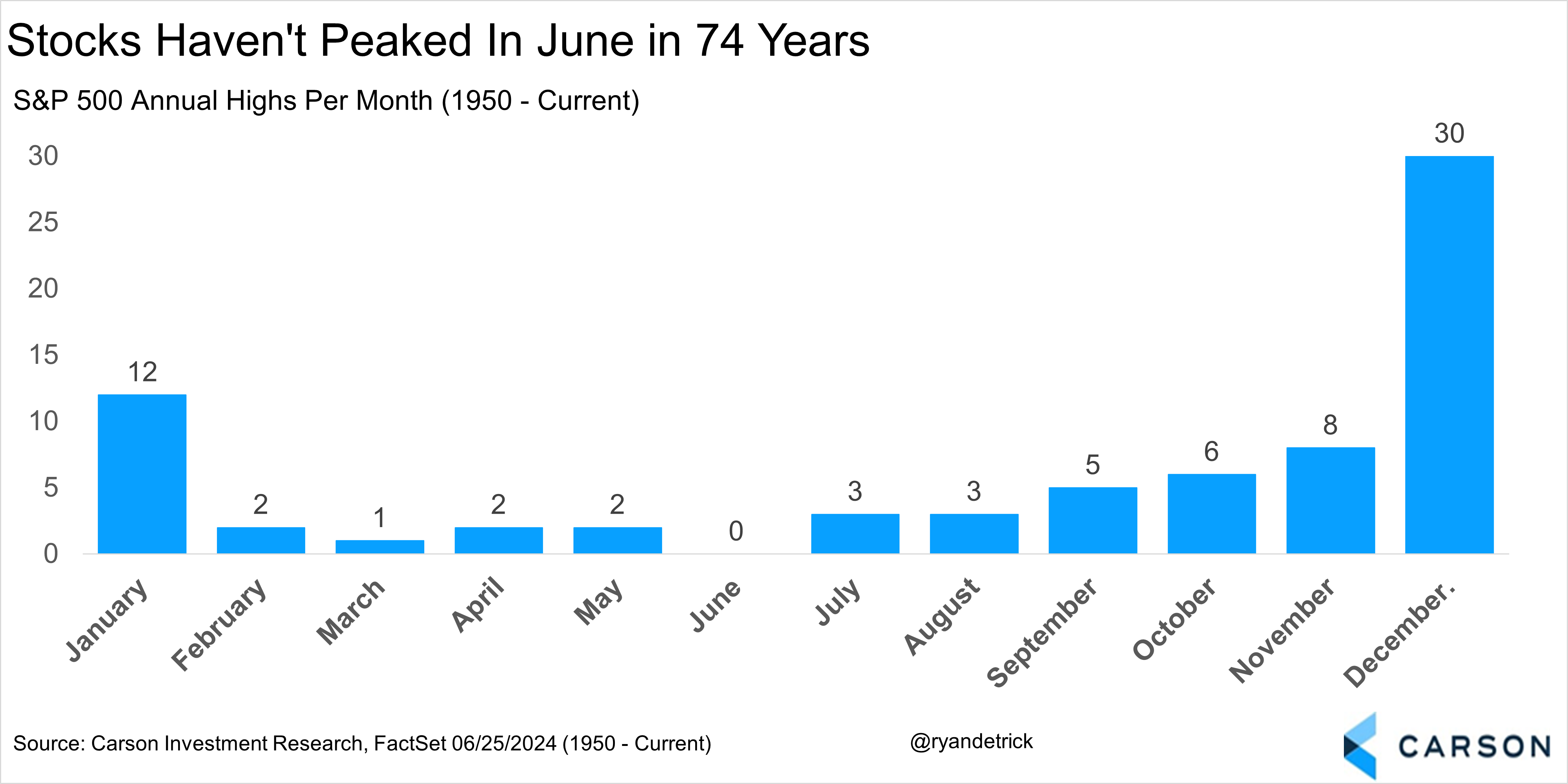

Something else to consider is stocks rarely peak for the year in June. In fact, since 1950 it has never happened. I won’t pretend to know why this is, but I won’t argue with it and this is another nice feather in the cap for the bulls.

