October payrolls were a big disappointment, with job growth clocking in at just 12,000. However, this shouldn’t be a big surprise because we knew Hurricanes Milton and Helene would weigh on the numbers. We just didn’t know how much. The Bureau of Labor Statistics (BLS) said that Hurricane Milton hit right during their data collection week, and the establishment survey responses were well below average (though it’s hard to quantify what the weather impact exactly was). Beyond hurricanes, there were also strikes at Boeing and parts of the auto industry in Michigan/Ohio that negatively hit payrolls, to the tune of about 41,000 jobs. Ultimately, all of these are likely to be temporary and will possibly reverse in November.

So that was the noisy part of the report. Let’s look for the signal now, and it’s mixed.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

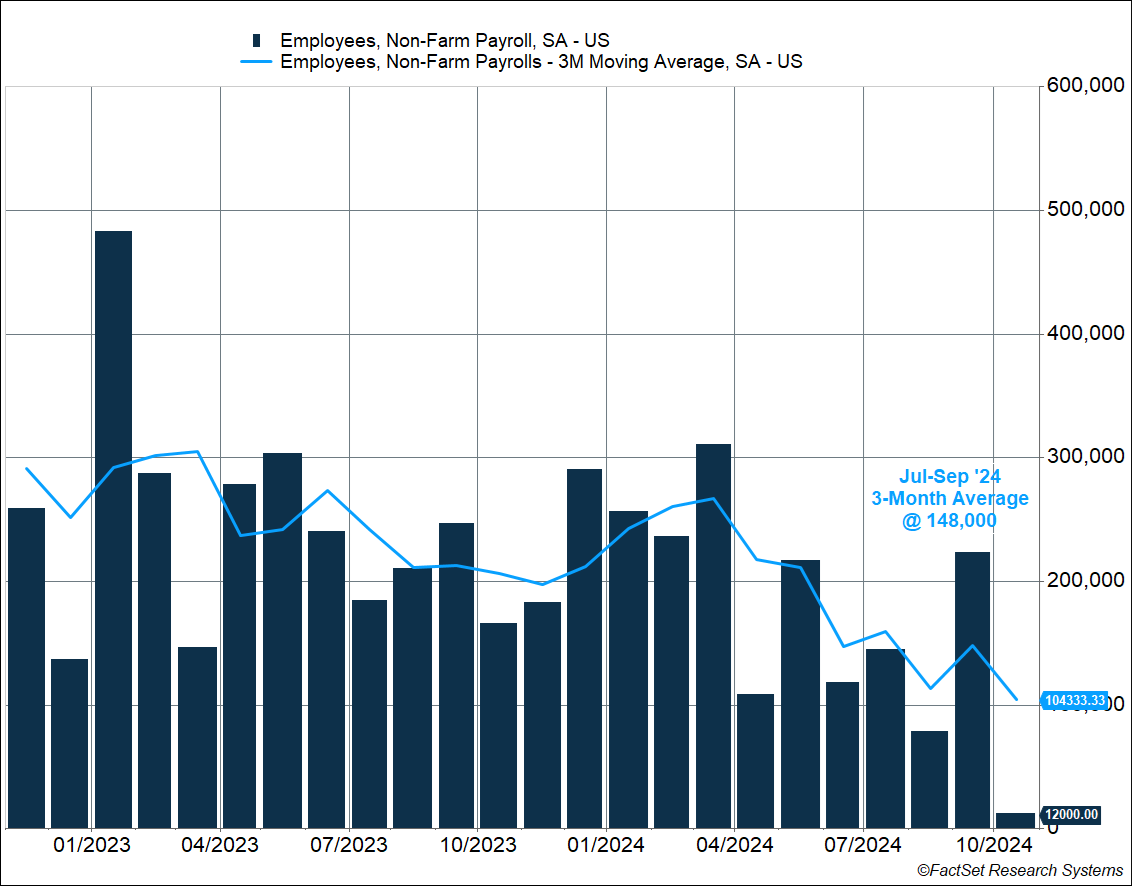

Payrolls for prior months were revised lower. September payrolls were revised down by 31,000 to +223,000 jobs, and August was revised down by 81,000 to +78,000 (the first sub-100 monthly payroll number since December 2020). By the way, a month (or two, or three) of sub-100,000 job growth is par for the course even during strong labor markets. In 2019, monthly job growth averaged 166,000 but we saw four months with 100,000 or fewer jobs created. Right now, the 3-month average of July-September job growth is 148,000 (ignoring October). That’s not bad, but that’s clearly a slowdown from what we saw in the first quarter of 2024, when monthly job growth averaged 267,000.

