Stocks reacted in a fairly neutral way after the Federal Reserve’s historically significant decision to jumpstart the rate cutting cycle with a 0.5%-point cut. But the real follow-through came on the day after the Fed meeting, perhaps after everyone slept on it. The S&P 500 surged 1.7% to close at a new record high on Thursday, September 19 (the first since July 16). The index is now up over 20% for the year. But wait, wasn’t the equity market supposed to move lower, not higher, in response to a large cut, on the assumption that a recession was looming?

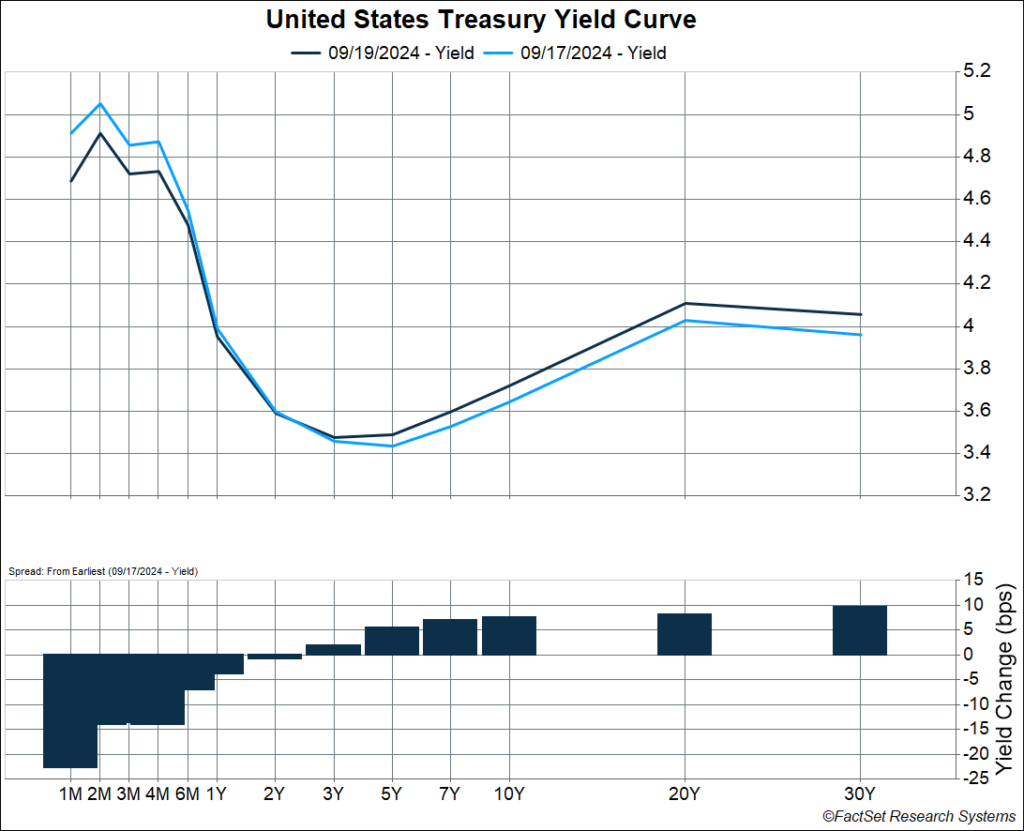

On top of that, Treasury yields for maturities over two years are now higher than they were relative to the day prior to the Fed meeting. If the Fed signaled a more dovish path for policy rates, why weren’t longer-term yields moving lower, not higher?

There’s No Puzzle: It’s About the Fed Supporting the Economy

I wrote yesterday that the key takeaway from the Fed meeting was that they are not willing to tolerate the unemployment rate moving much higher — their projections capped the unemployment rate at 4.4% (it’s currently at 4.2%). The Fed’s essentially putting a floor under the labor market.

Unlike in prior rate cutting cycles, the big rate cut wasn’t a “panic cut.” Safe to say we’re not in the middle of a recession, nor is one imminent over the next few months. Amongst other things, the August retail sales report showed that online sales grew at an annualized pace of 15% over the past three months. Layoffs are also relatively low. Notably, Fed Chair Powell said the time to support the labor market is when it’s strong, not when you begin to see layoffs. In other words, the large cut was about risk management, with the Fed looking to get ahead of deteriorating labor market data.