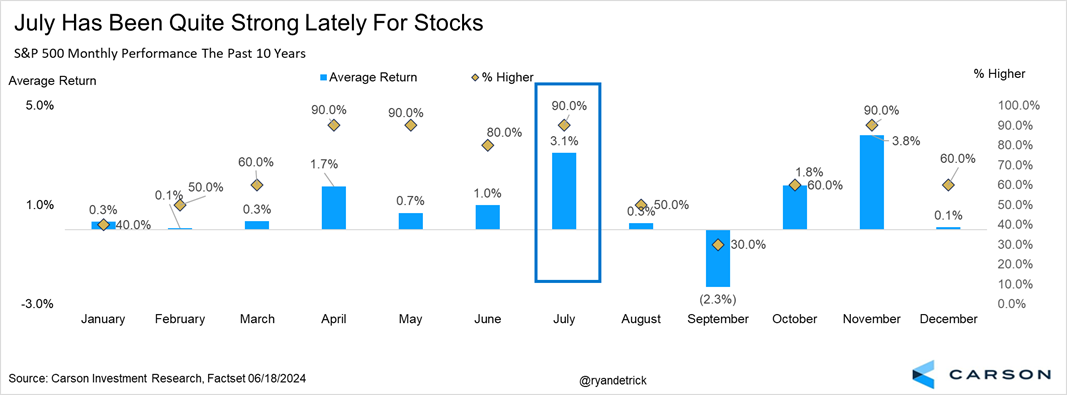

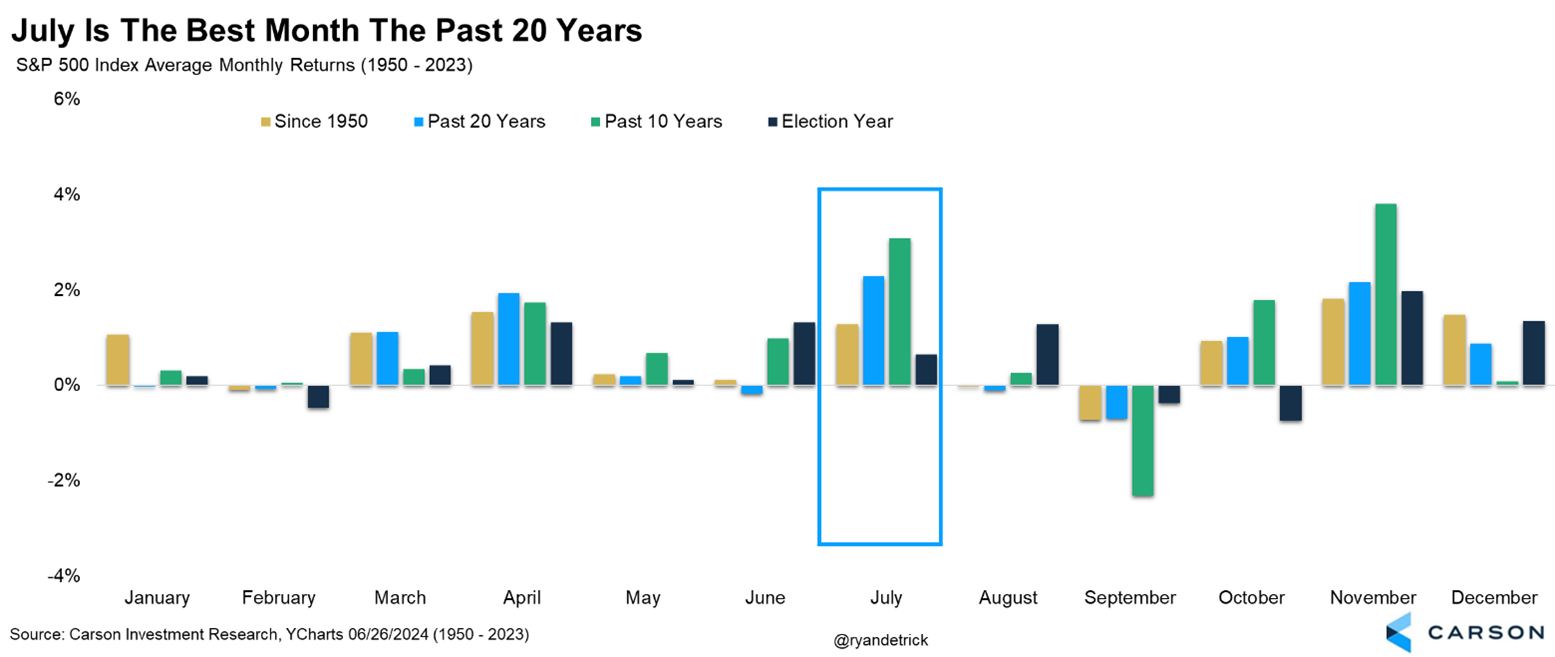

Let’s now look at how stocks historically do in July. Well, lately this month has been about as good as it gets, with the S&P 500 up an incredible nine years in a row in July and 11 of the past 12 years. That might sound like a lot, but it actually was up 11 years in a row from 1949 to ’59 and it had eight in a row back in the 1930s and ‘40s. Long win streaks apparently are quite normal for this month. The past 10 years July is the second best month on average, with only November better.

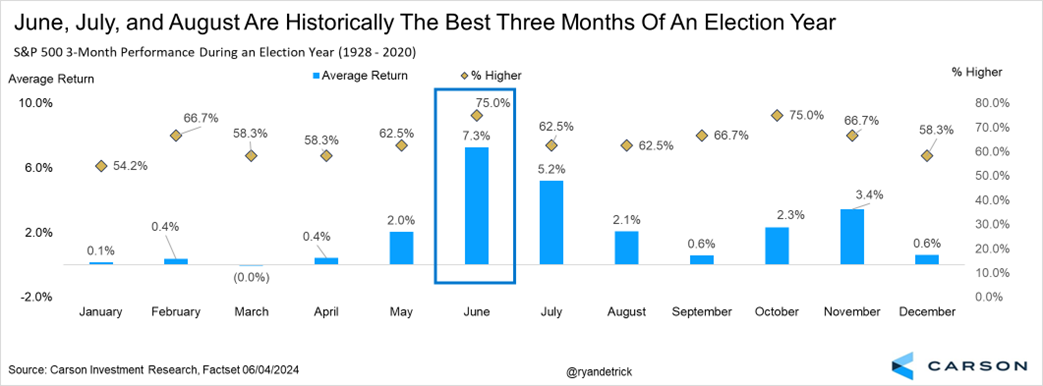

As we’ve mentioned many times lately, summer rallies in election years are quite common. In fact, the S&P 500 has gained more than 7% on average in an election year in June, July, and August. Go read the quote at the top one more time, as some of the best times happen during these three months. And for those thinking this summer rally is running on fumes, we’d argue there still could be some left in the tank.

Lastly, stocks have gained 2.3% in July on average the past 20 years, making July the best month for stocks.

I will leave on this note…Why in the world has July been so strong lately? Is it random? Is it people like summer? Or is it something else? I’ll say it is because July is second quarter earnings season and we’ve seen some very strong earnings lately. Seriously, every year we come into the year with all the bowtie-wearing economists telling us how bad everything is because of some small sample sized survey of purchasing managers, yet by the time we get around to second quarter earnings it becomes abundantly clear there is no recession coming and stocks soar. I joined BNN Bloomberg this week and discussed this very concept. You can watch that interview here.

Lastly, this year we could once again see solid earnings, but we also will likely see significant improvements in inflation as well. These two things could combine for another green July. For more on this, be sure to watch below (or listen) to our latest Facts vs Feelings podcast, as VP, Global Macro Strategist Sonu Varghese and I break it all down.

For more content by Ryan Detrick, Chief Market Strategist click here.

02300766-0624-A