At the same time, there was good news elsewhere in the report, with data points that were less impacted by the hurricanes.

- The unemployment rate was unchanged at 4.1%, which is encouraging.

- The prime-age employment-population ratio fell from 80.9% to 80.6%, but even this matches the highest we saw in the last cycle (and there could be some hurricane effects here).

- Wage growth picked up to an annualized pace of 4.5%, and that’s the same pace even if you take a 3-month average. (The 2017-2019 pace was 3.1%.)

- Weekly hours worked was also unchanged and is currently running at the pre-pandemic level. (It is actually higher for non-managerial employees.)

What really matters for an economy that depends on consumption is aggregate income growth, i.e. income growth across all workers in the economy. That’s the sum of employment growth, wage growth, and change in hours worked. Despite the negative revisions to August and September payrolls, and the huge hit from hurricanes and strikes to October payrolls, aggregate income growth is running at a 6.4% annualized pace over the past three months. That’s well above the 4.1% pace we saw pre-pandemic.

There’s Reason to Be Optimistic, But Not Wildy So

The big picture is that the labor market has cooled off a lot relative to where we were at the start of the year, but it’s still in a fairly healthy place right now. But there’s a lot more going on below the surface.

Between mid-2023 and mid-2024, we saw the unemployment rate move higher even as payroll growth remained fairly strong. This was because more people came back into the labor force to look for jobs. However, the dynamics are shifting as the labor market matures. There may be fewer people “coming off the sidelines,” which is going to result in lower monthly job growth, perhaps close to 150,000 – 170,000 a month. Yet if layoffs remain relatively low (as they have), we shouldn’t see the unemployment rate move higher. Going forward, aggregate income growth is more likely to be powered by strong wage growth, rather than employment growth that averages over 200,000 a month.

This also means there are risks to the outlook I sketched out above. It may seem strange to bring up risks when we just saw Q3 2024 GDP growth rise at an annualized pace of 2.8%. Consumption was really strong, powered by both income growth and a pullback in the savings rate. But if the savings rate starts to rise again, we could see consumption pull back from its torrid pace. Business investment was also strong in Q3, though half of that was from aircraft spending, and that is unlikely to repeat in the next quarter or two. Residential investment, i.e. housing, dragged on GDP growth for the second quarter in a row. We’re not optimistic for a turnaround anytime soon, especially with mortgage rates moving back to near 7%.

