“The farther back you can look, the farther forward you are likely to see.” Winston Churchill

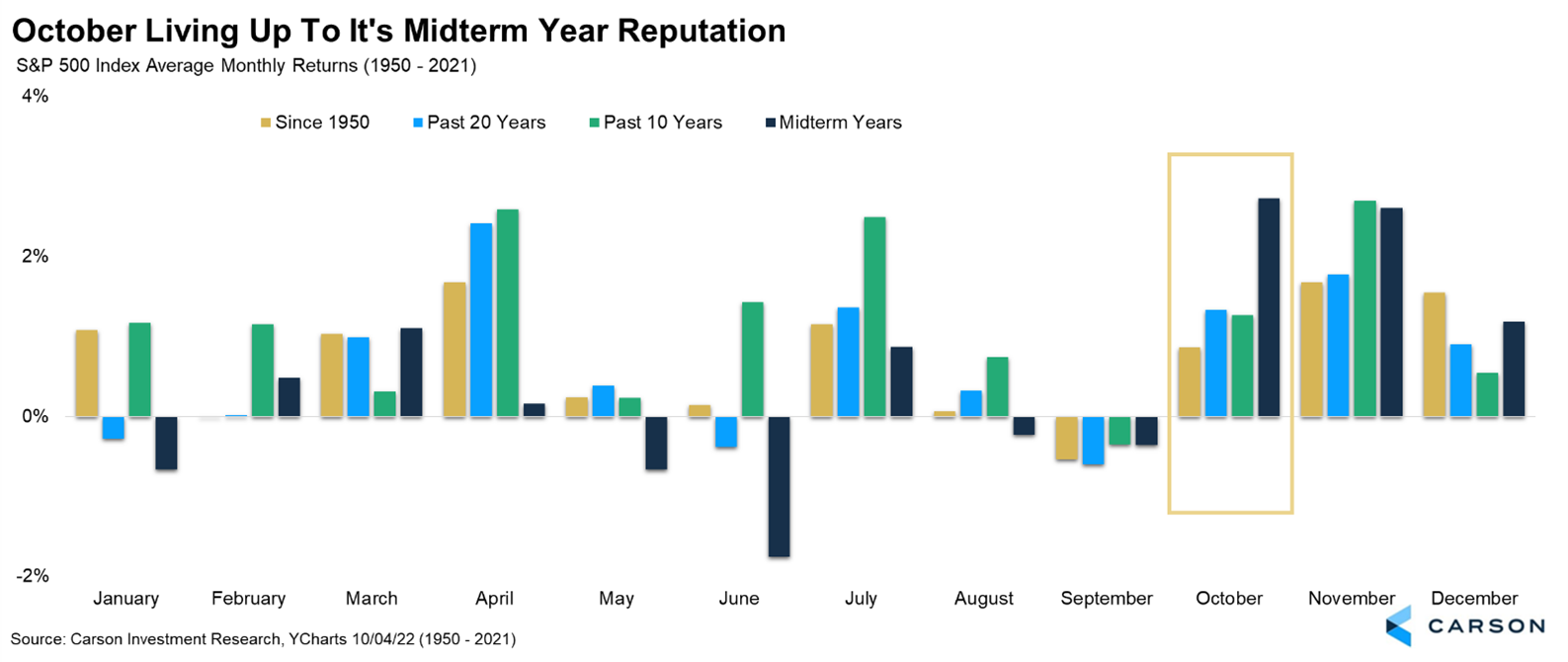

The bounce off the October lows continues, with October living up to it’s reputation as both a potential bear market killer, but also the best month of a midterm year. Even more interesting is the past eight times the S&P 500 closed green, stocks gained at least 1% as well. That could be another clue that buyers are aggressively adding and the good news is we’ve seen previous streaks like this take place near major bear market lows.