The good news is that the Fed has room to support the labor market because inflation has eased a lot. An underrated factor here is lower energy prices. Beyond headline inflation, higher energy prices can even feed into core inflation numbers that the Fed typically focuses on. For example, higher energy prices can raise restaurant prices and airfares. We’ve gotten a break there, with WTI oil prices pulling back by about 17% since early April.

All this is very positive for the economy. And if economic growth remains resilient, bond yields should not be moving lower. On the other hand, if investors didn’t believe the Fed and thought they were behind the curve, we’d likely have seen bond yields fall, as investors priced in a higher risk of recession. For now, investors appear to be taking the Fed’s word that they’re putting a floor under the labor market, and therefore the economy.

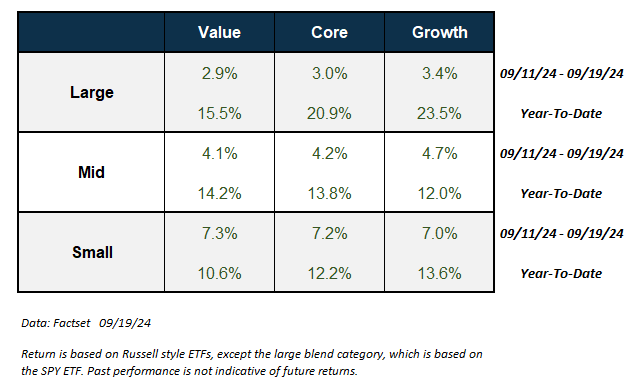

Equity markets have been reflecting this since last week, after a Wall Street Journal report published on September 12 suggested the Fed was considering a big cut. The massive rally on Thursday capped what was already happening. From September 11 through September 19, the S&P 500 rose 3%. But mid- and small-cap stocks, which are even more geared to economic growth, outperformed. The Russell mid cap index rose over 4% during this period, while the Russell 2000 small cap index rose over 7%. As you can see below, these still lag their large cap counterpart year to date, but we believe there’s potentially more follow-through to come, especially with the Fed backstopping the economy. Full disclosure: we’re overweight these areas of the equity market in our model portfolios. Economic growth is what you need for profit growth, and that’s what drives returns. The new record is not a “sugar high” by any means.

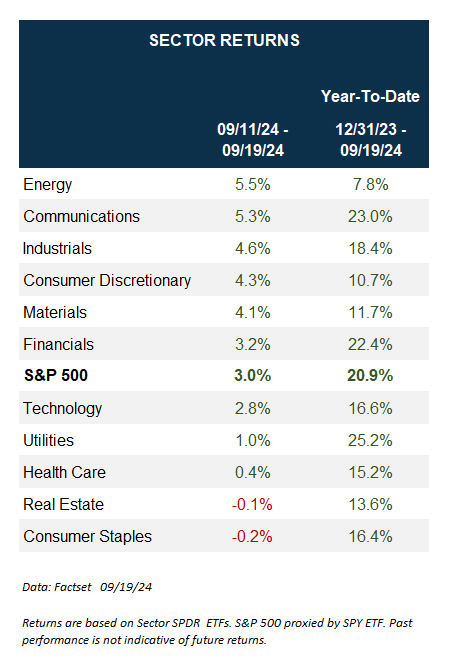

We also saw this story of stronger economic growth expectations playing out within large-cap sectors. Cyclical sectors, including energy, communications, industrials, consumer discretionary, materials, and financials all outperformed the broad index, whereas more defensive sectors like consumer staples underperformed.

All that said, keep in mind that we could yet see some volatility over the next several weeks. As my colleague, Ryan Detrick, Chief Market Strategist, recently wrote, late September and October of an election year are a seasonally weak period for equities. But going forward, we have some strong tailwinds for markets (and the economy). If nothing else, momentum begets momentum. And we have a lot of that now.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Ryan and I had an amazing discussion with noted market technician Frank Capelleri, CFA, CMT, Founder, and President at CappThesis on our latest episode of Facts vs Feelings. He has really sharp insights on how to draw signals from charts, and also talked about how they’re a risk management tool that can help investors navigate volatility. Frank’s targeting 6,100 for the S&P 500 through year end (which is 7% higher than its current level of around 5,700). I highly recommend a listen.

For more content by Sonu Varghese, VP, Global Macro Strategist click here.

02417798-0924-A