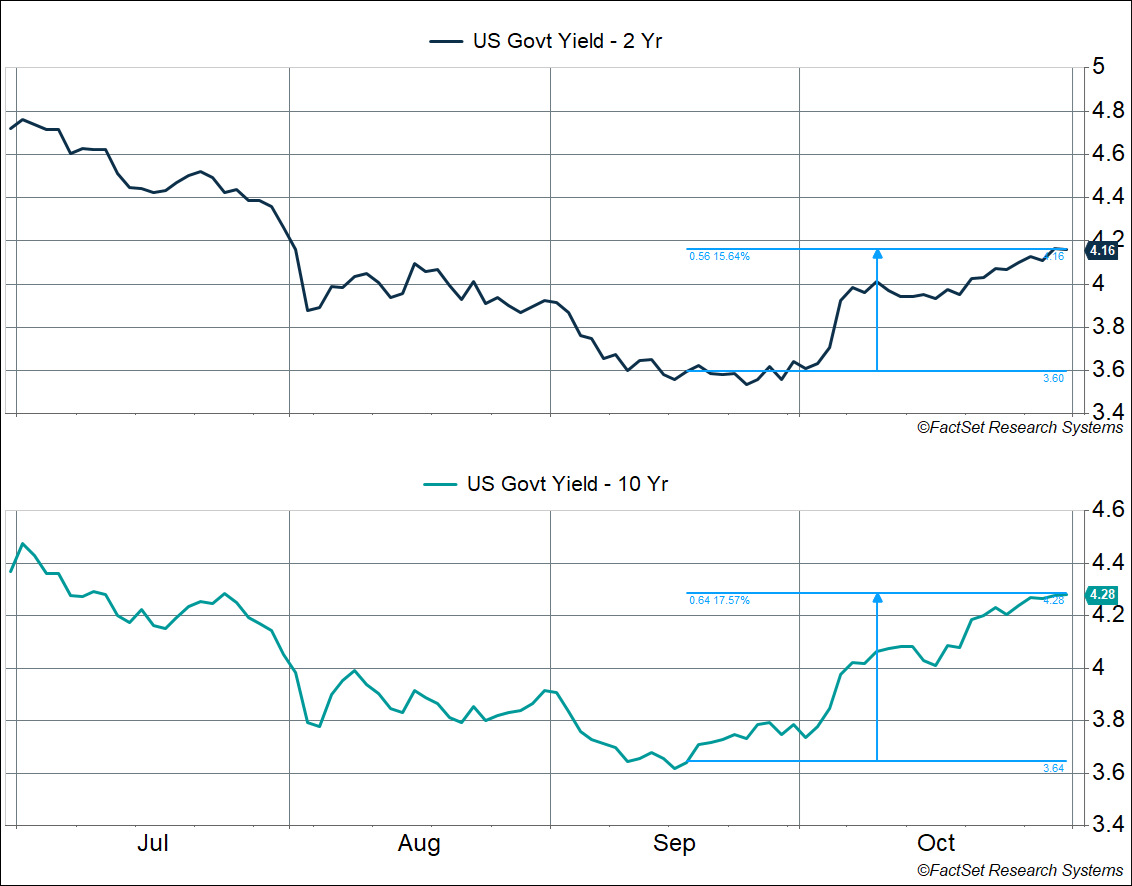

All this to say, it wouldn’t be surprising to see GDP growth revert to the 2-2.5% range (or even lower) in Q4 2024 and Q1 2025. This is not to say we’ll be in a recession – far from it – but it seems like investors are wildly optimistic. More than the equity market, we’ve seen this in the bond market. Since the Federal Reserve’s (Fed) meeting on September 18, 2-year US treasury yields have risen 0.56%-points to 4.16% and 10-year US treasury yields have risen 0.64%-points to 4.28% (driving mortgage rates higher). This is counterintuitive, since the Fed went big with a 0.50%-point cut at their September meeting and projected more c uts into 2024 and 2025. However, to a first approximation, yields are essentially expected Fed policy rates in the future. If economic growth is expected to be strong, there’s presumably less reason for the Fed to cut rates by a lot.

It seems like investors are a tad over-optimistic about growth and projecting the strong recent economic numbers out into the future. But those numbers are backward looking. Looking ahead, there are risks. For one thing, housing looks to be in a lot of trouble thanks to elevated mortgage rates. There are even risks for the labor market. When job growth is averaging 150,000 – 170,000 a month, it doesn’t take much of a shock to send it below 100,000. That becomes a problem. This is why the Fed needs to continue easing interest rates to mitigate downside risks to the labor market and revive interest-rate sensitive sectors like housing. The good news is that they seem to be attentive to this.

Keep in mind that the Fed was easing rates even in 2019, amidst a solid job market.