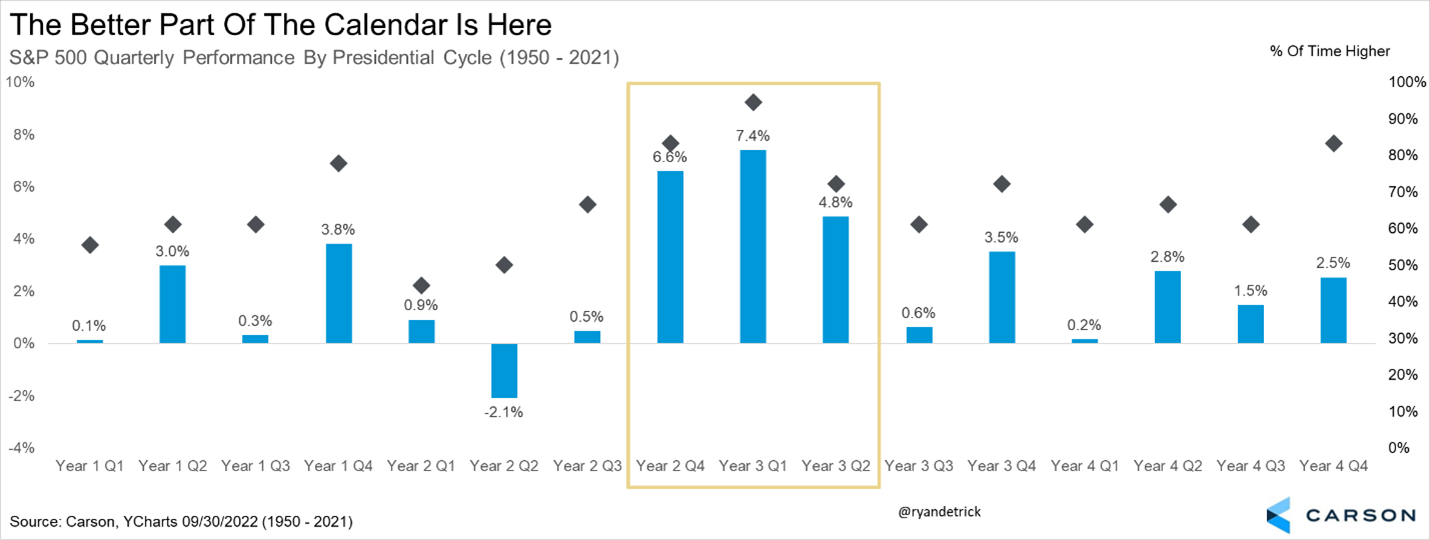

Here’s a chart we’ve shared a lot this year, but it still makes sense to share to make sure investors are aware of it. Looking at the first few quarters of a midterm year we find that stocks usually don’t do well. That’s sure happened this year. The good news is this quarter and the next two quarters have in previous years shown to be the strongest out of the entire four-year Presidential cycle. Better times could be coming and knowing history like Churchill told us means the bulls could be smiling soon.

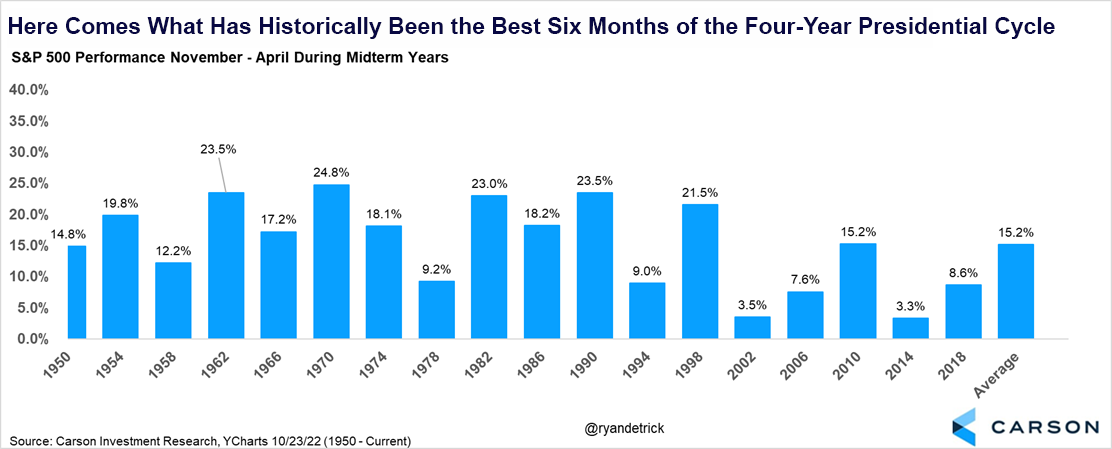

Lastly, many investors are aware of “Sell in May and Go Away,” which shows that the historically worst six months of the year for stocks are from May through Halloween. The good news is we are about to leave those worst six months and enter into what has historically been some of the best times for stocks. In fact, looking at the November through April period shows that stocks have been higher every single time during a midterm year going back to 1950. That is 18 for 18 for those counting at home. Sure, six months from now this could be 18 for 19, but as we’ve been noting a lot on this blog lately, we are seeing many signs that a major market low could be taking place.

Lastly, we have some great news to announce here at the Carson Investment Research team! Our brand new podcast called Facts Vs. Feelings is officially on iTunes. We’ve had some great feedback to this new weekly podcast and it just got a lot easier to listen to each week.