“April is a moment of joy for those who have survived the winter.” –English writer Samuel Johnson

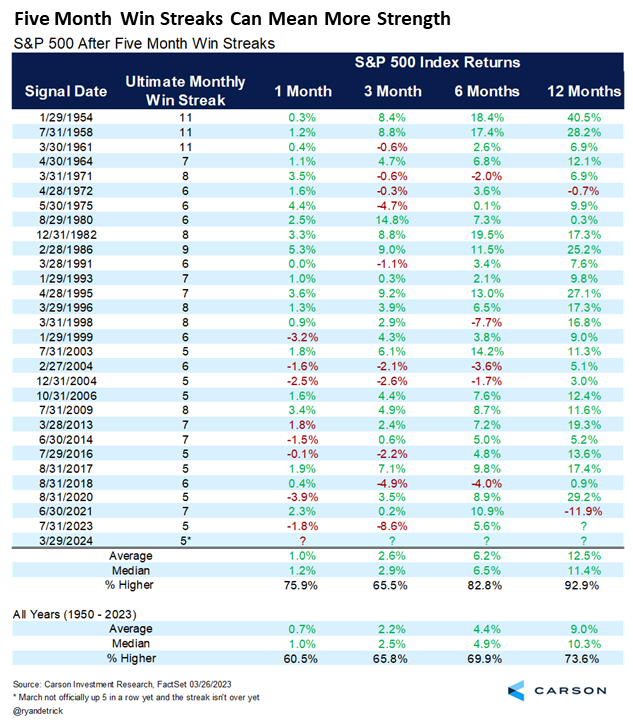

The bull market continues and with one day to go in the first quarter, it is looking like more gains for stocks this month. The S&P 500 will also be up a very impressive five months in a row.