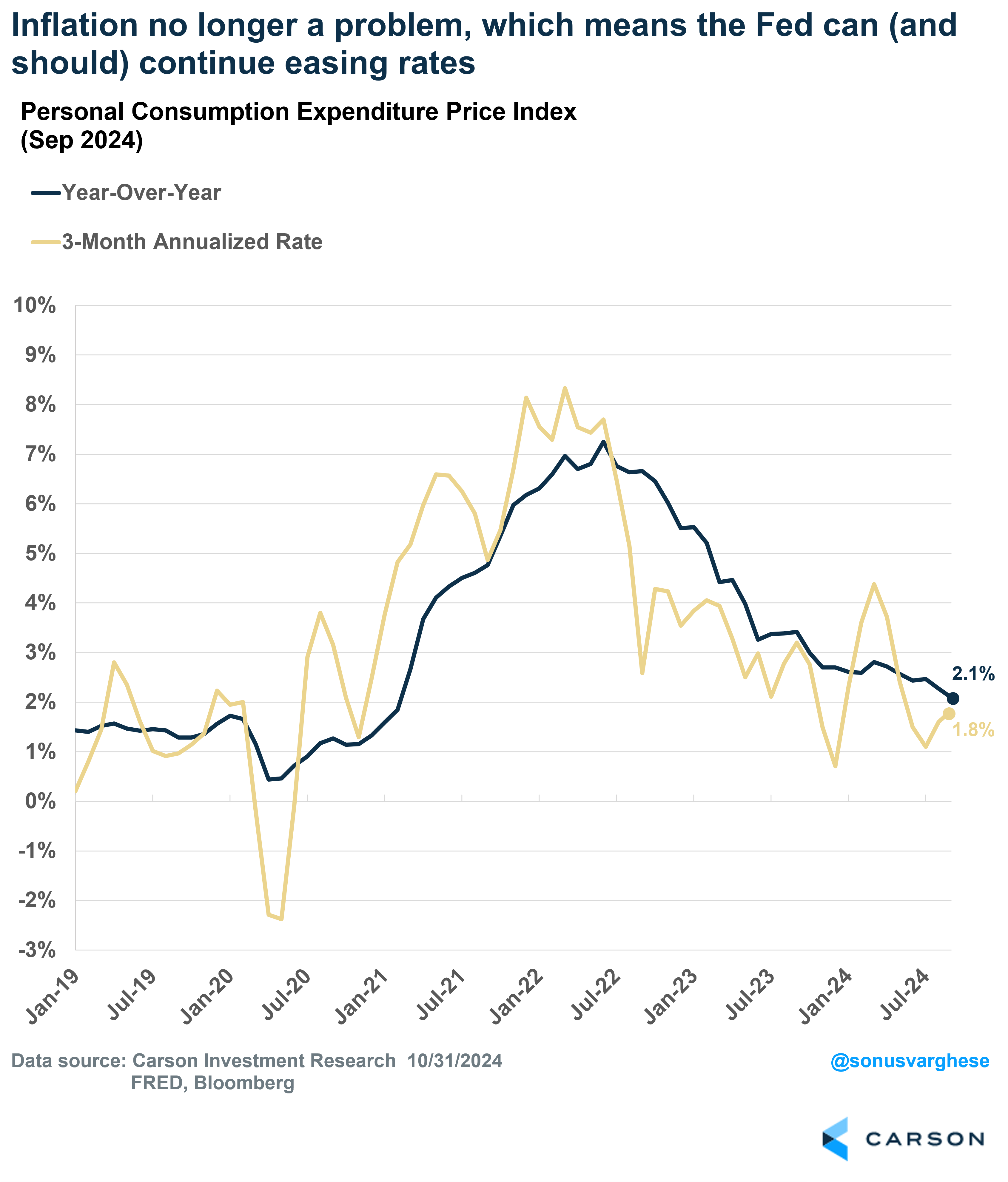

It’s about risk reduction at this point, and the good news is that they can continue easing rates because inflation has normalized. That’s thanks to lower gas prices and easing housing inflation. Headline inflation is up 2.1% year-over-year as of September, which is the slowest pace since February 2021 (as measured by the Fed’s preferred metric, the Personal Consumption Expenditures Index).

Ryan and I talked about all this more on our special Facts vs Feelings Halloween livestream with Neil Dutta (Head of Economic Research at Renaissance Macro Research) and Skanda Amarnath (Executive Director at Employ America). You can listen to the whole livestream here:

https://www.linkedin.com/events/factsvs-feelingslivestream-tric7252376720169709568/comments/

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02489601-1124-A