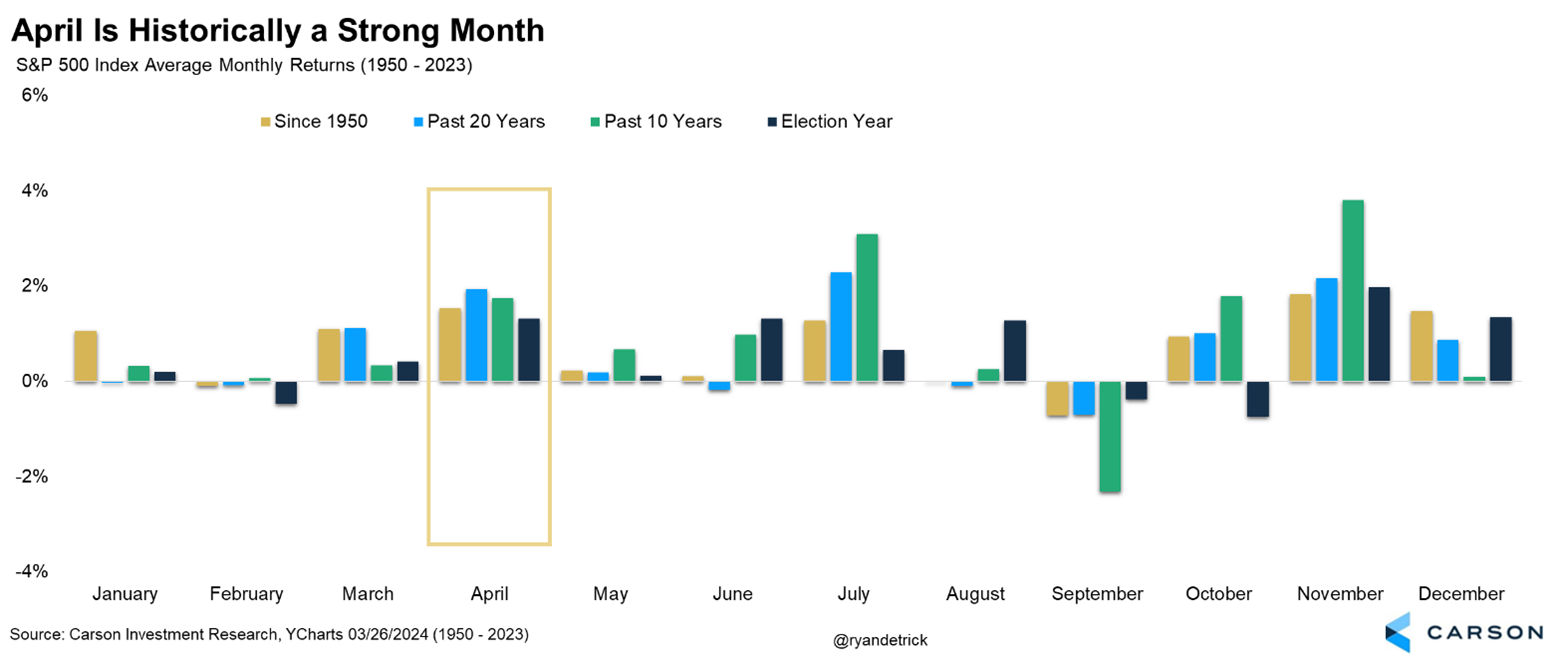

As we turn the calendar, we are now staring at the usually bullish month of April.

Here’s the high level thing to know. The S&P 500 in April has averaged 1.5%, the second best month of the year (only November is better). It is also the third best month the past 10 years and it is the fourth best month the past 20 years and in an election year.

Be aware that a lot of the gains in April historically take place the first part of the month.

As long-time followers know, we’ve been quite bullish on both the stock market and the economy for well over a year now. Could stocks fall in April? Sure, after the run we’ve had anything is possible, but the odds do favor more green numbers.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

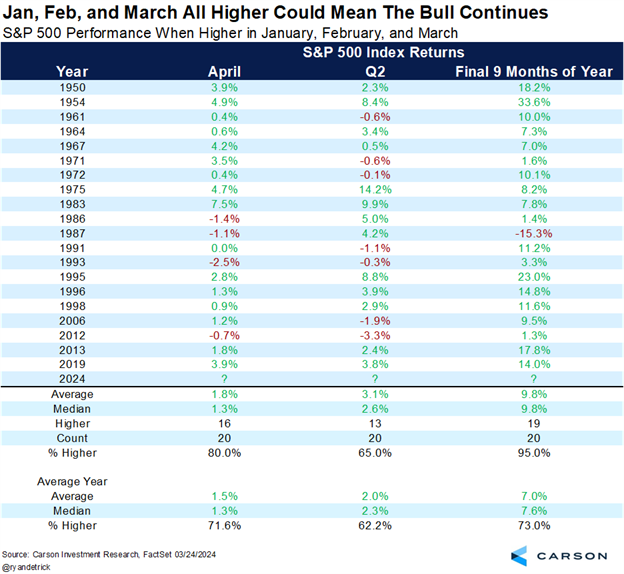

As we mentioned in Why a Strong Start to 2024 Is Bullish for the Rest of the Year, a big start to a year tends to see continued gains the final nine months. What is interesting is in many cases, a big start to a year means April will outperform as well.

For example, when stocks are up the first three months of the year, April is up 1.8% on average, better than the average April gain of 1.5%.

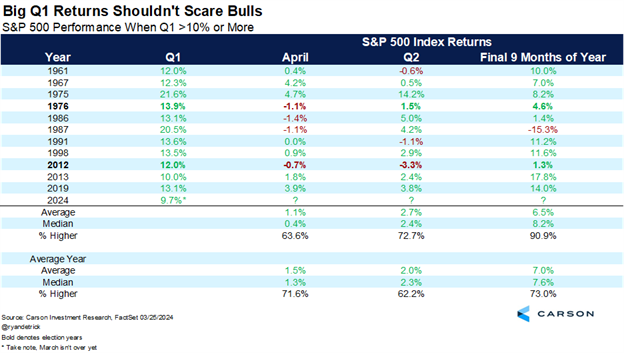

When the S&P 500 gained 10% during the first quarter (which might happen with a late rally this week) then April didn’t do quite as well, up 1.1% on average, but still higher at least and a pretty good number if you annualize it.

Turning the page from April, in the quote above from Samuel Johnson winters are portrayed as usually rough, but it has been a pure delight for investors this winter, as the S&P 500 is up five months in a row. We found the past 28 times the S&P 500 had a 5 month win streak it saw higher prices 12 months later 26 times, with above-average returns to boot.

We want to wish everyone a happy Easter holiday and if you have Spring Break this week or next week, remember to wear sunscreen!

For more content by Ryan Detrick, Chief Market Strategist click here.

02176823-0324-A